Substantial Growth

Toward 2030

Opening Remarks

Hori, CEO (Hori) : I am Kenichi Hori, CEO. Thank you very much for joining the Mitsui Investor Day 2025 today.

For today’s final presentation, I will explain the overall picture of how we will sustainably achieve substantial growth toward 2030.

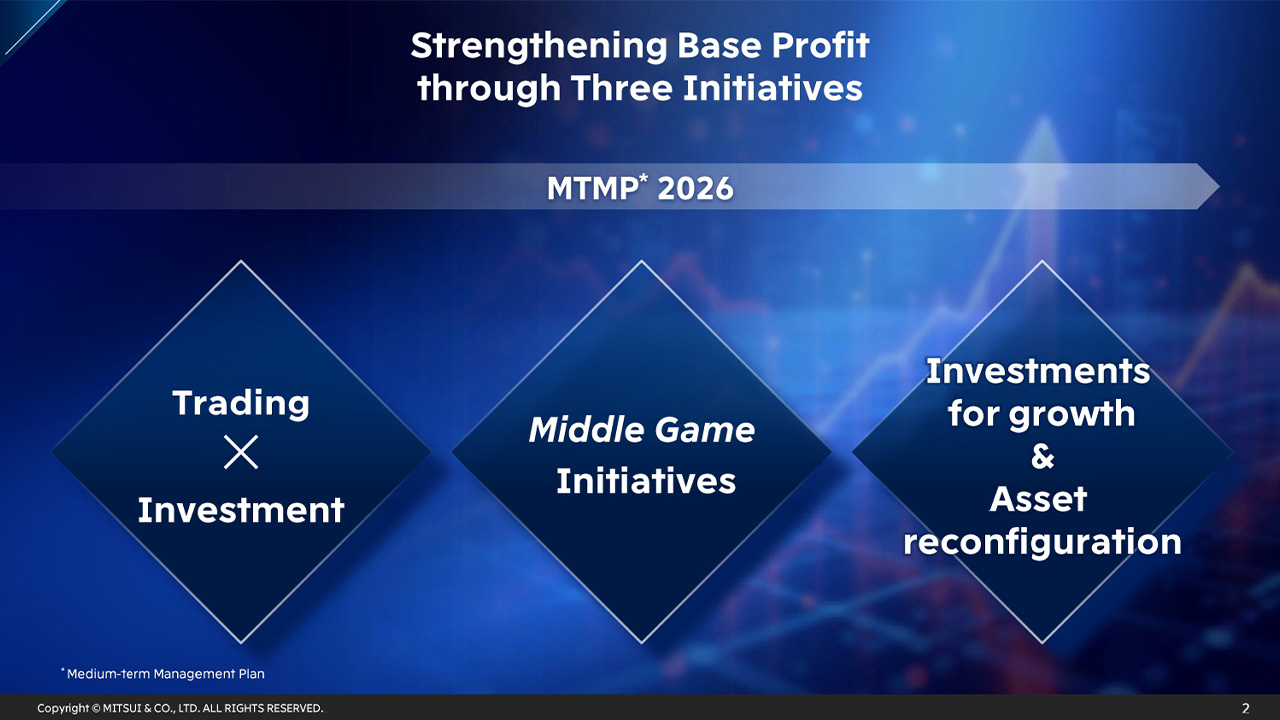

Strengthening Base Profit through Three Initiatives

Through the MTMP 2026, we have improved the quality of the portfolio and enhanced base profit.

I would like to go over our three priority initiatives.

First is the creation of synergistic value driven by the virtuous cycle that integrates sophisticated trading with investment development. As Takashi Furutani explained using chemicals as an example, we leverage the networks and expertise gained from our own field trading operations to originate high-quality investment opportunities. By further extending these initiatives into adjacent areas of businesses, trading and investment reinforce each other and continuously generate sustainable, synergistic value.

Second is driving forward what we call middle game initiatives. We define the middle game as the phase where we can fully leverage our strengths, such as strengthening existing businesses or turnarounds of challenging projects. In situations where diverse and holistic decision-making is required, our employees worldwide apply their creativity and expertise to enhance earnings and deliver organic growth.

Third, we are continuing to advance the creation of new earning sources through investments for growth, as well as asset reconfiguration with a focus on improving capital efficiency.

By linking these three initiatives, we are steadily strengthening our base profit by strategically expanding the scale of our businesses and improving the quality of our portfolio.

Enhancement of Base Profit Progressing as Planned

Under the current MTMP, we expect to achieve a total increase in base profit of 170 billion yen through the strengthening of existing businesses, efficiency improvements and turnarounds, and the launch of new businesses.

