Mobility Business

Strategy

Opening Remarks

Daikoku : I am Tetsuya Daikoku, and from this fiscal year I have been in charge of Energy Solutions Business Unit, Infrastructure Projects Business Unit, Mobility Business Unit I and Mobility Business Unit II. This will be the last presentation today.

Today, I will explain our strategy in the mobility field. Businesses in this field have continued to steadily grow over decades by responding to changes in industry structure and meeting the diverse needs of customers. Recently, there have been concerns about heightened geopolitical risks and the associated slowdown of the global economy, but even in such a business environment, we have globally and organically combined businesses and continuously strengthened our earnings base.

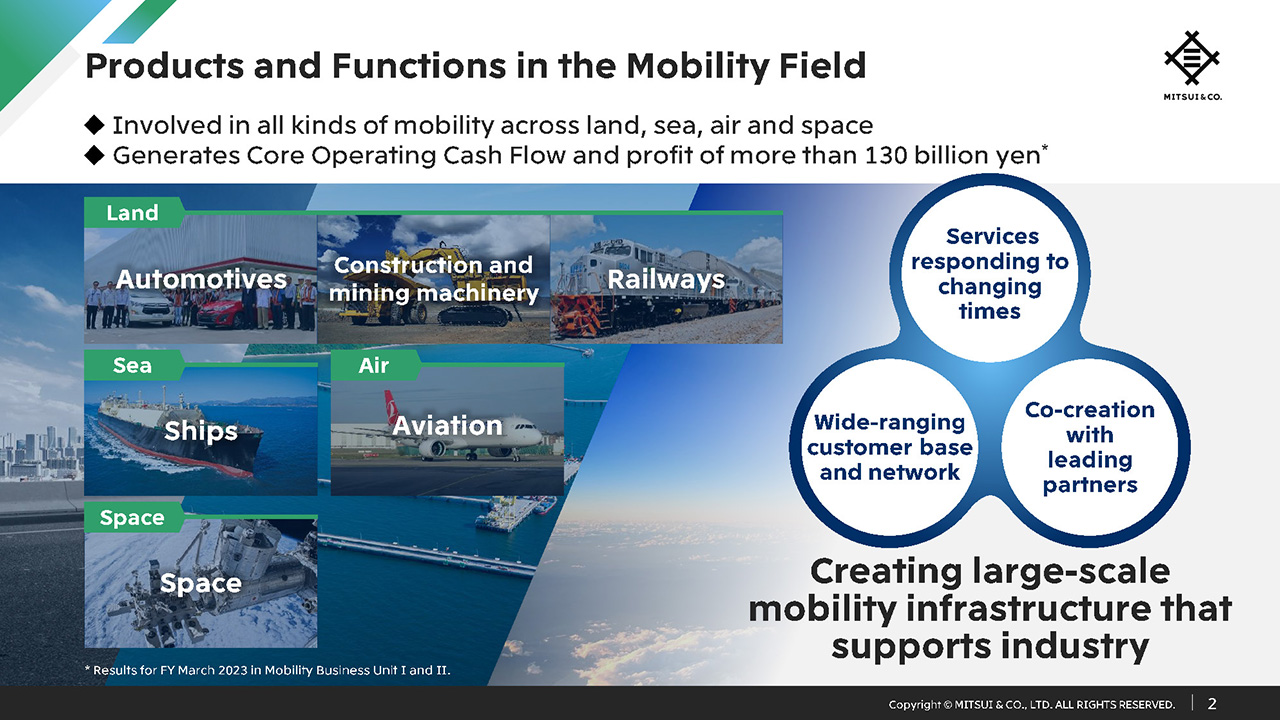

Products and Functions in the Mobility Field

As you can see, in the mobility field we handle various types of mobility including land, sea, air and space. For all of these, each business shares the common strengths of providing services that respond to changing times, a wide-ranging customer base and network, and engaging in co-creation with leading partners. In the field of mobility, Mitsui is creating large-scale mobility infrastructure that supports industry across the globe. In this field, Core Operating Cash Flow and profit for FY March 2023 exceeded 130 billion yen.

