Portfolio Enhancement

Opening Remarks

Nakai, CSO (Nakai) : I am Kazumasa Nakai, CSO. Today, I will speak about the progress that has been made in enhancing Mitsui’s portfolio. Specifically, I will touch upon the evolution and track record of portfolio management during the current Medium-term Management Plan (MTMP), turnaround cases currently being addressed, and the initiatives for the next MTMP from my perspective as Chair of the Portfolio Management Committee.

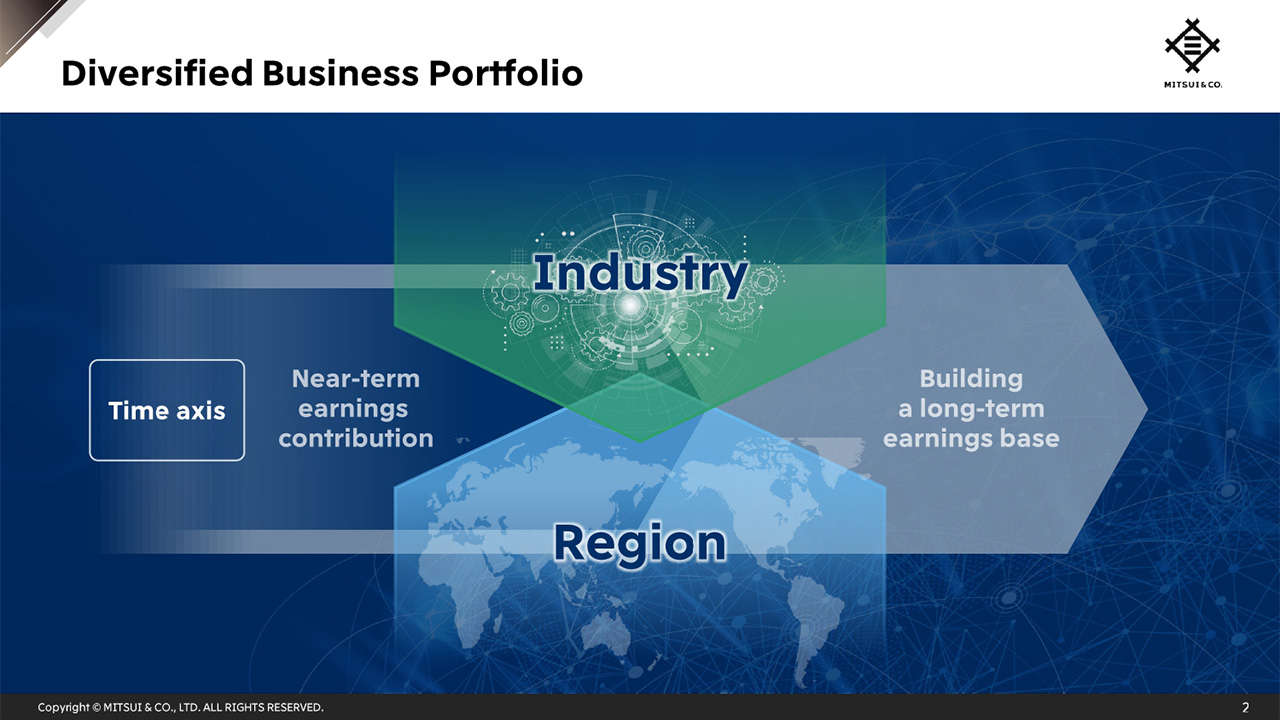

Diversified Business Portfolio

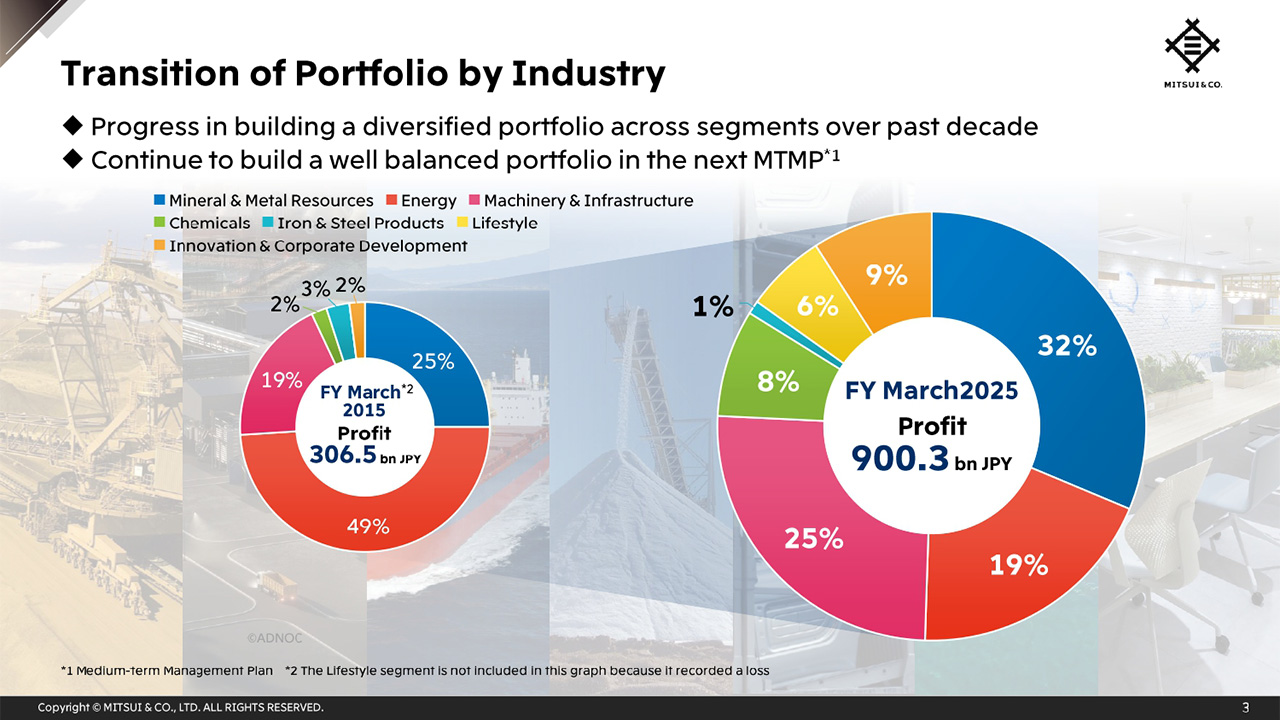

We have been working on building a high-quality business portfolio that is diversified across both industrial and regional axes, while being conscious of the time axis—balancing businesses that start earnings contribution in the near-term with those that contribute to building a long-term earnings base.

