Sustainable ROE Growth

Opening Remarks

Shigeta, CFO (Shigeta) : Good afternoon, I’m Tetsuya Shigeta, CFO. Today, I would like to talk about the sustainable growth of ROE at Mitsui. Specifically, I would like to speak on our track record regarding the expansion of base profit, and the strengthening of our earnings base through portfolio transformation. I believe that securing the repeatability and continuity of this track record will lead us to further growth in the future.

Operating Environment

Over the past decade, the challenges facing the world have become increasingly complex. Today we continue to face challenging situations to navigate through, such as the surfacing of geopolitical risks, increased volatility in financial markets, and changes in supply chains. Mitsui is quickly adapting to such changes, and working to provide real solutions through our business to respond to ever-changing social issues such as securing a stable supply of energy and resources, the realization of a sustainable society, and a growing interest in wellbeing.

In this environment, which is becoming increasingly uncertain, Mitsui has maintained a high level of financial discipline while focusing on both investments and shareholder returns in a balanced manner. Maintaining this high level of discipline has led to the current strong financial base that provides us with a variety of options as we aim for further ROE growth in the future.

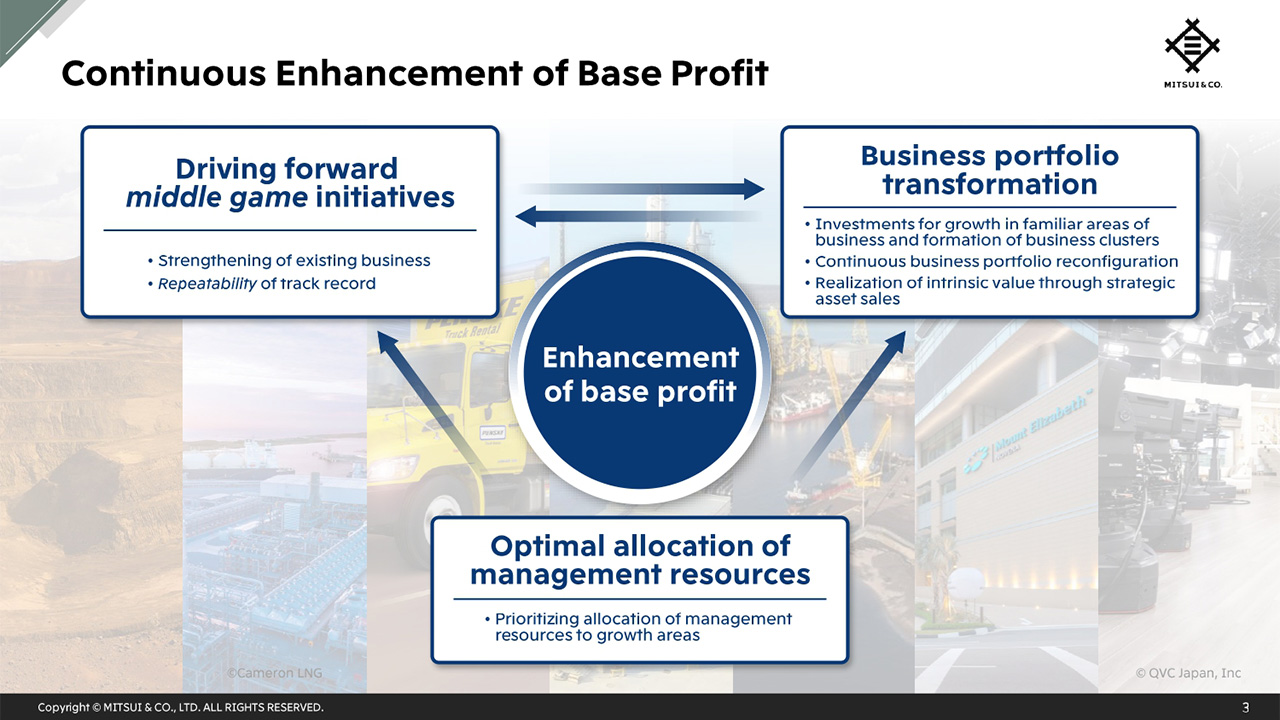

Continuous Enhancement of Base Profit

As part of our measures to improve profitability and increase ROE, we are driving forward our middle game initiatives, transforming our business portfolio, and optimizing our allocation of management resources including human capital. Up until now we have improved our earnings power through these measures, and by carrying them out with an even higher level of sophistication, we aim to achieve enhanced base profit, a major theme of the current Medium-term Management Plan (MTMP).

