Enhancing Corporate

Value

Opening Remarks

Hori, CEO (Hori) : Good afternoon, I’m Kenichi Hori, President and CEO. Thank you for taking the time out of your busy schedules to attend Mitsui & Co.’s Investor Day 2023.

Today, I would like to speak about our initiatives to enhance Mitsui’s corporate value under the current Medium-term Management Plan (MTMP).

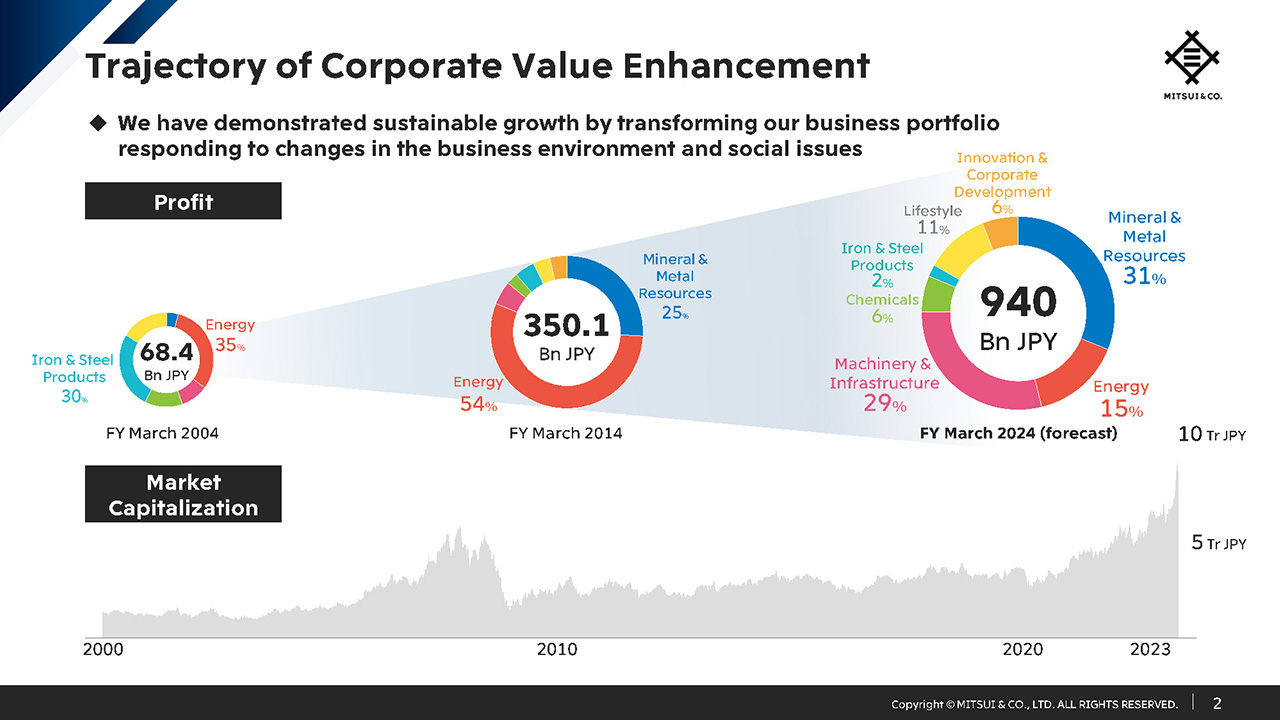

Trajectory of Corporate Value Enhancement

We have continually transformed our business portfolio to ensure that, through our business activities, we can provide real solutions for ever changing social issues.

A look at the past two decades shows that we have reconfigured our business portfolio in response to changes in the operating environment, changed our profit mix, and the continual increase of our market capitalization has reflected these changes.

Transforming our business portfolio is a crucial way to generate profits and cash while adapting to diverse business conditions, and it is the driver for our corporate value enhancement.