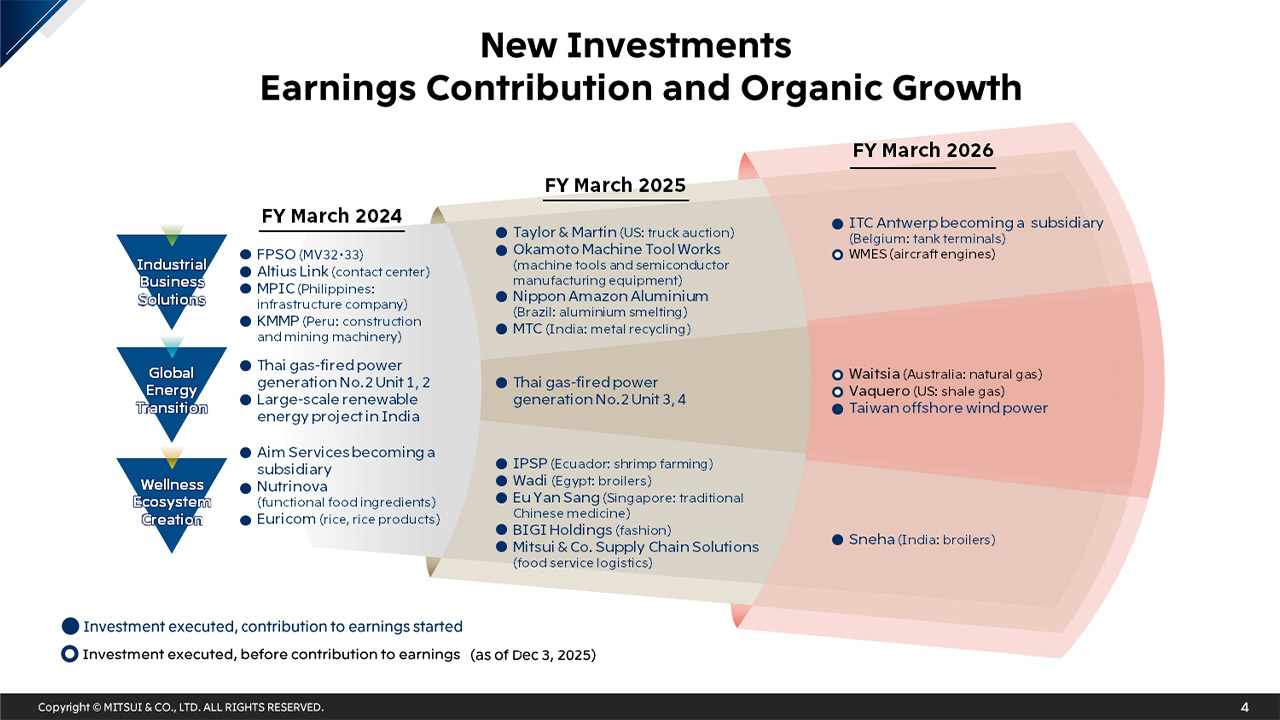

New Investments - Earnings Contribution and Organic Growth

Here, we show the new investment projects which start contributing to earnings during the current MTMP period.

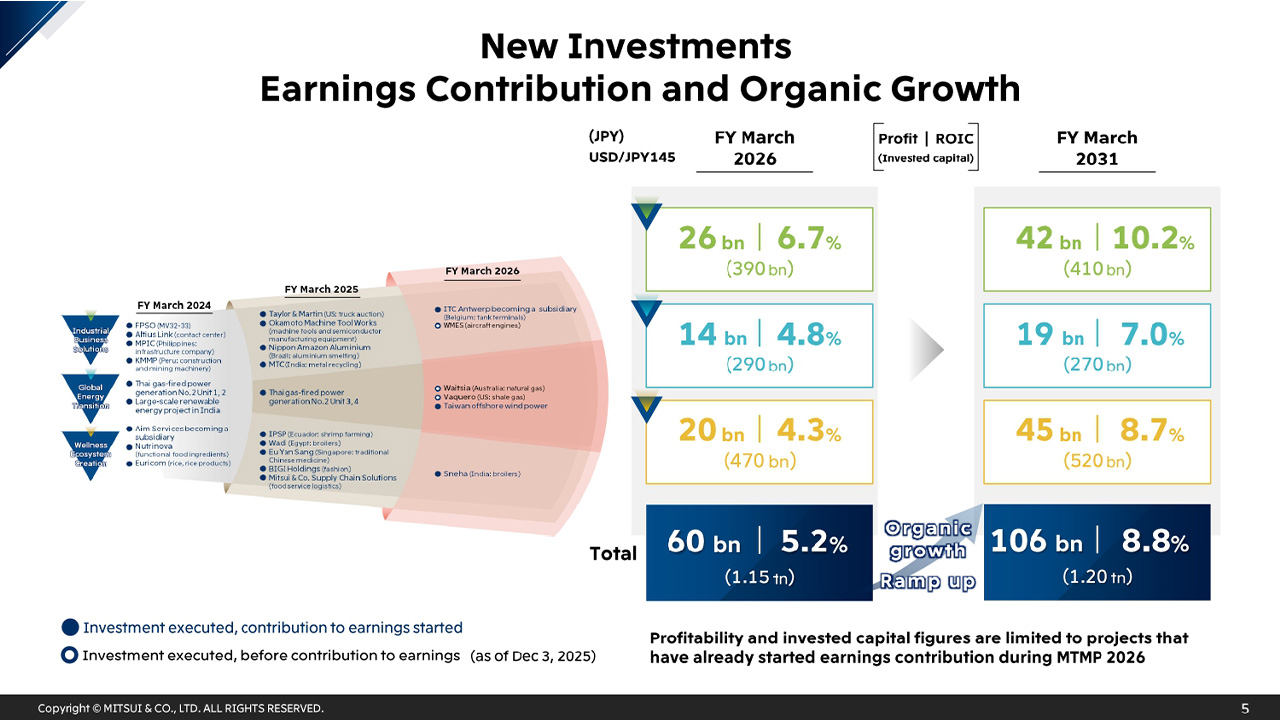

New Investments - Earnings Contribution and Organic Growth

From these new investments, we expect a total earnings contribution of 60 billion yen in FY March 2026, using a 145 yen to USD exchange rate. By firmly growing and expanding these in the future, we will further strengthen our earnings base. The earnings power of these projects is expected to grow to 106 billion yen in FY March 2031, and ROIC is expected to grow from 5.2% to 8.8% through ramp-up and organic growth.

