Progress on Activities

Toward a Decarbonized

Society

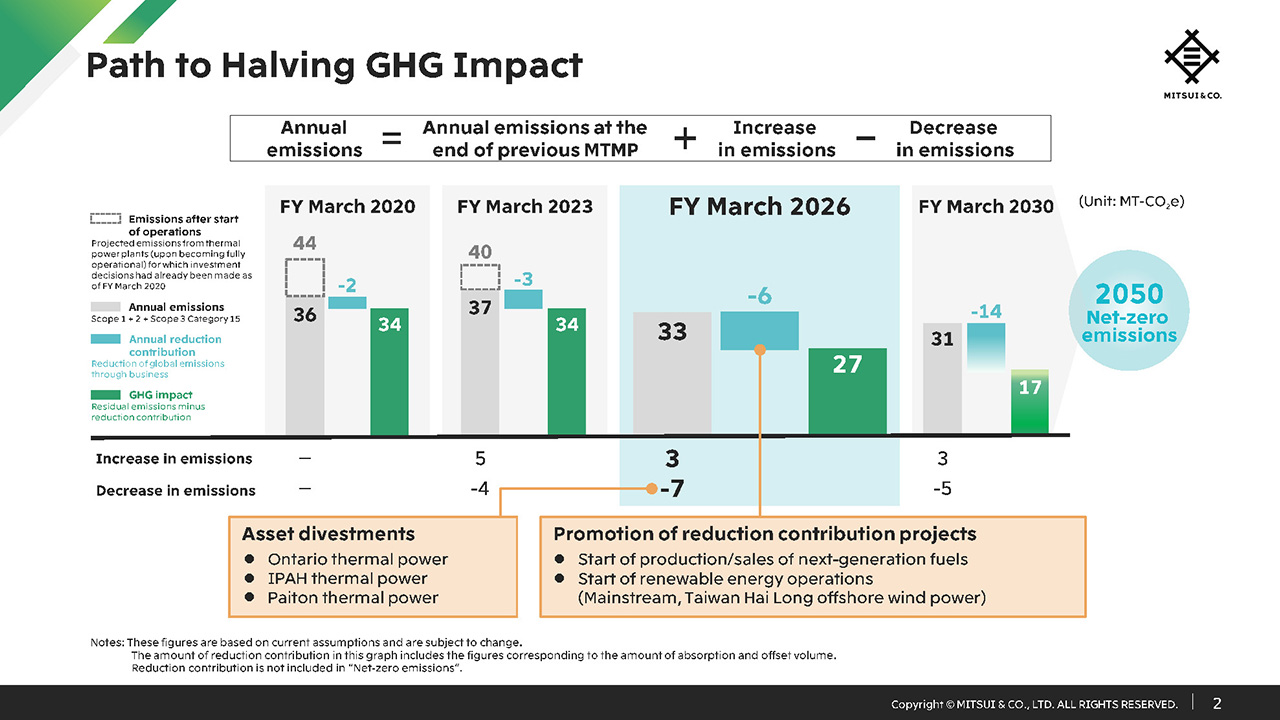

Path to Halving GHG Impact

Sato, CEO (Sato) : Hello everyone, I am Makoto Sato, CSO. I will discuss our climate change response, focusing mainly on the progress we have made since last year’s investor day.

We have set two goals: to halve our GHG Impact by 2030 compared to 2020, and to achieve net-zero emissions by 2050.

This is our path to halving our GHG Impact by 2030. We expect our GHG Impact in FY March 2026, the final year of the current Medium-term Management Plan (MTMP), to be 27 million tons. The calculation for this uses the emissions of 37 million tons in FY March 2023, the final year of the previous MTMP, as the starting point. We then add the increase in emissions of 3 million tons, and subtract the decrease in emissions of 7 million tons and the reduction contributions of 6 million tons.

Emissions reduction contributions were approximately 4 million tons during the previous MTMP and are forecast to be approximately 7 million tons during the current MTMP, for a total of approximately 11 million tons, and are based on the asset divestment of thermal power plants as well as from consolidated subsidiaries switching their consumption to renewable energy sources and increasing their energy efficiency. Promotion of reduction contribution in light blue include the launch of new renewable energy power businesses such as the Hai Long Offshore Wind Power Project and the start of operations in our next-generation fuels business, and are forecast to be 6 million tons during the current MTMP.

We will continue our efforts towards halving our GHG Impact by 2030.