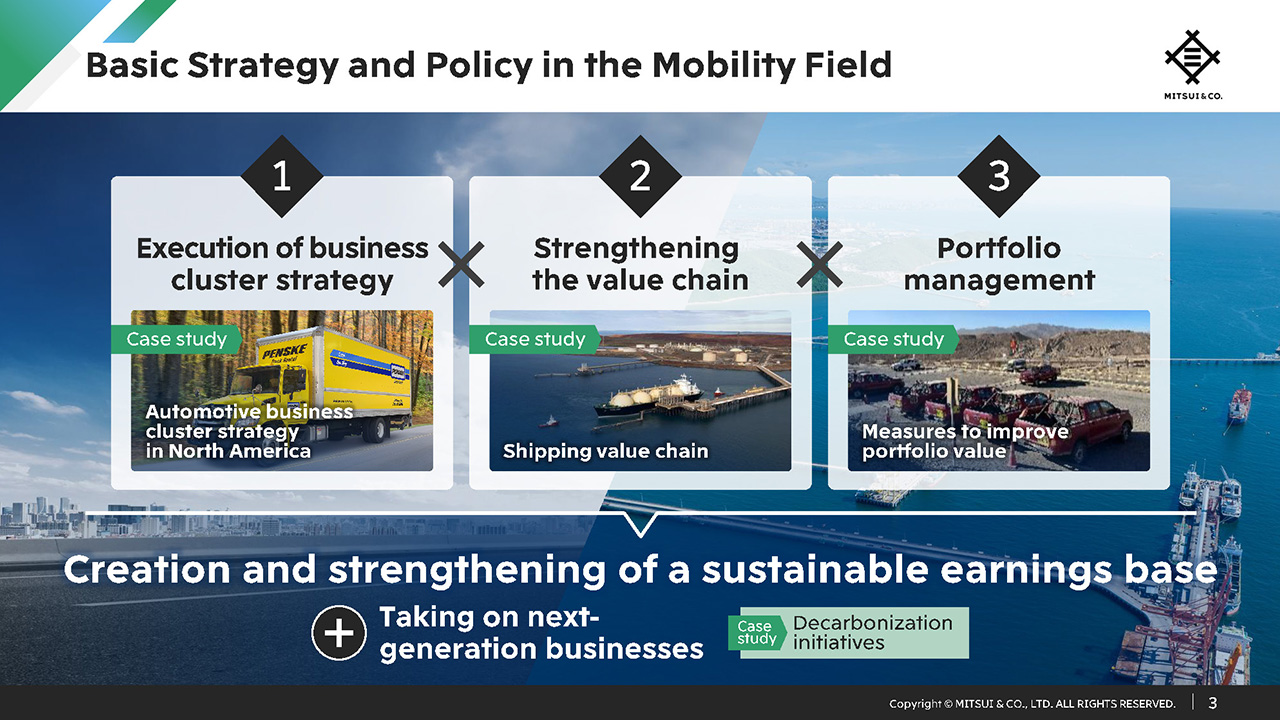

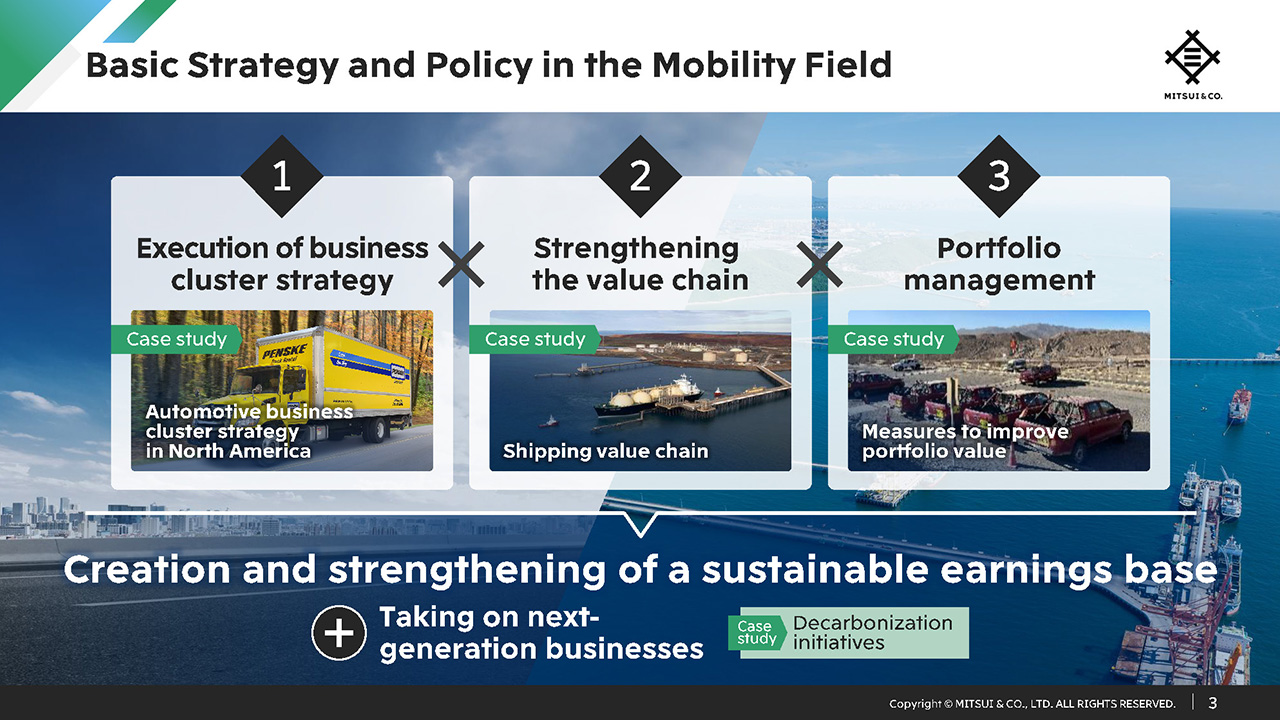

Basic Strategy and Policy in the Mobility Field

First, I will explain the basic strategy and policy in the mobility field.

We have laid out three basic policies, namely execution of business cluster strategy, strengthening the value chain, and portfolio management, which enable us to create and strengthen a sustainable earnings base. Today, I will explain mainly the automotive and ship businesses while presenting specific examples.

Leveraging this earnings base, we are also taking on next-generation businesses such as decarbonization initiatives which I will explain later.