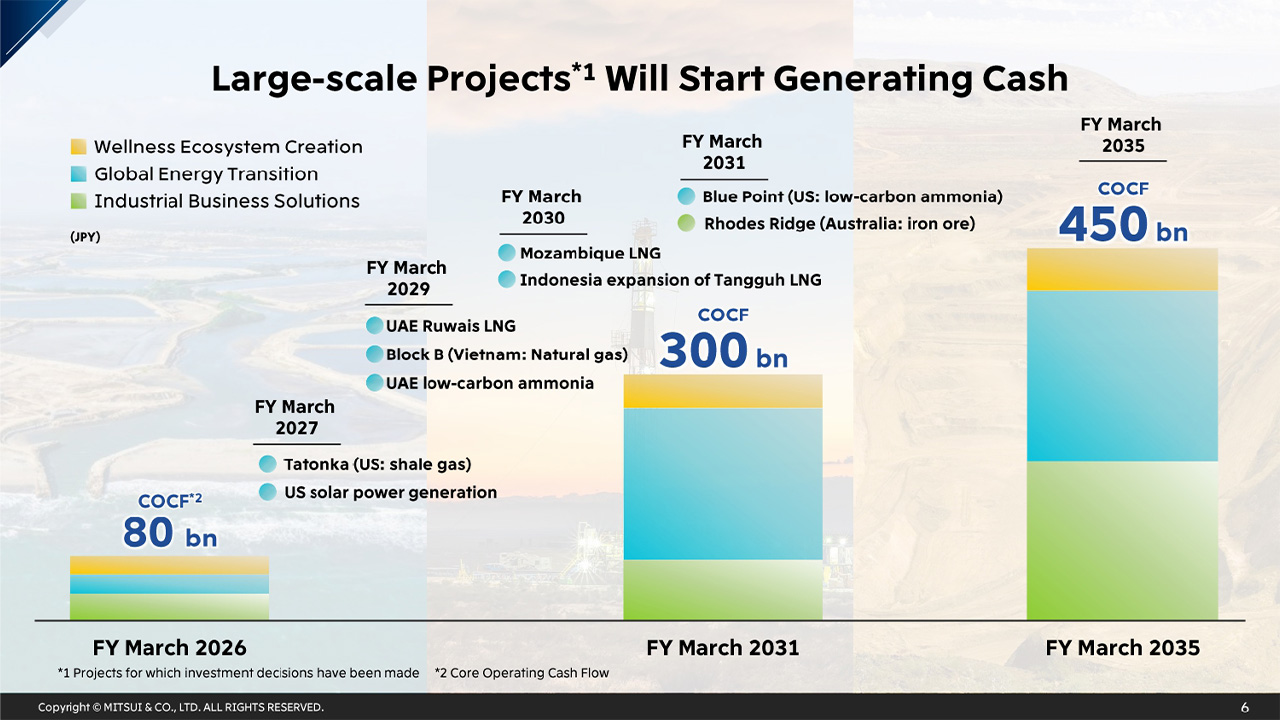

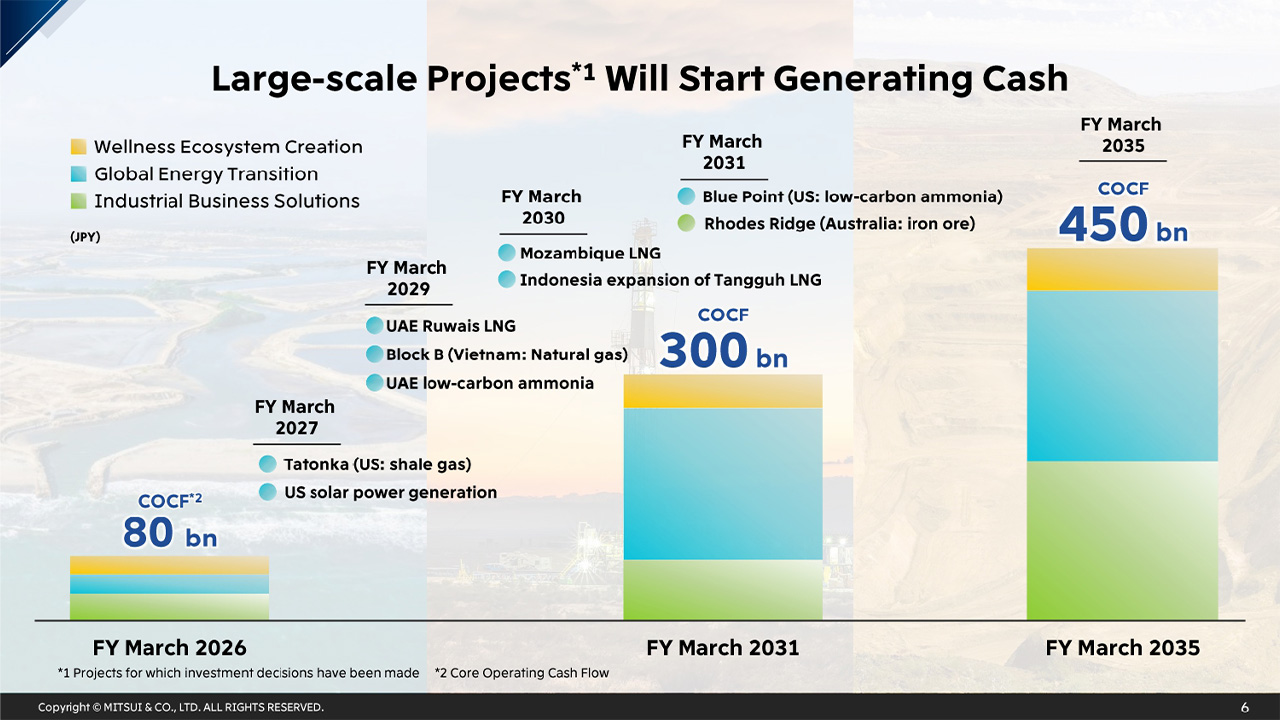

Large-scale Projects Will Start Generating Cash

Here, we present projects expected to start contributing to cash generation from FY March 2027 onwards. One of the strengths of our company is that there are many highly competitive, carefully selected large-scale new projects for which investment decisions have already been made, waiting to launch over the medium- to long- term, and you can expect a sustainable expansion of cash inflows.

The future cash contribution amount including these investments is expected to be approximately 300 billion yen in FY March 2031 and 450 billion yen in FY March 2035.

