Chemicals

Business Strategy

Opening Remarks

Furutani : I am Takashi Furutani, in charge of the Chemicals, Food, and Retail businesses. Today, I will explain the major initiatives and future direction of the Chemicals segment.

First, I would like to give you the background as to why we chose Chemicals as a theme for this year’s investor day.

The Chemicals segment has expanded earnings through the accumulation of numerous businesses, embodying our corporate value creation model of creating, growing, and extending businesses.

Furthermore, by leveraging broad expertise from raw materials to final products, the segment serves as a central hub for cross-segment collaboration and is expanding cross-industry initiatives.

As a result of this growth, the segment has grown to a point where profit on a scale of 100 billion yen is within sight.

The growth within the segment is tangible and is a topic we believe should be conveyed to all investors.

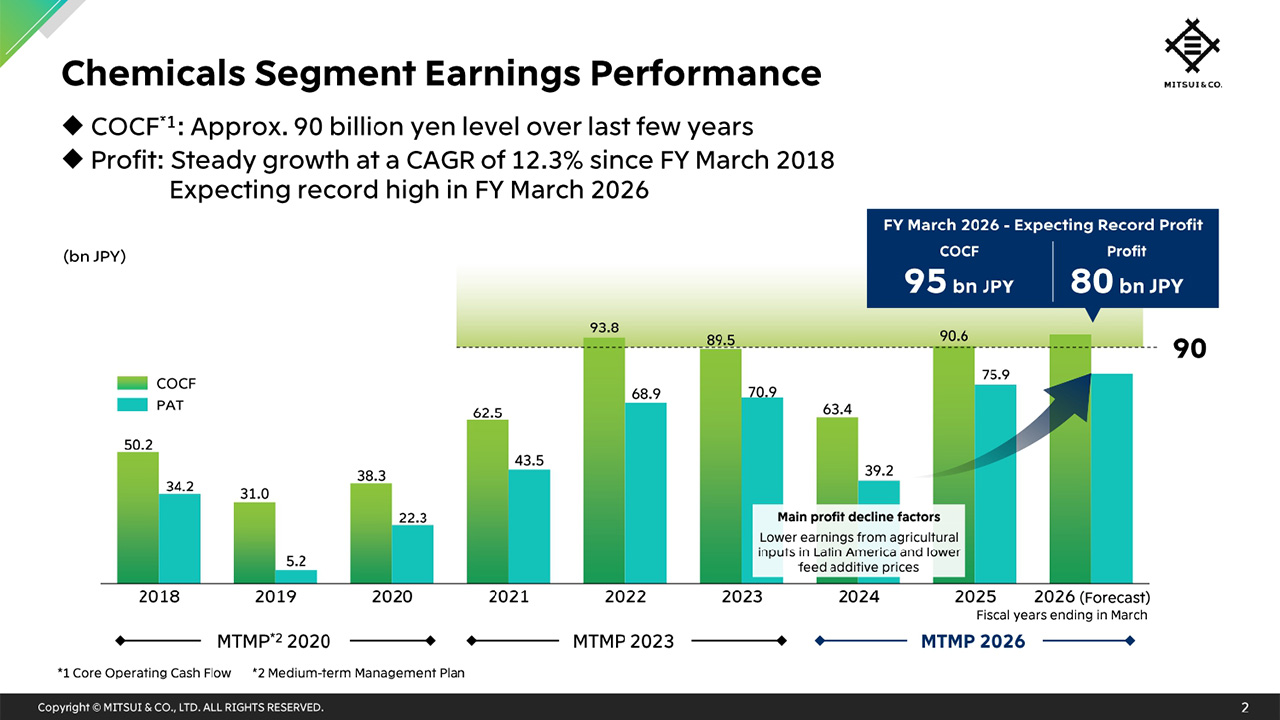

Chemicals Segment Earnings Performance

This is the earnings performance of the Chemicals segment since FY March 2018. Core Operating Cash Flow (COCF) has hovered around the 90 billion yen level since FY March 2022, and profit has continued to grow at a CAGR of 12.3% since FY March 2018, reaching a record high in FY March 2025.

We expect to increase profit in FY March 2026 as well, projecting record highs for both metrics. I will explain the major businesses supporting this growth and our strengths.

Main Businesses

The Chemicals segment consists of three business units: Basic Materials, Performance Materials, and Nutrition & Agriculture. Business clusters with origins in trading contribute to earnings in a balanced manner.

