Initiatives Aimed at

Enhancing Base Profit

- Steady Execution of

Post-Merger Integrations,

Turnarounds, and Exits

Opening Remarks

Shigeta, CFO (Shigeta) : Good afternoon, I’m Tetsuya Shigeta, CFO.

Today, I will speak about our initiatives aimed at enhancing base profit.

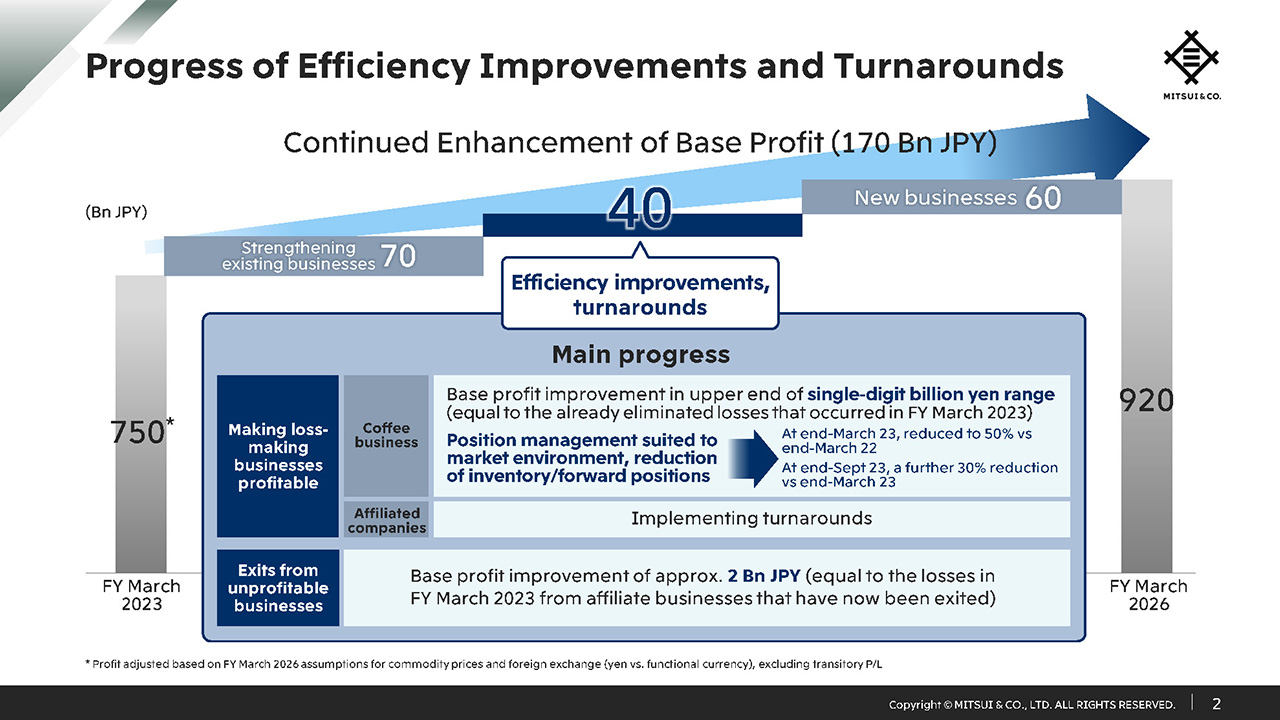

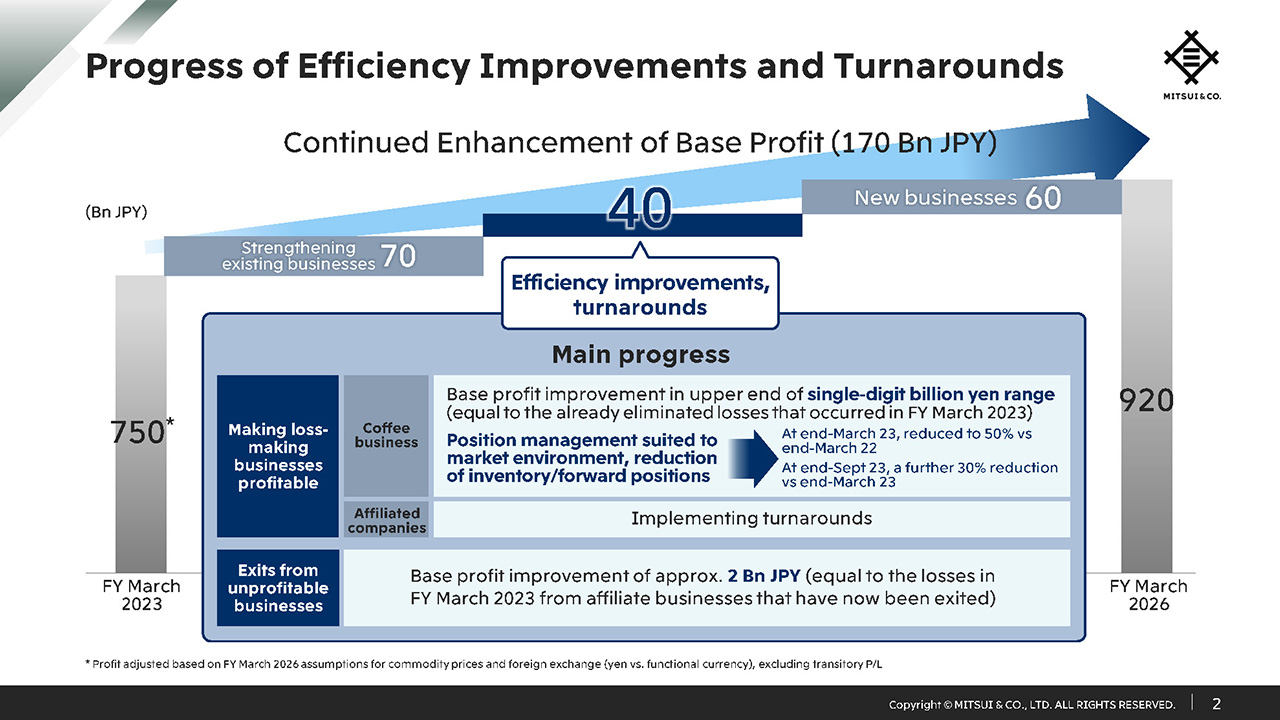

Progress of Efficiency Improvements and Turnarounds

In the current Medium-term Management Plan (MTMP), we are aiming to improve base profit by 170 billion yen. From the next slide, I will touch upon specific examples of turnarounds and post-merger integrations, or PMIs, which are necessary for ensuring returns from new investments. On this slide, I will explain the main progress made in efficiency improvements and turnarounds.