Toward the Next MTMP

I would like to speak briefly on the next MTMP. During the current MTMP period, I strongly feel that we have gained a clear line of sight to a step change to the next level of profit, driven by sustainable growth. We are having extensive internal discussions and plan on announcing the next MTMP in conjunction with the announcement of the full-year financial results. In this plan, we want to present our vision of the future and a medium- to long-term growth story with greater resolution. Today, I would like to share some of my current thoughts on this topic.

3 Key Strategic Initiatives: From Conviction to Expansion

First, I would like to emphasize that through the current MTMP, I have gained strong confidence in the effectiveness of the three Key Strategic Initiatives we initially set forth. In the next MTMP, through diversification across industries, regions and time horizons, we will continue to expand our business based on a further enhanced version of the three Key Strategic Initiatives.

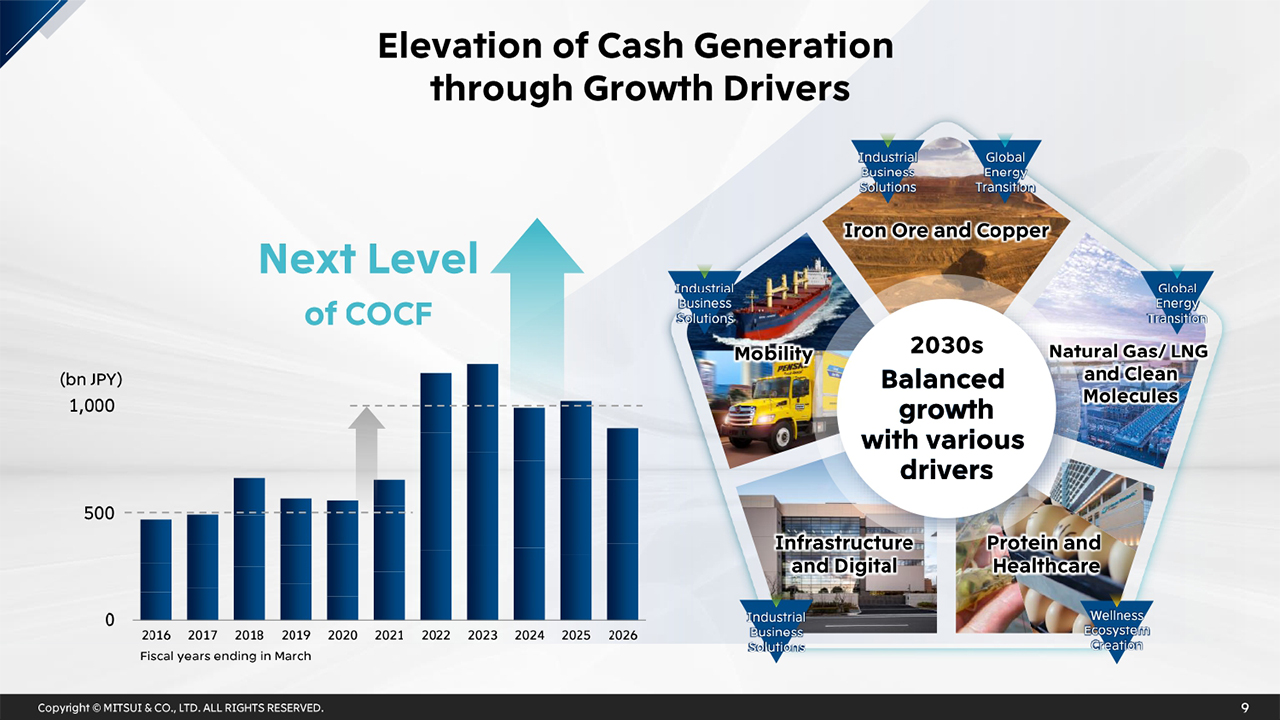

Elevation of Cash Generation through Growth Drivers

As shown in the graph on the left, COCF since FY March 2022 has undergone a step change to approximately double what it was previously. Toward a further step change, we will continue to achieve balanced growth through diverse growth drivers.

Through our initiatives so far, the key commodities, services, and markets that are important to our management strategy, and the functions expected of us by our customers, have become clearly visible. Going forward, I would like to substantially elevate our cash generation capability by thoroughly strengthening and pursuing each of these.

In Industrial Business Solutions, we will continue to strengthen initiatives in iron ore, mobility, and infrastructure, including digital. High-quality iron ore will continue to be essential for low-carbon steel production, and with the start of production at Rhodes Ridge in Australia, our equity production volume will grow significantly.

In Global Energy Transition, the importance of natural gas and LNG is being reaffirmed, driven not only by rising demand in emerging economies but also by the growth in power demand from data centers in advanced economies. We hold globally diversified, competitive interests and reserves, and we will expand our stable supply structure to customers, including related logistics. We will also ensure the responsible supply of clean molecules such as low-carbon ammonia in line with evolving global needs.

In Wellness Ecosystem Creation, we will focus on healthcare, protein and adjacent businesses. In healthcare, with IHH as the core, we will develop high value added adjacent businesses by leveraging the knowledge and data that accumulates every day. In protein, we will expand the supply of high-quality protein such as chicken, shrimp, and salmon globally.