Core businesses include methanol, tank terminals, and salt fields, automotive resin materials, and agricultural inputs centered on crop protection and fertilizers. These contribute approximately 60% of the segment's profit.

For example, tank terminals are operated with Mitsui’s 100% ownership in Texas and Antwerp, Belgium, supporting the trading functions of global chemical and energy companies.

The automotive resin materials business was developed based on long-standing resin raw material trading, and was expanded into production and sales in North America through joint ventures with Japanese producers.

The agricultural inputs business has also grown into a core business based on upstream interests in South America and sales networks mainly in Europe. In addition to these, we have started making investments in growth areas such as ammonia, forest resources, and functional food ingredients to form new core businesses.

Trading

Trading, which is the foundation of the Chemicals segment, still accounts for about 30% of segment profit and supports the earnings base.

By owning trading assets such as tank terminals and ships, securing procurement and sales destinations through long- and short-term contracts, and depending on the product sometimes owning production assets, we combine these in various ways and secure flexibility in trade flows and optimize them. Even in the event of supply chain disruptions caused by issues on the producer or consumer side, or geopolitical reasons, we believe we have maintained a stable supply structure with a certain degree of resilience.

This structure further solidifies trust from customers, creating a virtuous cycle where that trust leads to the next investments for growth.

Strengths

In the next several slides, I will speak on the four strengths that support the competitiveness of the Chemicals segment in order, giving examples of specific businesses.

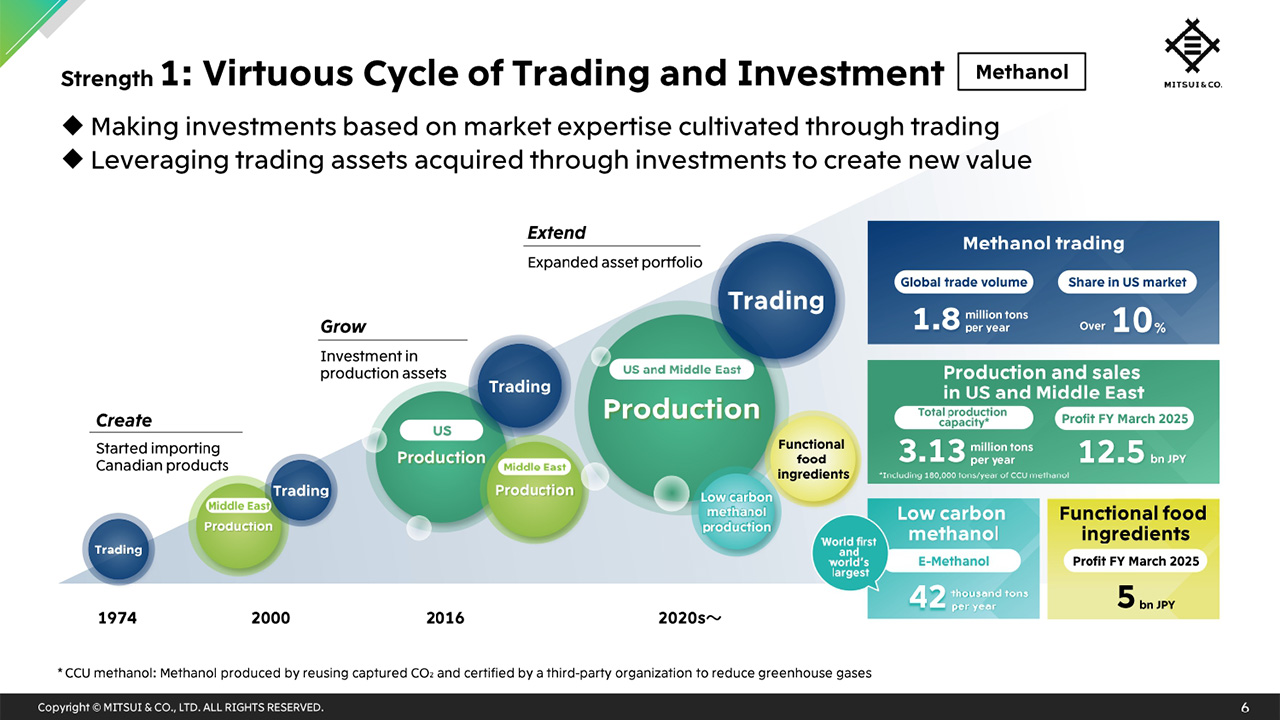

Strength 1: Virtuous Cycle of Trading and Investment (Methanol)

The first strength is the virtuous cycle of trading and investment. Our methanol business started with products produced inside Japan. In 1974, we were a first mover in stepping into importing products from outside Japan with high price competitiveness, starting full-scale imports from Canada.