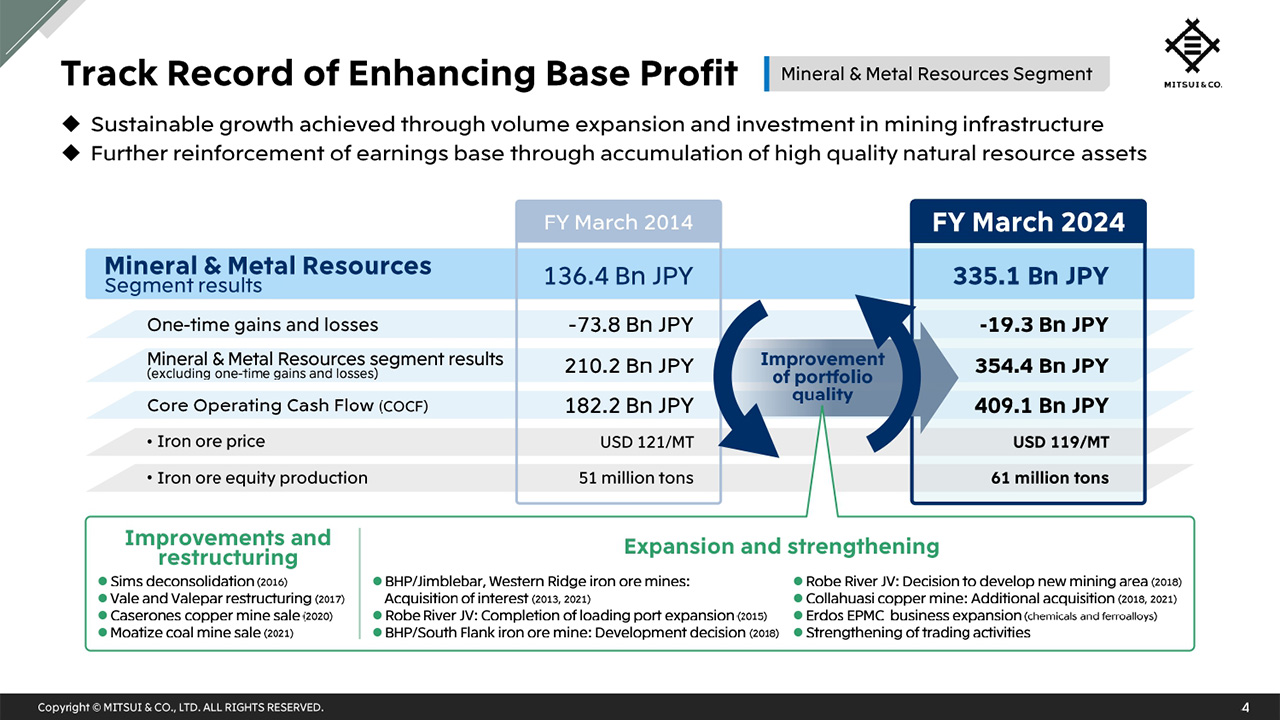

Track Record of Enhancing Base Profit (Mineral & Metal Resources Segment)

I would like to start by speaking on our track record in the Mineral & Metal Resources segment.

This table shows the changes in the Mineral & Metal Resources segment from FY March 2014 to FY March 2024. Iron ore prices are at a similar level as they were 10 years ago, but both profit and Core Operating Cash Flow have more than doubled.

The backdrop to this is that while we have withdrawn from unprofitable businesses such as the Caserones copper mine and the Moatize coal mine, we have been expanding and making additional acquisitions of prime assets by seizing on rare opportunities that Mitsui is uniquely positioned to access, such as the development of multiple iron ore mines in partnership with BHP, the expansion of the Robe River iron ore project including the related infrastructure with Rio Tinto, and the Collahuasi copper mine. Going forward, we will continue to work on further strengthening our earnings base by increasing our prime resource-related assets to further fortify this already well positioned business.