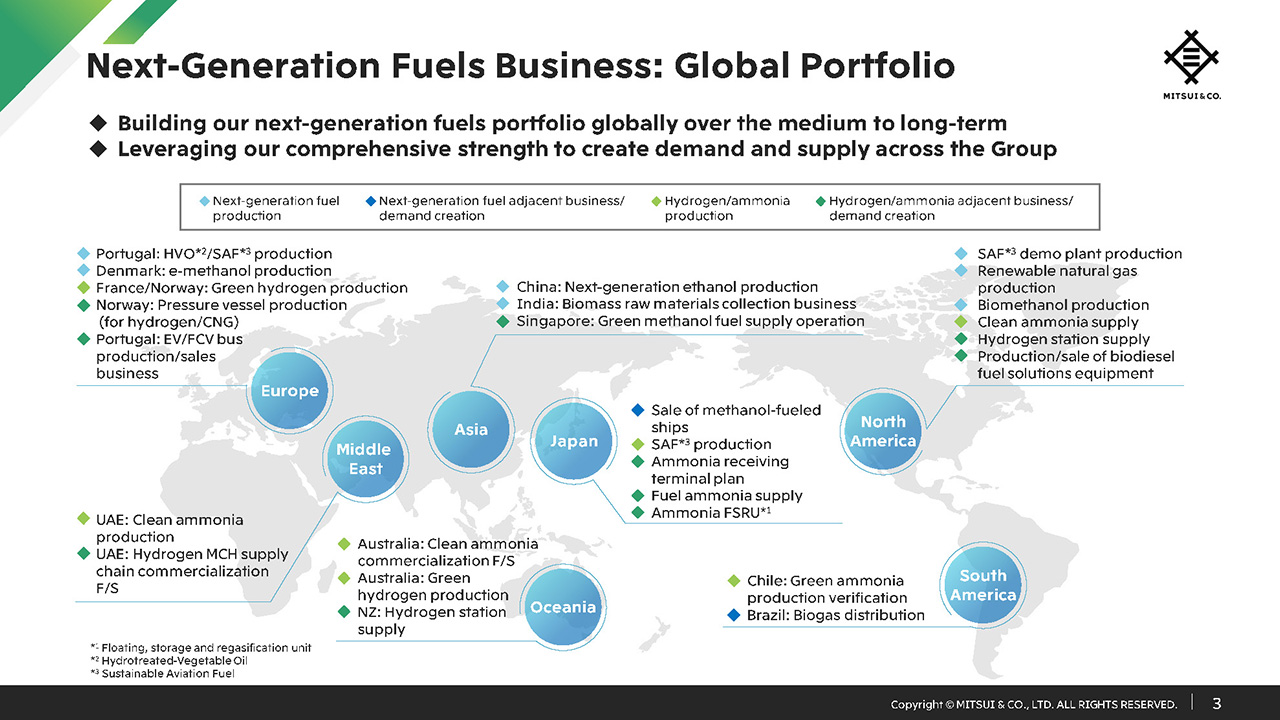

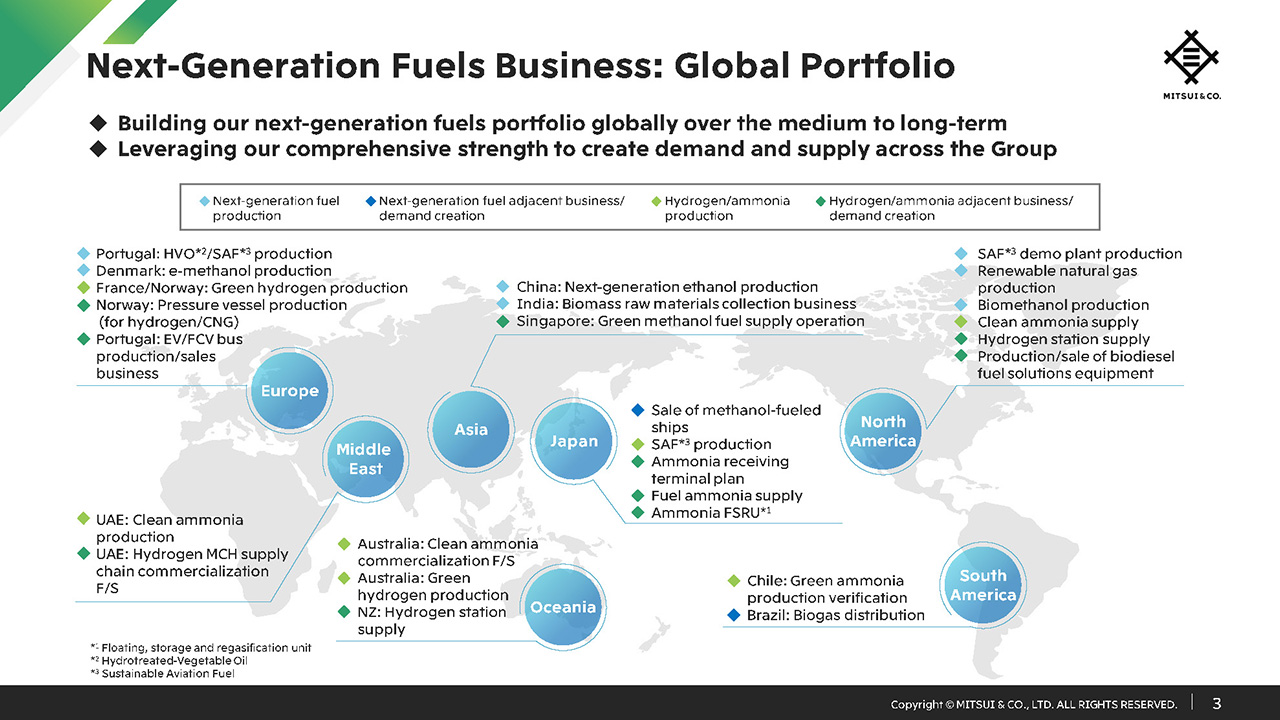

Next-Generation Fuels Business: Global Portfolio

This page shows our initiatives in the next-generation fuels business. Initiatives in this area are highly important for realizing a decarbonized society. By selecting from among various pathways, we will create a global portfolio and simultaneously advance multiple businesses from both the supply and demand sides.