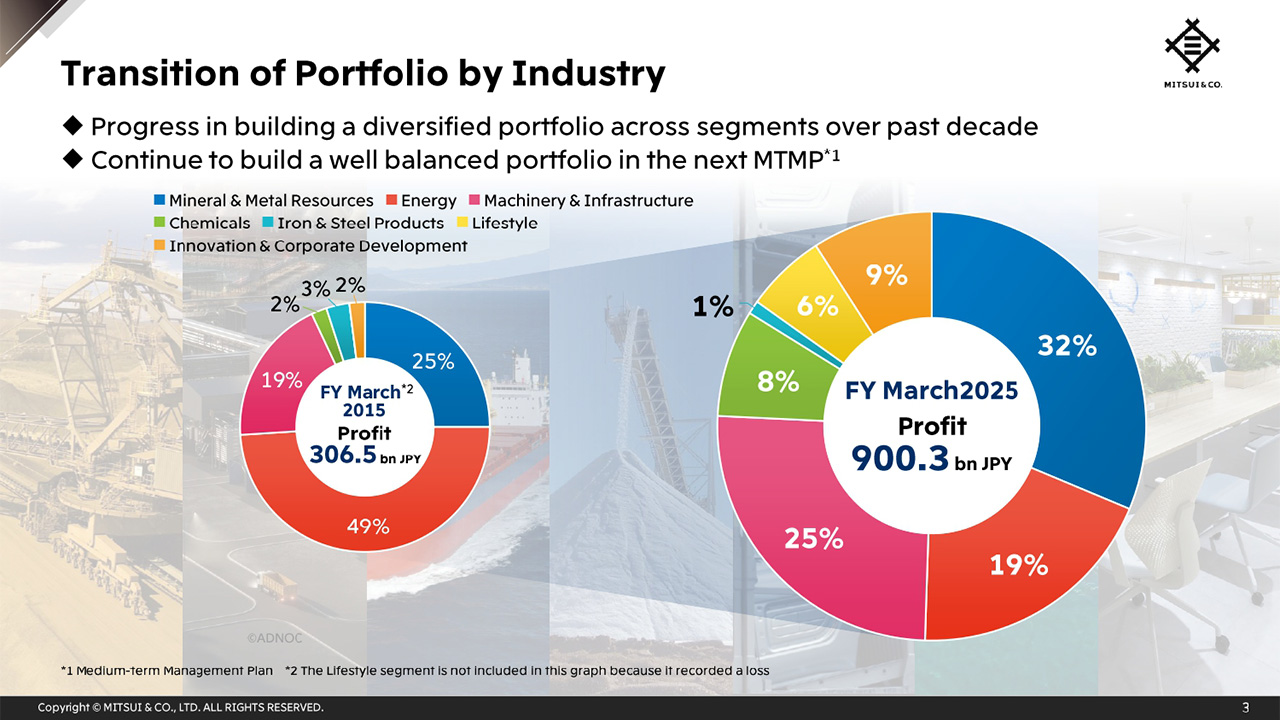

Transition of Portfolio by Industry

For profit by segment for FY March 2015, Mineral & Metal Resources and Energy accounted for more than 70% of the total. However, over the last 10 years, profit grew approximately 3 times and as a result of the growth in segments such as Machinery & Infrastructure, Innovation & Corporate Development, Chemicals, and Lifestyle, the portfolio balance has improved so that now Mineral & Metal Resources and Energy accounts for around half of the earnings.

In addition to the earnings contribution from large-scale projects in Mineral & Metal Resources and Energy, the enhancement of base profit has been achieved in segments such as Chemicals and Lifestyle. We aim to grow these segments to over 100 billion quickly and thereby continue to build a balanced portfolio.

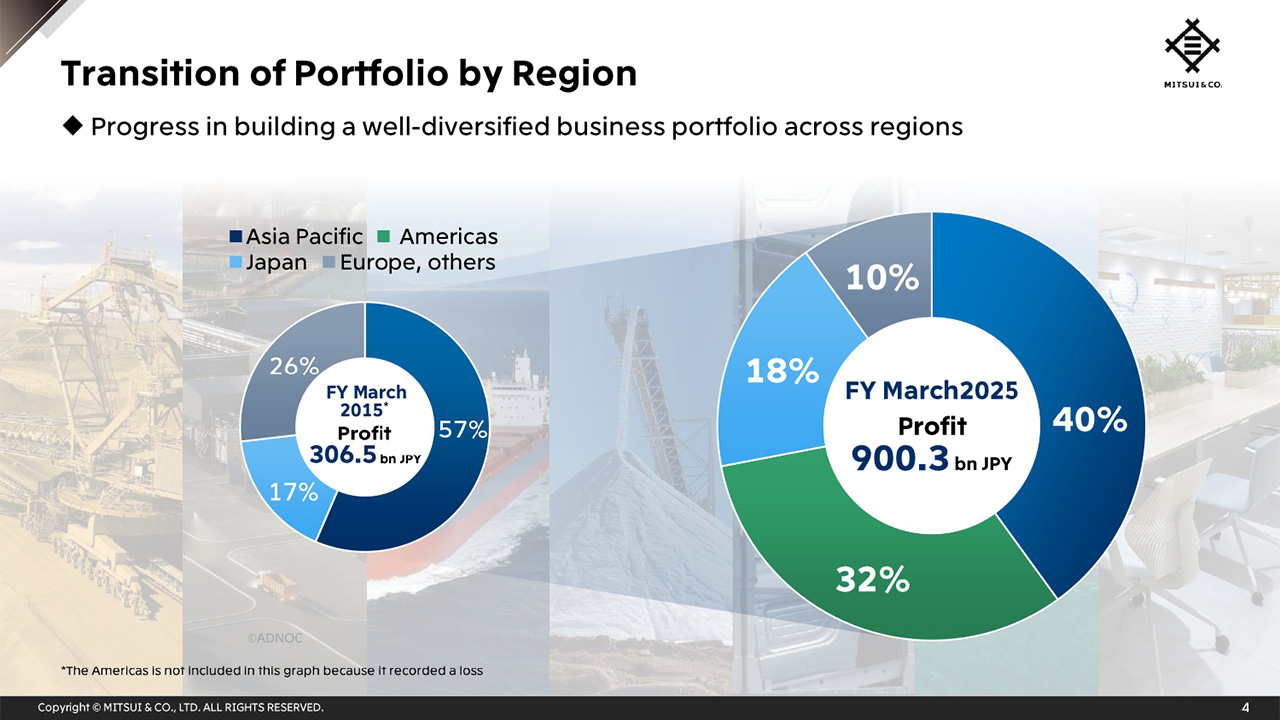

Transition of Portfolio by Region

Looking at the portfolio by region, in FY March 2015, the Americas business was in a deficit mainly due to one-time factors. However, over the last 10 years, initiatives have progressed and earnings have grown in each region. In particular, earnings capability in the Americas has increased, and currently, the portfolio is well balanced in terms of regional diversification.