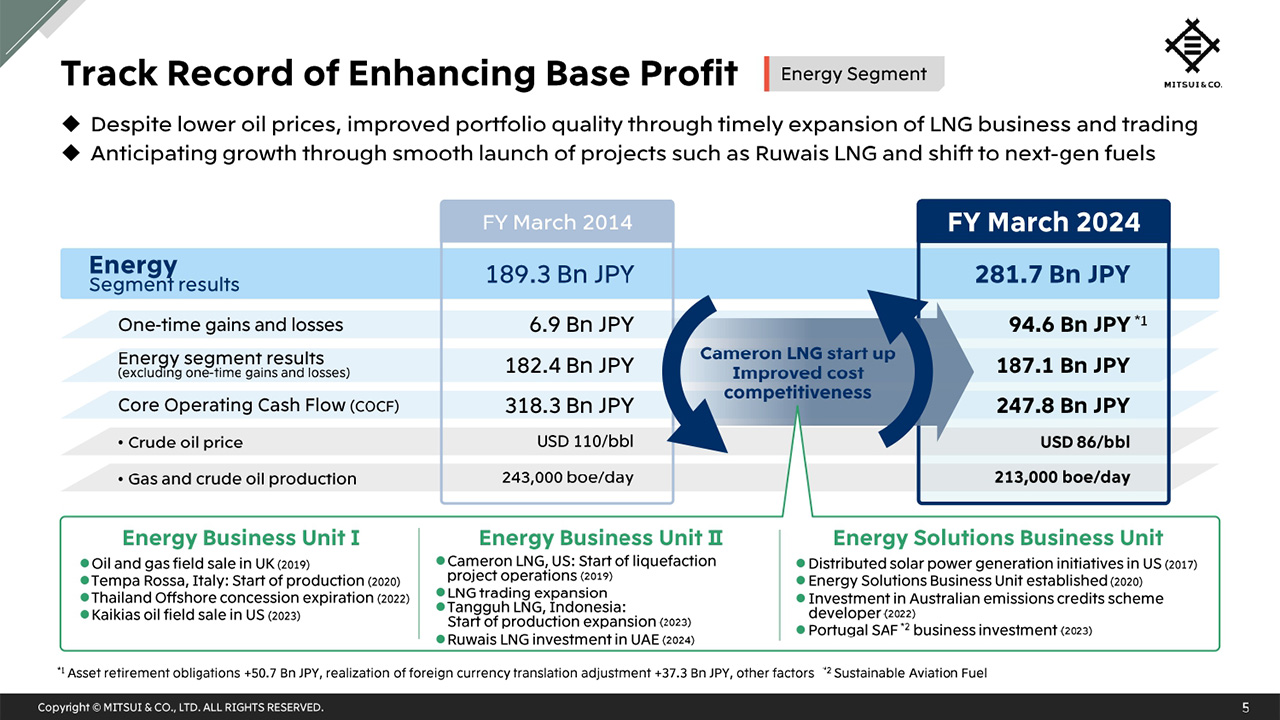

Track Record of Enhancing Base Profit (Energy Segment)

Next, I will move on to the Energy segment. Although the price of crude oil has seen a fall over this 10-year period, the earning drivers of the Energy segment gradually shifted from upstream operations to the LNG business, which includes LNG trading, and earnings grew upon the launch of the Cameron LNG project.

We will continue to strengthen the LNG business and LNG trading portfolios through the launch of projects such as Ruwais LNG, and expand and grow our long-term earnings base. Furthermore, we will also consider businesses that take advantage of opportunities to respond to climate change, such as the next-gen fuel business, and we will continue to improve the quality of our business portfolio from a medium- to long-term perspective, as we have done over the past decade.