With regard to taking loss-making businesses and making them profitable, the tide turned significantly in FY March 2022 in the market for the coffee business, and in both FY March 2022 and FY March 2023 losses were in the single-digit billions of yen range. Specifically, inventory and forward positions were reduced, increasing resilience to market fluctuations and also continuing to reduce the cost of inventory and hedging. These measures have already reduced working capital related to the coffee business by approximately 100 billion yen at present compared to end of FY March 2022, which also contributed to an improvement of ROIC. Combined with the improved conditions in the coffee market, losses have been eliminated as of the end of the first half of this fiscal year. We will continue to improve our earnings and maintain a stable supply chain.

Furthermore, we are proceeding to exit from unprofitable businesses and although it is an accumulation of small losses, the total amount of losses in FY March 2023 for companies from which we have now exited was 2 billion yen.

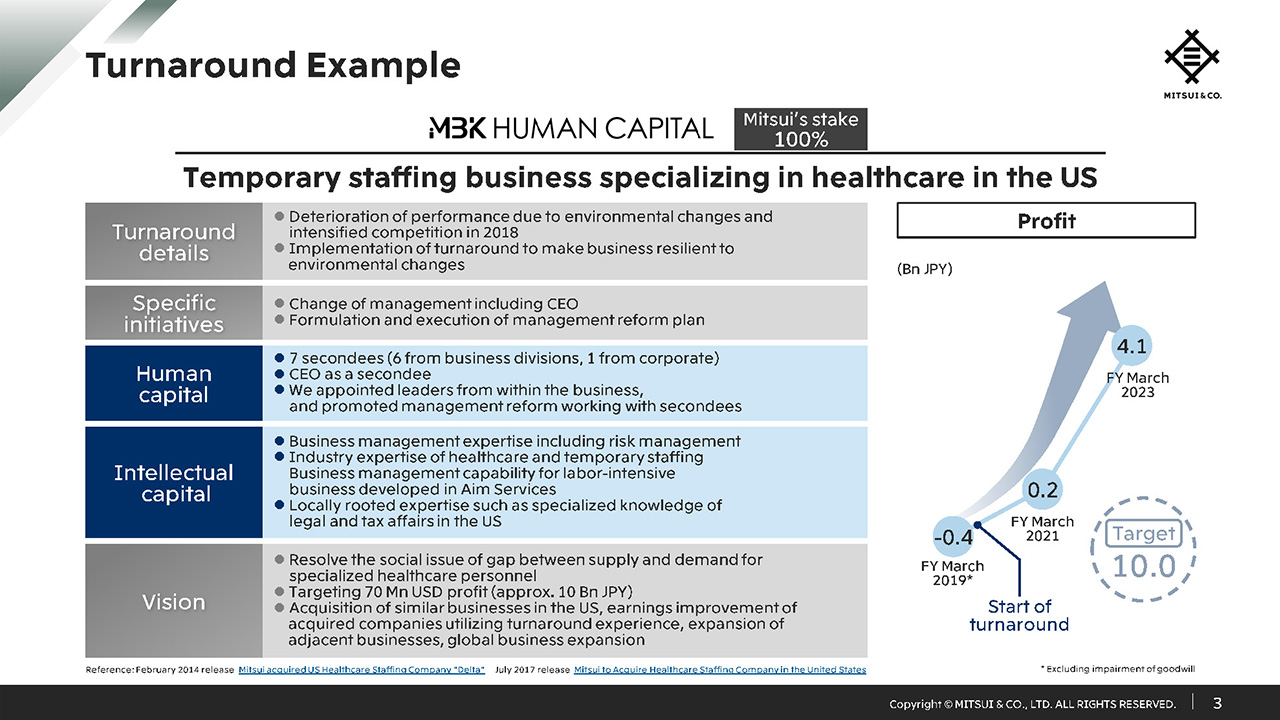

Turnaround Example

Talking of turnarounds, one specific example is MBK Human Capital, which achieved a turnaround from losses of approximately 400 million yen in FY March 2019 to a profit of approximately 4.1 billion yen in FY March 2023.

MBK Human Capital is a temporary staffing business specializing in healthcare in the US, and mainly dispatches nurses, doctors and therapists. Mitsui made an investment in the business in 2014, but performance deteriorated in 2018 due to changes in the operating environment and intensified competition. In September 2019, we began a management reform of the business.

A main point in this example is that we appointed a new CEO from within Mitsui and we initiated the reform as a global Mitsui team. Through the reform, we appointed leaders from within the business instead of bringing in talent from the outside. Working as a global group, Mitsui employees then speedily worked as one to turnaround the business.

Specifically, we implemented reforms such as reforming managerial accounting, altering organizational and evaluation systems, resetting strategic initiatives, and fully utilized our expertise in healthcare and temporary staffing where we have worked for many years, and business management for labor-intensive business developed at Aim Services.

Furthermore, in the process of determining the risks Mitsui can and cannot take, we utilized locally rooted risk management expertise on legal and tax affairs internally accumulated in our local offices. It is an example of turnaround achieved by skillfully combining human and intellectual capital.