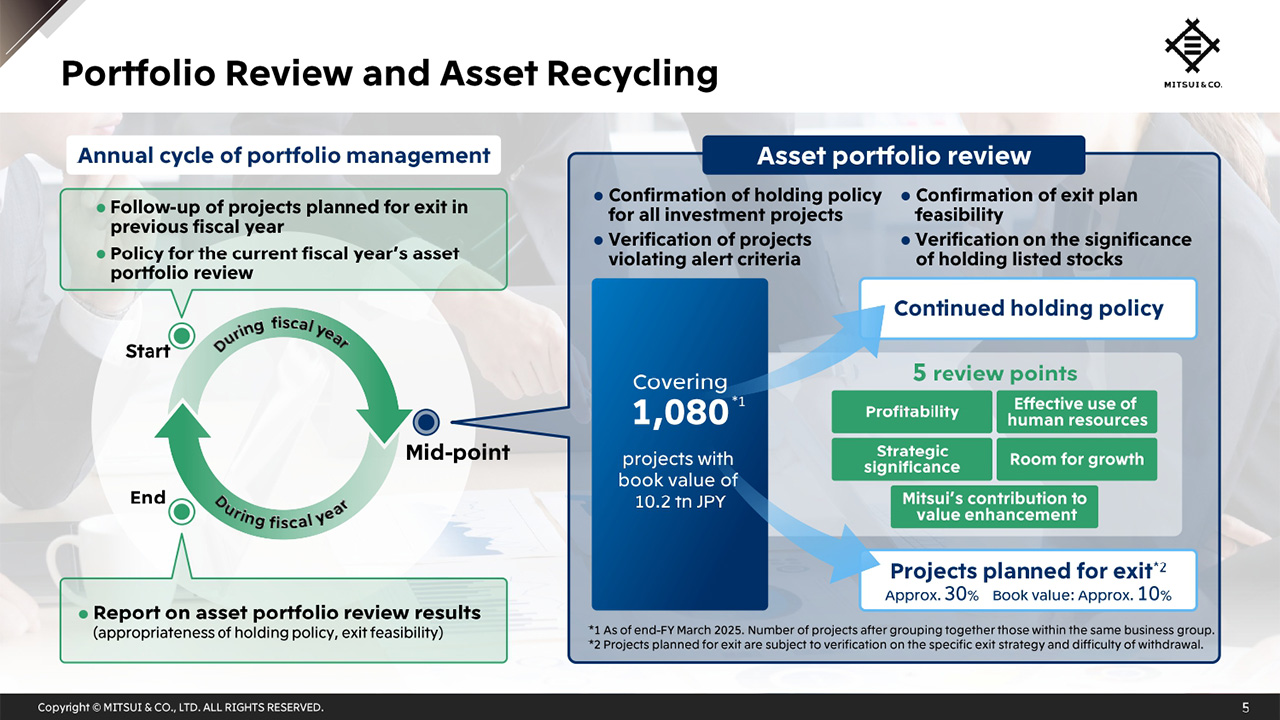

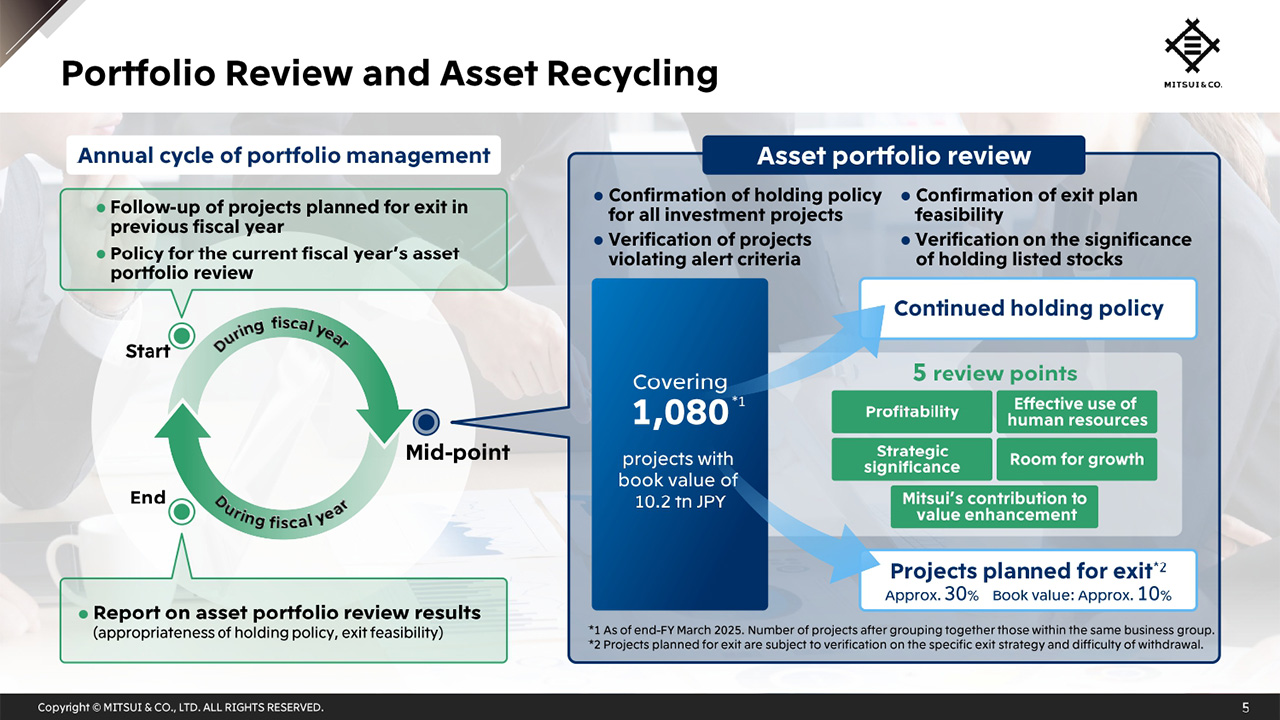

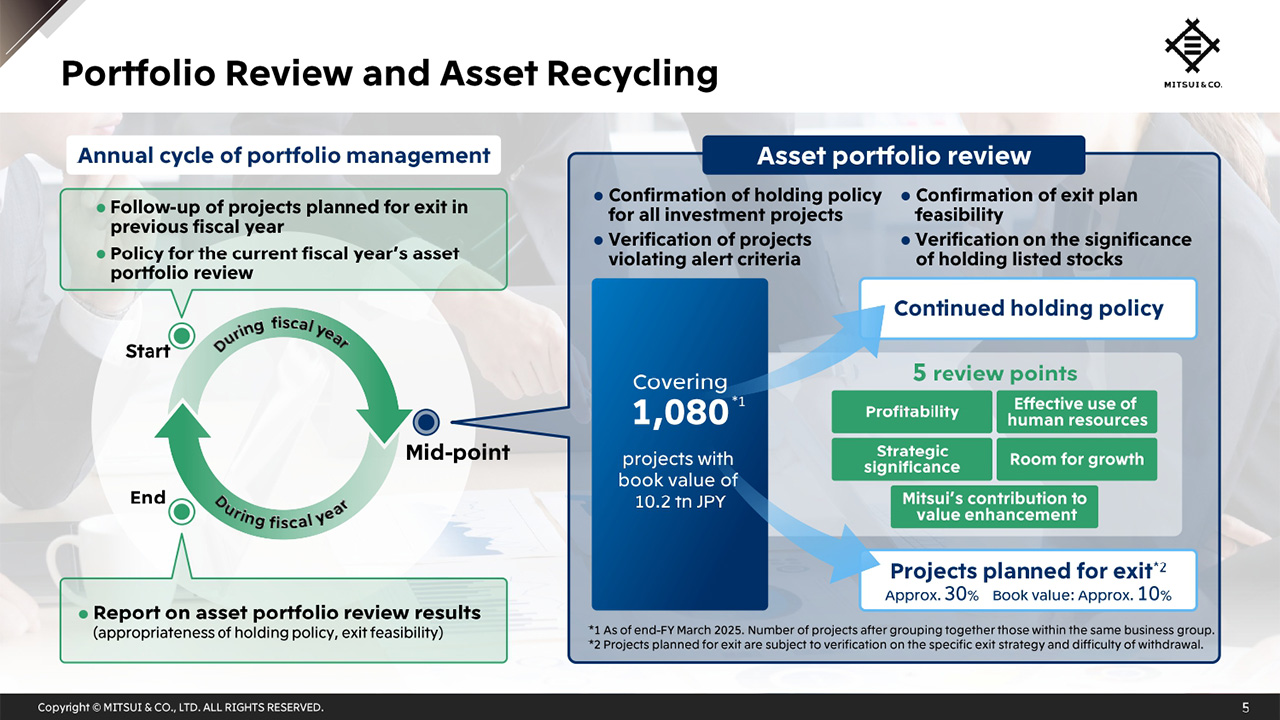

Portfolio Review and Asset Recycling

We have consistently reviewed our portfolio management methods and have evolved our portfolio management. Each business unit reviews the policy for continued holding or exit of all projects based on five review points. As of the end of FY March 2025, there were 1,080 projects in total. We follow a process where the Portfolio Management Committee confirms all projects and makes decisions from a company-wide perspective regarding the validity of the holding policy and the feasibility of the exit plan.