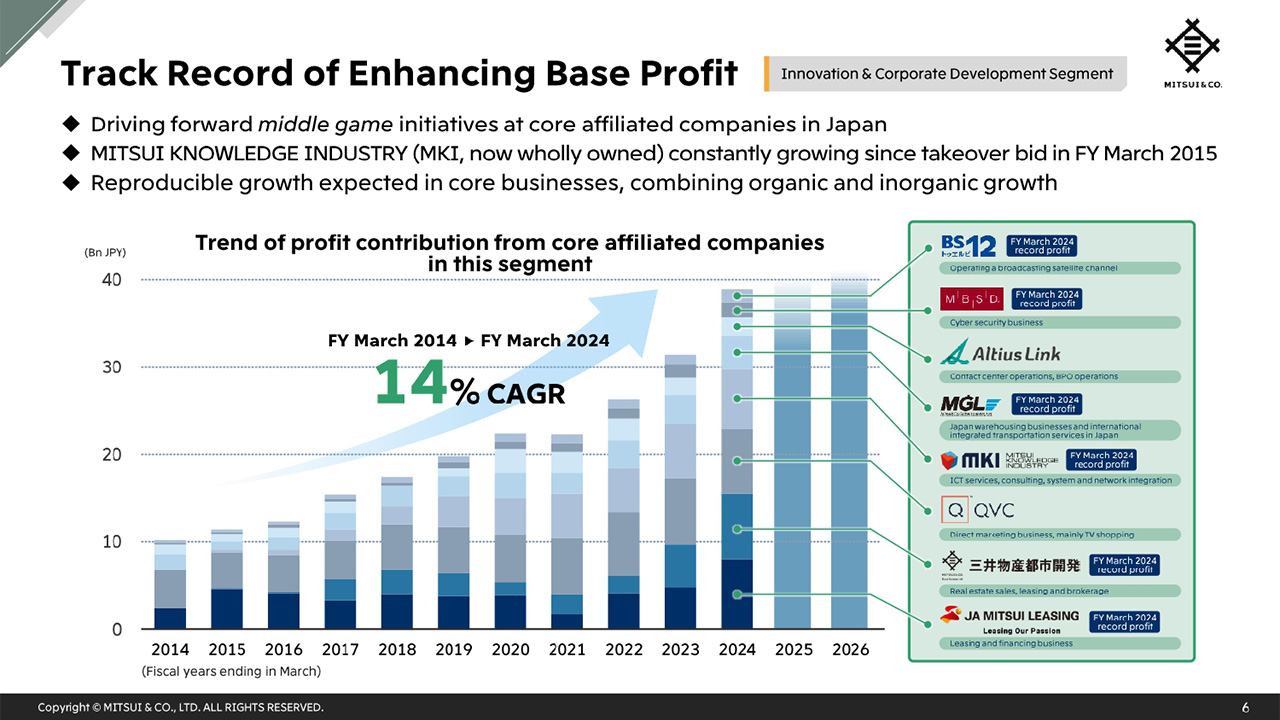

Track Record of Enhancing Base Profit (Innovation & Corporate Development Segment)

I will now speak on the Innovation & Corporate Development segment, which we have received feedback on in the past regarding asset efficiency. This graph shows the results of our core affiliated companies in Japan. As of FY March 2024, six of the eight companies have set new profit records and are steadily growing.

For example, we conducted a takeover bid in FY March 2015 for MITSUI KNOWLEDGE INDUSTRY, increasing our equity stake from just under 60% to 100%. Since then, the company has consistently increased its profits, except for FY March 2022, which saw a decline after a sharp post COVID increase in demand in the previous year.

As for QVC JAPAN, its growth once plateaued in the early 2010s. We decided to deploy Mitsui personnel to be directly involved in procurement of products that go on sale on the platform, which is the linchpin of the television shopping business. We were able to increase the number of well-known brands being offered, and in 2020 we succeeded in improving results to become the industry leader.

Lastly, the real estate business tends to have a relatively low ROIC due to its business characteristics. Mitsui has started to utilize third-party capital and adopt a buy, develop, and sell model that turns over assets, and we have started to see positive results.

In this way, we will focus on thoroughly strengthening each business area and increase the performance of our core affiliated companies in Japan.