Profit in FY March 2023 was approximately 4.1 billion yen, and the EBITDA margin, used as a KPI, has grown to be in the top-class range within the industry. While working to address the issue of supply and demand gap for healthcare specialists, we are targeting around 10 billion yen of annual profit by improving the earnings of similar companies we will acquire, utilizing our experience from business turnarounds. Furthermore, the insights obtained in this turnaround will lead to successful turnarounds in other cases for our global group in the future.

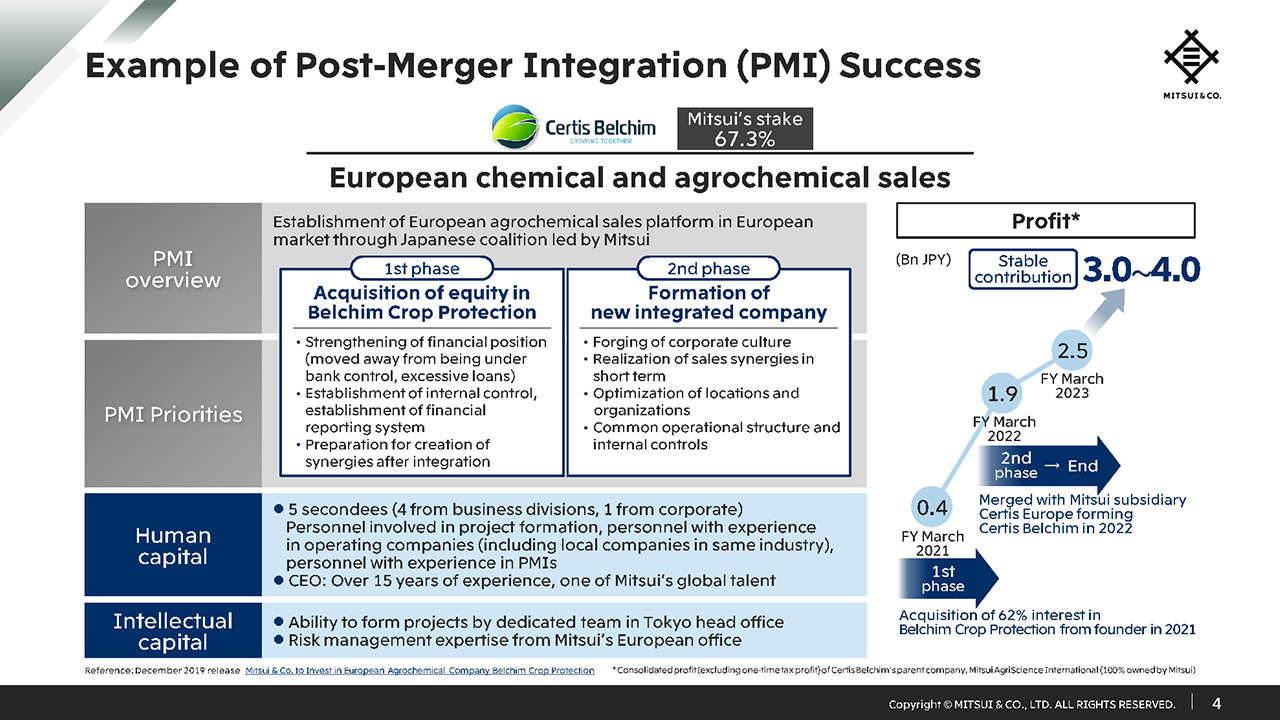

Example of Post-Merger Integration Success

I will introduce an example of a successful PMI with Certis Belchim, which is a key site in Europe in the agrochemicals business cluster.

In 2021, we obtained a stake in Belchim Crop Protection which was integrated with Mitsui’s European sales company Certis Europe in 2022 to form Certis Belchim, so this PMI is divided into the two phases of acquisition and subsequent integration.

In explaining this, it is important to cover the accounting fraud that was discovered when we were considering the acquisition of Belchim. Mitsui decided to purchase the company under bank control, due to it being insolvent, at a price that could be adequately explained. We executed the PMI by dispatching personnel from our Tokyo head office and affiliated companies. By reducing working capital and leveraging Mitsui’s network to refinance the company from day one of the PMI, we succeeded in resolving a debt default situation which had been caused by a breach of financial covenants under a loan agreement, significantly reducing the financing costs and improving the financial structure. During the integration, we proceeded with the consolidation of sites and organizations while paying particular attention to merging the corporate culture of Belchim, acquired from the founder, and the existing subsidiary Certis Europe, realizing sales synergies and cost synergies with understanding and cooperation from stakeholders such as shareholder partners like Japanese crop protection companies. At the same time, we worked to build processes such as the strengthening of internal controls, and were able to complete the PMI successfully this summer.

As shown on the right side of the slide, performance has steadily improved since 2021, and in FY March 2023, profit after deducting one-time factors, was approximately 2.5 billion yen. We aim for stable earnings in the range of 3 to 4 billion yen from FY March 2024.