As trading expanded we continued to take advantage of new opportunities and launched a production business in 2004 with Sipchem in Saudi Arabia, leveraging the feedstock advantage in the Middle East, while simultaneously strengthening our own procurement capabilities.

Furthermore, in 2015, focusing on the US which became more competitive due to the shale revolution, we collaborated with Celanese, the world's largest methanol consumer, to expand into the production business in the US.

As with this example, we started from trading for procurement and sales and moved into competitive production investments, building foundations in major regions of the world.

To meet the rising need for low-carbon methanol from customers and society, in 2025, together with European Energy, we pioneered the world's first production of e-methanol, capable of reducing GHG emissions by over 95% compared to conventional methods, and began supplying to Maersk.

We also invested in the functional food ingredients business of our long-time partner Celanese, expanding our collaboration with them from basic chemicals to nutrition.

Connecting trading to investment and then to the creation of new businesses, this has grown into a business that embodies the virtuous cycle unique to Mitsui.

Strength 1: Virtuous Cycle of Trading and Investment (Ammonia)

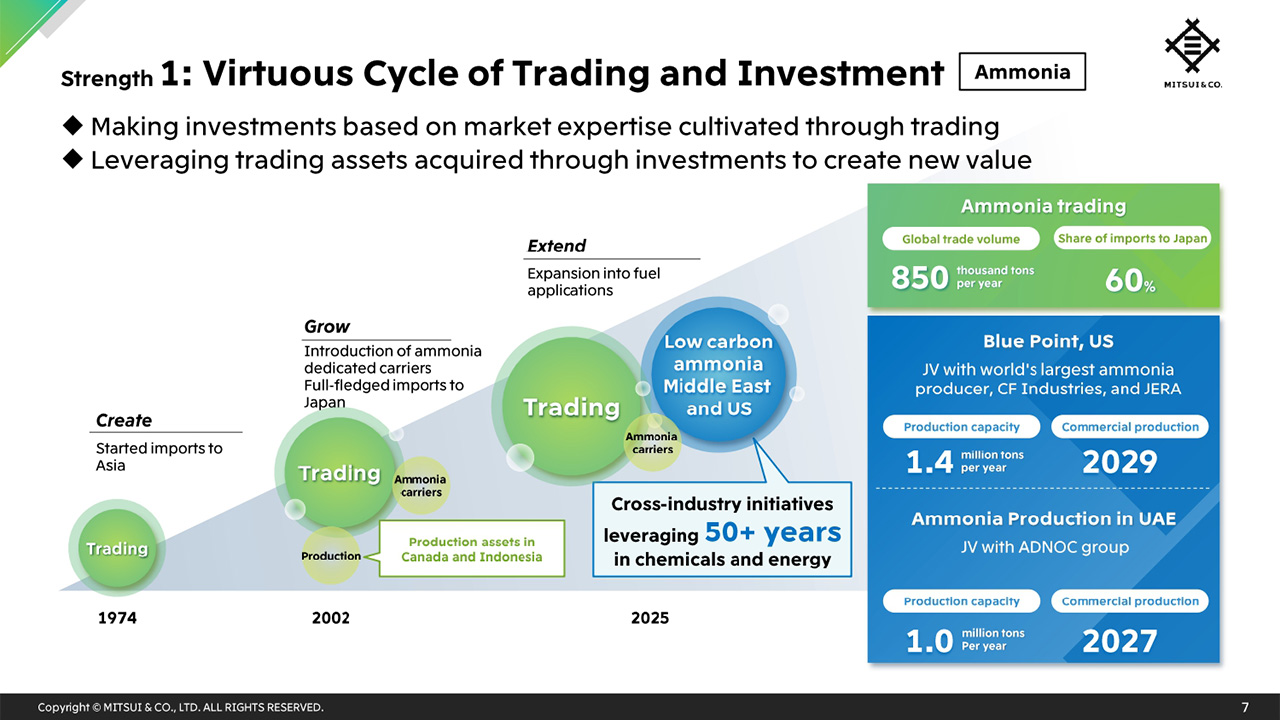

Next, I will speak on the ammonia business.