In addition to unprofitable businesses, even for projects generating a certain level of profit, we conduct thorough discussions from a management perspective by the officers in charge of businesses, from the viewpoint of company-wide capital efficiency. There are multiple projects where we changed the policy from hold to sell. I am always mindful not to just accept the status quo. Instead, at times, difficult decisions need to be made as we drive forward the enhancement of the portfolio.

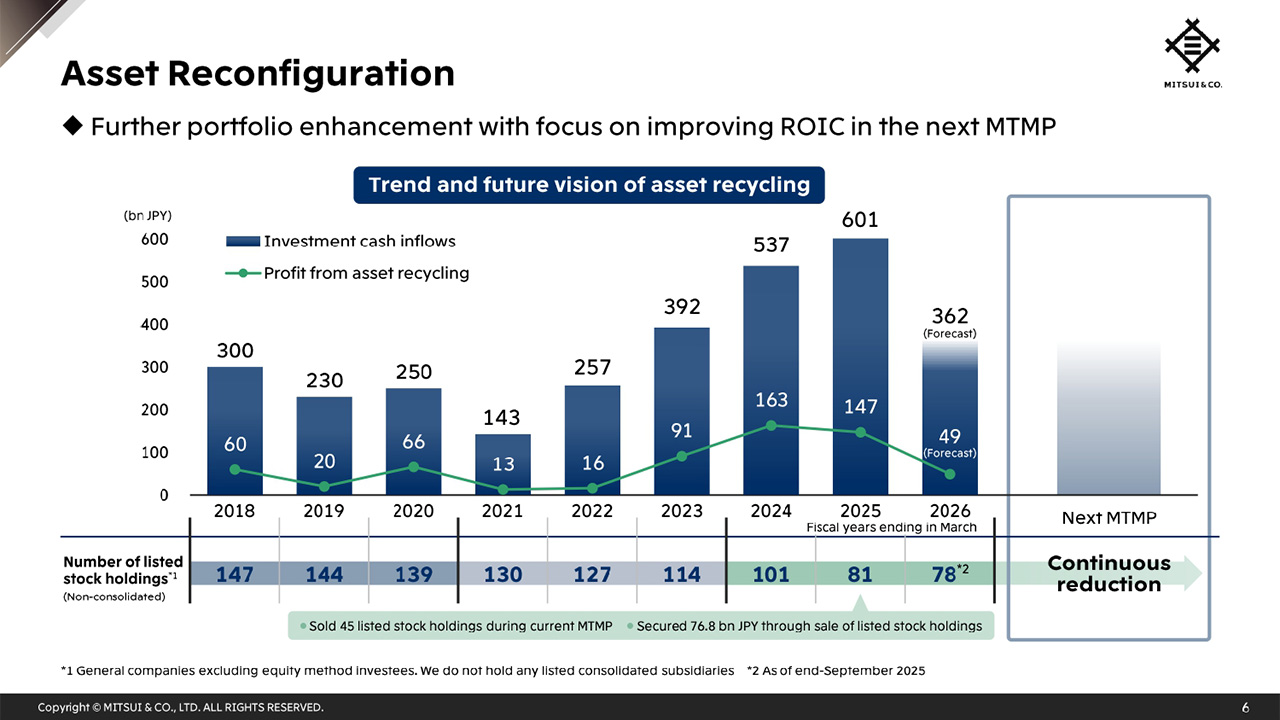

Asset Reconfiguration

In this slide, I will explain the progress of asset reconfiguration. During the current MTMP, we expect to carry out asset recycling in the order of around 500 billion yen on average per year. As a result of determining the right time to sell and proceeding with reconfiguration based on review points even for projects generating a certain level of profit, we have been able to increase the cash and profit from sales compared to the past. Regarding listed stocks, we have halved the number of holdings from FY March 2018 to FY March 2025. During the current MTMP, we sold 45 listed holdings and generated cash of approximately 77 billion yen. In the next MTMP as well, with a focus on improving ROIC, we aim for further portfolio enhancement by continuing to work on asset recycling, including the selling of listed holdings.

Progress in Enhancement of Base Profit

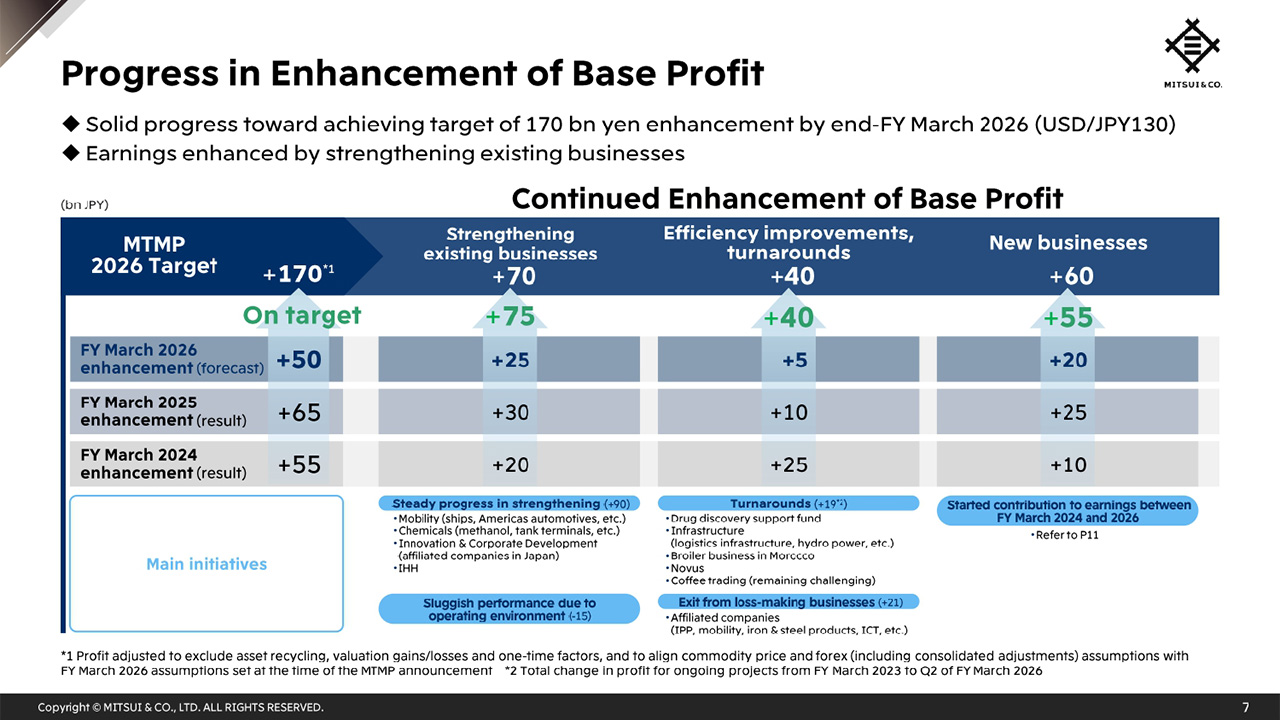

Next, I will explain the progress in enhancement of base profit during the current MTMP, giving more granular details than typically provided in the financial results presentations.