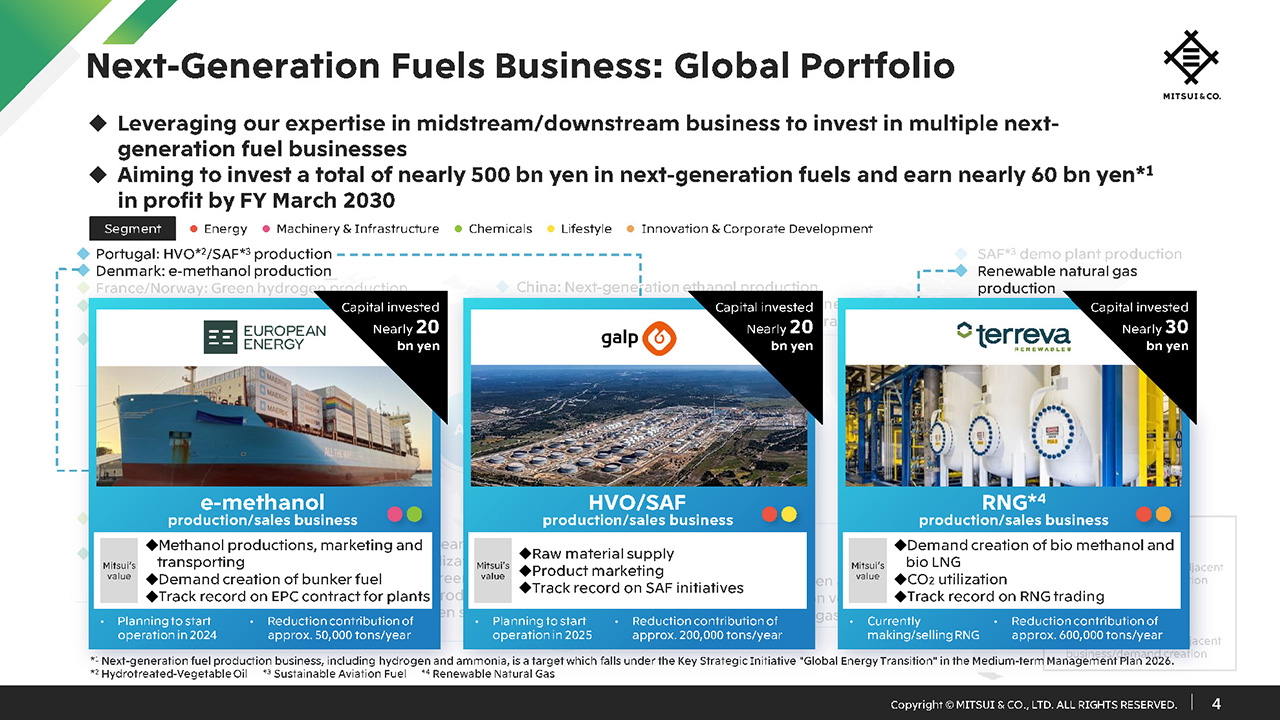

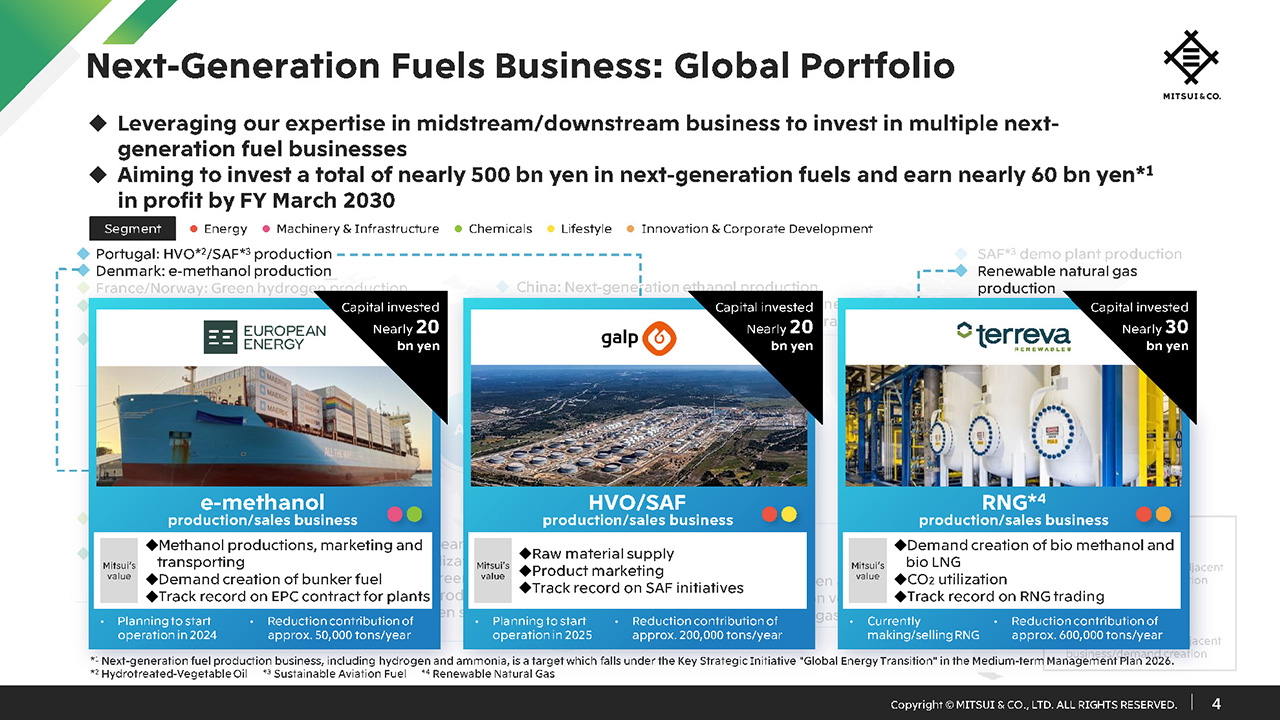

Next-Generation Fuels Business: Global Portfolio

As highlighted, we have many projects connected to our next generations fuels business. I will introduce progress of the next-generation fuels business this fiscal year. Together with European Energy, we invested in the world’s first e-methanol production business. We also concluded a joint venture agreement with Galp in hydrotreated vegetable oil and sustainable aviation fuel production businesses, and we invested in Terreva, a renewable natural gas producer as well. These investments come to over 60 billion yen in total.

Going forward, we anticipate significant demand for low-carbon e-methanol produced by combining green hydrogen with CO2 derived from biomass. This is a good example of collaboration between our Chemicals segment, with its track record in methanol production in the US and Saudi Arabia, and our Machinery & Infrastructure segment. Multiple segments collaborate on next-generation fuels initiatives, and I believe that connecting the cross-industry expertise and wide network we have cultivated over many years will enable the development of new businesses that are unique to us.

The next-generation fuels business also has an important role in terms of income. In the MTMP, we set a ROIC target for Global Energy Transition of over 9% for FY March 2030. Within this, in the next-generation fuels business we are aiming for nearly 500 billion yen in invested capital and ROIC of around 12%.

I believe that next-generation fuels are a business area where Mitsui can leverage its strengths, and therefore we would like to create, grow, and extend this business cluster across multiple projects in this sector.