We have been trading ammonia since the 1970s, and by securing dedicated ships early on, we have built a long-term stable supply structure leading to about 60% share of the Japanese market. By combining this strong trading foundation with upstream expertise in areas such as natural gas and carbon capture and storage in the Energy segment and our business network in power generation, we are in the process of forming a new value chain that transcends traditional chemicals trading.

In Louisiana, we are collaborating with CF Industries, the world's largest ammonia producer, and JERA to participate in the Blue Point low-carbon ammonia project, which reduces CO2 emissions in the production process by over 95%. We are also participating in an ammonia production project in Ruwais, UAE, aiming for commercial production of low-carbon ammonia through phased equipment introduction.

While demand for ammonia is expected to expand for use as a next-generation fuel and as a hydrogen carrier in addition to the traditional uses as fertilizer and chemical feedstock, we are fusing trading and upstream expertise to work on developing the next growth area.

Strength 2: Steady Growth of Core Clusters (Agricultural inputs: crop protection and fertilizers)

Next, I will speak on the second strength, steady growth of core clusters.

The agricultural inputs business is composed of two areas: crop protection and fertilizers, and has now grown into a core business contributing to profit on the scale of around 10 billion yen.

Both crop protection and fertilizers have their origins in trading. In fertilizers against the backdrop of trusted relationships cultivated in the iron ore business, we acquired phosphate ore interests in Peru from Brazil's Vale in 2010, and currently jointly own them with the major US fertilizer company Mosaic. We have built an integrated value chain from upstream to sales.

In the crop protection business, we built a sales foundation in Europe through collaboration with Japanese producers, and in recent years have expanded our sales network to major agricultural countries like Brazil and India.

Based on the sales network in Europe, we are also selling products for which we own the IP.

Furthermore, we were an early mover in 2001 into bio-product business utilizing biological microorganisms, and are applying this expertise to the fertilizer field as well.

We are also deepening cooperation with the seed and animal health businesses to expand synergies across the entire agriculture value chain.