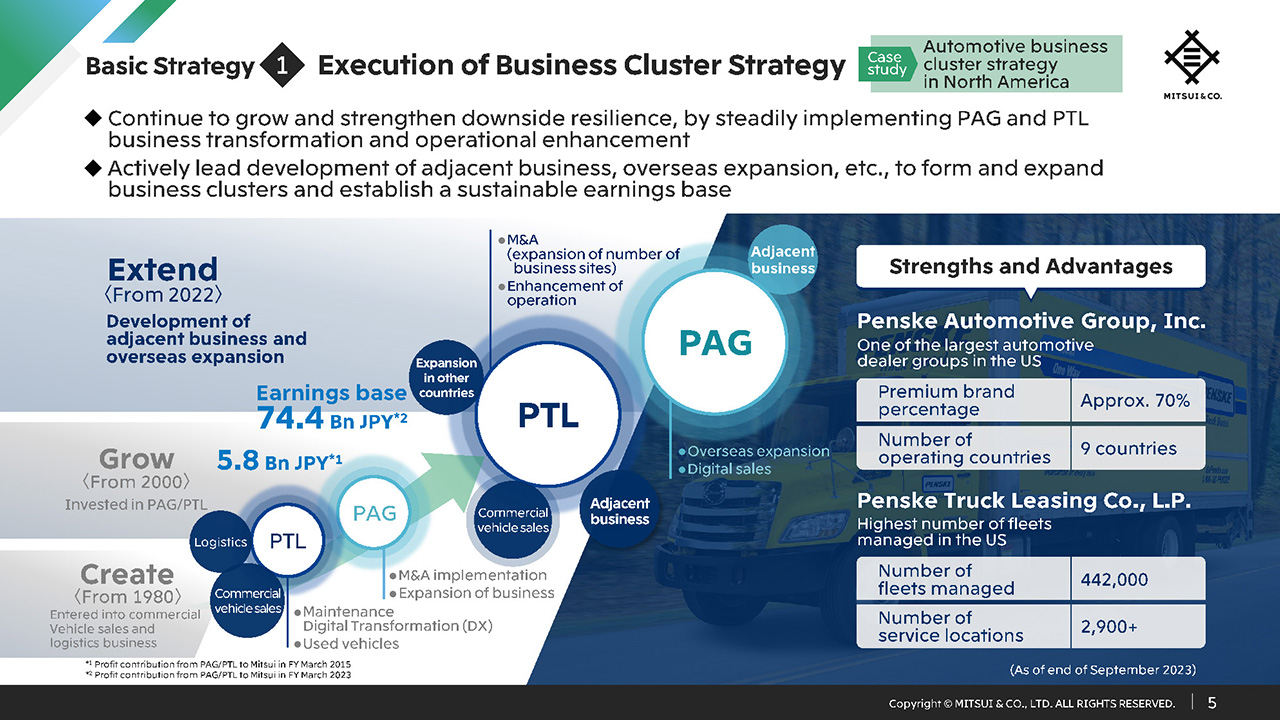

Basic Strategy① Execution of Business Cluster Strategy

To begin with, I will describe our first basic strategy of “execution of business cluster strategy.”

For this example, I will speak on land mobility, which includes automotives, and construction and mining machinery. In May this year we explained this as an example of a business strategy under Industrial Business Solutions, which is one of the three Key Strategic Initiatives of our Medium-term Management Plan. Here, we have continued to create and expand business by leveraging the strong relationships with partners spanning decades, starting with trading. There are over 100 affiliated companies worldwide, which form a geographically and functionally diversified business portfolio. Going forward, by not only clustering these businesses, but also developing adjacent businesses, and generating synergies between existing businesses, we aim to provide solutions with high-added-value as business clusters. From the next slide, I will use the automotive business cluster in North America as an actual example to specifically explain our process of business cluster formation.

Basic Strategy① Execution of Business Cluster Strategy

Even in the North American automotive market, which is the largest and most competitive in the world, the Penske business continues to have an overwhelming presence. Penske Automotive Group, or PAG, and Penske Truck Leasing, or PTL, have both transformed and expanded their businesses through M&A, and have steadily executed the enhancement of operations incorporating the latest technology through digital transformation.

As a result, PAG is not only one of the largest dealer groups mainly handling premium brands of passenger cars in the US, but has a very diversified portfolio operating in nine countries including the UK and Australia, in addition to the diversified product lineup with trucks and used cars, etc.

In addition, PTL has exhibited its strength to maximize customers’ vehicle utilization rates by providing full-maintenance service leasing through its own maintenance workshops, and now manages around 440,000 vehicles, showing an overwhelming presence in the US. The company is continuing to grow by seeking to differentiate without easing up on investment in maintenance technology, digital technology and human resources.

We will strengthen downside resilience by deepening such operational excellence efforts of each group company, and also utilize Mitsui’s global network to actively lead development of adjacent businesses and overseas expansion and promote the formation of business clusters to further solidify our earnings base.