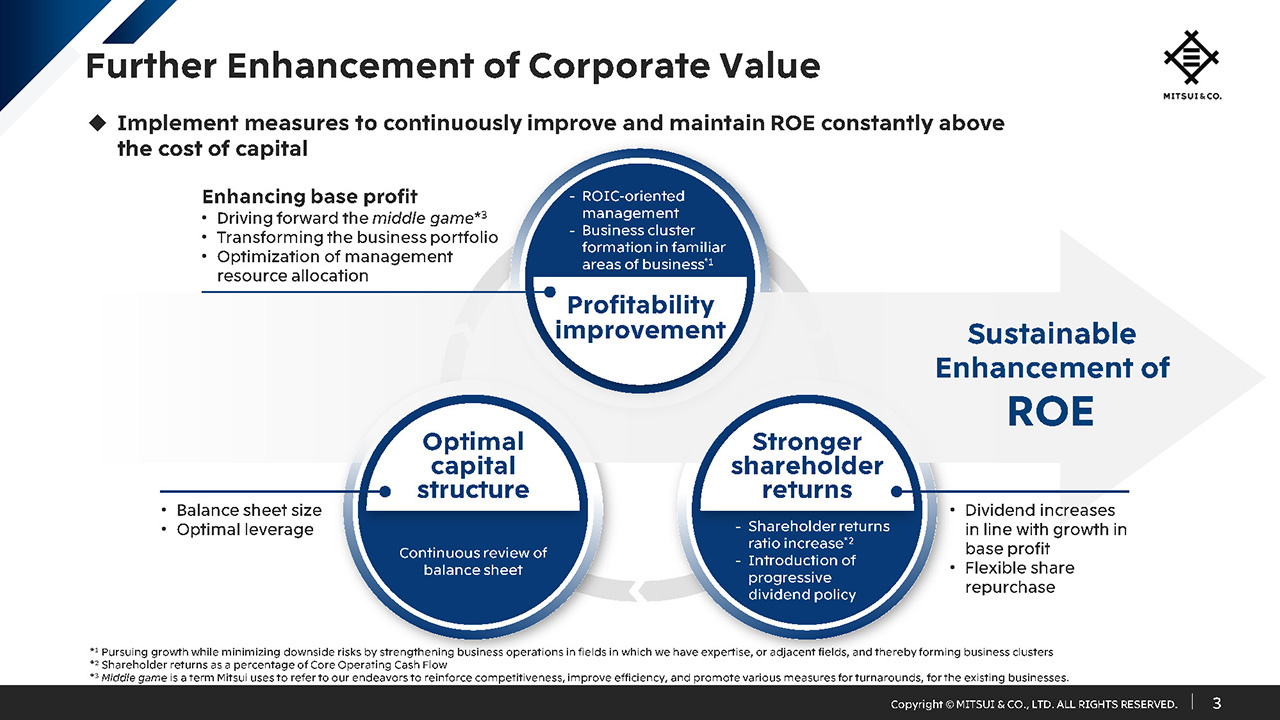

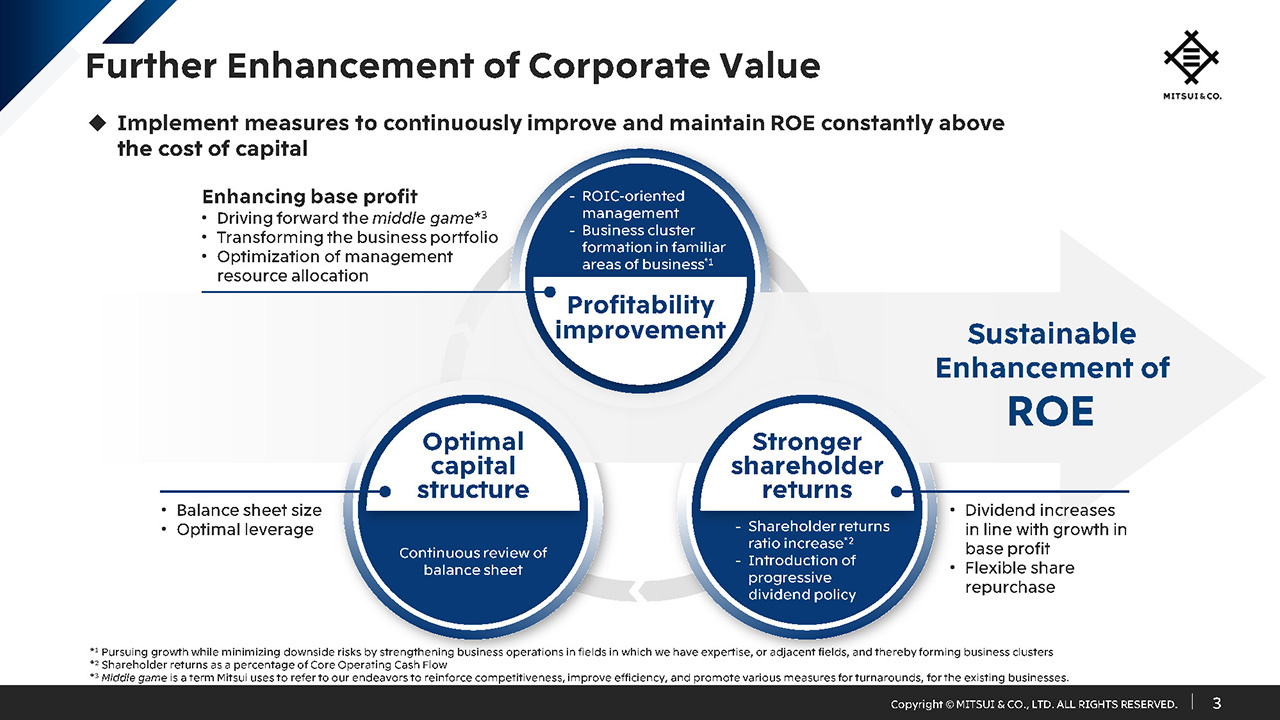

Further Enhancement of Corporate Value

As I explained when we announced MTMP 2026 in May, to further enhance our corporate value, we will work to improve profitability, strengthen shareholder returns, and pursue an optimal capital structure, and link these approaches to sustainable enhancement in ROE. Today, I will focus on profitability improvement.