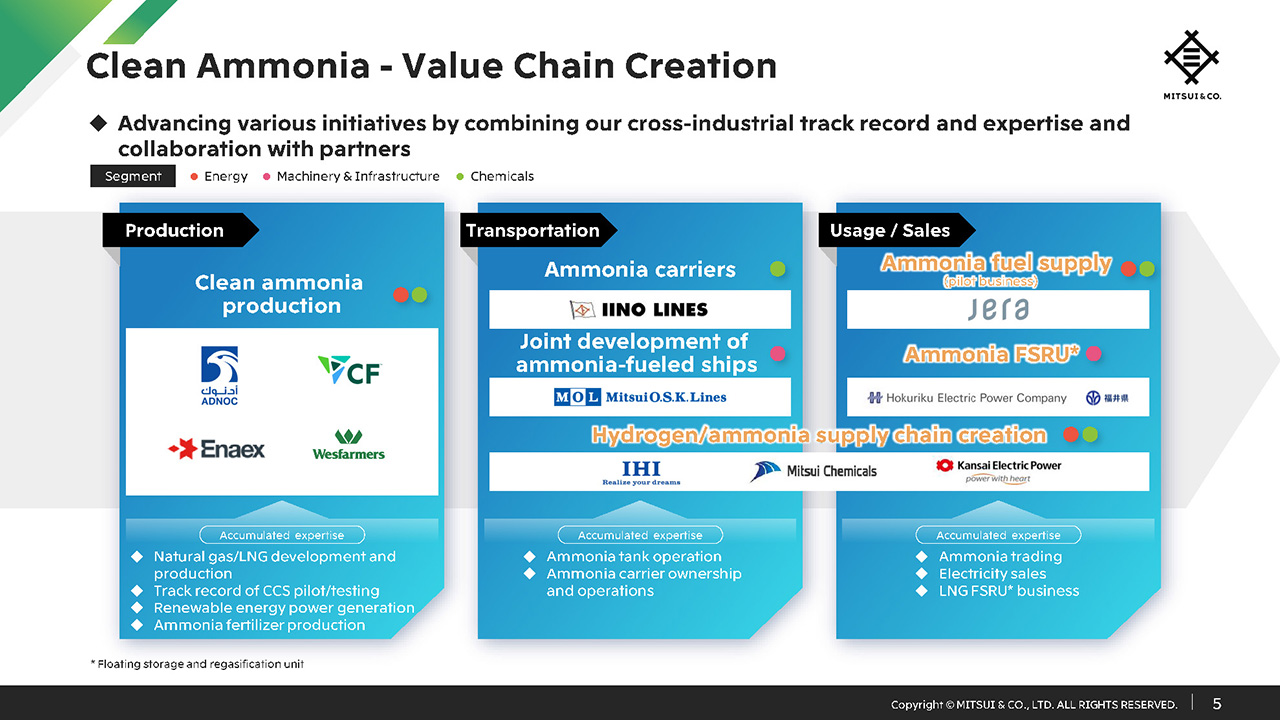

Clean Ammonia - Value Chain Creation

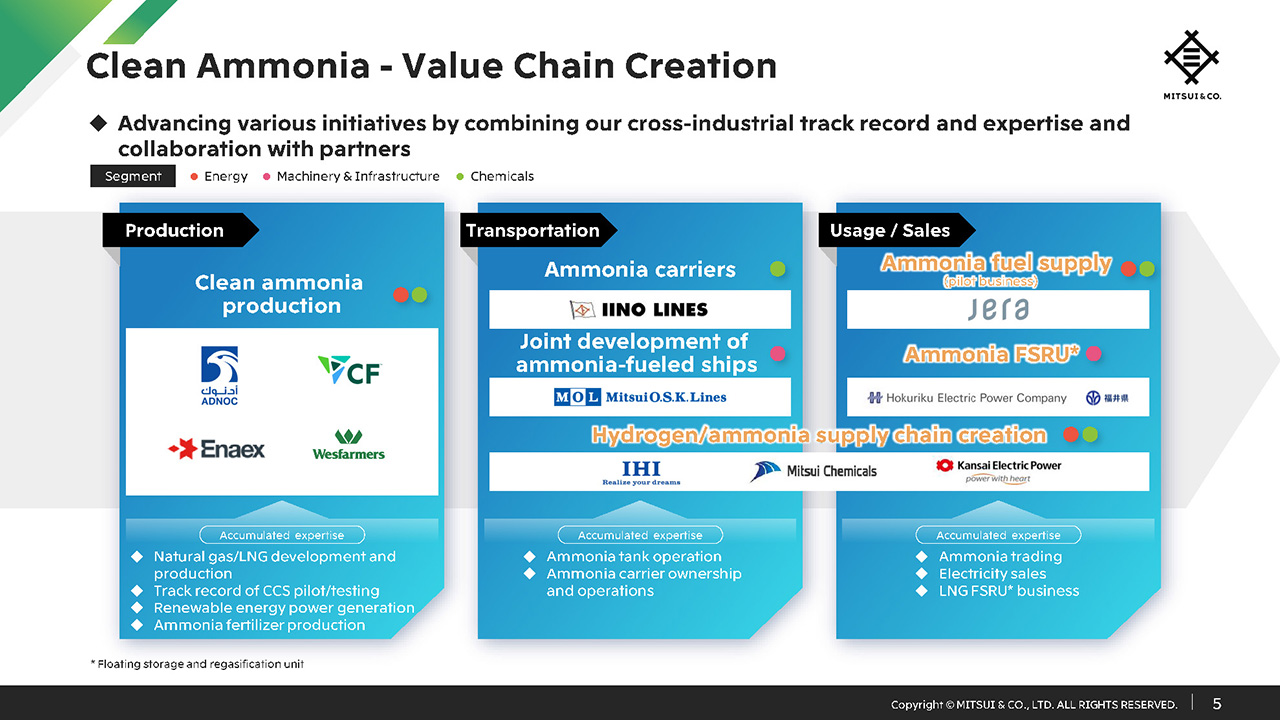

Next, I will explain initiatives related to the creation of a clean ammonia value chain.

We are advancing efforts towards final investment decisions on multiple clean ammonia production projects.

This year we have made particular progress in initiatives for value chain creation. We are supplying fuel to an ammonia pilot project of JERA, we are conducting an ammonia floating storage and regasification unit feasibility study with Fukui prefectural government and Hokuriku Electric Power Company, and also conducting a joint study of a hydrogen and ammonia supply chain concept in the Osaka coastal industrial zone with IHI Corporation, Mitsui Chemicals, and The Kansai Electric Power. Together with domestic and overseas partners, we will build a value chain with initiatives that are unique to us, leveraging our leading share in ammonia trading for import to Japan, our track record in natural gas and LNG development and production, and our strengths in the shipping business.