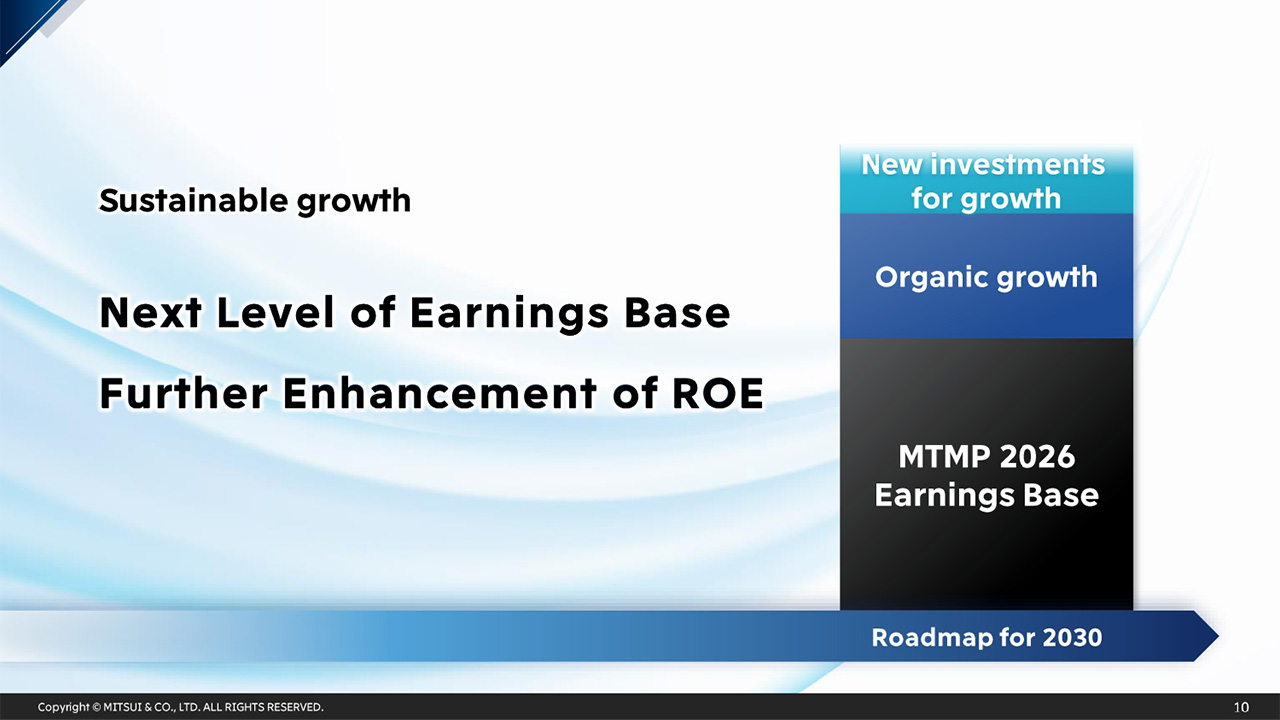

Sustainable growth: Next Level of Earnings Base

Even under a complex and dynamic business environment, we will deliver both resilience and sustainable growth on a global base by emphasizing our evolving three Key Strategic Initiatives and growth drivers.

Based on the solid earnings base built in the current MTMP, which includes new projects for which investment decisions have already been made, we will continuously realize organic growth through middle game initiatives, including strengthening existing businesses, and efficiency improvements and executing turnarounds. Furthermore, by adding the earnings contribution brought by new investments from the next MTMP onwards, our earnings base will undergo a substantial step change toward 2030. With this, further enhancement of ROE is on the horizon.

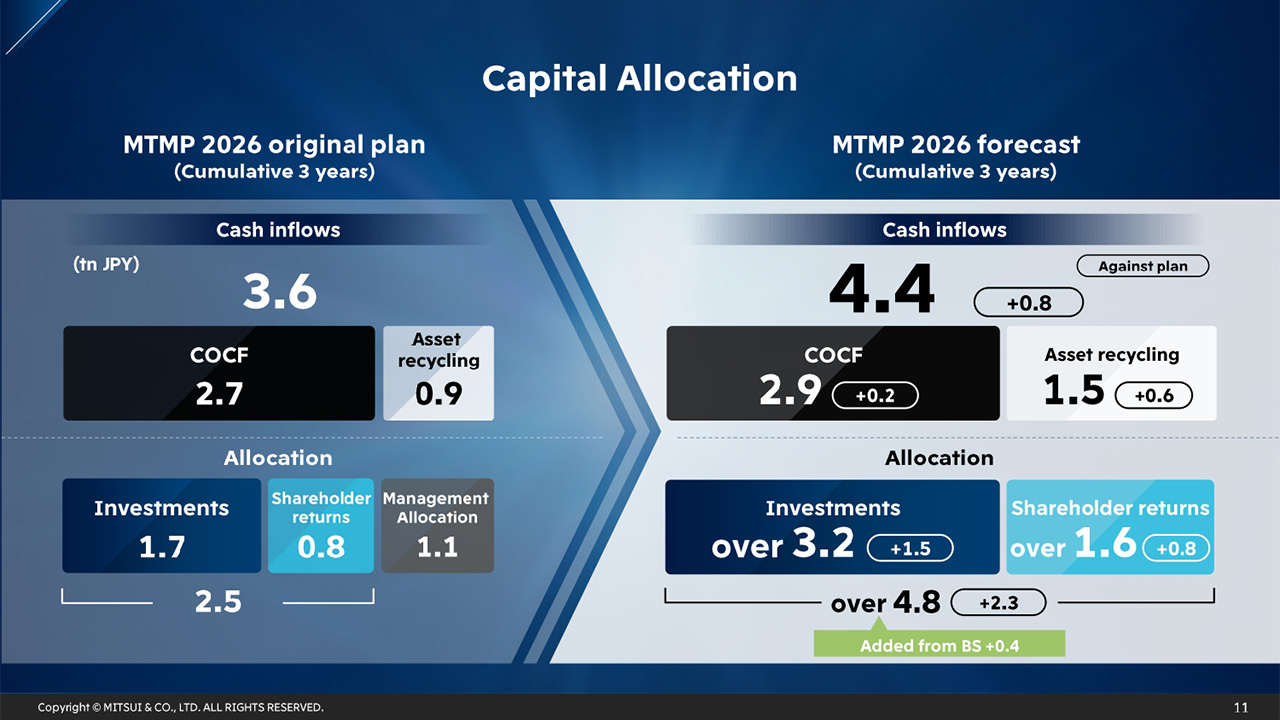

Capital Allocation

In the current MTMP, in addition to the strong cash generation base we had established, we significantly increased cash inflows from the original plan by recycling assets in a timely manner. This enabled us to expand the Management Allocation, and by distributing this in a balanced manner, investments increased from the original plan of 1.7 trillion yen to 3.2 trillion yen and shareholder returns doubled against the original plan. Moreover, by utilizing the balance sheet when a high-quality, large-scale investment opportunity arose, we executed investments for growth in an agile and bold manner. The total amount of investments for growth in FY March 2026 is expected to be the largest ever in one fiscal year.