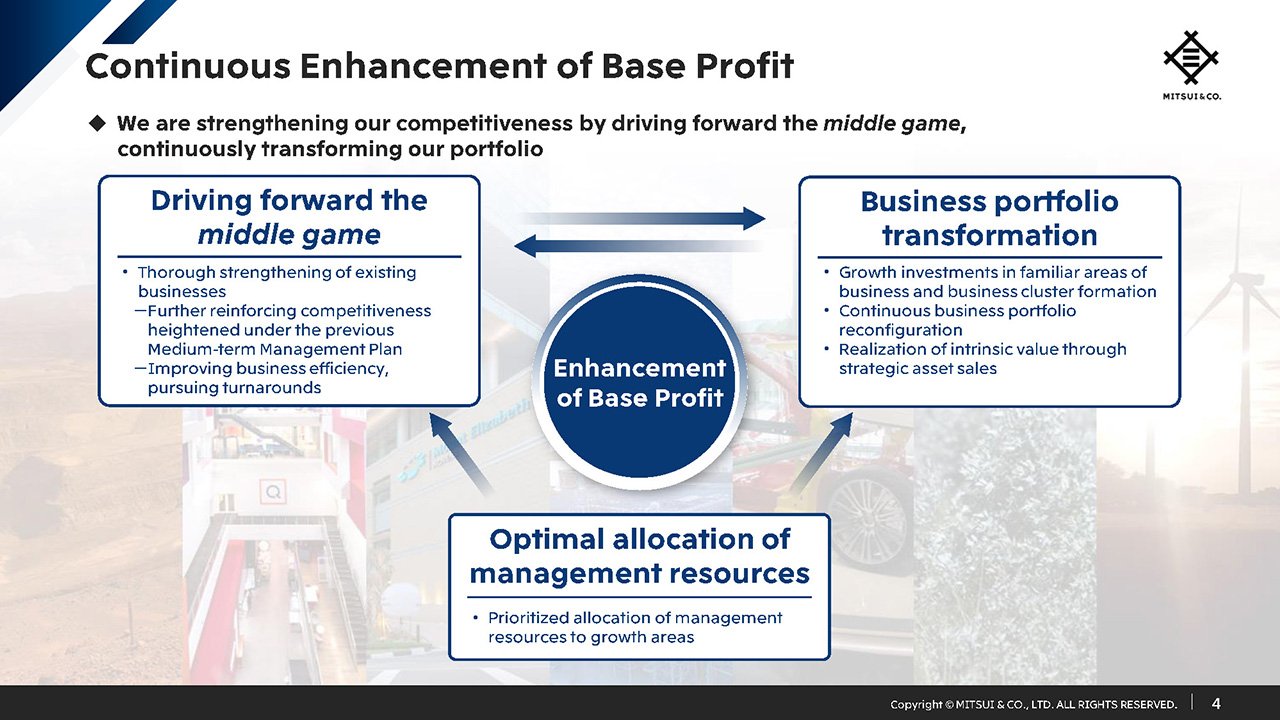

Continuous Enhancement of Base Profit

One of our strategies for improving profitability calls for the enhancement of our base profit. To that end, we are working to drive forward the middle game of business, transform our business portfolio, and optimize the allocation of management resources.

Here, middle game refers to our endeavors to reinforce competitiveness, improve efficiency, and promote various measures for turnarounds in the existing businesses. We are determined to further reinforce the competitiveness of each business – something that has been continuously heightened while overcoming a number of challenges in an ever-changing environment.

We will also continue to transform our business portfolio. Throughout its history, Mitsui has created and fostered core businesses in a wide range of fields. Through this process, we have gained deep expertise of each business field. The key to our growth investments has been investing in familiar areas of business where we have extensive expertise and subsequently forming business clusters.

To succeed with these initiatives at the highest level, we must optimize the allocation of our finite management resources.

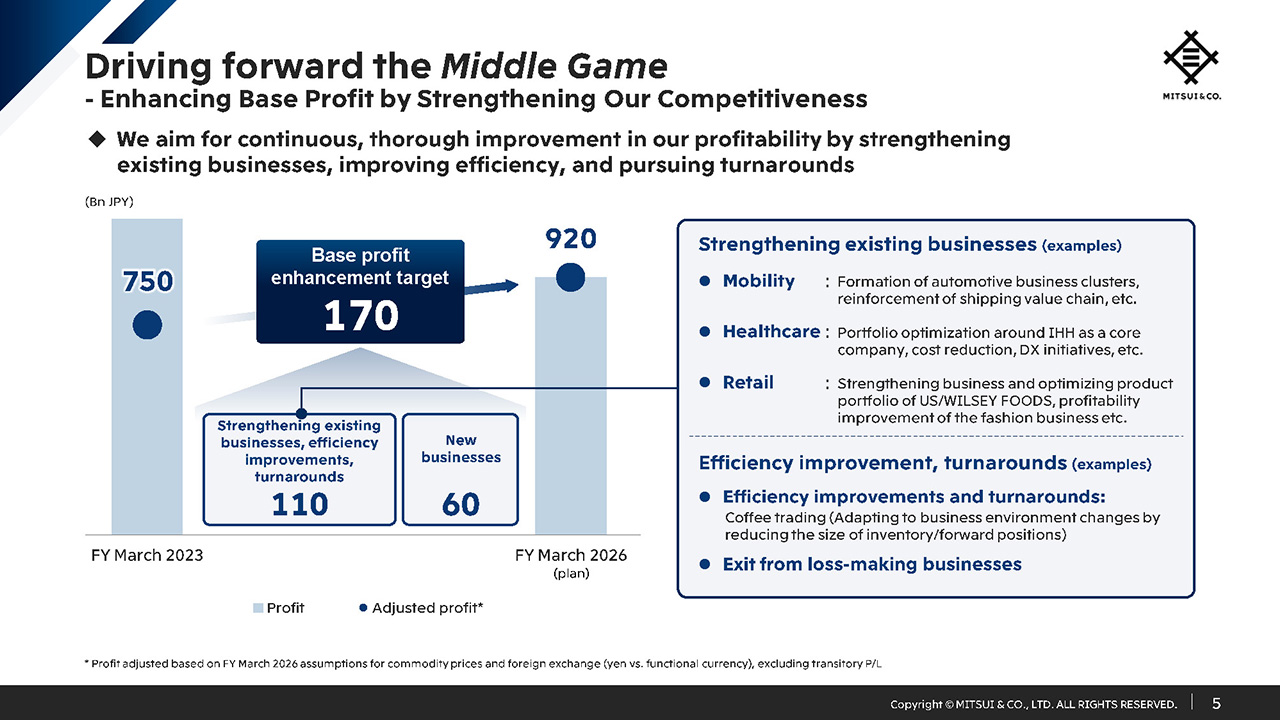

Driving forward the Middle Game - Enhancing Base Profit by Strengthening Our Competitiveness