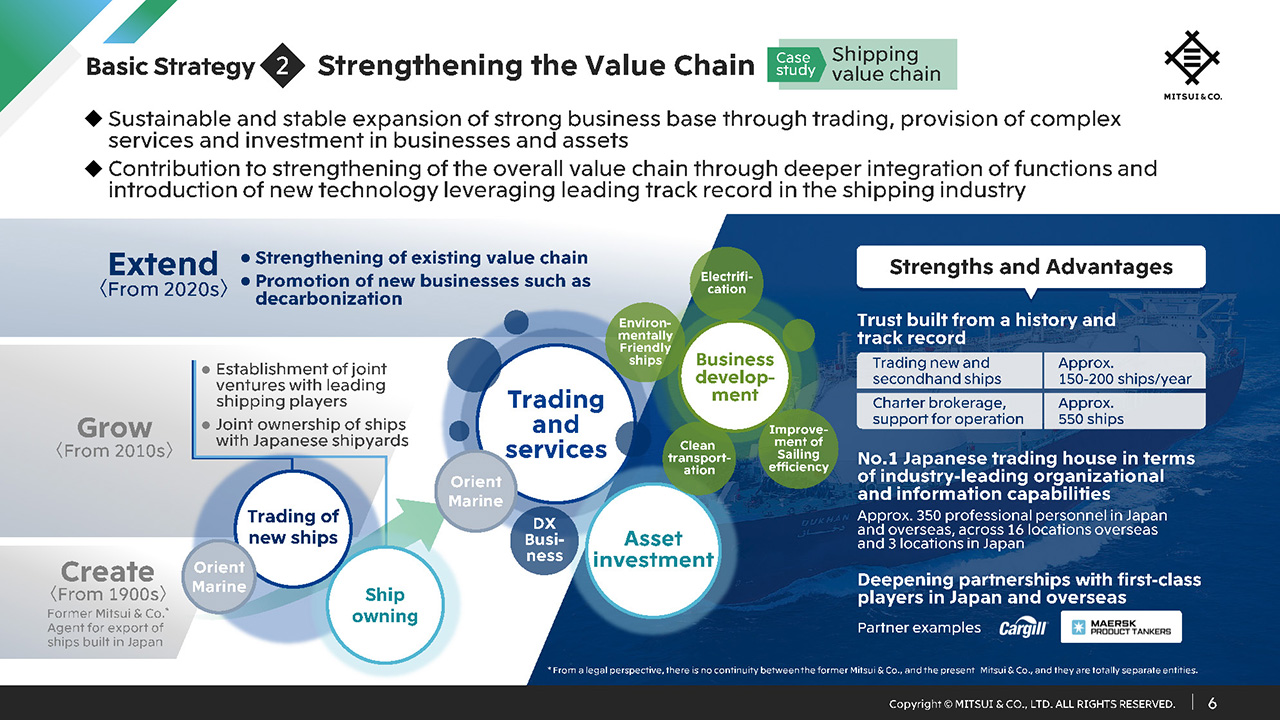

Basic Strategy② Strengthening the Value Chain

The second basic strategy is strengthening the value chain. Here, I will explain this using the ship business as an example. We have not had many opportunities to provide a comprehensive description of Mitsui’s ship business in the past, so I would like to provide a detailed explanation here.

The former Mitsui & Co. * before the war played a role as the export agent for ships built by Japanese shipyards starting in the 1900s, and the current Mitsui E&S and Mitsui O.S.K. Lines also originated from the former Mitsui’s ship division. Just after the current Mitsui & Co. was established in 1947, we engaged in the ship business and established the subsidiary Orient Marine in the 1980s. Since then, we have provided a wide range of services other than selling new ships, such as secondhand ship brokerage, charter arrangement, and operational and technical support of ships that we have sold. Furthermore, in addition to the asset investment and ship ownership that we have been engaging in since the early days, we have strengthened joint ownership of ships and related joint businesses with leading shipping players and Japanese shipyards since the 2010s. Now we have approximately 350 professional personnel globally, and are the number one Japanese trading house in terms of industry-leading organizational and information capabilities as well as our track record in making deals. We are also steadily implementing development of businesses related to decarbonization including environmentally friendly ships, and are maintaining and expanding our business base combining the three aspects of trading and services, asset investment and business development.

* From a legal perspective, there is no continuity between the former Mitsui & Co., and the present Mitsui & Co., and they are totally separate entities

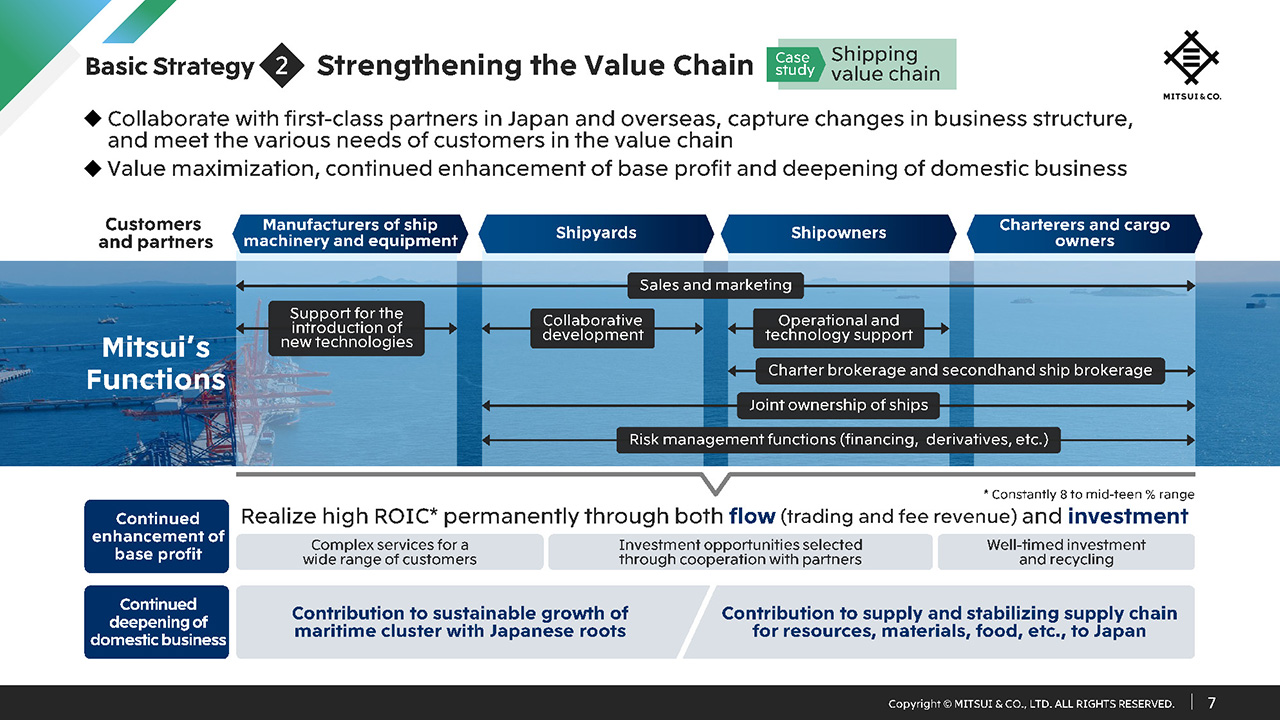

Basic Strategy② Strengthening the Value Chain

Mitsui’s ship business covers a variety of customers and partners in the value chain, and provides complex services as shown here. In asset investment and business development, we participate in investment opportunities jointly adopted with influential partners to realize well-timed investment and recycling amid the volatility of shipping market conditions. As a result, we have continuously and steadily enhanced base profit through both flow and investment, and ROIC has constantly been at a high level between 8 to the mid-teen percent range.