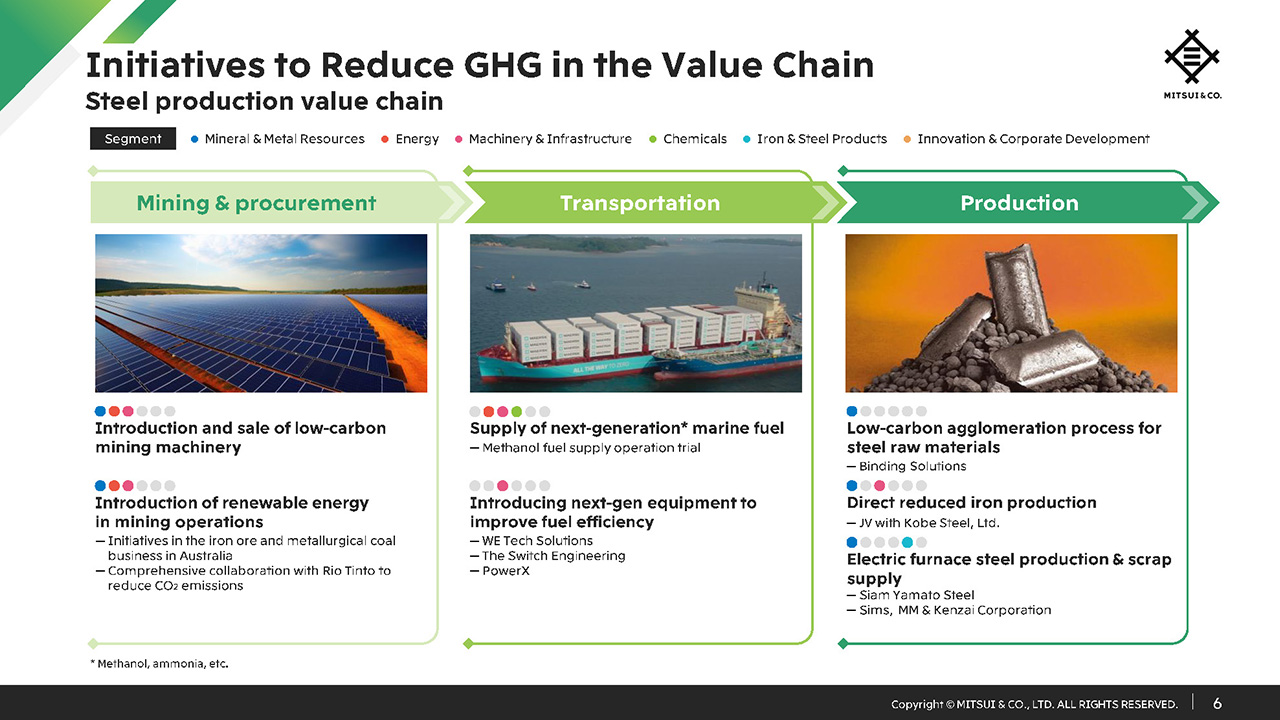

Initiatives to Reduce GHG in the Value Chain - Steel production value chain

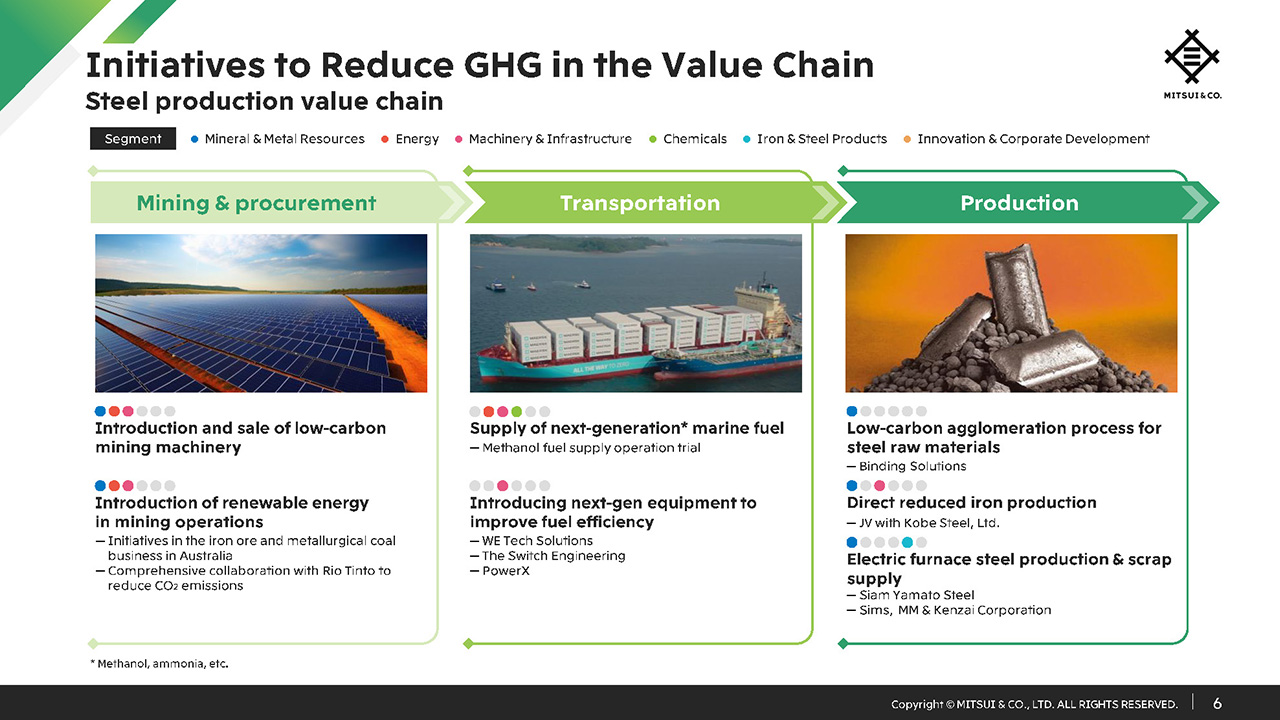

Now, I will explain our steel production, gas and automotive value chain initiatives from a GHG perspective. These are the areas where we can make significant impact.

Last week, we enhanced our Scope 3 GHG emissions disclosure, which covers from category 1 to 15 on our sustainability website. Initiatives throughout the entire value chain are necessary to reduce Scope 3 emissions. Together with our partners and customers, Mitsui is advancing initiatives in every industry in our broad range of businesses, from upstream to downstream, to reduce emissions across the whole of society.

First, in the steel production value chain, we are working to reduce carbon emissions in mining as well as steel production. Specifically, we are conducting a study on direct-reduced iron production in Oman. We are conducting a feasibility study with Kobe Steel and steadily progressing discussions with raw material suppliers and customers. For the future, we are looking into switching to hydrogen reduced iron and utilizing carbon capture, utilization, and storage, or CCUS, and see this as a sector that can potentially contribute to a significant reduction in GHG emissions.