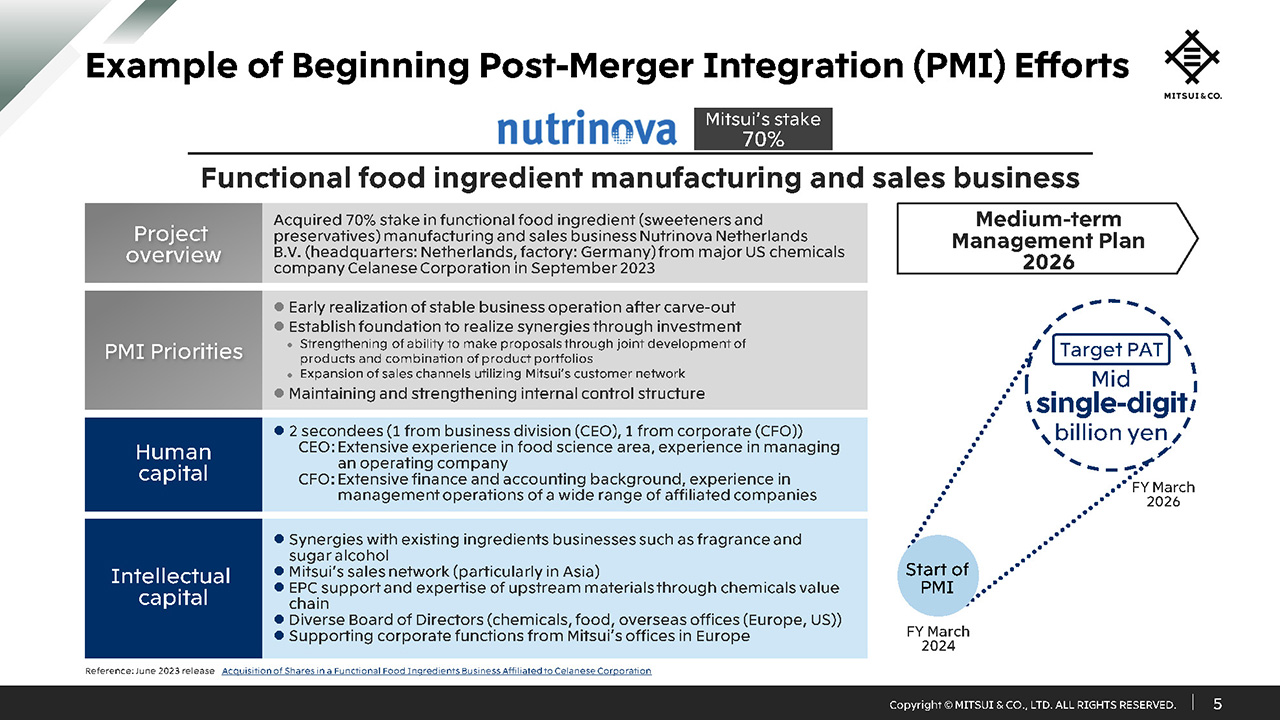

Example of Beginning Post-Merger Integration Efforts

The final example I will present is the case of Nutrinova, for which we are beginning to fully implement the PMI. As previously announced, Mitsui acquired a 70% interest in Nutrinova, from Celenese, a US partner in the methanol business, in September 2023.

This case was a carve-out of an existing business and a case that is contributing to earnings immediately without any significant PMI risk. By effectively utilizing Mitsui’s human and intellectual capital as shown in the slide, and steadily proceeding with PMI aimed at early stable operation of the business, we aim to realize mid- single-digit billion yen profit by FY March 2026. We also aim to improve profitability as a business cluster including in adjacent areas by aiming to pursue synergies with Mitsui’s existing businesses such as fragrances and sugar alcohol, and to expand sales channels utilizing Mitsui’s existing sales network.

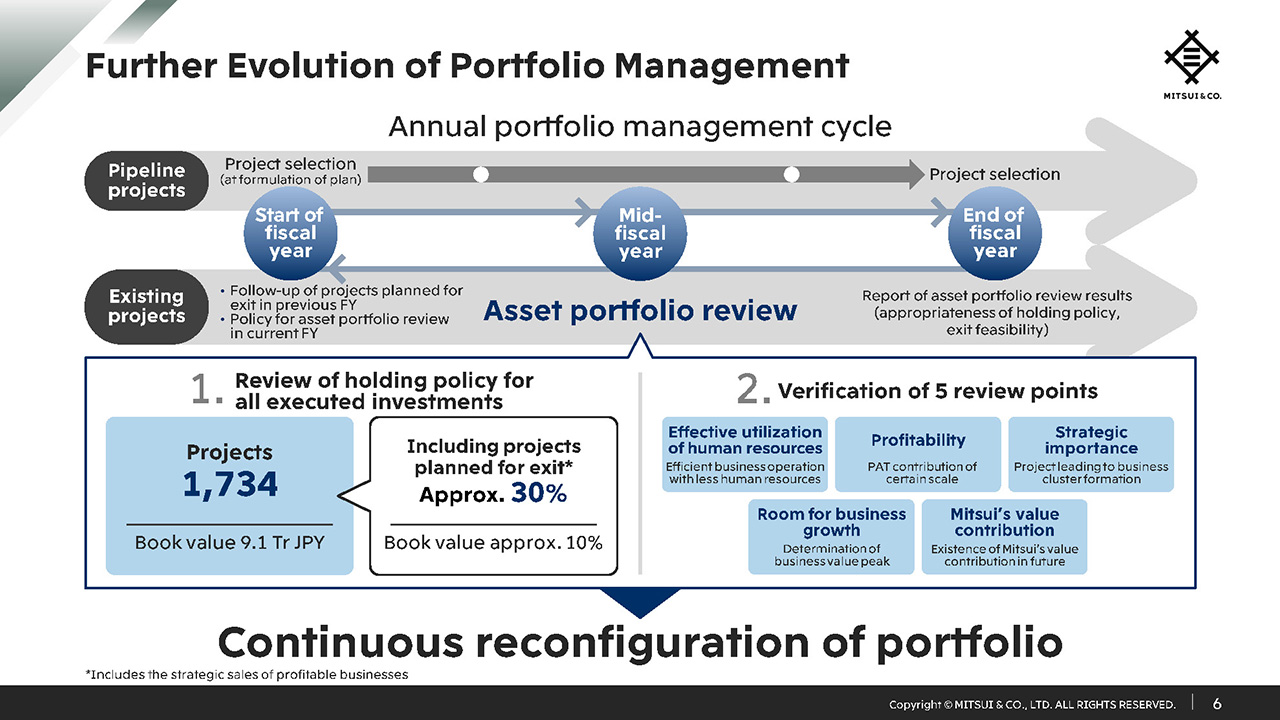

Further Evolution of Portfolio Management

While working to improve the quality of individual businesses day to day, Mitsui is constantly endeavoring to improve portfolio quality throughout the year. A feature of Mitsui’s approach is how we review the holding policy for all investments in the asset portfolio review in the middle of every fiscal year. Through this review, we identify around 30 percent in number of investment projects and 10 percent in terms of book value that we consider the feasibility of exits, including profitable assets and listed companies. For example, we actually completed the exit of around 120 investments in FY March 2023. Based on these figures, I think you can see that recycling has become common practice for us.