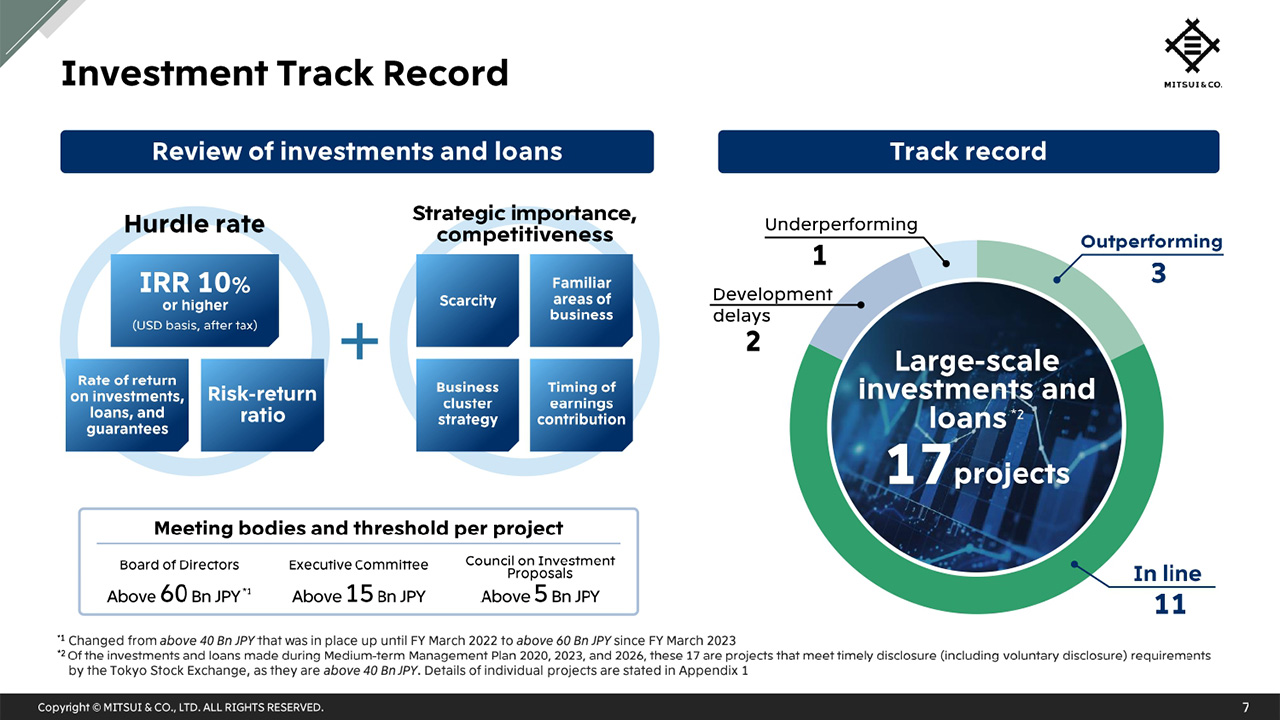

Investment Track Record

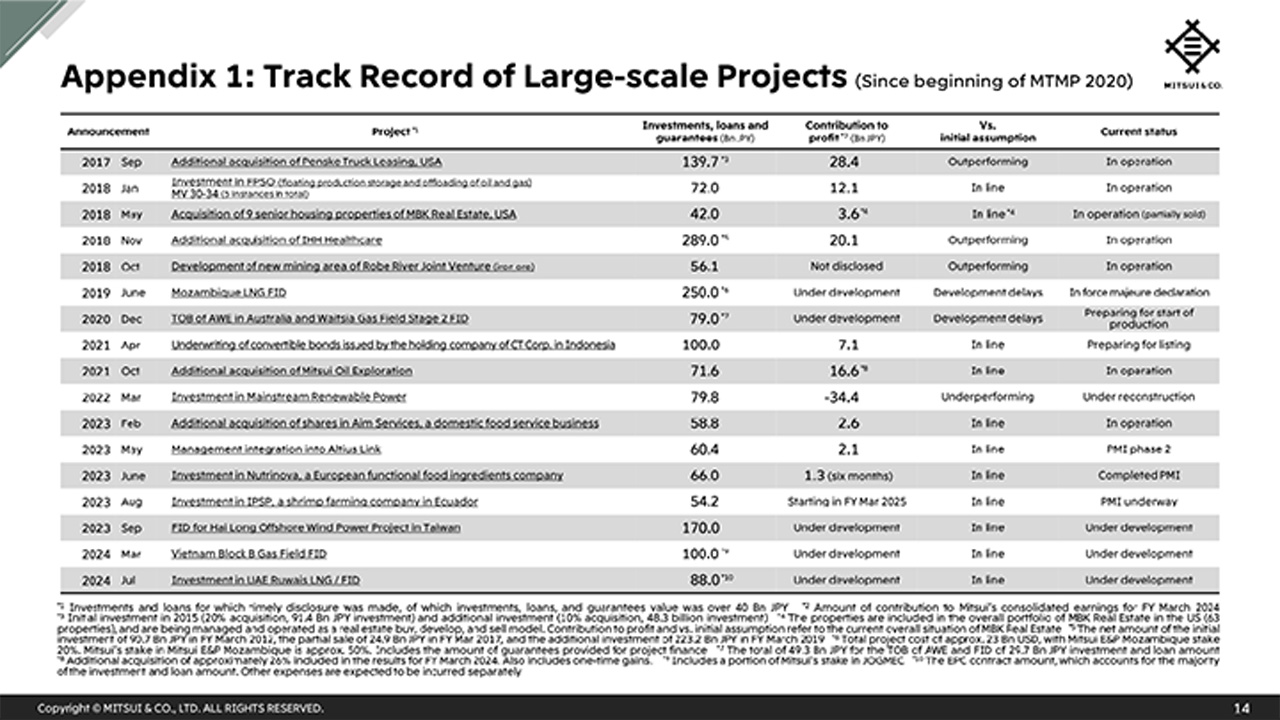

I would like to take a step back and provide an overview of the progress made following our investment in 17 large-scale projects since the start of MTMP 2020, including those made in the three segments I have already spoken on.

The pie chart on the right shows the status of these 17 projects, of which around 80% are either in line or outperforming compared to expectations set when the investment decisions were made. The vast majority of these projects were decided upon by the Board of Directors.

Some projects are not progressing as expected, but we are working towards turning them around by focusing our human resources. We will then thoroughly analyze the factors that did not go as anticipated and make use of the lessons learned to improve our track record in the future. Please refer to appendix 1 for details of the 17 investments and loans.