Furthermore, through the maximization of value provided, such as Mitsui’s services and functions, we are constantly endeavoring to grow the Japanese maritime cluster, thereby indirectly contributing to the stable supply of various materials to Japan, over 90 percent of which depends on marine transportation, further strengthening the value chain.

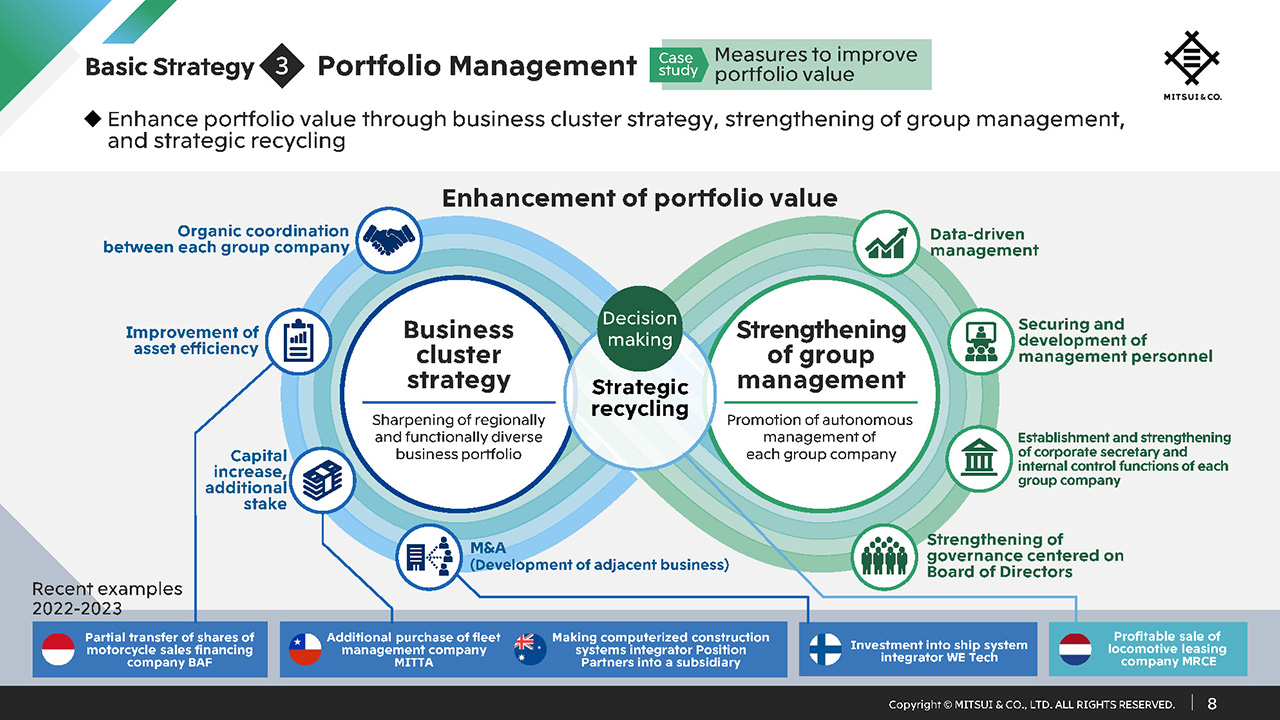

Basic Strategy③ Portfolio Management

Now I will explain our third basic strategy, portfolio management. This is an initiative to enhance portfolio value through efforts combining the three aspects of the business cluster strategy I just explained, as well as strengthening of group management capability and strategic recycling.

We will improve the quality of the geographically and functionally diversified business portfolio by implementing the business cluster strategy, and proceed to maximize the added-value provided to stakeholders.

Strengthening of group management capability is an initiative to promote the autonomous management of each group company by measures such as strengthening governance through the Board of Directors of each group company. By doing this, we will realize improvement of enterprise value of group companies forming business clusters.

However, we will decide to withdraw from and proceed with strategic recycling of businesses that do not match our business cluster strategy, or are deemed to be difficult to further increase corporate value by the Mitsui & Co. Group, while determining the appropriate timing.

These have already produced results to some extent and some of the recent achievements that we have made in 2022 and 2023 are illustrated in the bottom of this slide.