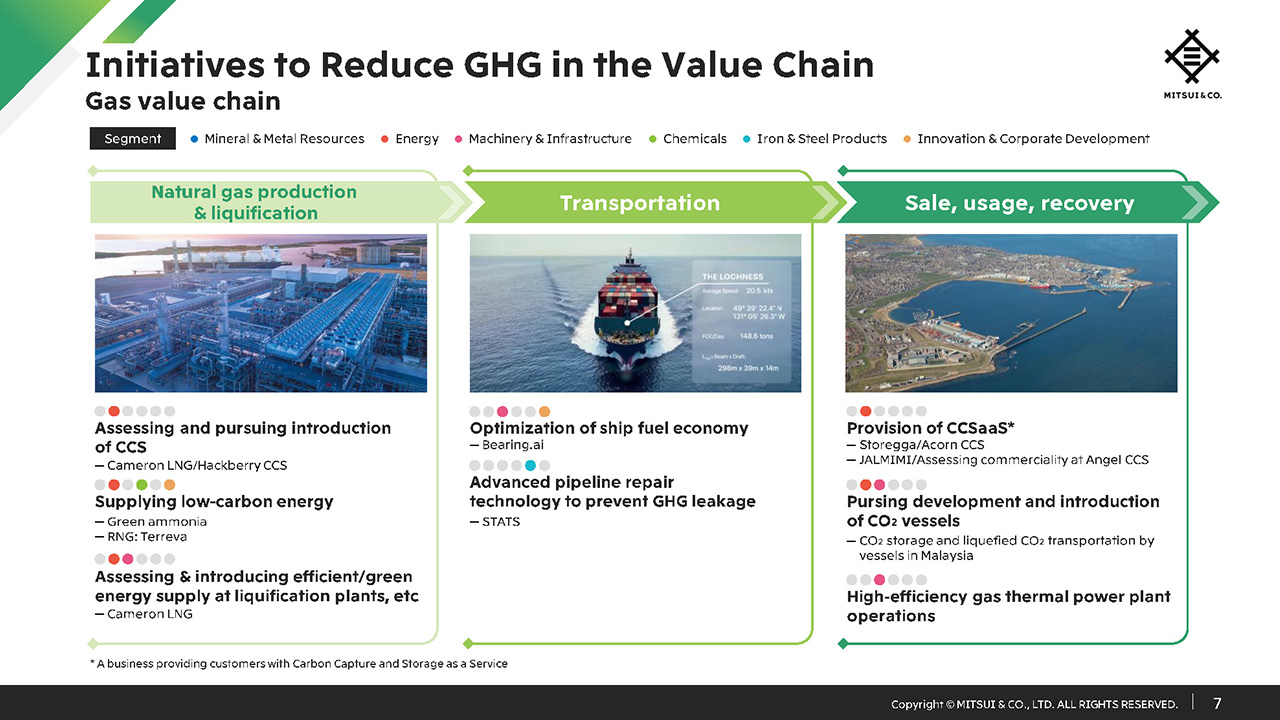

Initiatives to Reduce GHG in the Value Chain - Gas value chain

Next is the gas value chain. As my colleague Toru Matsui explained at last year’s investor day, Mitsui positions its natural gas and LNG business at its core, while advancing initiatives towards a decarbonized society.

Within this business, we are leveraging the technical expertise related to subsurface structure cultivated from the oil & gas production business as well as our partner network to proactively drive the carbon capture, utilization, and storage, or CCS, and CCUS business. Specific examples include a joint survey with Cameron LNG partners, and our work at Storegga in the UK. Storegga is the operator of the Acorn CCS project, which was selected by the UK government in July to start operation by 2030.

The value chain also includes transportation. Tetsuya Daikoku will touch on this later, but through Mitsui’s strengths in the shipping business, we are advancing the supply of next-generation marine fuels and greater marine fuel efficiency through AI.

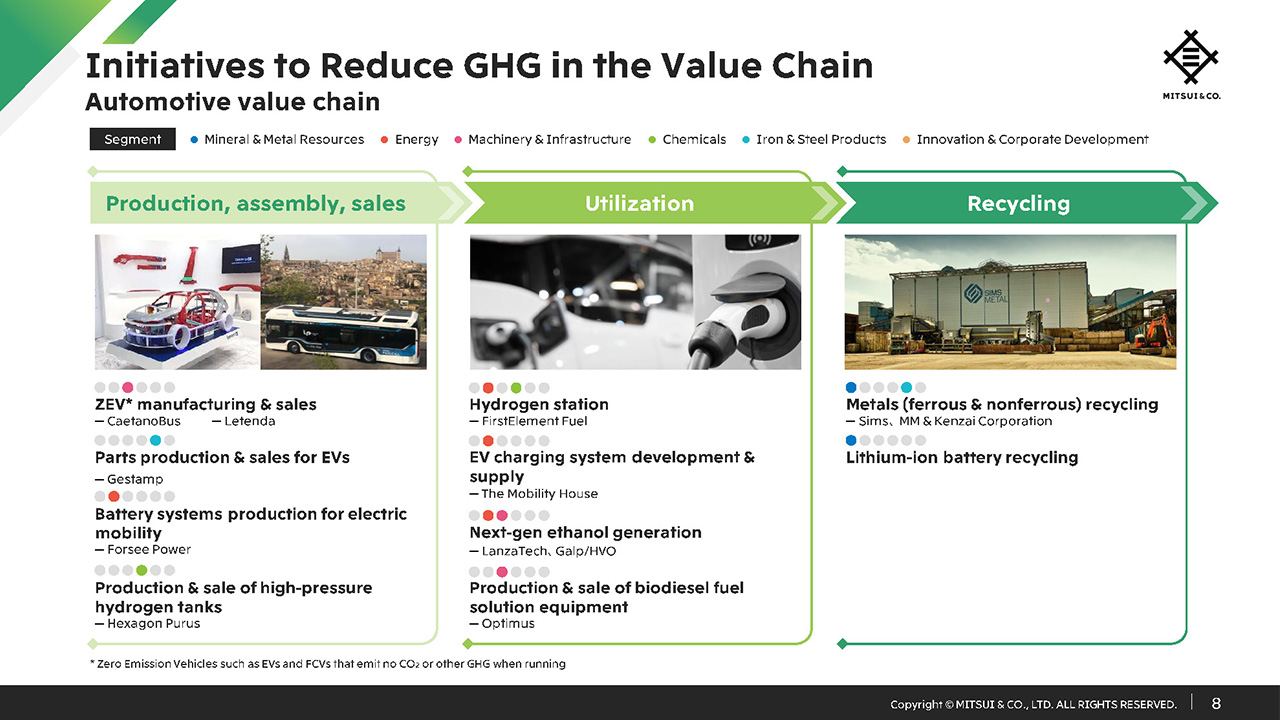

Initiatives to Reduce GHG in the Value Chain - Automotive value chain

Mitsui is also undertaking initiatives towards realizing a decarbonized society in the automotive value chain. In 2017 we invested in CaetanoBus, which manufactures and sells electric buses. Some of those electric and fuel cell buses use battery systems of Forsee Power and hydrogen fuel supply systems of Hexagon Purus. Moreover, batteries are reused as storage batteries to manage energy demand in a business handled by The Mobility House. And, we are also in the business of recycling metal products and lithium-ion batteries used in automobiles. Mitsui is an investor in all these companies, and by combining our strong relations with partners together with the businesses of our investees, this will accelerate the creation of a value chain that will achieve decarbonization.