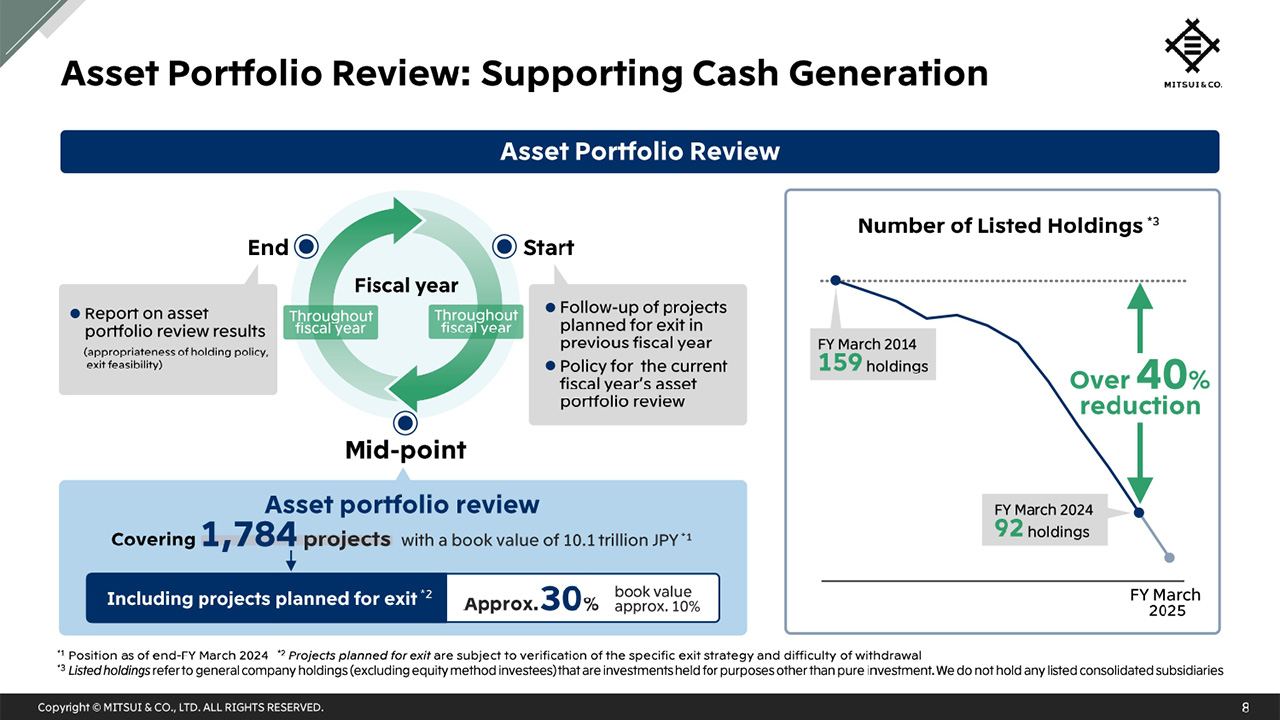

Asset Portfolio Review: Supporting Cash Generation

Even after making an investment, at Mitsui we constantly work to improve the quality of our portfolio. The asset portfolio review, which is conducted in the middle of the annual cycle, is characterized by the fact that the holding policy for all investments is verified based on five review points, including profitability and effective utilization of human resources.

Specifically, we review all assets, which as of end-FY March 2024 totaled approximately 1,780 and had a book value of approximately 10 trillion yen. Of