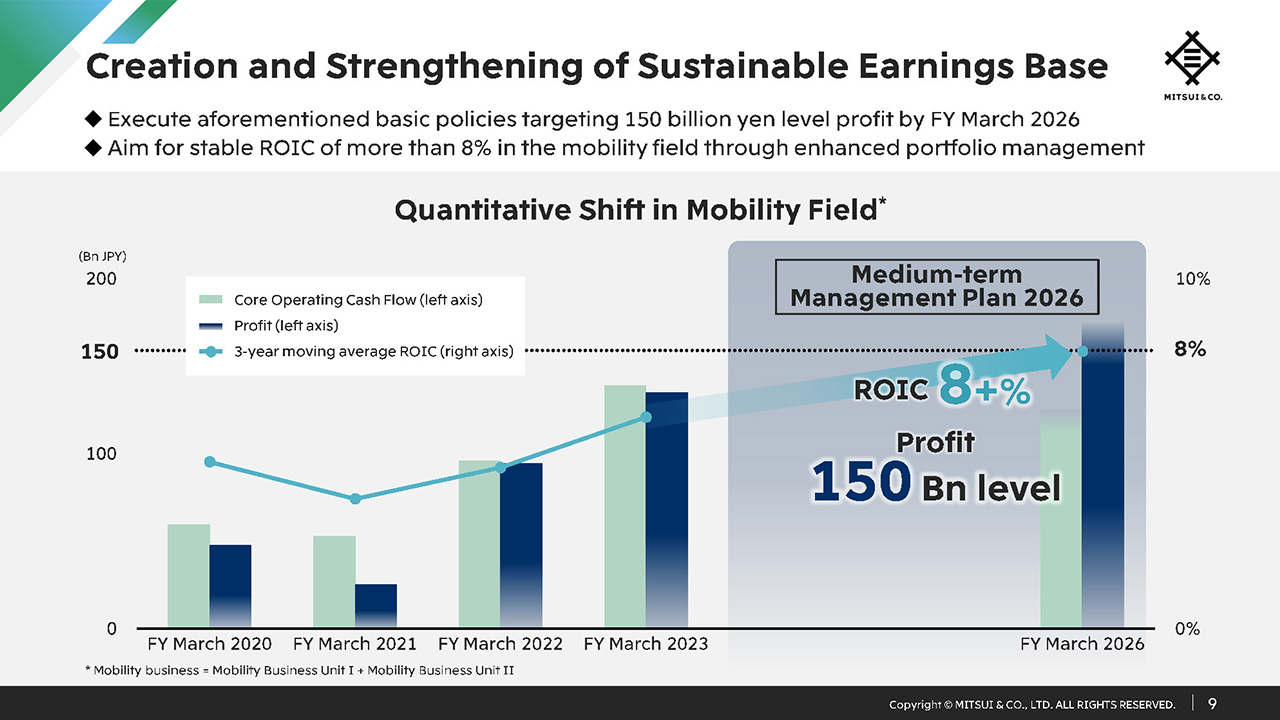

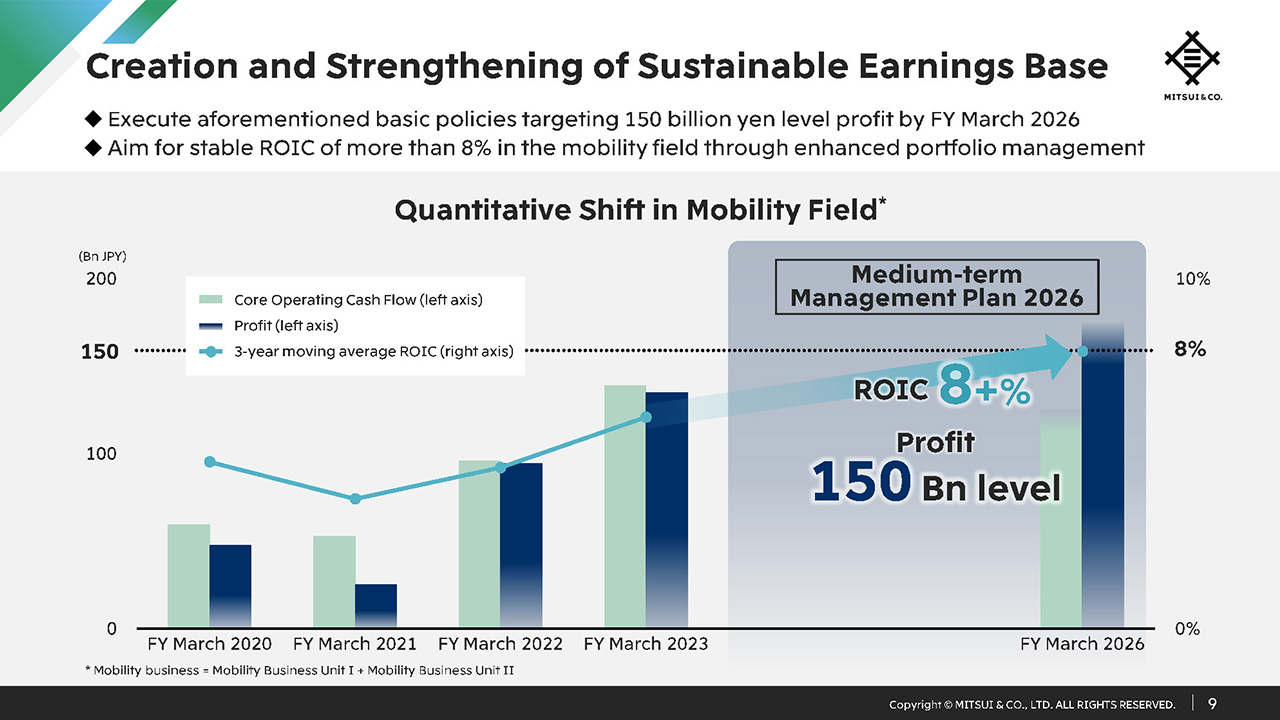

Creation and Strengthening of Sustainable Earnings Base

We aim to achieve profit in the range of 150 billion yen by FY March 2026, by enhancing business portfolio value through these three business strategies. We also aim to constantly generate ROIC in excess of 8 percent.

