Business Innovation

Building virtual pipelines: how Mitsui connects up the global chemical industry

Everyone knows Adam Smith’s “invisible hand.” Mitsui has its equivalent—a “virtual pipeline” that links up the world’s chemical factories to provide a stable supply of the basic materials used in everything from bottles to cars.

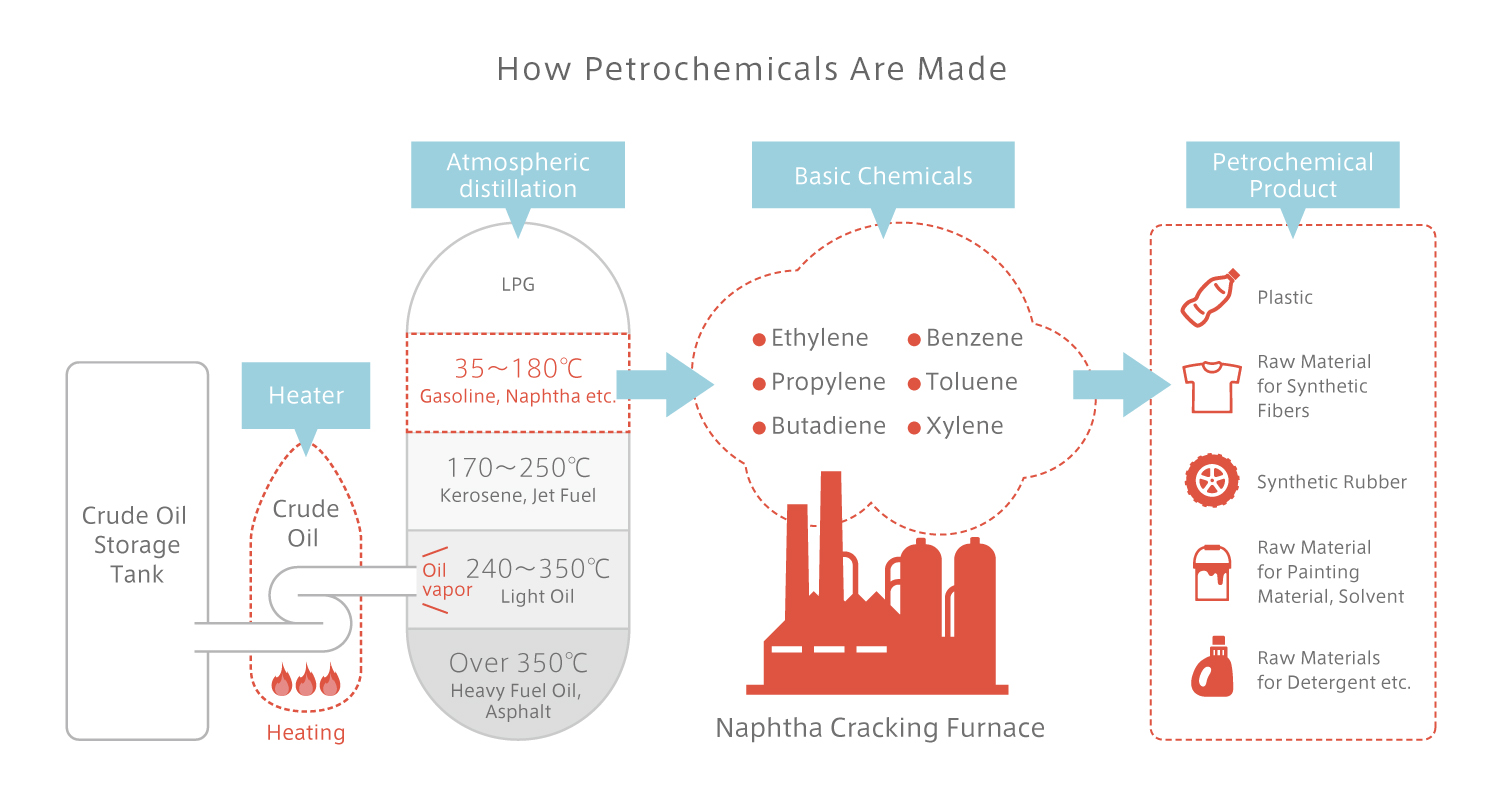

Mitsui & Co.'s Basic Materials Business Unit has two core businesses: investment and trading. On the investment side, that involves activities like manufacturing methanol and bisphenol. On the trading side, it involves selling chemicals that are by-products of the naphtha-cracking process. The company enjoys high levels of market share. For example, Mitsui handles around 20% of all Asia trade’s ethylene and propylene (raw materials used in the manufacture of plastics and resins), and 37% of the world trade's ethylene dichloride (used to make PVC). Market share figures in this article are from 2015 and are based on Mitsui's own research.