At the time of the current MTMP announcement, we adjusted commodity prices and foreign exchange rates to our assumptions for FY March 2026, and excluded one-time factors from profit as the definition for base profit. The aim has been to enhance base profit by 170 billion yen over the three year MTMP period, and we have been making steady progress toward achieving this. Here, the US dollar to Japanese yen exchange rate assumption was set at 130 yen to the dollar.

Strengthening Existing Businesses

Over the next few slides, I will go over each of the three components that constitute the enhancement of base profit and how things have progressed, giving examples along the way.

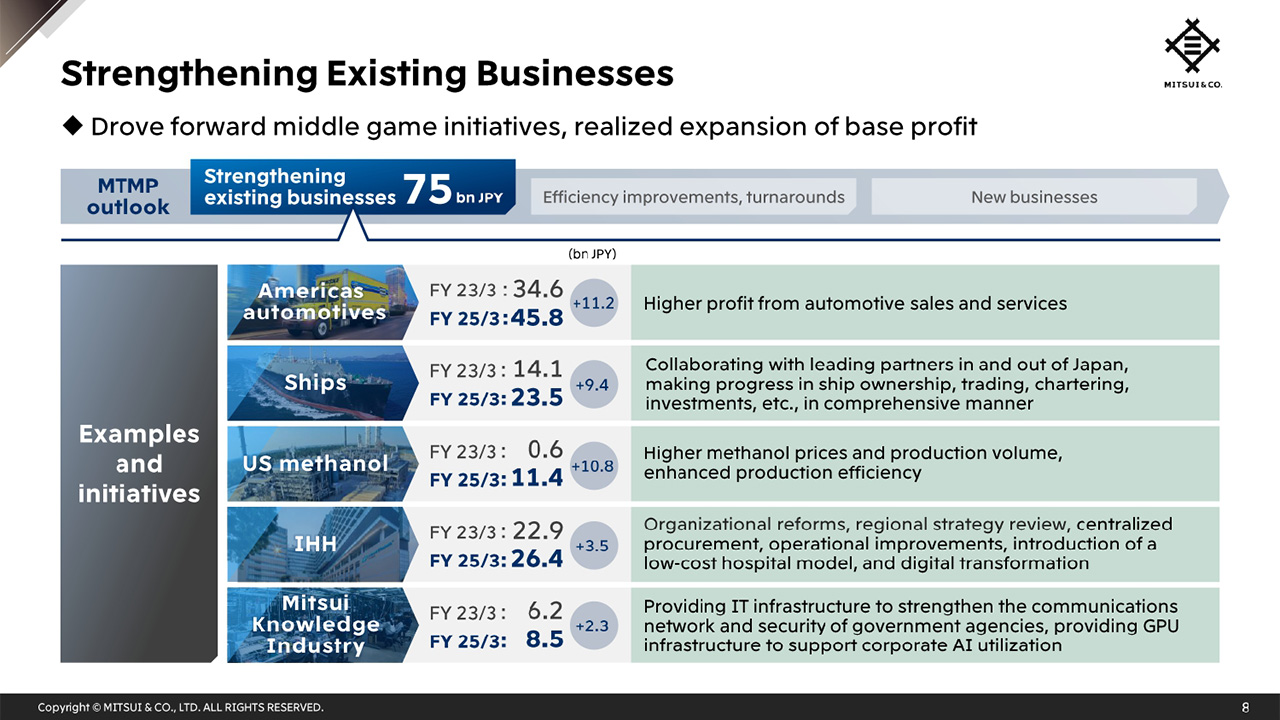

First, regarding the progress of strengthening existing businesses, I will speak on several businesses where a significant enhancement of base profit was made from FY March 2023 to FY March 2025.

In mobility, the Americas automotives and truck-related business has grown continuously by steadily increasing earnings from automotive sales and services.

Ships related subsidiaries provide comprehensive services in collaboration with partners, responding to the needs of various customers in the value chain.

In the methanol business in the US, performance grew due to higher methanol prices and production volume, combined with enhanced production efficiencies.

In the healthcare business, IHH is continuously growing through organizational reforms, reviewing regional strategies, strengthening the group management foundation through centralized procurement, operational improvements, and the introduction of low-cost hospital models, as well as advancing digital transformation.

Mitsui Knowledge Industry is also continuing stable growth with strong performance in the IT infrastructure business for government agencies and enterprises. In the next MTMP, we will continue to steadily drive forward what we call middle game initiatives in each business and enhance base profit.

