Business Innovation

Innovative Operations:

Transforming Hospital Care in Asia

As Asia’s middle class expands, spending on healthcare is set to rise. Mitsui is the single largest shareholder in IHH Healthcare, a leading international healthcare provider which is innovating on multiple fronts, including in digital technology and big data. In 2020, the company launched telemedicine services. This was followed by a multi-country smartphone app designed to make life easier for patients.

Asia’s economy has grown by leaps and bounds in recent years. Already larger than any other region of the world, its GDP is expected to account for a whopping 60 percent of all global growth by 2030, according to the WEF.

But economic progress inevitably brings new problems in its wake. As people live longer, more prosperous lives, they require more—and more expensive—healthcare. Non-communicable diseases, such as diabetes, stroke and heart disease are predicted to skyrocket. Meanwhile, the elderly—who require the most care—will become the fastest-growing population segment. The WEF sees factors like these driving a massive 70-percent jump in healthcare costs in the ASEAN 6 (Malaysia, Singapore, Philippines, Vietnam, Thailand and Indonesia) between 2018 and 2038.

The development of a sustainable healthcare system is now a matter of urgency for the region. While governments are seeking new sources of healthcare funding, healthcare providers are working on cutting costs, improving efficiency and focusing on preventive medicine in an effort to deliver more cost-effective outcomes.

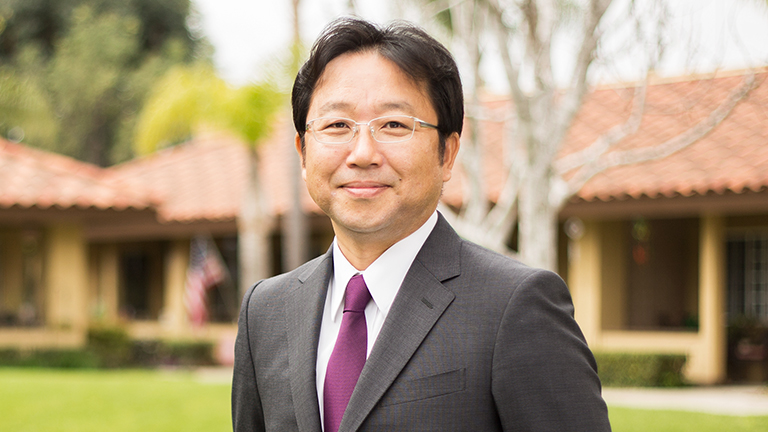

As the single largest shareholder in IHH Healthcare—Asia’s largest hospital operator by market value with 15,000 beds in 80 hospitals across 10 countries—Mitsui & Co. is in a strong position to tackle the Asian healthcare challenge. And it is looking to innovation to deliver the high-quality, cost-efficient solutions that the region needs. Leading this push is IHH’s Innovation Office, a new division set up in 2016 and headed by staff seconded from Mitsui. The division is charged with sparking growth by driving innovation across three areas: new technology adoption; investment in healthcare startups; and fostering an innovation culture within IHH.

Peace of mind through technology

Let’s look at technology first. As anyone who has been to hospital knows, complex medical procedures don’t come cheap. One challenge faced by patients is how to navigate a balanced course between various treatment options and affordability. Hospitals have long tried to provide advance bill estimates to patients, but they were generally very wide of the mark—at least until AI came along.

In November 2018, IHH’s four Singapore hospitals introduced an AI-driven predictive hospital bill estimation system. The system has already more than doubled the accuracy rate, and that accuracy is continuing to improve because the system learns as it goes. By providing AI-enabled bill estimates, IHH enables patients to get a better grasp of their costs and to have a better patient experience in consequence.

Remaining on the technology front, we’ve all heard of Apple Watch and Snapchat Spectacles. Wearables, however, also have a serious role to play in the healthcare space. One example: IHH’s Cardiac Centre in Brunei is now using wearable vital monitoring technology to keep track of patients’ conditions after they have been discharged.

Some of IHH’s innovations have an even more consumer-facing feel. In 2019, IHH Singapore released a handy app that streamlines a multitude of everyday processes, enabling patients to book appointments, make inquiries and review their medical histories on their smartphones. A companion app was also developed for doctors, who can use it to look up patient data or check accounts receivable.

Tie ups with Startups

“Not invented here” or NIH—a deep-set bias against innovative ideas that come from the outside—can become an Achilles’ heel for large companies. But IHH does not “do” NIH. The company is on a permanent lookout for startups that can add new capabilities to its portfolio.

Take diagnostic testing labs as one example. IHH is already a market leader in Malaysia, Singapore, and Turkey, and in 2018 it acquired Fortis Healthcare which owns Agilus, the largest diagnostics company in India. In 2019, IHH led the Series A funding round for Lucence, a Singapore-based genomic medicine company that specializes in ultra-sensitive, non-invasive liquid biopsy testing for cancer diagnosis. This technology enables IHH to offer more affordable personalized medical treatment based on the genetic profile of individual patients, while staking out a leading position in molecular diagnostics.

Little apps and big data

IHH treats over 800,000 inpatients every year. As a result, it generates masses of data. IHH aggregates all the data associated with the entire patient journey, including admission, test results, treatments, and discharge. This is an expensive and by no means easy thing to do, but in the long run the benefits easily outweigh the costs. At a simple level, data can be leveraged to boost patient satisfaction ratings by identifying and addressing stress points in the patient journey. For example, My Health 360, another smartphone app which was launched in Singapore in 2022, analyzes reams of past data to provide patients with reassuringly precise advance estimates of medical costs.

Clever use of the group’s accumulated disease management data can lead to more effective patient care. For instance, monitoring and analyzing of patient blood glucose levels can help predict the worsening of diabetes, enabling patients to visit the doctor before their condition starts to deteriorate.

Big data offers outward-facing possibilities as well: IHH sees the pharmaceutical firms and medical equipment manufacturers it works with not just as vendors, but as fellow stakeholders with whom it can collaborate. IHH can help pharma companies with the process of drug development, for example, by contributing its data to drug discovery or drug trials.

Last of all, data from across the group can be pulled together and systematized to drive group-wide synergies. IHH operates across multiple countries which have different areas of strength. India, for example, is a leader in liver transplants. With a single shared digital platform, local knowledge like this can be transferred across the group to provide high-level, standardized patient care everywhere. The same is true for diagnostic testing. IHH can leverage data to standardize tests across multiple countries and create a single coherent platform not just of regular tests, but of sophisticated tests based on DNA extraction from blood, and so forth.

Leapfrogging ahead

Through IHH, Mitsui has a double opportunity. First, there’s the simple issue of quantity. As a region, Asia suffers from an acute gap between healthcare supply and demand. IHH can address this by building more clinics and hospitals. Then there’s the quality issue. Asia is a fragmented market made up of multiple countries. As a result, healthcare innovation happens more slowly than in large, unified markets with a few dominant players, like the United States. IHH is unique in operating across so many markets in the region. With this unusual scale and reach, IHH can bring in the most innovative medical technologies and business processes, enabling Asian healthcare to leapfrog right to the front of the global cost-efficiency pack.

Posted in June 2019

Updated in November 2020

Updated in July 2024