Looking ahead to the next MTMP, we will place greater emphasis on capital allocation, as we focus on our engagement with investors. By carefully selecting high-quality investments from a rich investment pipeline, we will thoroughly verify our balance sheet while carefully observing the business environment and set the Management Allocation in a more agile and appropriate manner. Under a highly unpredictable business environment, we will steer the company in a way that we preserve flexible managerial options. At the same time, if we become ready to take advantage of a strategically extremely important investment opportunity, we intend to execute capital allocation in a dynamic manner so that we do not miss an opportunity.

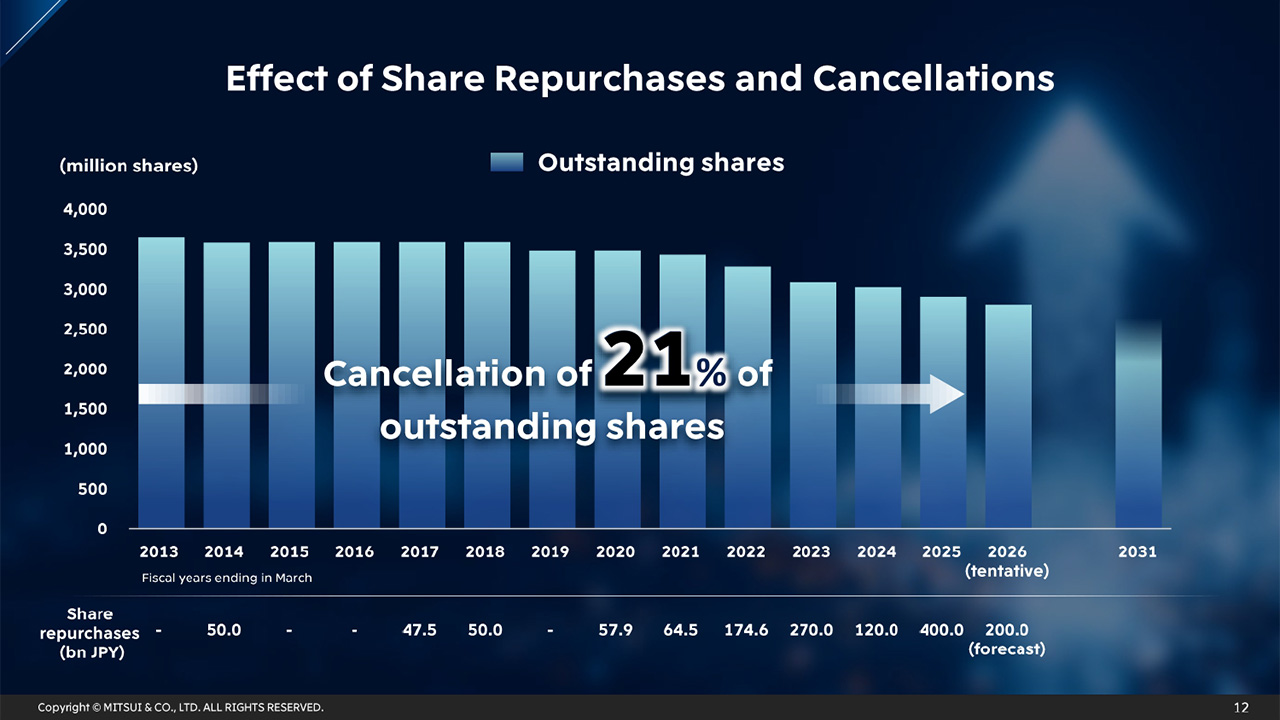

Effect of Share Repurchases and Cancellations

Ahead of industry peers, we have been conducting share repurchases and cancellation of treasury stock starting from FY March 2014 with the intention of enhancing shareholder returns. We have acquired over 1.2 trillion yen of our own shares in total so far, and cancelled approximately 21% of outstanding shares as of the end of FY March 2013, thereby increasing the value per share. We are planning a total of 200 billion yen share repurchase this fiscal year as well, and we will continue to maintain a strong focus on improving the value per share going forward.