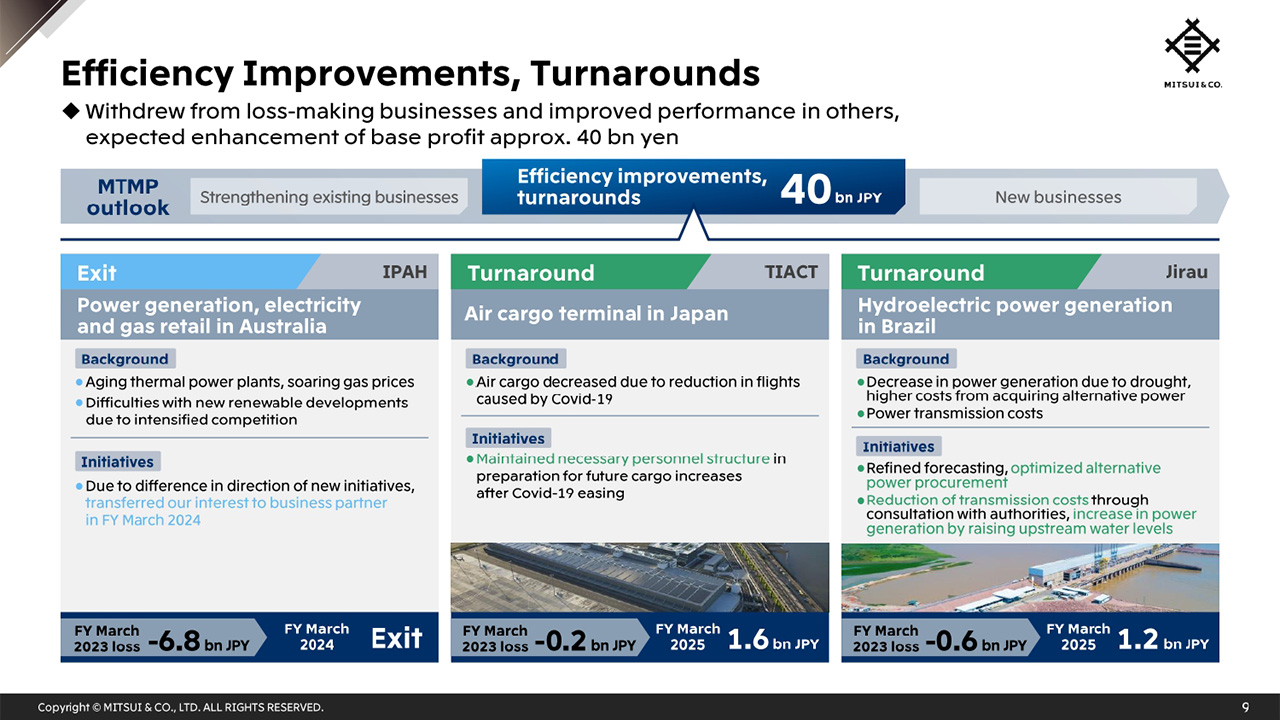

Efficiency Improvements, Turnarounds

Next, I will give three examples where we executed efficiency improvements and turnarounds.

The power generation, and electricity and gas sales business in Australia saw deteriorating performance due to aging thermal power plants and soaring gas prices. Although we worked on improving profitability through strengthening risk management and new projects, given differences in direction with our partner regarding new initiatives, we decided to sell them our entire stake after discussions, completing the sale in FY March 2024.

Performance at the Haneda Airport cargo terminal deteriorated due to a decrease in passenger flights and lower cargo volume caused by the impact of COVID-19. However, by deliberately maintaining the necessary personnel structure in preparation for future cargo increases, we were able to capture the rebound in volumes after COVID-19 subsided and recover our performance.

The hydroelectric power generation business in Brazil saw a delay in the start of earnings contribution due to a decrease in power generation caused by drought and increased costs from acquiring alternative power. However, the business became profitable through achieving a reduction in transmission costs via discussions with authorities and an increase in power generation by raising upstream water levels.

We will continue to make efforts to realize successful efficiency improvements and turnarounds like these in the next MTMP.

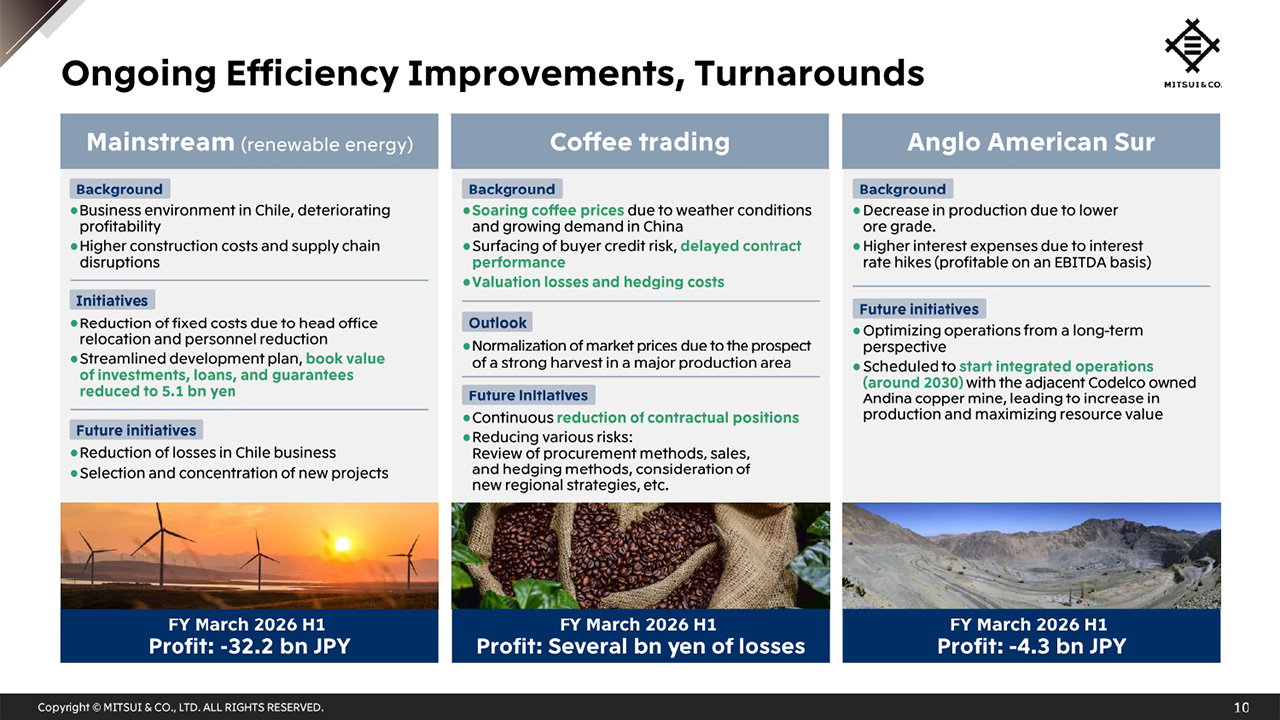

Ongoing Efficiency Improvements, Turnarounds

There are several businesses in which challenges remain in terms of efficiency improvements and turnarounds which I will speak on here.

Regarding the renewable energy business, Mainstream, tough management conditions persist due to deteriorating profitability in Chile, higher construction costs, and supply chain disruptions. Therefore, from the perspective of optimizing cash flow, we have streamlined the development plan and significantly reduced the investments, loans, and guarantees book value. Going forward, we are continuing discussions among shareholders to work on strictly selected new projects with an optimal structure, while continuing initiatives to reduce losses in Chile.

In coffee trading, future prices soared as coffee beans became in tight supply globally due to poor weather conditions starting around 2021, combined with rapidly expanding demand mainly led by China. Additionally, while futures prices were high, the emergence of buyer credit risk and the simultaneous rise in supplier contract risk led to delayed contract performance, resulting in valuation losses and hedging costs. On the other hand, a strong harvest is expected next year in Brazil, a major production region, and since US tariffs on Brazilian coffee beans have been completely lifted for now, we assume the market will normalize. We will continue to work on reducing our position and simultaneously reducing various risks.

Regarding the Anglo American Sur copper business in Chile, production volumes decreased due to lower ore grades. Although it is still profitable on an EBITDA basis, our investment subsidiary is recording losses due to the impact of increased interest costs caused by interest rate hikes. The good news is that we plan to start integrated operations around 2030 with an adjacent copper mine owned by Codelco. We will continue to strive for the optimization of operations as well as the stable securing of copper resources.