Strength 3: Strategic Portfolio Enhancement

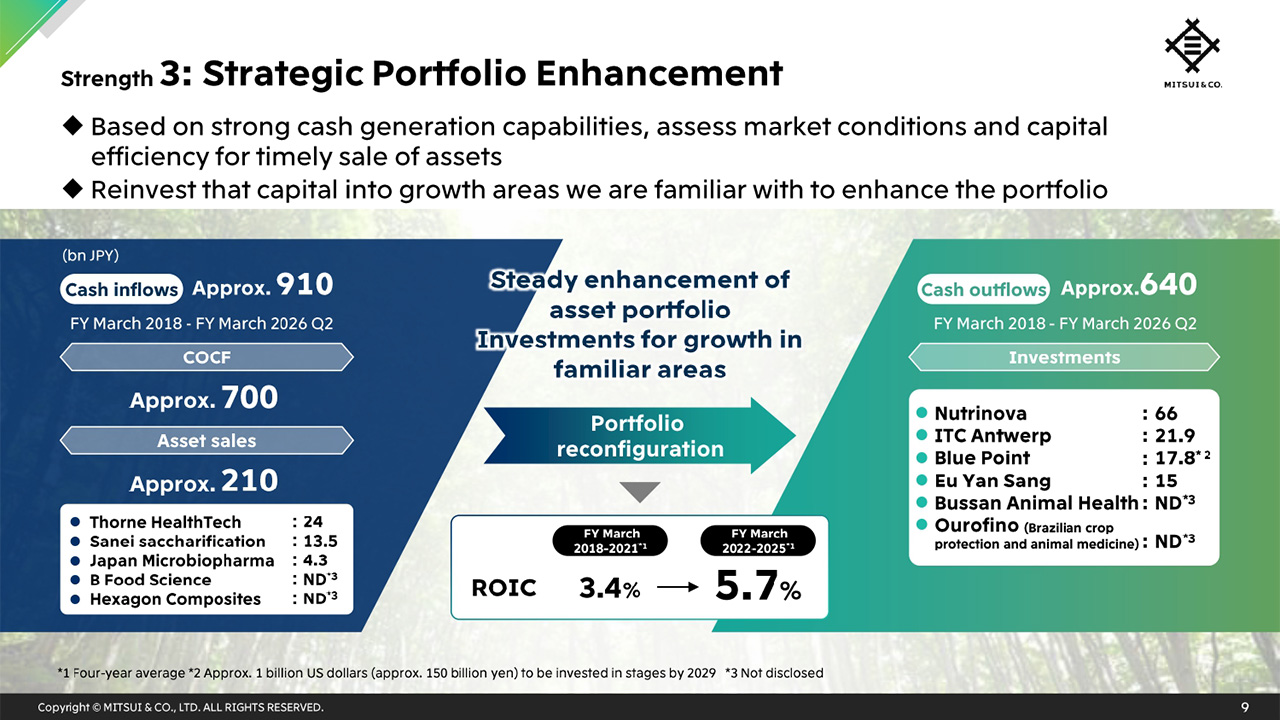

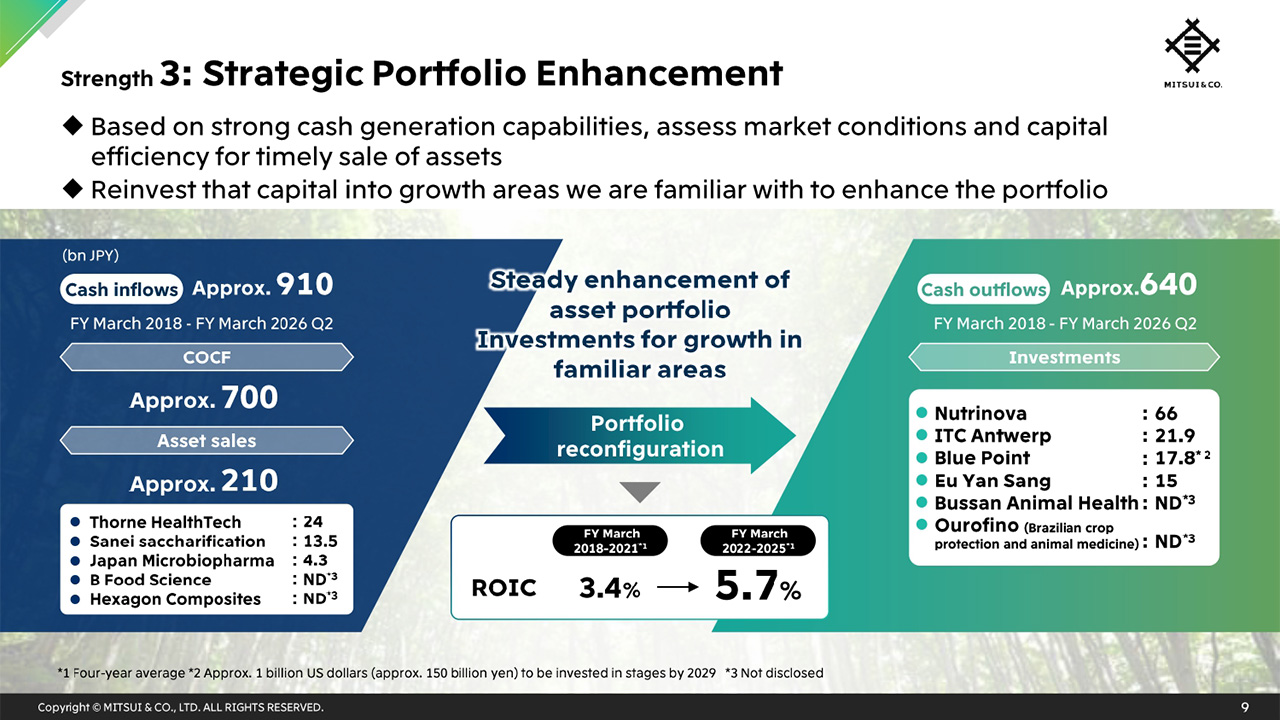

Regarding the third strength, strategic portfolio enhancement, in this slide we have our track record for portfolio reconfiguration from FY March 2018 to Q2 of FY March 2026. Combining the cumulative COCF of 700 billion yen and asset sales of 210 billion yen during this period, we secured total cash inflows of 910 billion yen. Utilizing those inflows as a foundation, we executed investments for growth of 640 billion yen.

We have steadily improved ROIC through portfolio reconfiguration, by consistently executing timely asset sales and reinvesting in growth areas.

We will continue to further enhance the quality of our business portfolio through investments for growth and asset reconfiguration in our areas of expertise.