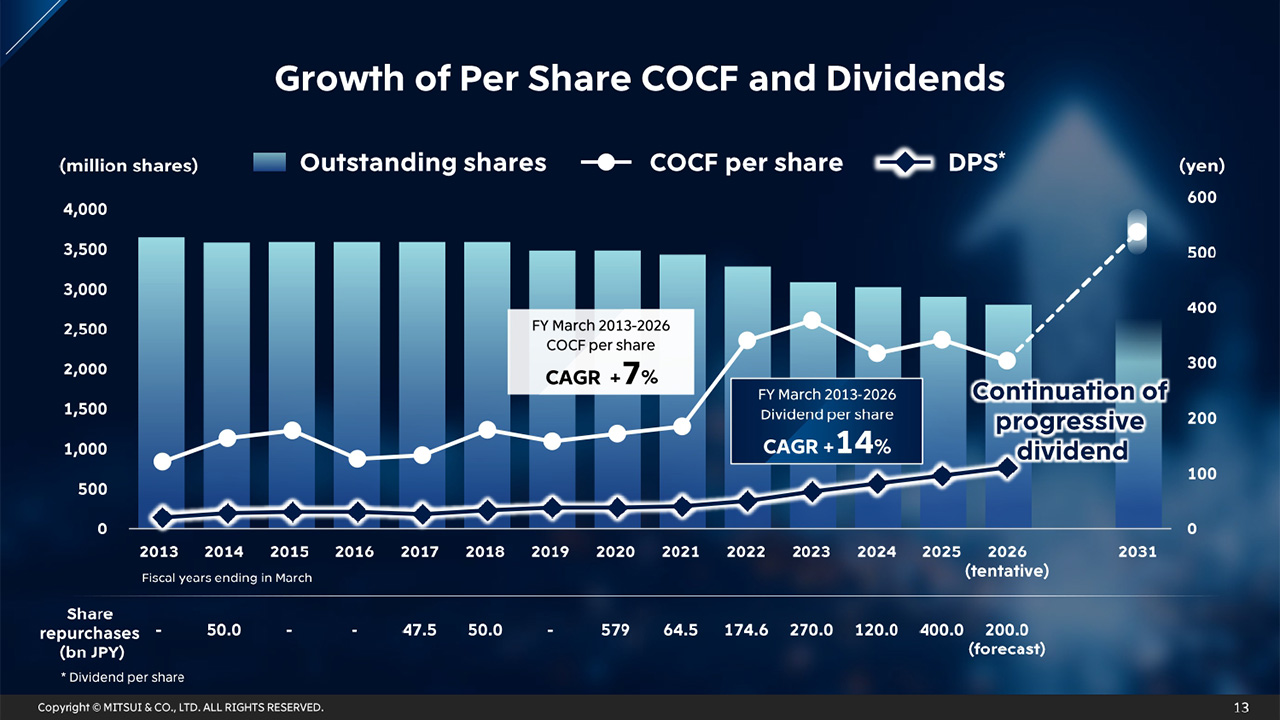

Growth of Per Share COCF and Dividends

This line graph shows the trend of the COCF per share. The growth of the total COCF and the continuous cancellation of treasury stock have led to a CAGR of 7% in COCF per share since FY March 2013. DPS has also grown significantly by 14%. Going forward, through the sustained growth of the cash generation base centered on growth drivers and agile share repurchases and their cancellations, we will substantially grow our COCF per share and continue with our progressive dividends policy.

We are currently redefining Mitsui’s unique competitive strengths and discussing our future vision, along with the concrete strategies that will take us there, guided by our Key Strategic Initiatives and growth drivers. At the time of the next MTMP announcement, we will provide a more detailed explanation of the roadmap toward a step-change in our earnings base to the next level. We appreciate your continued support and look forward to delivering Mitsui’s next leap forward.

That concludes my presentation. Thank you for your attention.

Q1:

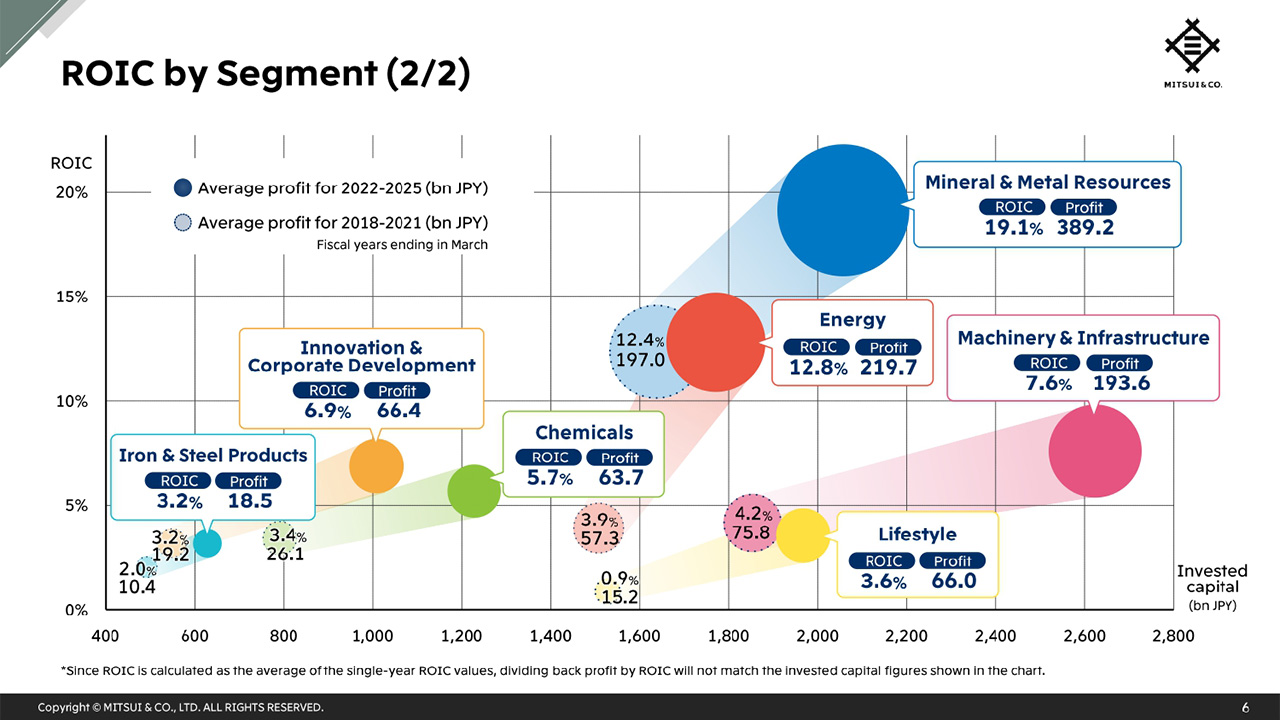

On slides 6 and 7 of the CFO presentation, you showed ROIC by segment. Please tell us what kind of discussions are taking place regarding initiatives to expand the valuation multiple and margins.

Hori : First, regarding the expansion of the multiple, I believe it is important to clearly demonstrate our unique business model. For example, for projects in the Mineral & Metal Resources and Energy segments, we simultaneously incorporate elements that aim for the upside of commodity prices and infrastructure related elements that generate earnings regardless of commodity prices. By doing so, we can manage the risk of commodity price fluctuations while retaining the upside. If the understanding of this model sinks in to investors, I believe we will receive a higher valuation.