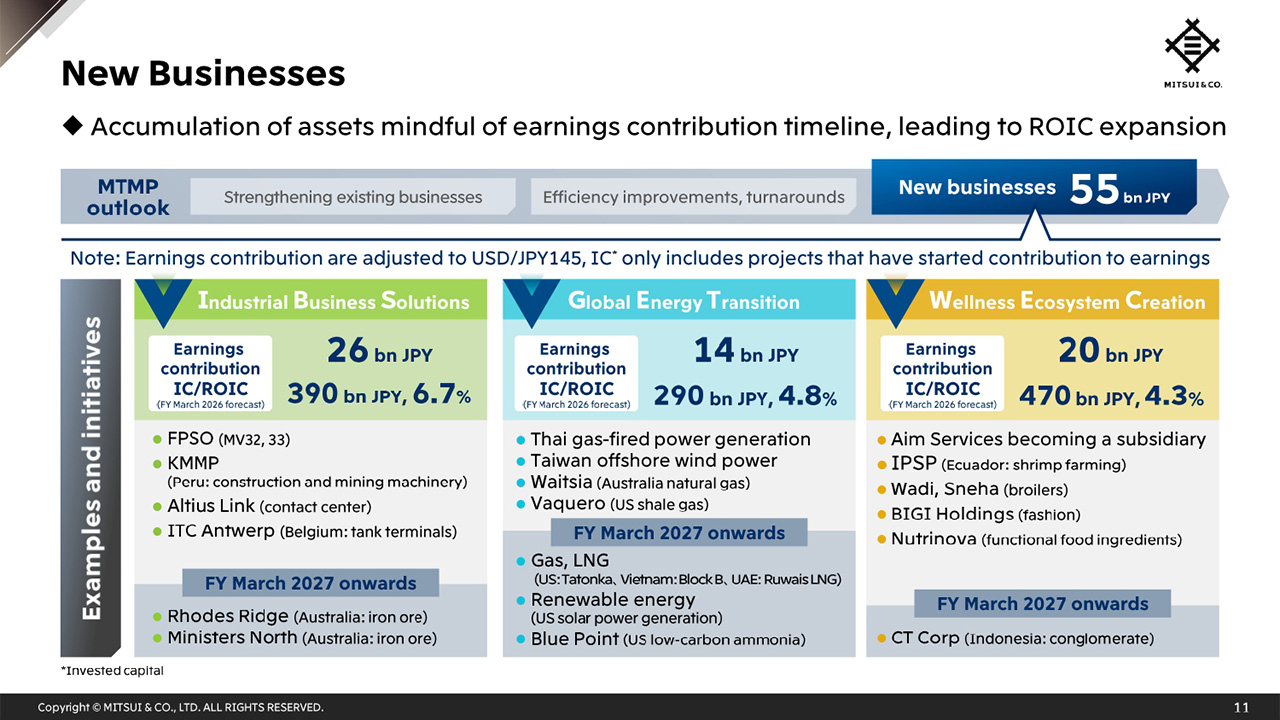

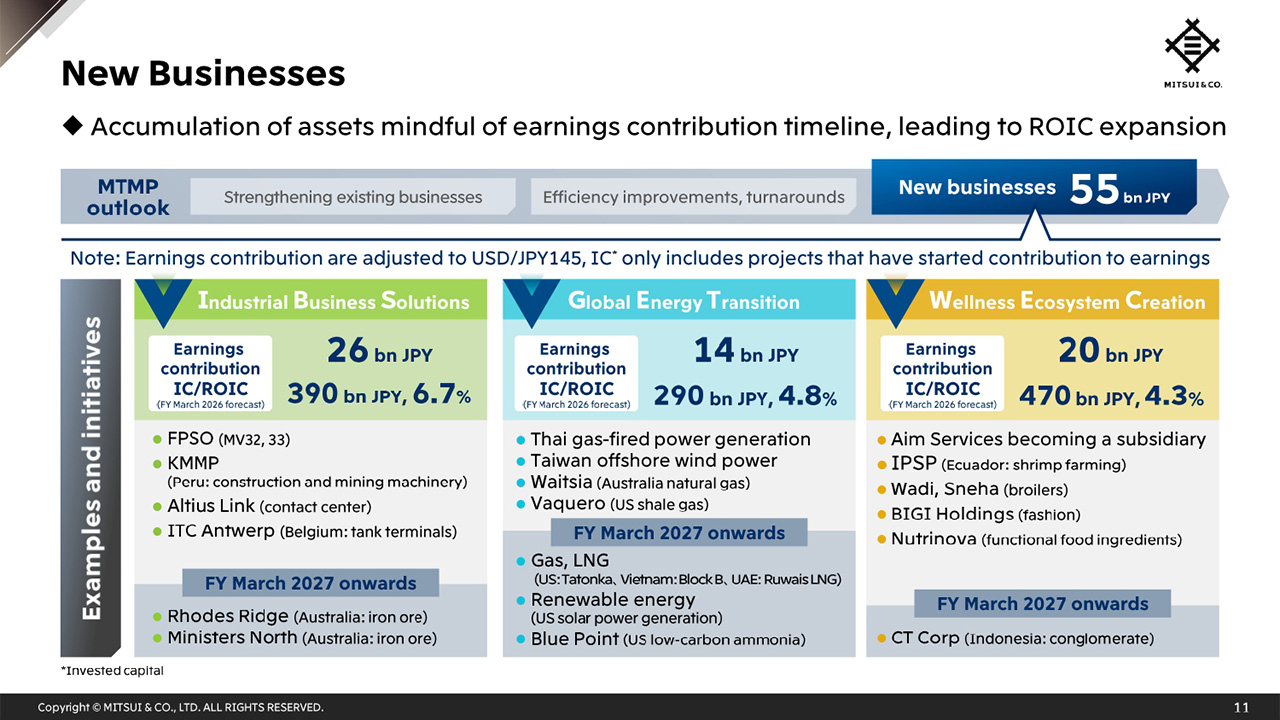

New Businesses

Regarding new businesses, we are executing carefully selected investments for growth in line with the three Key Strategic Initiatives defined in the MTMP. Among the investments for growth executed during the current MTMP, many of the projects that started earnings contribution in the near-term are increasing their earnings capability, while investments for growth aimed at expanding the long-term earnings base are also progressing steadily.

Over the three years of the MTMP, we anticipate earnings contributions of 26 billion yen in Industrial Business Solutions, 14 billion yen in Global Energy Transition, and 20 billion yen in Wellness Ecosystem Creation. The total of 55 billion yen communicated in the financial results presentation is a figure based on a US dollar exchange rate of 130 yen, but here, the earnings contribution for each of the Key Strategic Initiatives is listed on a 145 yen basis, which is closer to the actual situation, bringing the total to 60 billion yen.

Regarding the ROIC forecast for FY March 2026, we anticipate 6.7% for Industrial Business Solutions, 4.8% for Global Energy Transition, and 4.3% for Wellness Ecosystem Creation. This is still ramping up, and for the future, we are looking at organic growth to reach an even higher level. Although there are differences in characteristics and stages for each business area, we will steadily grow profitability while being mindful of enhancing ROIC in each and every business.

Toward Further Portfolio Enhancement

We believe that constantly enhancing the quality of our portfolio through the execution of excellent investments for growth carefully selected from an abundant project pipeline, the strengthening of portfolio review, and the execution of asset reconfiguration is the foundation of our management. We will work on this continuously to produce results that meet the expectations of our investors.

This concludes my presentation.

Q1:

Please tell us about the progress of new businesses. In slide 11, the invested capital and returns for them are shown divided into three initiatives. For example, regarding Industrial Business Solutions, there is a large investment for Rhodes Ridge as a project contributing to earnings from FY March 2027 onwards, and I believe that is probably not included in the invested capital of 390 billion yen.

Depending on the period of the next MTMP, where do you see additional investment occurring in these three initiatives over the next three to five years? Also, please tell us which of these is attracting attention for growth in ROIC going forward.