these, we are considering strategies including a potential sale for about 30% of the total number of projects, which equates to about 10% of the total book value, including profit making projects and listed stocks.

Listed stocks are reviewed, and the number of such holdings has decreased by about 40% from end-FY March 2014 to 92 holdings as of end-FY March 2024. We have divested several more holdings this fiscal year, and we are continuing to reduce this number.

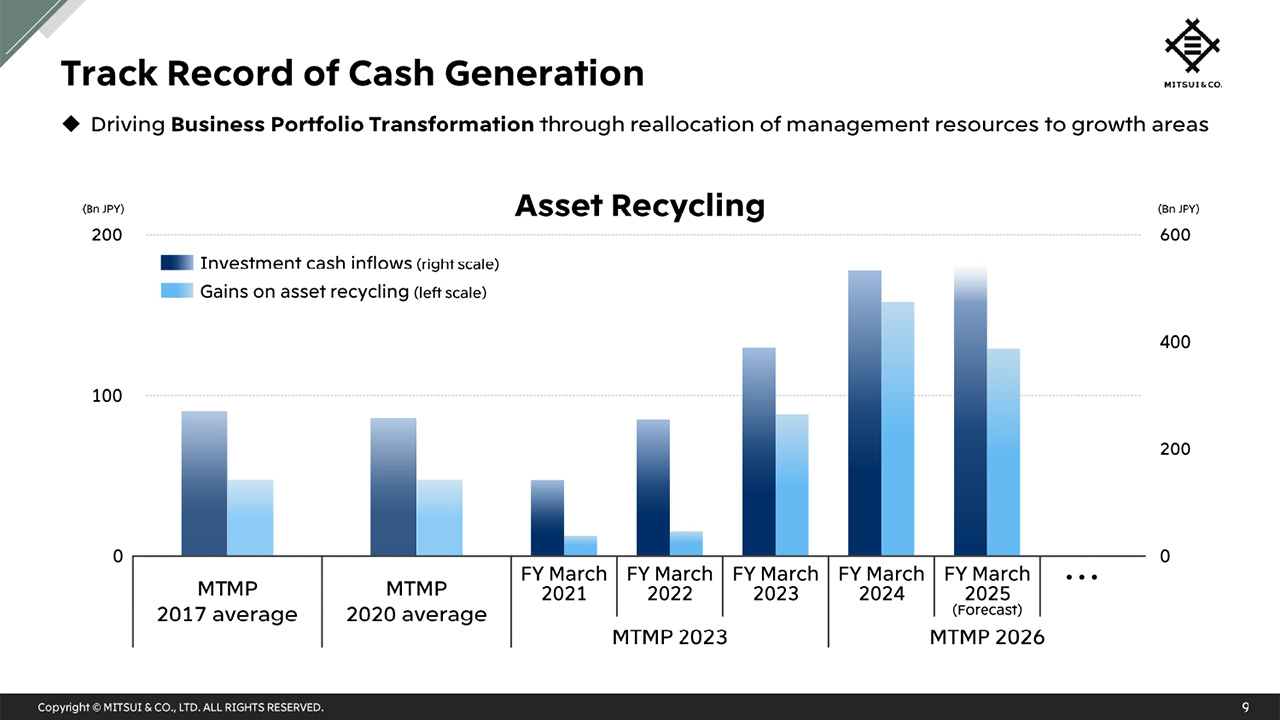

Track Record of Cash Generation

This slide shows trends in investment cash inflows and gains on asset recycling.