As shown in this slide, we aim to improve base profit by a total of 170 billion yen during MTMP 2026. This consists of a 110 billion yen profit contribution resulting from our middle game endeavors, and 60 billion yen from new businesses.

Around one-half of the 60 billion yen contribution from new businesses is already in sight.

While we will report on quantitative progress toward the 110 billion yen contribution from middle game initiatives when we announce our full-year financial results, today, Tetsuya Daikoku, our Senior Executive Managing Officer in charge of the mobility business, will provide some examples of our middle game initiatives. Also, CFO Tetsuya Shigeta will speak about our efforts to improve efficiency and achieve business turnarounds.

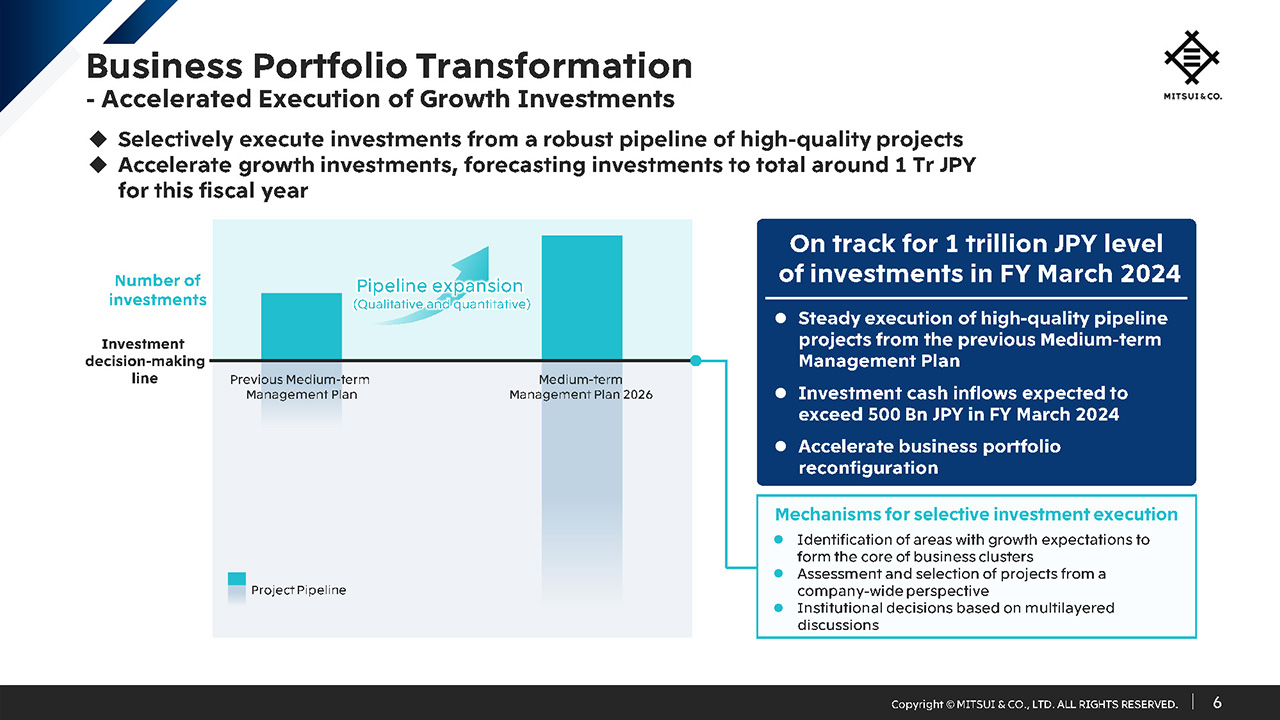

Business Portfolio Transformation - Accelerated Execution of Growth Investments

In addition to our efforts to strengthen our existing businesses, we are accelerating the execution of growth investments.

During the previous MTMP, by combining our diverse businesses, we proposed and successfully provided real solutions to the social issues that emerged as a result of changes in the global operating environment. These activities have resulted in significant qualitative and quantitative enhancement of our investment project pipeline.

We see the three-year period covered by the current MTMP as a time to accelerate the execution of rigorously selected investments while further expanding our project pipeline. In the current fiscal year, we plan to execute investments totaling around 1 trillion yen, including some projects from the previous MTMP that were carried over into the current plan. Along with new investments, we are also proactively divesting assets. We estimate that our investment cash inflows will exceed 500 billion yen in this fiscal year and we are accelerating our portfolio reconfiguration.

This substantial qualitative and quantitative enhancement of our investment project pipeline enables us to select high quality projects that meet or even exceed our criteria despite an environment that requires higher investment returns.