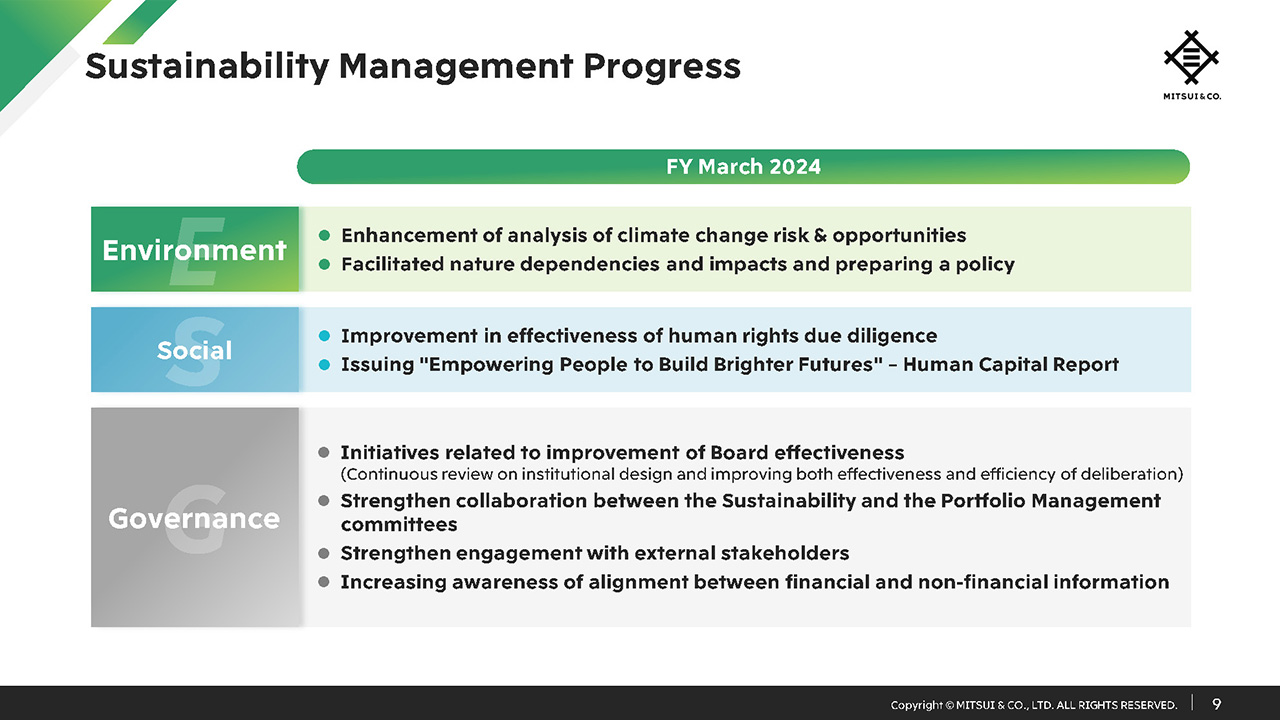

Sustainability Management Progress

Through our investments and efforts in the value chain, we are keenly aware of the growing importance of climate change. Beyond these efforts, we recognize that business and human rights, as well as natural resources and governance play an important role in sustainability management.

We have identified natural capital as a particularly high priority business field, and are conducting impact and dependence analyses related to risk and business opportunities through LEAP analysis. On that basis, we will determine the direction of our initiatives taking the actual situation into account.

In our initiatives related to respect for human rights, we believe it is important to continue to steadily conduct due diligence and to respond conscientiously to suggestions for improvement and other matters according to the survey results. In the social field, we have issued our first human capital report, Empowering People to Build Brighter Futures.

Last but not least is governance. Portfolio reform is important in responding to climate change, and we are strengthening collaboration between the Sustainability Committee and the Portfolio Management Committee and carefully selecting investment projects from a comprehensive perspective that includes factors such as profitability and climate change.

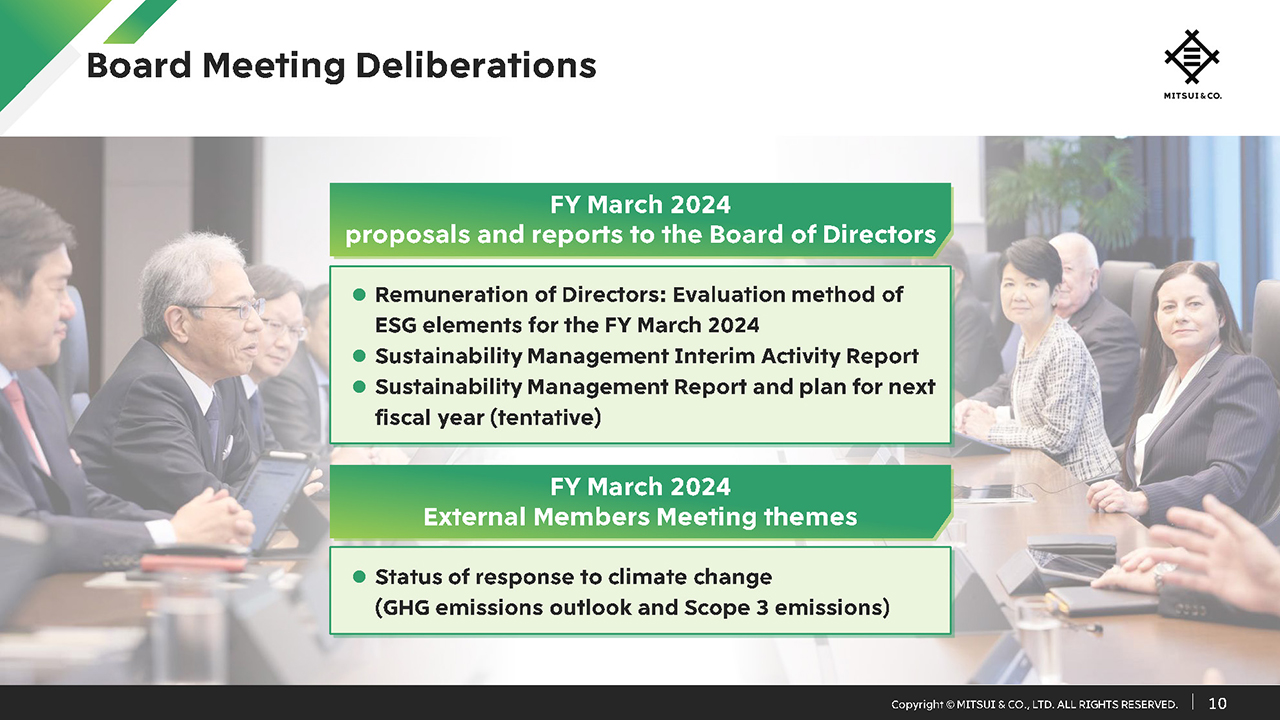

Board Meeting Deliberations

We place not only climate change, but sustainability in general, at the center of management. The Board of Directors is responsible for overseeing Mitsui’s sustainability management efforts.

The Board of Directors determines the evaluation method for the Directors’ and Audit & Supervisory Board Members’ remuneration system introduced last year, which includes ESG elements among its management evaluation indicators. Regular reports related to sustainability initiatives as well as the results of discussions were reflected in Mitsui’s activities via the officers in charge.