Furthermore, we have also strengthened the five review points stated on the slide, properly addressing the justification of holding onto businesses that are not performing well, leading to active strategic recycling.

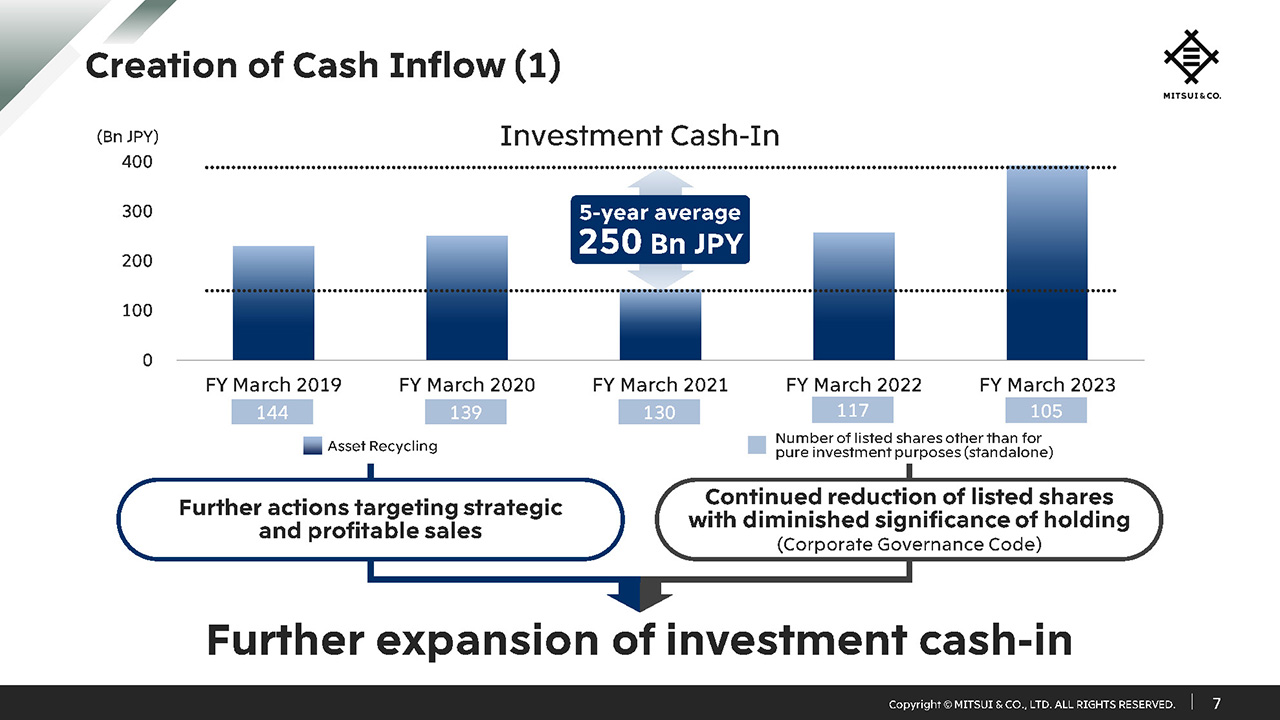

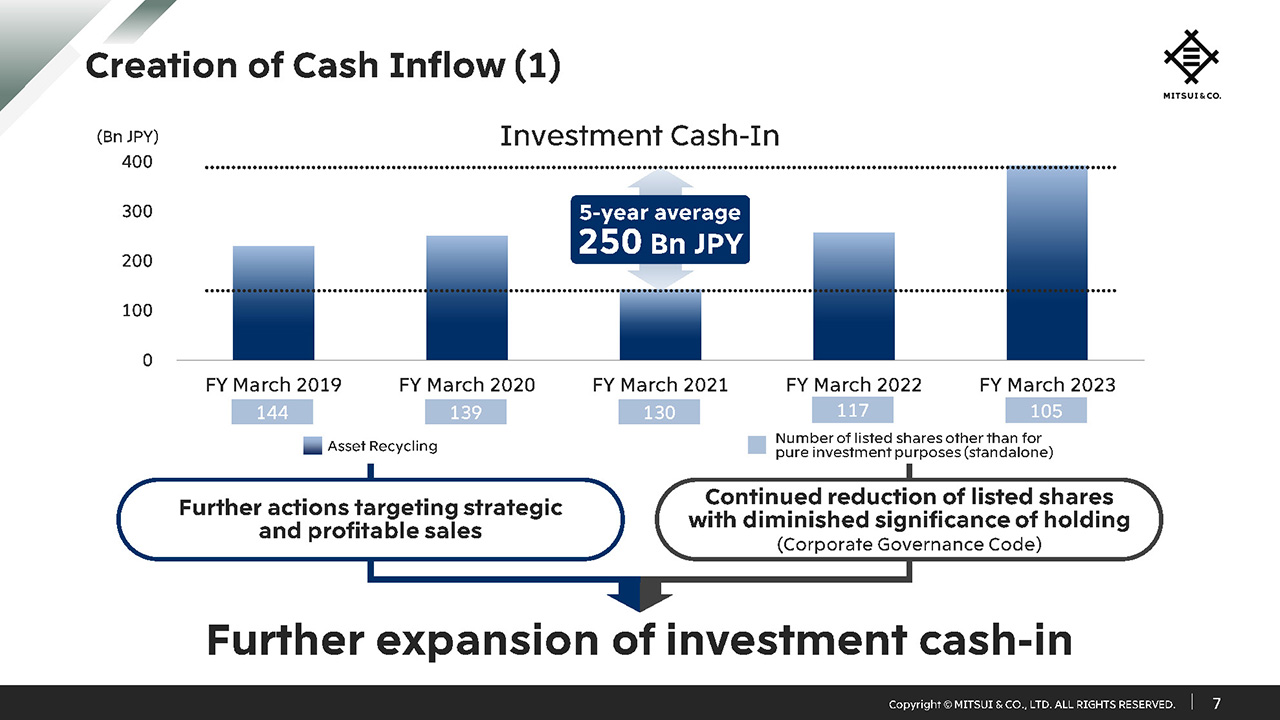

Creation of Cash Inflow (1)

Mitsui emphasizes efforts aimed at obtaining stable and additional cash inflow by replacing assets through a portfolio review.