When selecting projects, we first identify the areas with growth expectations to form the core of business clusters aligned with the three Key Strategic Initiatives defined in the MTMP 2026. Projects that are selected in this way are then assessed from a company-wide perspective by executive officers in charge of multiple business fields. Further, through multi-layered discussions by the Portfolio Management Committee and Corporate Management Committee, we delve deeper into these projects in terms of factors including quantitative contribution, management resources, and ESG, before making institutional decisions.

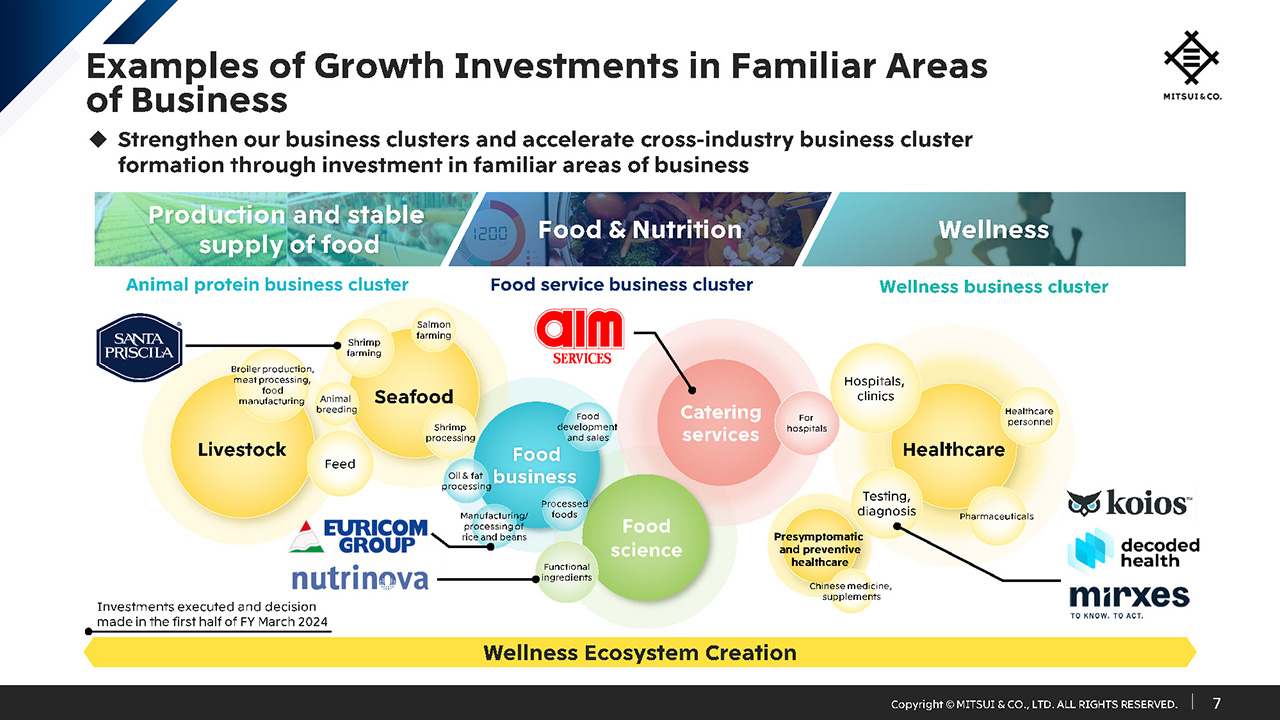

Examples of Growth Investments in Familiar Areas of Business

In the first half of the current fiscal year, we executed multiple large-scale investments in the Food & Nutrition domain to drive one of our Key Strategic Initiatives, Wellness Ecosystem Creation. The animal protein business cluster includes the Santa Priscila shrimp farming business in Ecuador. In the food science area, we invested in the functional food ingredient manufacturer Nutrinova. Examples in the food service business cluster include Euricom, which manufactures and sells processed rice products, as well as the contract food service company Aim Services.

Also, in the healthcare field, we are pursuing growth investments with the aim of strengthening the competitiveness of the hospital and clinic business centered on IHH.

We have expanded our hospital and clinic portfolio by investing in a clinic business that provides both online and face-to-face consultations. In the testing and diagnosis area, we are working to reduce healthcare costs while bettering treatment benefits through investment in the healthcare technology businesses that can provide hospitals and clinics with advanced technology and solutions, including the vital utilization of healthcare data and AI.

All of the businesses that I just mentioned are examples of growth investments in familiar areas of business. In each business field, we have made acquisitions that are highly profitable and/or complement our core business functions. By thoroughly strengthening these newly added businesses through our middle game endeavors, we will turn them into drivers of profit expansion.