In addition, there are cross-industry initiatives, which are a characteristic of trading companies. As introduced in the chemicals business strategy presentation today, low-carbon ammonia projects begin with multiple divisions collaborating based on an understanding of the fundamentals of ammonia. I believe the profitability of such projects and the structuring that is unique to Mitsui will also raise the multiple.

Also, in the wellness-related area of the Lifestyle segment, as an example, the market capitalization of IHH has expanded significantly recently, and the valuation of our investment projects is steadily rising. We will continue to hold IHH strategically, and opportunities are emerging to combine highly effective AI and digital technologies based on data. Linking these reveals connections with the pharmaceutical industry and insurance business. These are industries with very high multiples, and we will clearly show this going forward.

We plan to present concrete plans in the form of strategies in the next MTMP, and I believe we will be able to show a vision that improves the multiple.

Q2:

In slide 6, the earnings contribution from projects for which investment decisions have been made is set to increase going forward, reaching COCF of 300 billion yen in FY March 2031 and 450 billion yen in FY March 2035. This difference appears to be mainly due to the earnings power of Rhodes Ridge in Industrial Business Solutions. Please tell us the assumptions regarding the start time of the earnings contribution for the Rhodes Ridge project in this slide. In light of this disclosure, does this mean you are confident in the profitability of Rhodes Ridge?

Hori : In this presentation material, regarding the timing of the start of earnings contribution from Rhodes Ridge, we have reflected the assumptions we had at the time of announcing the project and have not included any potential upside from an early start to production. We can see a certain degree of potential for moving it forward, and we will proceed while coordinating closely with our joint venture partners. Regarding profitability, we have reflected our projections with a certain degree of probability.

Q3:

Since these are decided investments, will this profit increase account for the majority of organic growth in the next MTMP?

Hori : That is correct. We will work on these as existing businesses. We will plan dynamic new investments in the next MTMP and contributions from those investments will appear during the next MTMP period, or from FY March 2031 and FY March 2035, but have not been included in slide 6.

Q4:

You mentioned that capital allocation will be conducted flexibly and that you will operate the Management Allocation flexibly, and even more dynamically than before. Specifically, will you expand the framework of the Management Allocation, including the utilization of the balance sheet?

Hori : When we announce the next MTMP next year, we plan to conduct a verification of the balance sheet and present our strategy based on that.

We adopted the concept of the Management Allocation from MTMP 2023. It has two aspects: one of which is being mindful of the balance sheet, and the other involves making judgments on allocation between investments and shareholder returns after thoroughly scrutinizing the investment pipeline.

Since the current MTMP concludes at the end of this fiscal year, the remaining Management Allocation was allocated to both investments and share repurchases, leaving the current balance at zero. However, going forward we will always continue to think about the distribution between pipeline projects and shareholder returns. This is the most important point I want to convey.

Also, among the investment projects currently being considered, there are certain significant ones we are looking at for the next MTMP. We take a thorough approach when thinking about how much investment or shareholder returns to carry out, and how to proceed with capital efficiency in conjunction with the ROE target. I believe that by setting the Management Allocation flexibly, we can effectively discuss our dynamic progress with stakeholders.

This is also the reason I would like to present the Management Allocation more boldly, and speak with stakeholders on topics including leverage.

As for our method of communication regarding capital allocation, we are thinking of further expanding the Management Allocation which you have become familiar with during the current MTMP.

Q5:

In the CFO presentation, while ROIC by segment rose, the company's ROE looks likely to land in the 10 percent range, which is almost the same level as before the COVID-19 pandemic. Please tell us where you intend to place emphasis toward ROE improvement in the next MTMP.

Hori : We presented an average of 12 percent for ROE in the current MTMP and are working toward achieving that, but we are in the situation of reviewing our strategy in order to maintain or increase it toward the next MTMP.

To maintain or increase the ROE, I believe increasing earnings is the top priority. In the current MTMP, there are 3.2 trillion yen of carefully selected high-quality investments from the pipeline. As a characteristic of Mitsui, the earnings contribution timeline is divided into short-, medium-, and long-term, with some contributing to earnings quickly and others taking effect from around FY March 2030 like Rhodes Ridge. I think the most important thing is to firmly realize results without shifting the timeline.

Also, I believe that enforcing middle game initiatives even further is the most important path for improving earnings. In addition, we will firmly work on asset recycling every year. We have built up our track record but we will take this further, and while observing market conditions, we will conduct deals wisely to ensure economic rationality. Including asset recycling, we want to pursue high earnings that lead to ROE improvement.

To that end, I believe raising the value of held assets is best. I would like to maintain and improve ROE through the realization of added value to the existing portfolio so that decision-making on whether to continue holding or selling assets can be done at a high economic level.

At the same time, if earnings increase, our options will increase, so although it depends on the balance with the pipeline for investments for growth, I think the room to flexibly continue and execute share repurchases that raise capital efficiency will increase.

I want to consider appropriate leverage while taking the global economic environment into account, and view the next MTMP with ROE as the highest priority KPI.

Q6:

Industry peers are also indicating policies such as the ideal state of the balance sheet and appropriate leverage. I feel that setting an upper limit such as 0.6 times narrows the breadth of strategy, but please let us know your current thoughts.

Hori : I do not feel there is a strong need to keep the D/E ratio within a certain range. It is important that our credit rating is stable, but since it also depends on the global macro economic environment, we are constantly thinking about strategy while observing the economic environment.

We are always looking at the resilience of our portfolio, and it is entirely possible to rethink leverage depending on the situation, so I would like to make well thought out judgments. Having the widest possible range of options is the best approach in the current management environment, so we are not thinking about restricting that.

Also, historically, the D/E ratio of trading companies has had quite a wide range, so I think a slightly more flexible approach is possible. However, since a certain degree of caution is necessary, I would like to think about this while making good use of the global intelligence we possess. The MTMP is an important opportunity for Mitsui to make in-depth verification of various factors which we are currently in the process of doing.