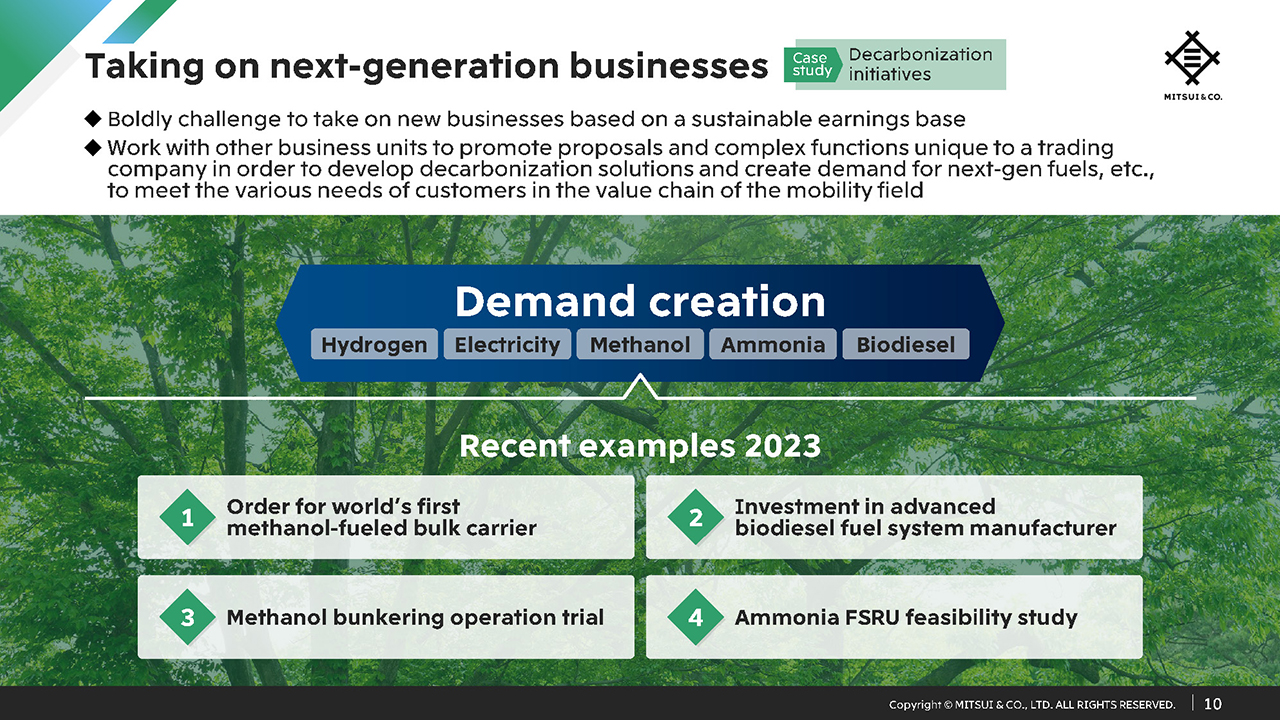

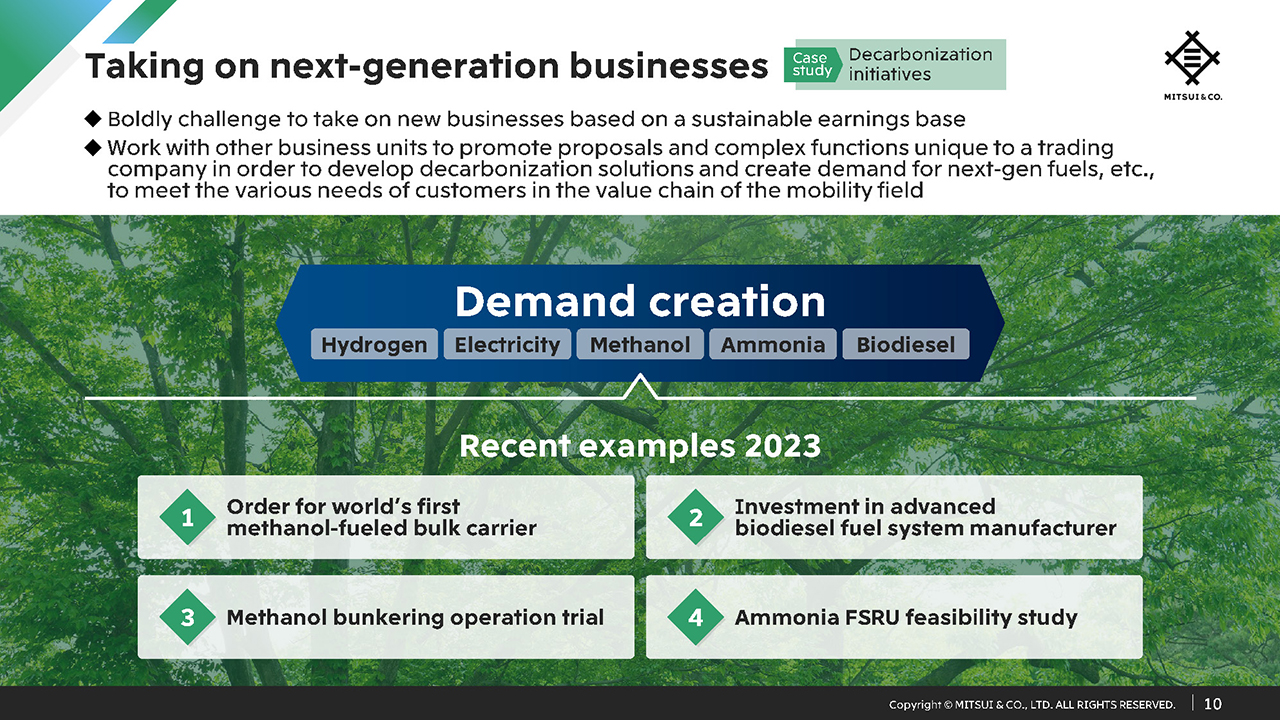

Taking on next-generation businesses

Finally, I will explain businesses aimed at the realization of a decarbonized society as initiatives leveraging our track record and expertise in the field of mobility. The projects shown here are actual examples of initiatives in 2023. We will respond to the demand of various stakeholders in the value chain and also realize complex value provision in combination with the functions of other business units with the aim of further promotion and utilization of next-gen fuels such as hydrogen, electricity, methanol, ammonia and biodiesel.