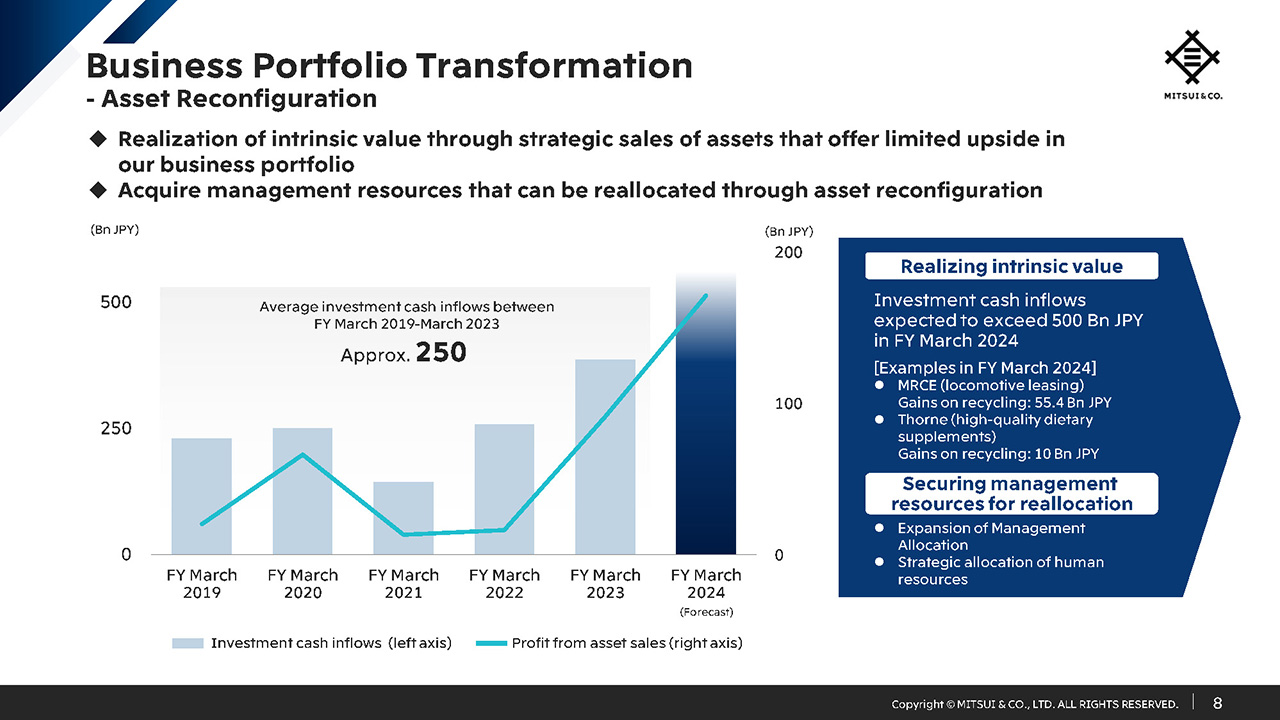

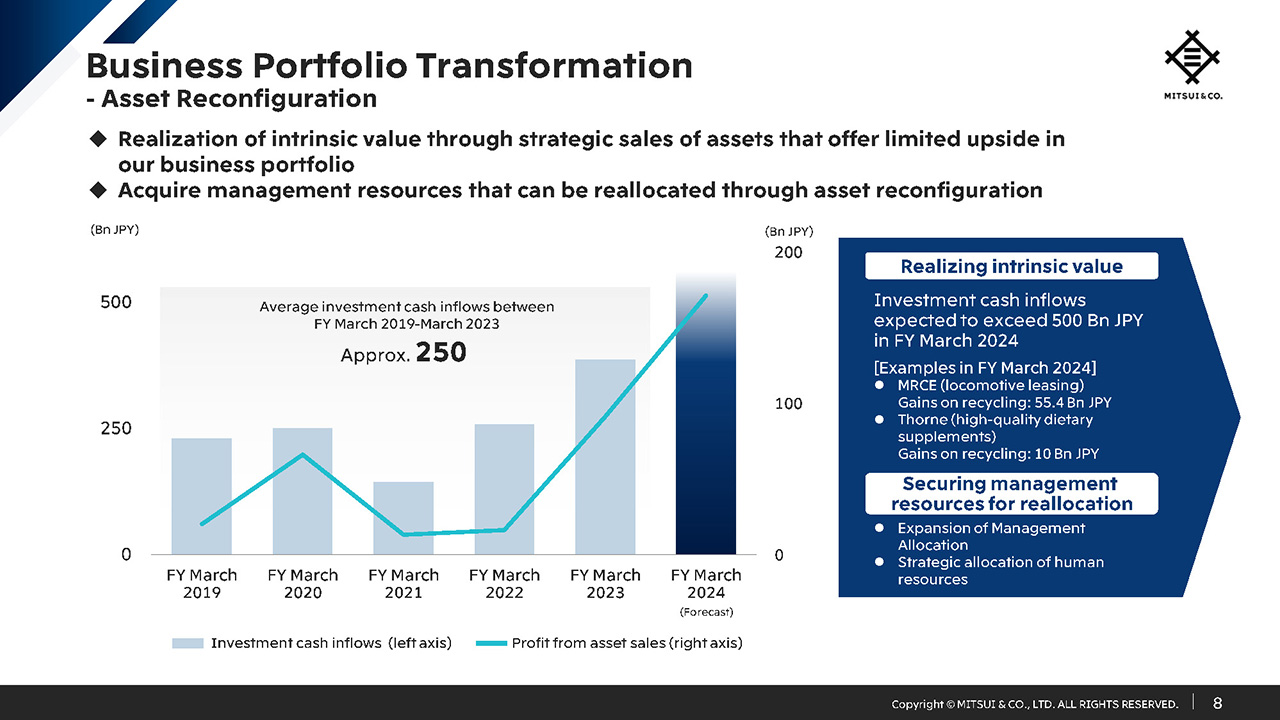

Business Portfolio Transformation – Asset Reconfiguration

As I have explained, Mitsui is actively executing growth investments while also accelerating strategic asset sales at the same time.