As explained by the CEO earlier, the asset recycling of Mitsui’s businesses has become common practice, and looking back over the past five years, we have realized cash inflows on average of 250 billion yen. Through the evolution of the asset portfolio review and the establishment of ROIC, which was introduced in the previous MTMP, we have been steadily increasing our focus on portfolio reconfiguration and pushing for further efforts toward making strategic and profitable asset sales. In addition, we will continue to reduce the number of listed shares of companies that have become less significant for us to own.

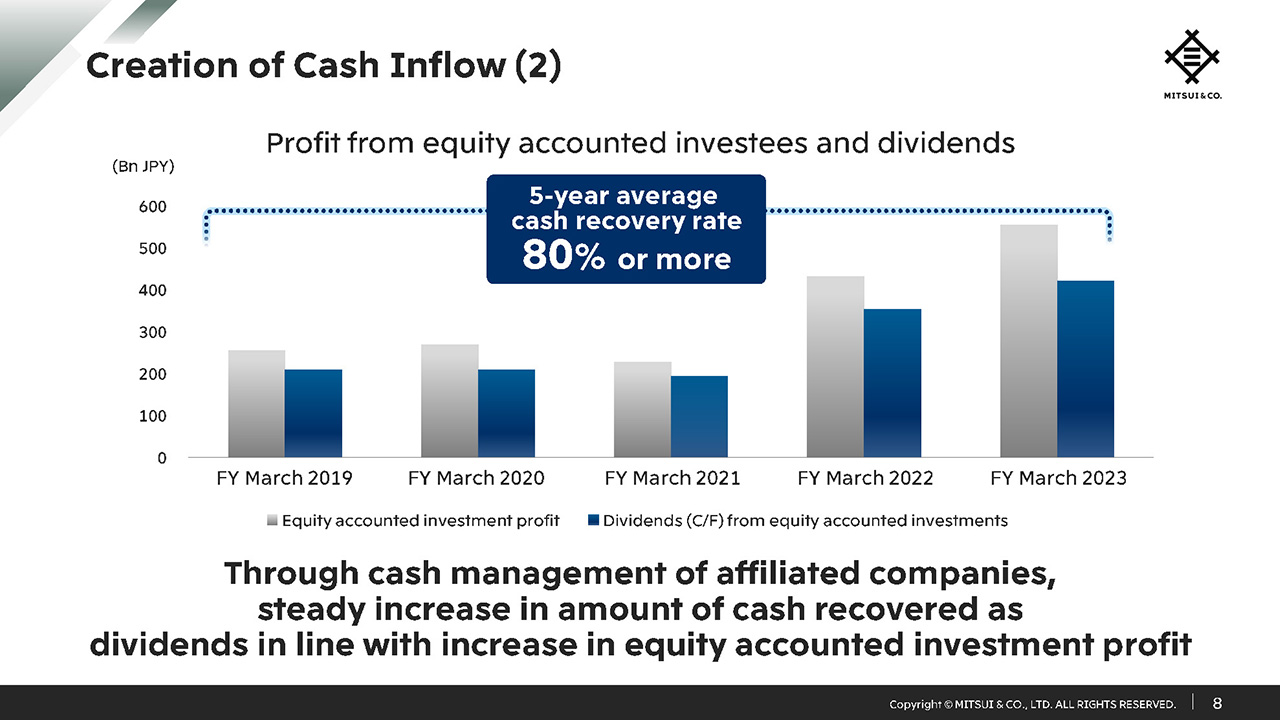

Creation of Cash Inflow (2)

This slide looks at cash inflow from a slightly different perspective. Over the past five years, Mitsui’s average rate of recovery of cash from equity accounted investees has been over 80%.

We apply Core Operating Cash Flow as a key performance indicator, therefore regardless of what form the investment takes, we are extremely mindful of cash recovery. One of the reasons we have maintained a high rate of cash return from equity accounted investees that are not subsidiaries is simply the fact that Mitsui’s functions and strengths are appropriately applied on the business frontline and Mitsui’s voice is reflected in management. Each business unit and corporate unit will continue to work as one with the business frontline to improve cash management of affiliated companies and aim to maintain and expand Core Operating Cash Flow through dividends.