Strength 4: Cross-industry Initiatives

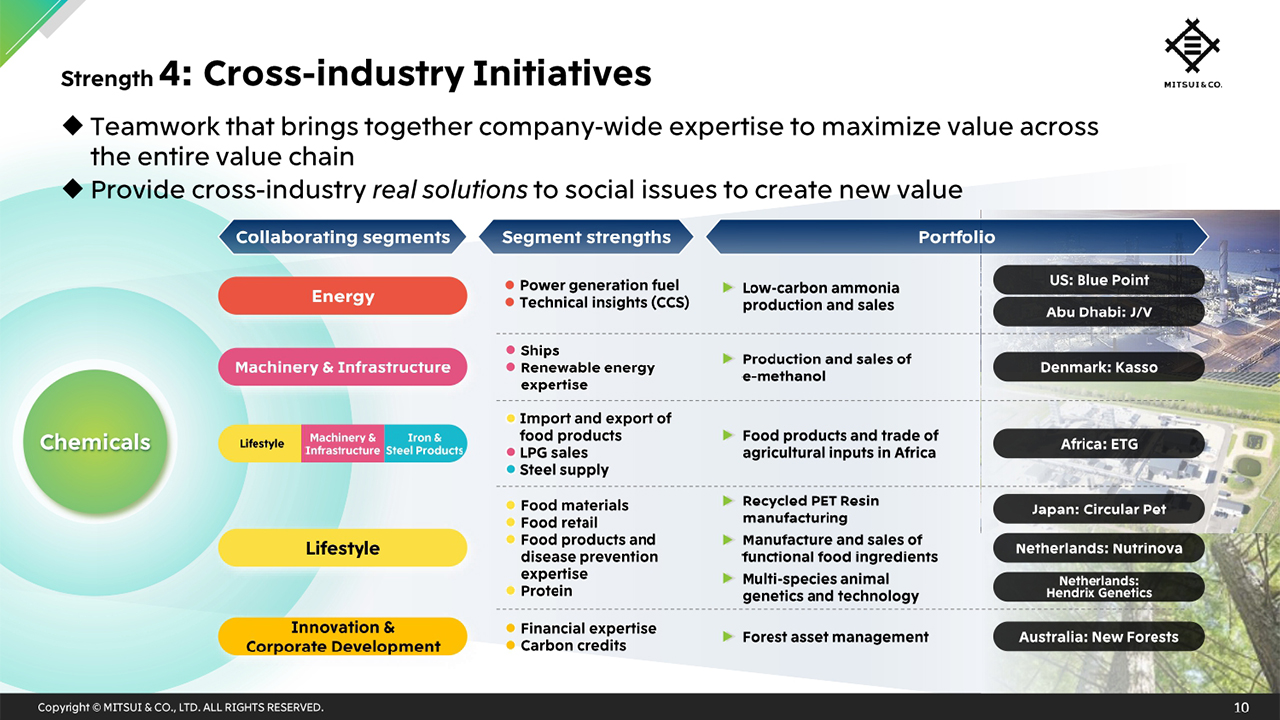

The fourth strength is our cross-industry initiatives.

The chemical industry has a wide base through various materials and has contact points with many industries. Our Chemicals segment covers a wide range from feedstock and basic materials to functional materials, and utilizing this breadth and depth of expertise, we are seeking cross-industry initiatives in cooperation with other segments.

In addition to low-carbon ammonia mentioned earlier, in the forest asset management business, we have combined the know-how in finance and carbon credits in the Innovation & Corporate Development segment, and have expanded globally with a core business in Australia. By utilizing expertise in pulp, paper, and construction materials in the Chemicals segment, we add value to forest resources, making proposals to customers that differentiate us from other asset management funds.

What supports these initiatives is the deep trust with top-tier customers that the Chemicals segment has cultivated over many years.

Based on that trust, and by combining the strengths of each segment across the entire value chain, we submit proposals that we call real solutions, which are highly practical, leading to greater value and the creation of new business opportunities. Cross-industry initiatives are a new growth driver that further propels existing core businesses, and we position them as an important pillar for the medium- to long-term earnings expansion of the Chemicals segment.

Company-wide collaboration is the true value of Mitsui as a global investment and trading company, and serves as the driving force to simultaneously realize the solution of social issues and the creation of new value.