We will continue the steady implementation of sustainability management in our business operations under an appropriate governance system, striving to contribute to the development of society as a whole and Mitsui’s further growth.

That concludes my explanation. Thank you very much for your attention.

Q1: Securing High ROI in the Next Generation Fuel Business

Can you tell us about the next-generation fuel business on page 4 of the presentation? You explained that accumulated invested capital would be around 500 billion yen, profit about 60 billion yen, and ROIC 12 percent. Recently, next-generation fuels has become highly competitive area, and there is a growing perception that ROIC is low. How would you be able to maintain a high ROIC in this field?

Sato : Ammonia and methanol are business domains where we have traditionally performed very well. We are also in a strong position in the Energy segment, having developed strong relationships with national oil companies and electric utilities.

In addition to trading, we have also developed relationships with manufacturers in the Chemicals segment. For example, we have built a network with CF Industries, the world’s largest ammonia producer. The combination of these helps us increase profitability. At the same time, in the process of selecting from a large number of deals, we negotiate and obtain favorable terms to further increase profitability.

That is for the ROIC of the next-generation fuel business, but we are also building our business in adjacent areas, such as ships and aircraft that use next-generation fuels, including establishing business networks and trading. Our strategy is to use chains and clusters to ensure profitability.

Q2: Background Leading to the Promotion of Clean Ammonia

I would like to ask about clean ammonia. Clean ammonia is also being promoted by the Japanese government. I believe it is a great solution in terms of making effective use of existing coal-fired power generation.

On the other hand, some have pointed out that co-burning at coal-fired power plants may extend the life of those plants. What kind of internal discussions took place in response to these points of view, and how did you come to the decision to move forward with clean ammonia? Alternatively, please explain how you respond when such observations are made by external parties.

Sato : Your question is not just about us but also stems from Japan’s position. This is a very important problem, and yet one that will be quite difficult to get global agreement on.

Japan and South Korea already have coal-fired power generation, and in developing countries, especially in Asia, the reality we face is that coal-fired power plants are a must to ensure a stable energy supply.

If countries such as Japan and South Korea, which already have coal-fired power generation, were to switch entirely to nuclear power starting tomorrow, there would be a whole new set of challenges and issues even then. So, no matter what, a process of gradual transition is required. This is very similar to the concept of natural gas or gas-fired power generation.

When it comes to ensuring a stable supply of electricity while using existing coal-fired power generation and gradually reducing greenhouse gas emissions, ammonia plays a vital role whether it would be co-burning or single burning.

In the next-generation fuel business, our clean ammonia has applications not only in co-burning or single burning thermal power generation but also in the world of mobility, where it is used for ships powered by dual fuel with ammonia.

Furthermore, in other applications, such as traditional fertilizers and chemicals, the significant change in costs means the replacement will not happen right away, but the aim is to make a gradual shift to clean ammonia.

That last part deviated a bit from the question, but we are advancing our clean ammonia business based on the belief that it’s necessary to promote a gradual transition in thermal power generation.

Q3: Direct Reduced Iron Business

In today’s explanation, there was mention of steel making initiatives. You have been looking into the direct reduced iron business, including hydrogen reduced iron, together with Kobe Steel for some time. I believe you are now entering the stage where you can showcase the results.

In Europe, construction has already begun on commercializing the first unit using hydrogen-based reduction. In the development of this business, you will presumably start with a natural gas-based project in the Middle East, but considering the scalability and future of the business, if you can just secure the infrastructure for hydrogen, it seems that technically, you would be able to move on to the next step.

How will you include natural gas or hydrogen-based reduction in your vision as a first or next step in developing the direct reduced iron business? I know it’s still early at this point, but if you could even just touch on the direction of the business, that would be great.

Sato : In Oman, we will begin manufacturing direct reduced iron using natural gas, employing Midrex® technology.

As explained, just doing this, we will produce less than half the greenhouse gas and CO2 emissions of the blast furnace method.

We will look to use CCS and CCUS to address the CO2 emissions, preventing them from being released into the atmosphere. CCS will not be launched at the same time as production begins, but we will work on it.

Midrex® technology itself has established the technical capability for hydrogen reduction at 100 percent hydrogen. They’re also using Midrex® technology in Europe for hydrogen reduction. The difference is whether to start there or to change from natural gas-based direct reduction to hydrogen reduction.

The approach we are currently considering involves initially starting direct reduced iron production with conventional reformed natural gas and subsequently transitioning to hydrogen reduction. Hydrogen reduction requires clean hydrogen, so we would look at transitioning once enough is available.

Q4: ROIC and Profitability in Next-Generation Fuels Business

Based on the explanation on page 3 of the presentation, I understand that there are already various pipeline projects available and that you are currently in a very favorable situation of being able to choose from.

On the other hand, please tell us which of your businesses have the highest ROIC and how you approach choosing new investments when making major changes to your portfolio. Also, you mentioned earlier that you are aiming for profit of about 60 billion yen in the next-generation fuels business. What is the time frame for that?

Sato : It is common to hear that greener businesses, including business investments, may not be profitable, may have low profitability, or may take time to monetize, and in some areas, this is definitely true.

However, we believe the next-generation fuels business is an area where early cash return can be expected. For example, there are regulations for logistics involving ships running on heavy fuel oil, meaning a change in fuel is unavoidable and as such, there is considerable demand for this.

We believe this is a domain where we can gain the first-mover advantage by getting in ahead of the competition amid this demand. In our case, we established the Energy Solutions Business Unit four years ago and have been pursuing this domain from early on. In terms of being a first mover, e-methanol, for example, is expected to be the first business of its kind in the world.

In this way, we intend to ensure profitability by proceeding with these initiatives as a first mover. Demand will increase over the long term, and we will carefully select cost-competitive businesses.

The timing of profit contribution will, of course, vary from project to project. However, we have presented ROIC and other figures for the fiscal year ending March 2030, so we are looking at projects based on the assumption that those figures will show up by then.

Q5: Visualization of Revenue by Segment

I have a request. In projects jointly undertaken across multiple segments, I believe revenue recognition would also span multiple segments. In such cases, I hope you will take measures to ensure that the revenue from each project is visible to external stakeholders.

Sato : In our case, the boundaries between the various business units are very low, and in fact, we already have projects in which multiple business units collaborate. In such instances, as you may expect, revenue is allocated and recorded accordingly among the involved business units.

We disclose financial figures as results divided among segments, but of course, we want to make sure we present these figures in an understandable manner for investors and external parties, including continuity.

Whenever making changes, we will, of course, consult with all stakeholders and proceed with proper accountability.