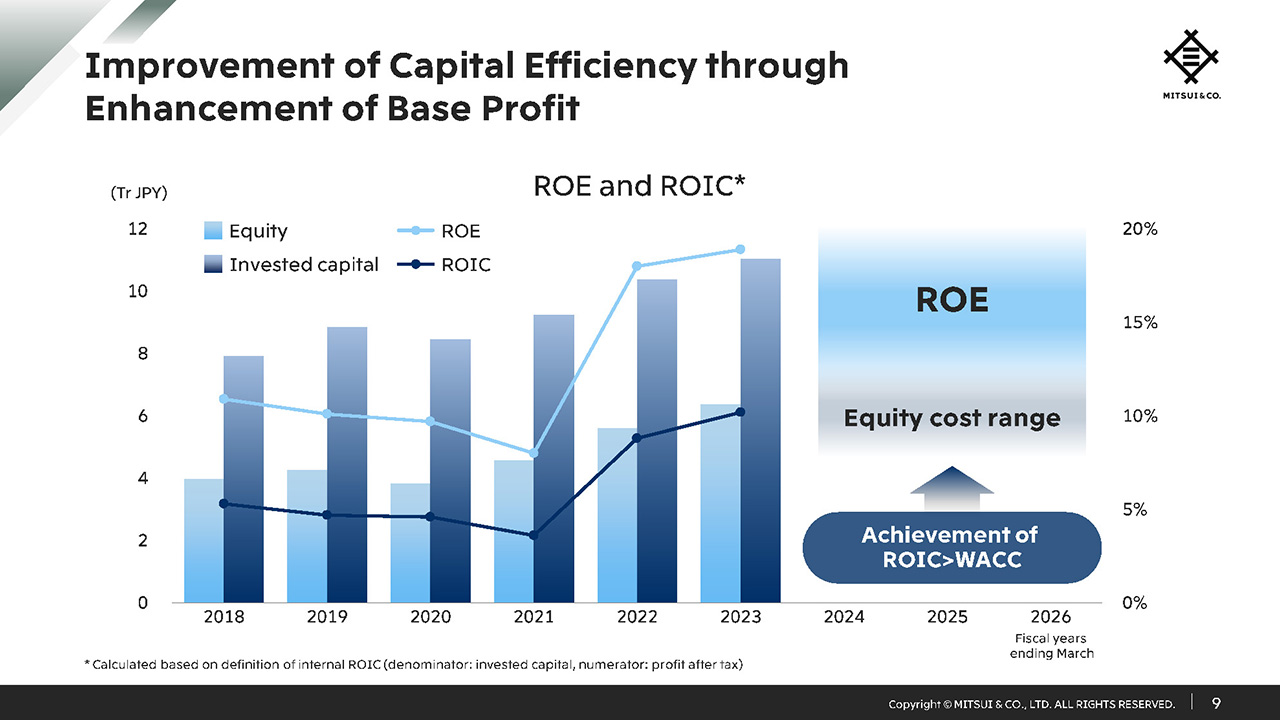

Improvement of Capital Efficiency through Enhancement of Base Profit

This graph shows the trend of Mitsui’s ROE and ROIC.

The equity cost has a range of sources such as those based on the CAPM based calculation, analyst calculations, and figures from financial information providers. I think the important thing is to be aware of cost of capital figures, range and changes according to the current operating environment, and to expand the equity spread.

When considering investments for growth, which we are actively pursuing under the current MTMP, we are always conscious of the upper range of the cost of capital, and we continue to consider the significance of keeping existing investments in light of the rising trend of cost of capital.

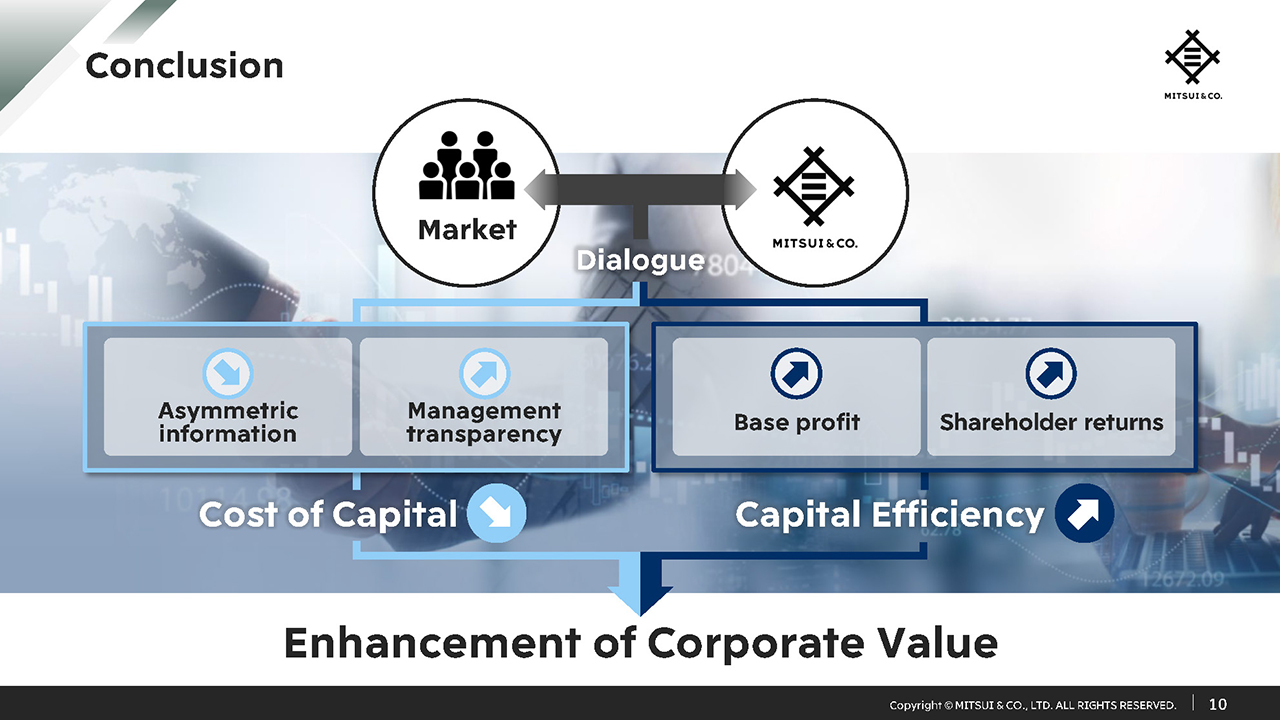

Conclusion

Just as I have explained today by presenting turnarounds and PMIs as examples of initiatives aimed at enhancing base profit, we will continue to try to provide explanations that are easy for everyone to understand, and would like to provide a deeper understanding of Mitsui’s business model by improving management transparency through dialogue.

We also ensure that the suggestions and comments received through dialogue are provided as feedback within the company to be utilized in improving management. By building up such efforts, we will reduce the cost of capital, and along with this, by improving capital efficiency through the day-to-day efforts on the business frontline and in management as we have introduced today, we will enhance corporate value.