Although not shown on this slide, we aim to support the future of Japanese logistics, and work with diverse shareholders and partners such as Preferred Networks engaged in AI development and Mitsubishi Estate to proceed with development and proof of concept of trunk line transportation services utilizing level 4 autonomous driving technology. Please see the Integrated Report, which also touches upon this.

That concludes my presentation. Thank you for listening today.

Q1: Measures to Address Downward Resilience of Earnings

The expansion of earnings in the mobility field has been extremely strong over the past few years, and I am pleasantly surprised that profit has reached such high levels.

Meanwhile, you are aiming for profit of 150 billion yen in FY March 2026, and your earnings have improved considerably. However, due to the unusual situation of a booming economy coupled with lingering supply chain disruptions, profits have been overly inflated to some extent, and I am concerned about future earnings.

As you expand your investments going forward, what measures are you taking to deal with the downward resilience of earnings. Also, if the economy heads into a downturn, what level of profit do you think you can achieve?

Daikoku : Regarding the downward resilience, I would like to go back to when the COVID-19 pandemic began. In the first half of FY March 2021, of all Mitsui’s businesses, the mobility field was especially impacted by the pandemic. Although the situation was challenging and the number of group companies posting losses rapidly increased, each company made steady efforts such as reducing selling, general and administrative expenses, as well as reducing the size of their balance sheets. As a result, they strengthened their resilience in the face of challenging market conditions.

The pandemic also served the function of revealing the strengths and weaknesses of businesses. During the three years of the previous Medium-term Management Plan (MTMP), and also during this fiscal year, we have continued to withdraw from businesses that we have determined to be no longer feasible.

Through these efforts to improve the efficiency of our operations, when the recent market tailwinds and economic recovery came into play, our mobility field suddenly began to soar.

While we expected market conditions to normalize to some extent from the beginning of this fiscal year, conditions have varied depending on the region and product. In some markets and regions we have significant order backlogs and backorders. Moreover, we adjusted our positioning during the pandemic, and our business has improved considerably, with some businesses having increased their competitive advantages.

With our business portfolio improving in this way, we are in a situation where we can really focus on the three basic strategies I explained earlier, namely, execution of business cluster strategy, strengthening the value chain, and portfolio management. We will continue to steadily pursue these strategies.

Looking back, we created new businesses and improved operations and when the market was growing, our performance improved, but when market growth slowed, our performance tended to deteriorate. I think your question is based on assuming a future outlook based on that history.

The aim of executing our business cluster strategy was precisely to address your point. Until recently, we have been making greenfield investments designed to grow in just one area. Going forward, in addition to those investments, we will also use adjacent business and consider ways to combine organic and inorganic growth through measures such as brownfield investments and bolt-on acquisitions. With our business cluster strategy, we may be exposed to market factors to some extent. However, we are working to create a structure in which our business performance does not simply fluctuate in conjunction with the market.

When the strategy was announced in May 2023, we explained that we have three business clusters. In an effort to increase this number, we have set a fairly ambitious target of nine clusters. If and when we achieve this, our earnings base will expand as a result. Moreover, we will be able to integrate functions in various ways, so even if market conditions worsen, we can be in a situation to compensate in various ways.

Q2: Growth Timeline for the Business Clusters

On page 9 of the presentation material, it says that you are aiming for profit of 150 billion yen by FY March 2026. However, looking at the chart, it appears that Core Operating Cash Flow is expected to decline in FY March 2026, meaning the target appears to be 150 billion yen including asset sales.

You are aiming to go from three business clusters to nine, and it will probably take time to develop this scale. Am I correct in thinking that the required timeline will extend beyond the current MTMP? If so, would I be wrong to assume that it will continue to grow even as earnings will likely decline as market conditions normalize? Please share your thoughts regarding the timeline.

Daikoku : Regarding the challenge of expanding to nine business clusters, some of the clusters will include initiatives for next-generation products and projects for achieving carbon neutrality.

Therefore, during the process of new business cluster creation, we believe that some will see stronger growth rates and generate high ROIC, while others will only see increased ROIC toward 2030 rather than during the current MTMP. We are working on combining different growth businesses in this way. Although I cannot disclose the details, we expect our total profit will be 150 billion yen.

Please note that the 150 billion yen forecast does not include transitory items such as asset sales. On the other hand, as new business opportunities increase and the market and operating environment change, we will not only expand our balance sheet by building up our portfolio in line with profitability, but also carry out strategic asset recycling.

We want to develop our business portfolio in a way that improves quality by both adding and divesting businesses.

Q3: Role of the Mobility Field in Decarbonization Efforts

You explained that as the company heads toward net zero, you will be active in the mobility field by creating new businesses related to decarbonization.

It seems there would also be opportunities for you to reduce CO2 emissions in existing businesses, such as trucks and ships. What role will the mobility division play in the effort to achieve net zero, and how will it contribute to this goal?

Daikoku : As you indicated, it will play various roles. Of course, we will continue to work toward achieving carbon neutrality in our existing businesses.

I also believe that the next-generation fuel business is an area where Mitsui can demonstrate its strengths. Rather than having each business unit tackle this initiative on its own, we plan to move forward together as team Mitsui.

Accordingly, there is still room for GHG emissions reduction in transportation, and it is an area that must change. By working on next-generation engines and vehicles to help achieve decarbonization, not only for ships but also in vehicles and mobility, we can make upstream next-generation fuel and energy segment projects possible. We believe that we have a role to play as a demand creator.

With regard to next-generation fuels and carbon neutrality efforts, the boundaries between business units have disappeared in recent years, and the number of projects we are working on together has increased significantly. I believe that the role of the mobility field is to help create sufficient demand for next-generation fuels to make it possible to better realize projects where future developments are difficult to foresee.