Even if an asset is currently contributing to profit, it may be subject to divestment if there is limited upside for Mitsui. In addition to realizing the intrinsic value of assets, divesting them also enables management resources to be acquired, such as financial and human resources, which can then be reallocated. We accelerate the business portfolio reconfiguration by appropriately allocating such resources. In the current fiscal year, we saw and acted upon several opportunities for strategic asset sales and realized substantial gains, for example by divesting MRCE, a locomotive leasing business in Europe, and Thorne HealthTech, which develops, manufactures, and sells high-quality dietary supplements.

We are still in the process of intensifying the reconfiguration of our portfolio based on the current business environment and outlook. We therefore expect the level of strategic sales to increase compared with the past. As I said earlier, we estimate that investment cash inflows will exceed 500 billion yen in the current fiscal year.

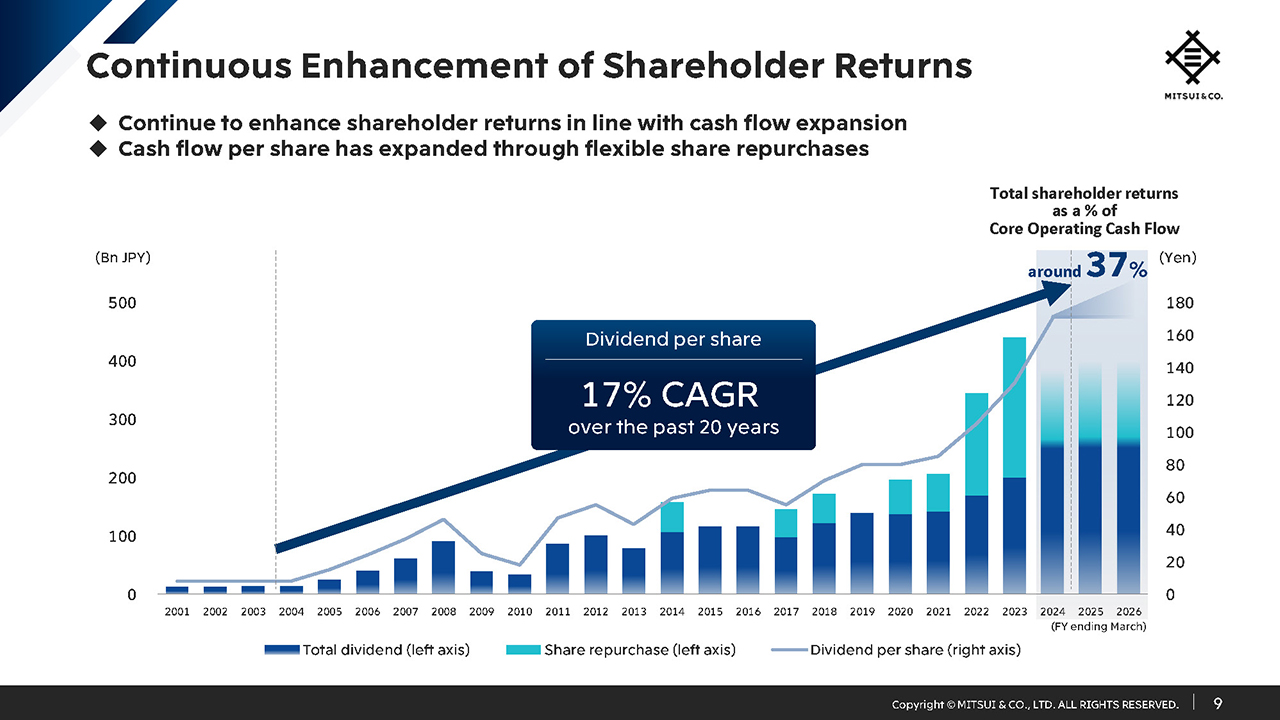

Continuous Enhancement of Shareholder Returns

Through the initiatives to enhance our profitability that I have explained today, we have steadily expanded our cash flows. Over the past 20 years, we have increased our dividend per share by 17% per annum in line with this cash flow expansion. Moreover, since FY March 2014, we have used flexible share repurchases to enhance both total payout and cash flow per share. We will continue these efforts to enhance shareholder returns along with cash flow growth.

Lastly, changes in global dynamics and the operating environment are expected to continue, and social issues such as climate change and the maintenance of natural capital will become even more complex. While continuing to provide real solutions to social issues, we are determined to respond to the expectations of our shareholders by sustainably enhancing ROE and corporate value, underpinned by profitability improvement, strengthening of shareholder returns, and pursuit of an optimal capital structure.

That completes my presentation today.

Q1: Appropriate Leverage

Regarding your thinking on the appropriate capital structure as shown on page 3 of the presentation, the actual net debt to equity ratio as of the end of September 2023, for instance, is 0.48x. I understand that a weaker yen has the impact of increasing shareholder equity. However, even if we were to recalculate using an exchange rate of 132-133 yen to the dollar as of the end of March, it would still be in the neighborhood of 0.5x.

Of course, you want to have a buffer in case of unforeseen circumstances, but how should we interpret optimal leverage as part of an optimal capital structure?

I think this also ties into how we should think about stronger shareholder returns, mentioned on the same slide. What is your thinking on the optimal leverage at this point in time?

Hori : We are highly sensitive to the operating environment and constantly mindful of the totality of conditions observed around the world and what degree of variation we are up against.