Conclusion

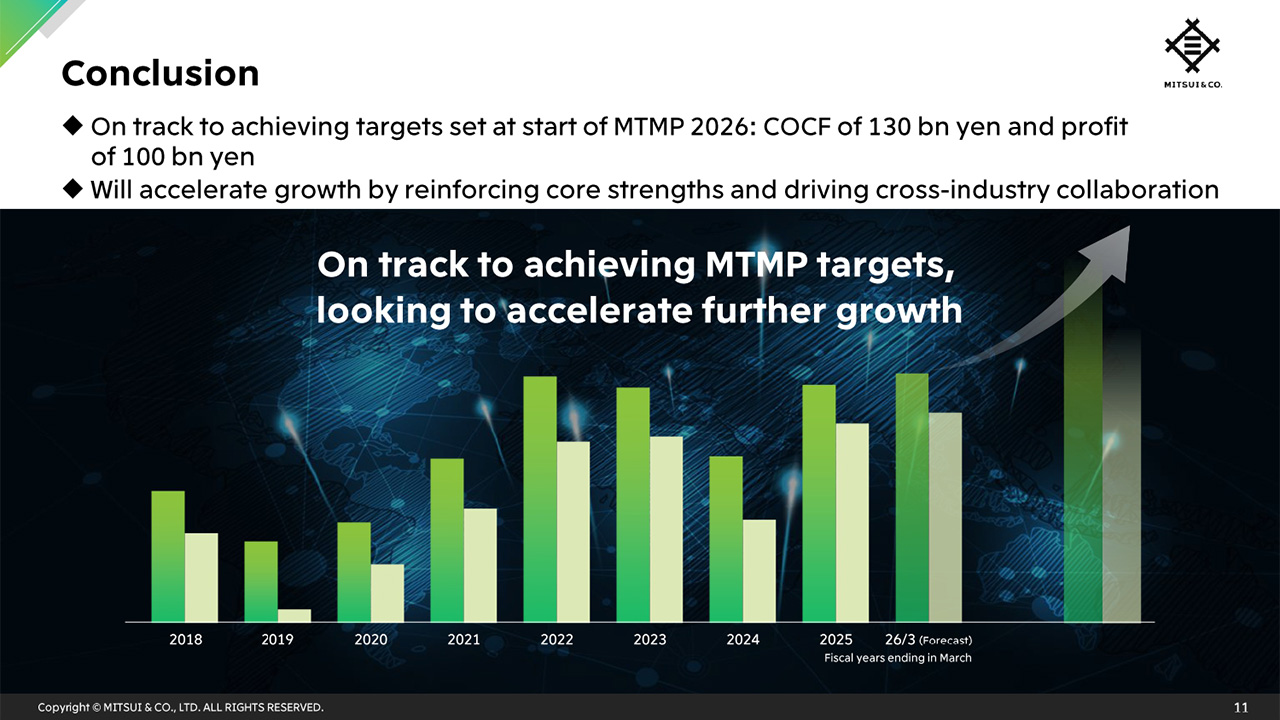

The Chemicals segment has set MTMP targets of COCF of 130 billion yen and profit of 100 billion yen. Through initiatives to date, we have made good progress in the strengthening of competitiveness in core businesses and the enhancement of the quality of the business portfolio, and the depth of the earnings base has increased as we work towards our targets.

We will continue to demonstrate our ability to collaborate across industries, as we steadily move forward to enhance earnings and aim for the early achievement of the targets.

This concludes my presentation, thank you for your attention.

Q1:

Regarding portfolio enhancement on slide 9, the 210 billion yen asset sales, what were the level of ROIC for the assets you sold Also, regarding the assets currently being invested in as part of the reconfiguration, I assume many have not yet contributed to earnings, but what is your future outlook for their ROIC?

From the outside, it is difficult to see if the portfolio reconfiguration is truly leading to ROIC improvement, so please tell us the difference in ROIC between the assets sold and the assets to be acquired in the future.

Furutani : We do not disclose ROIC on an individual company basis, but the ROIC of sold assets varies significantly depending on when we invested or when the business started. Therefore, it is not simply that we invested in companies shown on the right side of the slide because the ROIC of the sold companies on the left side were uniformly low. The companies we are currently investing in include those where the contribution to earnings will come later, such as Blue Point.