In recent years, Mitsui’s overall business model has tended to emphasize investment over trading. In basic materials, however, it is the trading business that still generates the lion’s share of profits. How come? It’s largely because Mitsui has radically redefined what trading means. From a simple linear transaction connecting Seller A to Buyer B, trading has evolved to mean the orchestration of complex, tailored solutions to bring buyer and seller together on the best possible terms for mutual long-term advantage.

The two case studies below provide a snapshot of Mitsui's virtual pipeline in action.

1. Overcoming disruption from the shale revolution

The shale revolution in the United States increased the supply of oil and natural gas and helped bring down prices. Despite being generally positive in its effects, the shale revolution came with some unintended consequences. One of these was a nationwide shortage of butadiene, a chemical used in the manufacture of synthetic rubber (Shale gas feedstock produces far less butadiene than crude oil). This shortage was a life-and-death problem for the chemical manufacturers Mitsui had traditionally supplied with butadiene via tanker truck from butadiene producers on the Gulf Coast of the United States.

Mitsui set about orchestrating a global response to address this country-specific problem. We knew that we could continue to supply our existing customers in the United States by importing butadiene mainly from Europe and Brazil on our own fleet of chartered tankers. Still, we would need tanks to store the butadiene when it was offloaded. We quickly located some unused storage tanks in Houston, Texas and made the necessary modifications. Here a problem arose: renting, renovating and maintaining the storage tanks was going to be expensive. If we passed those costs on to our customers, our imported butadiene would no longer be cost-competitive. We had to cut costs by maximizing the tanks’ utilization rate. The best solution would be to find a new customer who was a heavy user of butadiene.

We found just such a user in the form of an international tire manufacturer with a factory in the Midwestern United States. In addition to the basic challenge of procuring butadiene against a background of shortage, the tire firm was chafing against the high cost of trucking butadiene inland from the Gulf Coast.

The first stage in devising a virtual pipeline was to reduce transport costs by finding an alternative butadiene supplier located closer by. We found one in Canada. This Canadian butadiene manufacturer was shipping large volumes down to the Gulf Coast by rail. We instead arranged for the Canadian firm to send its butadiene to the tire company in the Mid-West, greatly reducing transport costs for both sides. In addition, we arranged a swap, which enabled the Canadian company to keep supplying its original customers in the south with butadiene from Mitsui’s storage tanks.

Through combining multiple functions in this way, Mitsui devised a virtual pipeline that simultaneously solved the problems of a Canadian butadiene manufacturer, a global tire manufacturer and our preexisting customer base of chemical manufacturers in the United States.

2. Keeping the fizz out of soda bottle prices

Coke, Pepsi, Dr Pepper—America is the home of carbonated drinks. These days, an increasing proportion of carbonated drinks are sold in plastic bottles rather than in the traditional glass bottles or metal cans. These bottles are made of polyethylene terephthalate, or PET. PET itself is a mixture of purified terephthalic acid (PTA) and monoethylene glycol (MEG). However, as the prices of PTA and MEG are quite volatile, the cost of raw material inputs for beverage bottles fluctuates wildly. This volatility presents a major challenge to bottle manufactures and beverage companies. They both have a clear need to acquire PET bottles, and the raw materials for them, for a fixed price, usually for a year, when prices are reset. This presented Mitsui with the opportunity to develop a whole new business.

Mitsui’s Basic Materials Business Unit is the Asian leader in trading paraxylene (PX) and handles 2.5 million tons per year. Paraxylene, which is made from naphtha, is the key raw material in the manufacture of PTA. Leveraging its strong position in the PX business, Mitsui used naphtha futures and other instruments to sell paraxylene at a fixed price to PTA manufactures, who in turn sold PTA to the PET bottle manufactures at a fixed price. Likewise, Mitsui devised a system that made clever use of our logistical functions to hedge prices to sell them MEG at fixed rate too.

Once again, this solution represented a long-term win-win for all three parties. Because they were securing raw materials at stable prices, the PET bottle manufacturers could earn steady profits. The beverage companies were free from worrying about any lack of visibility on costs. Meanwhile Mitsui was also generating profits for itself based on setting a fair margin.

Virtual pipelines: real benefits

In a globalized economy, distance is not the only obstacle that separates factories along the chemical supply chain. Things like imbalances of supply and demand, cost pressures, delivery deadlines and differing quality standards also have to be contended with.

Mitsui has what it takes to overcome all these challenges: top market share in multiple product areas, sales offices in 65 countries, worldwide logistics capabilities. In addition, our expert staff combine creative thinking with a mastery of negotiation and execution.

Leveraging these strengths, Mitsui is crafting virtual pipeline that can overcome any obstacle to seamlessly connect the 100,000 factories worldwide that are busy transforming chemicals into the materials that go into the everyday essentials of life.

Posted in November 2016