Today’s operating environment has a high range of variation, making it difficult to predict the future. As such, we believe it is necessary to maintain a certain amount of funds in reserve to ensure security while at the same time striving for sound management of the balance sheet, so that we maintain the ability to respond to unforeseen circumstances.

We operate according to capital allocation principles based on these assumptions. Specifically, we acquire cash through annual earnings and also generate cash inflow through portfolio reconfiguration. As I mentioned earlier, the latter refers primarily to asset sales through portfolio reconfiguration. While considering such allocable cash and ensuring safety, we hope to balance investing in excellent projects and enhancing shareholder returns.

We prioritize projects in familiar areas of business, and that can relatively quickly contribute to earnings to certain extent. In doing so, we gradually expand our portfolio while taking into account the confidence we have in our own viewpoint and the quality in terms of both cash-generating potential of the projects and the assets themselves.

Specifically, when we determine that we have sufficient control and adequate risk levers or when the deal itself is a high-quality one, we can be flexible in our approach towards leverage to expand our base of work.

With respect to shareholder returns, we have set a target to proceed with a certain percentage of Core Operating Cash Flow (COCF) in the three-year Medium-term Management Plan (MTMP). We aim to steadily achieve this target, and within such options, we anticipate that leverage will settle within an acceptable range with a certain level of flexibility.

Q2: Cash Flow Allocation

I would like to ask about cash flow allocation. Earlier, you talked about cash flow allocation and explained that leverage would be utilized if suitable opportunities arise.

However, cash flow allocation for trading companies, including Mitsui, today is basically managed with the aim of keeping free cash flow positive after shareholder returns. This approach ensures that net debt does not increase and equity continues to accumulate, leading to a decline in ROE.

You also mentioned earlier that you would consider leveraging if you find a good deal, but I think a deal requiring leverage on your scale would be quite a significant investment.

Unless such a deal comes up, I think ROE is likely to decline as a general rule. Are you beginning to consider changing the approach of keeping the free cash flow positive after shareholder returns? Could you talk about your policy?

Hori : As part of our overall operational discipline to adapt to the current operating environment, we want free cash flow after subtracting shareholder returns to be positive.

I think this baseline is essential for the MTMP. At the same time, however, in an operating environment where opportunities are increasing, there is naturally a possibility that we may encounter relatively large-scale acquisition opportunities and other deals.

There have already been cases where we’ve had opportunities but chose not to proceed. Deals only exist in the presence of a counterparty. Opportunities arise, and they could come from within the pipeline. When coming across such large-scale deals, I believe we should consider our tolerance for borrowing flexibly while maintaining an overall balance. We need to assess the quality of the asset and how confident we are that future profits can be secured.

While communicating our ability to maintain such flexibility through discussions with you all, I also believe that we should protect the neutrality of cash flow over the three-year period.

As for return to shareholders, we hope to consider them along with the efficiency and improvement of capital. It would be a slightly longer time frame, for this MTMP and beyond, but we are very conscious of this.

We will carefully monitor the balance between our investments and our goal of improving profitability, ensuring there won’t be a structural limit to ROE and taking action as necessary. We will periodically keep you informed regarding this.

We believe it’s important to have a certain basis for the major framework within the MTMP.

Q3: Scale of Portfolio Reconfiguration

Earlier, you explained the possibility of more business portfolio reconfiguration in the future. I believe the investment cash inflow of over 500 billion yen from asset sales in the fiscal year ending March 31, 2024, is quite large. Please provide an idea of the scale we can expect going forward.

I think now is a good time to sell because of the weak yen, but if the environment changes, such as an appreciating yen, are there prospects for maintaining a plan of that scale? Do you have any thoughts on the environment or the scale?

Hori : Deals only exist in the presence of a counterparty and are also something to be understood within the strategies of each business division and the context of changing environments. As such, it is quite difficult to predict macro-level figures.

However, I am feeling the increase in the degree of business portfolio reconfiguration mentioned earlier. For example, investment cash inflows, which up until now had been estimated at just over 200 billion yen per year, are estimated to be 500 billion yen this year. I believe the perception that the scale is increasing is probably correct.

In some cases, we have an idea of the functions we can add as a company, and in cases we feel that we have achieved the limit we may divest. In other cases, we may have a very good investment in which a potential buyer could add even more value than we could, and so we could sell it for a much higher multiple than when we entered the deal. That is a favorable scenario where cash inflows increase, and we hope to grow the scale with combinations of deals like that.

Given that such asset reconfiguration has become a part of our earnings model, our management policy is to handle this flexibly, carefully building up such cases one by one. That’s the overall context.

I would like to add that there is also considerable expansion of cluster building with suitable partners in our investments across the globe. For example, in Asia, we are working with the CT Corp group in Indonesia, Metro Pacific Investments Corporation in the Philippines, where we recently announced the completion of a tender offer, and the Penske group, a long-standing mobility company in North America. Through collaborations with these partners, we have created a considerable number of new business bases.

Another example is the gas distribution business in Brazil. Previously, our partner was Petrobras, but now, in the value chain of biomass fuel production from sugarcane, we are partnering with Cosan S.A. (Cosan Group), one of the world’s leading producers. I believe there are numerous potential opportunities that emerge from such a partnering strategy. While firmly focusing on this type of work, there’s also a pipeline on the investment side that includes promising projects. As such, we hope to proceed with an expansive model that combines proactive cash outflows with appropriate cash inflows, some of which will be converted into business earnings.

As these activities are generally on the rise, I hope it gives you the image of the scale of cash inflows being raised slightly.