Business Innovation

Brand turnaround: Steering Subaru onto a growth path in Mexico

Mitsui & Co. has been active in the automotive business since the 1960s, but it needed to deploy all its know-how to turn Subaru from an also-ran into a popular and distinctive brand in Mexico.

Anyone with an interest in the automobile industry knows that Mexico is one of the world’s major vehicle producers and exporters. The country has an annual output of 3.5 million vehicles, of which almost 90% are sent abroad, according to the ITA. Many international car makers have built factories in Mexico attracted by its low labor costs, free trade agreements and proximity to the giant US market.

But there is another side to the Mexican auto story. With a population of 129 million, the country’s sheer size makes it an important market. The youthfulness of the population—the average age is under 30—and expected economic tailwinds from nearshoring suggest that the auto market, which was around 1.36 million units in 2023, has years of growth ahead.

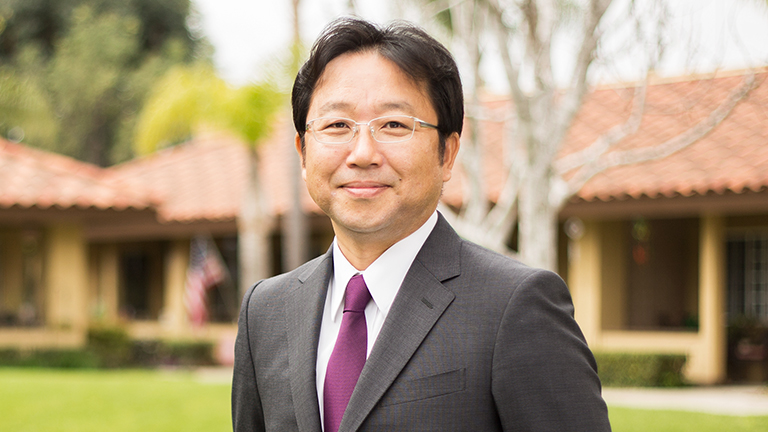

This promising macro-outlook was one of the key factors that prompted Mitsui & Co. to participate in the 2016 competition to become Subaru’s official Mexican distributor. Mitsui emerged the winner, but before we get into that story, a little background information on the company’s auto-industry history is needed.

Mitsui’s auto expertise meets Subaru’s brand equity

Mitsui has been involved in the auto industry for over half a century. It started out in the 1960s helping Japanese OEMs export finished cars for wholesale abroad. As Japan evolved into a global automotive superpower, Mitsui began adding dealerships, auto finance and aftersales service to its distribution offering. The company is particularly strong in Latin America, where the distributor businesses of Toyota in Peru (founded in 1965) and Chile (1980) are textbook examples of this business model.

What makes Mitsui and Subaru such a good fit? First, unlike most other smaller producers, it is a proudly independent company. Without a deep-pocketed parent to fall back on, Subaru needs third-party capital and expertise to help it penetrate certain markets.

Subaru is a highly profitable marque thanks its manufacturing efficiency—Subaru uses a single platform and the same Boxer engine for all its models—and its extraordinarily powerful brand. Consumers feel intensely loyal to Subaru and nowhere is this truer than in the United States, where Subaru’s 4% market share is the highest in the world. Since Mexico neighbors the United States, and the two countries have so much in common culturally, Mitsui saw Mexico as a market rich in unrealized potential.

A bumpy ride from restructuring to revival

In 2016, however, when Mitsui took over Subaru’s Mexican distributorship, the outlook was far from rosy. Subaru had entered the market around a decade before in partnership with a Mexican company. However, since the local partner wasn't an expert in the automotive distribution business, poor marketing and non-existent aftersales service had weakened the brand and market share was languishing.

The organization Mitsui inherited thus needed root-and-branch restructuring. Key executives, including the CFO and the head of sales, were let go; twenty of 23 dealers were cut; inventory sold off at fire-sale prices. To signal a complete break from the past, the company changed its name to Subaru Automotriz Mexico and moved to new offices.

By the end of 2019, with the restructuring complete, Mitsui was ready to roll out its growth strategy. The first step was to improve brand communications. The message was stripped down to two simple pillars: “safe” and “fun to drive.” This message was then targeted at the same niche demographic who support Subaru in the United States: upper-income professionals between 40 and 60 years of age with families.

The initial marketing outreach had to be entirely digital due to budget constraints. However, converting digital interest into physical sales ultimately required something more. That is the reason Mitsui introduced “Subaru Days” at the dealers, giving potential buyers the chance to sit behind the wheel and enjoy the Subaru driving experience first-hand for half a day at a time.

Mitsui also streamlined business operations. It eliminated duplication and inventory by shipping cars direct to dealers from the Pacific Coast, rather than transporting them via train to Mexico City then trucking them out again from the capital. With the brand back on a firm footing, discounting was terminated, enabling Subaru Mexico to enjoy the industry-leading margins the brand boasts everywhere else.

Mitsui also added new functions. Subaru Financial Services was set up to help car buyers finance their car purchases and Subaru Insurance established to provide customers who get into accidents with repairs using legitimate imported parts. Mitsui also entered into an alliance with a vocational school to train up specialized mechanics to ensure those repairs were carried out to a high standard.

The results—allowing for the delay caused by the pandemic and the semiconductor shortage which crushed worldwide auto sales in 2020 and 2021 —have been spectacular. Subaru Automotriz México has been in the black since FY 2022/3 and Subaru’s Mexican sales in 2023 were four times higher than their 2018 nadir.

Accelerating along a growth path

For Mitsui this is only the start. The goal now is to achieve a 1% share of the Mexican market by 2028, or 15,000 cars in a market of 1.5 million units. This will require a further tripling of sales from current levels.

Mitsui has put a two-pronged strategy into place. Internally, the organization will be switching from a survival mindset to full-on growth mode. A new accounting system is due to be introduced, headcount increased, and staff dispatched to Mitsui’s subsidiaries in Latin America and its Tokyo headquarters for training. Externally, the dealer network, which currently covers just 16 of Mexico’s 32 states, will be expanded, the number of models imported will be increased from the current five, and marketing spend will rise.

Mexico is a strategically important country for Mitsui. Even before the addition of Subaru, the company was already the Mexican distributor for Hino trucks and Komatsu construction equipment. Now, with a presence across every automotive transportation segment, Mitsui possesses a full mobility value chain in one of Latin America’s largest nations, providing it with a foundation it can build on as the global auto market goes through rapid change driven by digitalization, electrification and new market entrants.

Posted in March 2024