That completes my part of the presentation today. We will now move on to Q&A.

Q1: Future Outlook Concerning Performance Volatility

Mitsui is currently involved in businesses such as next-generation fuels. As you make various investments and reorganize your business, do you expect the volatility of your company’s performance to decrease in the future? The next-generation fuels business, which includes ammonia, is not likely to expand in its initial phase without government subsidies. Therefore, it seems that the volatility would be lower than for conventional resource businesses. I understand that Mitsui is planning a range of investment projects, but from your perspective as CFO, how do you view the volatility of Mitsui’s performance going forward?

Shigeta : As I mentioned in my presentation today, we expect that by reducing and stabilizing the volatility of our financial results as much as possible, we can lower our cost of capital. We are therefore working to increase performance stability.

It is true that some new technologies and next-generation energy and fuels pose uncertainty, and that it will take some time before they can contribute to our profitability. Accordingly, we would like to stabilize our business performance by combining these activities with projects that can be expected to generate profits in the short term.

We continue to focus on natural gas initiatives because we recognize its importance as a fuel in the energy transition. By maintaining these kinds of existing businesses or finishing those under development, we can forecast a certain level of earnings for the foreseeable future. By using these for support, we can continue to develop businesses that will only begin to contribute to earnings in the future. Moreover, we can incorporate multiple scenarios for those businesses that involve uncertainty or that will only be profitable in the future. However, we are not currently considering lowering our investment standards or requirements. While I can’t deny there is a certain level of uncertainty to our earnings, our investment criteria have not been lowered. With the combination of businesses, we will strive to maintain stability in Core Operating Cash Flow and profit.

Q2: Progress of Efficiency Improvements and Turnarounds

Could you explain the section on page 2 of the presentation material, progress of efficiency improvements and turnarounds. The breakdown of 170 billion yen as continuous enhancement of base profit is shown here, leading to the forecast of 920 billion yen in FY March 2026. You have provided great examples of efficiency improvements and business turnarounds, and if you continued to build on them, it seems the figure would become quite large. Regarding the 40 billion yen improvement shown in the table, could you explain how much progress you have made so far, and if you are aware of any issues that will require further improvement efforts?

Shigeta : As an accumulation of small items, we have eliminated 20 billion yen of losses so far and intend to steadily build up this figure. Regarding the progress, please allow us some more time for us to make sufficient explanation. Across the company we have been making diligent efforts to eliminate losses, make fundamental improvements to low-profit businesses, and in some cases, promote asset recycling. We have a long-established practice throughout the company of exiting from unprofitable businesses, and we have not put these low-profitability businesses to the side.

Return on invested capital (ROIC) was adopted as an internal indicator since the previous Medium-term Management Plan. Although the numbers vary depending on differences in each segment and the risks associated with each business, there is a growing awareness of the need to be responsive and we have built up a track record of doing this. I believe we can achieve an improvement of 40 billion yen through efficiency improvements and business turnarounds.

At the same time, I would like to make sure to continuously check the 70 billion yen for strengthening existing businesses, including those that are expected to show continued improvement.

Q3: Project Risk and Country Risk

Today, you actively spoke about how you plan to achieve balance, timelines, and related aspects, as part of efforts to reduce the cost of equity.

You mentioned project risk and country risk exposure, and I wonder if there is any opportunity to flexibly review the quality of projects that are already in progress or for which investment process has already started? I understand that you perform impairment tests, however, changes could occur in country risk, for example. A previously required level of return on investment could increase, and there could be cases where additional measures might be required due to added uncertainty of the time frame to recover an investment. This is especially true when a resource related project takes longer than expected.

It seems there should be more flexibility in your discussion beyond whether to recognize impairment losses on assets. Perhaps this could have a direct impact on increasing stakeholder trust and reducing cost of capital. As CFO, could you share your thoughts on this?

Shigeta : By thoroughly explaining the stability and future prospects for our business, the reproducibility and sustainability of our business model, and the future growth potential, I believe stakeholders will understand our thinking, and this can then lead to a lower cost of capital.

We believe in taking on country risk to the extent that we can. While it becomes a totally different dimension when things escalate to the level of international sanctions on Russia, in general we would like to take on country risks to the extent possible. On the other hand, even if a country’s risk premium increases, it does not mean that there are many projects in such a high-risk area and so we revisit the valuations for each individual project on an annual or quarterly basis.

While recognition of impairment loss is necessary for accounting purposes, we also discuss the reasons for holding the assets concerned and the significance of the related initiative, either at the same time or in advance. Another point that we focus on is ensuring an exit strategy at the time of making the investment. We respond to rising country risk premiums by reexamining whether the originally planned exit strategy is still viable, by reviewing the significance and meaning of each investment, and by reviewing valuations.

Q4: Continued Reduction of Listed Shares with Diminished Significance of Holding

Given the sale of the cross-shareholding of a listed stock recently observed in the automobile sector, I would like to ask a question regarding the continued reduction of listed shares with diminished significance of holding you state on page 7 of the presentation material. It appears that Japanese trading companies are continuing to reduce such holdings. However, the 105 holdings that you have on a standalone basis have a book value of 410 billion yen, indicating the scale of your holdings. I understand that the policy is to reduce these holdings in stages, but I would like to hear your explanation as CFO.

Shigeta : As of FY March 2023, the number of holdings we had decreased to 105, and since the beginning of the current period, there are now six fewer, so the number has dropped to less than 100. Our policy is to reduce the number of strategic shareholdings, but before selling, we do a quantitative check of each one in the same way we do for unlisted shares. We also take into account aspects such as dividends, interest costs, and trading benefits when setting criteria for quantitative levels. We have been reviewing those securities that do not meet our such criteria. Although there are quite a few cases where the level is at the very limit due to the balance with cost of capital, the minimum condition is that the quantitative criteria are met.

In light of the rising cost of capital, we would like to raise the criteria bar and continue our efforts to reduce strategic shareholdings, while utilizing stakeholder feedback for our management decisions.