It is difficult to simply explain the reason why the ROIC of the entire Chemicals segment rose from 3.4 percent to 5.7 percent in terms of asset divestitures and investments for growth. However, as a result of investing in assets where we could increase added value, selling assets where ROIC improvement had peaked, and investing in assets that could grow in the future, we believe we have been able to improve ROIC to 5.7 percent for FY March 2022 onwards, compared to 3.4 percent between FY March 2018 and FY March 2021. Going forward, we want to further improve the ROIC of the Chemicals segment by strengthening businesses that are already generating earnings and by bringing businesses where we made investments for growth to fruition.

Q2:

I understand that for Chemicals, you have expanded from trading to investment. I would like to ask about the trading business, which currently accounts for about 30% of profit. Amidst rising geopolitical risks, it seems that the trading function of trading houses is being revisited, and that you are receiving more and more inquiries from customers. Please tell us if there are any specific examples where the need for your trading functions and earnings generating opportunities are actually increasing. Also, do you think the profit from the trading business, will increase further in the future? If it increases, I think this will lead to an increase in ROIC, so tell us your thoughts on that point as well.

Furutani : As you pointed out, due to geopolitical issues and the uneven distribution of raw materials, trade flows are suddenly disrupted, or situations occur where supply is stopped due to regulations. In such an environment, the trading function possessed by trading houses is being revisited, and needs are indeed increasing. However, we do not believe this is temporary due to the current situation. For example, we own tank terminals in various parts of the world and do business with many customers. Even if supply stops in a certain region, it is possible to respond flexibly, such as by utilizing tank terminals in other regions to adjust the timing. Please understand that actual transaction volume is increasing because we have this responsiveness.

The background to the increasing trading volume of products and commodities we handle is that we are flexibly exercising our functions in response to supply chain changes and reconstructing the trading. As a result, a cycle has been created where orders from customers come to us, and we are also building up trading assets so that we can reliably capture this demand.

As you mentioned, trading currently accounts for about 30% on a profit basis, and we will continue to strengthen it as a business foundation. On the other hand, we are not thinking of separating investment and trading and growing only trading. As I explained earlier, we mean to connect logistics contracts related to supply and purchase with trading functions such as production businesses and tank terminals, and expand by comprehensively combining these. We believe that by combining trading and investment to leverage functions, rather than growing only trading, business for the entire Chemicals segment will increase as a result.

Q3:

For MTMP 2026, the profit target is 100 billion yen, and this fiscal year's profit forecast is 80 billion yen, so I think you are envisioning significantly growing profit in the future.

Regarding the Basic Materials, Performance Materials, and Nutrition & Agriculture business units listed on Slide 3, please tell us which business unit you are currently particularly focusing on investing. Also, when viewed over a time frame of the next 3 to 5 years, please tell us which areas you think will grow significantly. In addition, I would appreciate it if you could provide a little more supplementary information about the businesses that you gave as examples in today's explanation.

Furutani : Among the areas developed by the three business units, there are differences in the asset scale of each business unit. However, regarding future investment, we are considering growth areas to be low-carbon chemical products including ammonia, forest resource assets held by Performance Materials, and its derivatives such as biochemicals and biorefineries, which will lead to basic chemicals. For example, in our collaboration with Celanese, we are working on functional food ingredients, and this also utilizes materials derived from basic raw materials within their complex.

As a company, we are investing in areas where future growth is expected, such as low-carbon areas, nature-derived green areas utilizing forest resources, and areas leading to nutrition within derivatives which are downstream of chemicals. These are fields we will invest in as future growth areas, and rather than investing with a bias toward a specific business unit, we believe there is growth potential in the areas between businesses such as upstream, midstream, agriculture, and nutrition within the entire Chemicals segment. Therefore, we want to invest flexibly in growth areas without being bound by frameworks and generate earnings.

Q4:

You mentioned investing overall without being bound by frameworks, but looking at the historical investment background of your Chemicals segment, I recognize there was a period when investment was stagnant for a time. Since the COVID-19 pandemic, the external environment has turned positive, and I think the earnings base has been significantly strengthened, but I also feel that we are entering an era where profit cannot be accumulated without new investments. Is the outlook that the investment amount in the Chemicals segment will increase in the future?

Furutani : We believe that firmly proceeding with investments for growth and aiming for earnings generation while increasing the depth of each business is a necessary approach. As the Chemicals segment, our policy is to pursue investment possibilities more than ever before in order to raise earnings. Among them, we want to firmly invest in high-quality projects such as the low-carbon chemicals I explained earlier, as well as green-related, bio-related, and nutrition, that are close to downstream in specialty areas.