Nakai : Some of the points you asked about will be covered in the CEO session, so I will refrain from speaking on specifics now, but we have raised three Key Strategic Initiatives in the MTMP, and I believe we have been able to make investments of a certain scale in each.

In building that track record, we are strengthening our conviction that setting these three Key Strategic Initiatives was the correct approach.

In the next MTMP, rather than setting new Key Strategic Initiatives again, our image is to dig deeper into these three.

Regarding each Key Strategic Initiative, it goes without saying that we will firmly bring invested items to fruition and produce results, but profit pools and domains that we have not touched yet are also coming clearly into view. By digging deeper into that, I believe the Key Strategic Initiatives themselves will grow larger and become more bold.

We will explain later regarding what level the ROIC of each Key Strategic Initiative will rise to as a result.

Q2:

Regarding the portfolio on slides 3 and 4, there are other trading companies that say they want to reduce the ratio of resource businesses, that they will invest more in the US, and that they will build their portfolio strategically.

Mitsui has large investments such as Rhodes Ridge, but are discussions being held regarding an optimal portfolio? Amidst heightening geopolitical risks in each region, are you discussing what direction you will go? If a good opportunity to invest in a project comes up, do you just invest or is it part of a bigger strategic decision?

I understand the transition that has taken place in the portfolio, but please tell us what kind of discussions are being held regarding the direction from here.

Nakai : Regarding the point that the portfolio is built on both the axes of industry and region as shown in slides 3 and 4, it is of course not the case that this is decided without planning and that we just add new projects as opportunities arise. We are enhancing the portfolio while discussing how we expect it to take form overall.

Regarding regions, I consider this to be a characteristic and strength of Mitsui, but we are set to take up projects in each region of the Americas, Asia Pacific, Europe, the Middle East, and East Asia, together with the 16 business units by working on developing new business models.

Regarding industries, by having three major Key Strategic Initiatives, projects come up by region and industry through each business unit developing new businesses within the framework of those Key Strategic Initiatives.

In response to that, we proactively move forward with project selection while discussing the overall direction of the portfolio. We have forums such as the Portfolio Management Committee, as well as a separate body consisting of Executive Committee members that conducts discussions regarding the pipeline of opportunities.

Q3:

Since you are making a quite large investments such as in Rhodes Ridge and there are several energy-related projects, are there conversations in the Portfolio Management Committee turning to investing more in non-resource areas?

Nakai : It is not that we will not invest in metal or energy projects from now on because we invested in Rhodes Ridge. If top-tier projects that satisfy the five review points shown on slide 5 come up, we have decided to consider them on a case-by-case basis. We are proceeding with discussions while of course thinking in parallel about what the overall balance will be.

Q4:

When discussing portfolio reconfiguration, investors also tend to look at things like which division will have what percentage, and will look at the exposure by region. What discussions are held and what actions are taken regarding reconfiguration?

For example, if it is about raising ROIC, I think there are options such as applying more leverage, taking more risk, or pursuing more volatility.

Whether it is Mineral & Metal Resources or Energy, I feel that the business model itself is not just about having interests, but designing various features such as having offtake rights or incorporating distribution components into the business.

Are you holding discussions on portfolio reconfiguration from the perspective of how to control volatility, or not just pursuing ROIC but raising shareholder value from the perspective of suppressing the cost of shareholder equity and expanding the equity spread?

I would like to ask if there are changes between the conventional portfolio allocation and discussions being held aiming for the next step.

Nakai : Exactly as you just pointed out, it is not a matter of us simply investing in interests and being exposed to volatility due to commodity prices.

For example, I think that entering into LNG trading and using that volatility to our advantage and reducing risk overall is a way of doing things that has become the norm for us. We want to continue to increase value by combining investment and trading in such a way.

Also, since large-scale investments are continuing, we are currently discussing using third-party capital to apply leverage rather than using entirely our own capital. Regarding future projects we are looking to invest in, we are currently discussing them in the overall context, including the application of leverage.

Q5:

Regarding the asset portfolio review, in what time frame do you plan to proceed with divesting projects planned for exit equivalent to approximately 10 percent of overall book value? There is a statement in slide 6 that you aim for further portfolio enhancement in the next MTMP as well, but in the most recent financials briefing, CEO Hori mentioned that buyers are also becoming cautious, making budget formulation for asset turnover-type businesses difficult.

I think there are people who do not know to what extent they can expect asset recycling gains, cash inflows, and ROIC improvement under these circumstances. Please tell us your thoughts

Nakai : I think the time frame for projects planned for exit is difficult to predict.

There are projects that can be exited immediately, and there are projects that take time to exit as we make adjustments through discussions with other shareholders or partners. I think we must proceed while always being conscious of the time frame for exit.

On the other hand, I believe there are both cases where profit from asset recycling is generated when making an exit, and cases where depending on the circumstances, we must exit with resolve even if some loss is incurred. Since this involves counterparties, I think it differs greatly depending on price conditions, negotiations, and the situation in market.

Regarding the develop and sell type assets in real estate given as an example, the story that buyers are becoming cautious because the market is becoming difficult to forecast is certainly true, and I think that the sale of assets being pushed back little by little is something that is actually happening.

We want to do our best until the end to proceed as planned as much as possible while observing the market.

As for initiatives for actual project exits, we are creating plans while firming up discussions on how much and which projects we recycle every year, and how much profit will emerge from that, while taking into account various elements such as the total pluses and minuses and the time frame. We believe we must firm this up together with each business unit precisely for the formulation of the MTMP.

In the current MTMP, we initially explained that we would conduct asset recycling of about 870 billion yen over three years. On an annual basis this is an average of around a little under 300 billion yen.

In the current MTMP, we have been able to achieve asset recycling of 1.5 trillion yen, or an annual average of 500 billion yen, but this is an uncommonly high level and turned out like this because there were various projects such as Paiton and VLI.

I am confident we can conduct asset recycling at a level of around 300 billion yen going forward as well. We want to do our best so that we can firmly summarize that at the time of the MTMP announcement.

Q6:

I would like to ask about Global Energy Transition. I understand that initiatives for decarbonization are gradually becoming less prominent with many taking a wait-and-see approach.

Could you please tell us with what stance you will work on these investments over the medium- to long-term, or whether there is a possibility that some risk will arise as a result of such unwinding among the projects expected to generate earnings in the future?

Nakai : When thinking about Global Energy Transition, I believe how the world views decarbonization and sustainability is a very important point, and I think it is a fact that largely due to the influence of US President Donald Trump, there are reviews undergoing to various regulations and delays to projects are occurring in Europe.

I think your question is about what we will do in a situation in which such unwinding takes place. For Mitsui, as with the recent torrential rains in Southeast Asia, I think it is a fact that responding to climate change is something that cannot wait. Regardless of how others around the world respond to the situation, we want to take a firm stance on the matter.

While working on Global Energy Transition projects with environmental and social value, we have come to a point where we cannot gain the understanding of our stakeholders unless there is clear economic rationality. In order to proceed with the Global Energy Transition strategic initiative while firmly securing economic rationality, we are being selective regarding the projects we work on.

Actually, although the difficulty level of the projects is rising a little, I believe Global Energy Transition itself will succeed beyond the expectations set out in our plan. There are projects for which investment decisions are being made or which have already started, such as the low-carbon ammonia projects explained earlier.