The introduction of ROIC has had the effect of accelerating asset recycling, a trend which can be seen here. This, along with portfolio reconfiguration, has become a source of stable cash inflows. The latest forecast is that we will achieve approximately 500 billion yen in cash inflows for FY March 2025, a similar level to FY March 2024. Through asset recycling, we are able to continuously allocate capital to areas with greater growth potential, leading to the active transformation of our business portfolio. In addition to capital, we also endeavor to optimize the allocation of management resources by reallocating personnel together with the reconfiguration of assets.

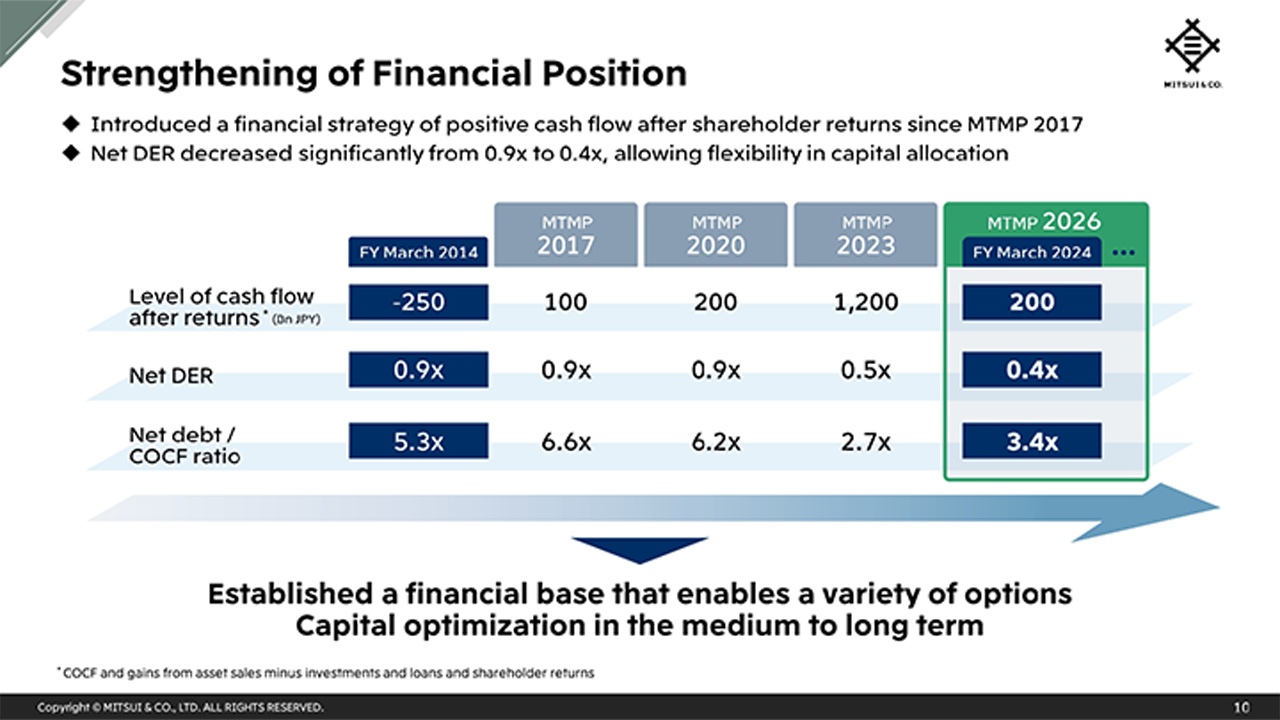

Strengthening our Financial Position

Now I will explain the financial strategy that supports our investments and business operations. Since MTMP 2017, Mitsui has been working to strengthen its financial base through cash flow management on the premise of achieving positive cash flow after providing shareholder returns. Since the start of MTMP 2017, we have maintained a positive cash flow over each three-year MTMP period, and the net debt to equity ratio has fallen significantly from around 0.9 times to 0.4 times. In addition, the net debt to Core Operating Cash Flow ratio has fallen to 3.4 times, an indication that the company's ability to repay debt has improved.

The current balance sheet is the result of disciplined management over the past decade, and it is precisely because of this that we are now in a position to consider a variety of options. We will continue to optimize our utilization of capital from a medium- to long-term perspective.

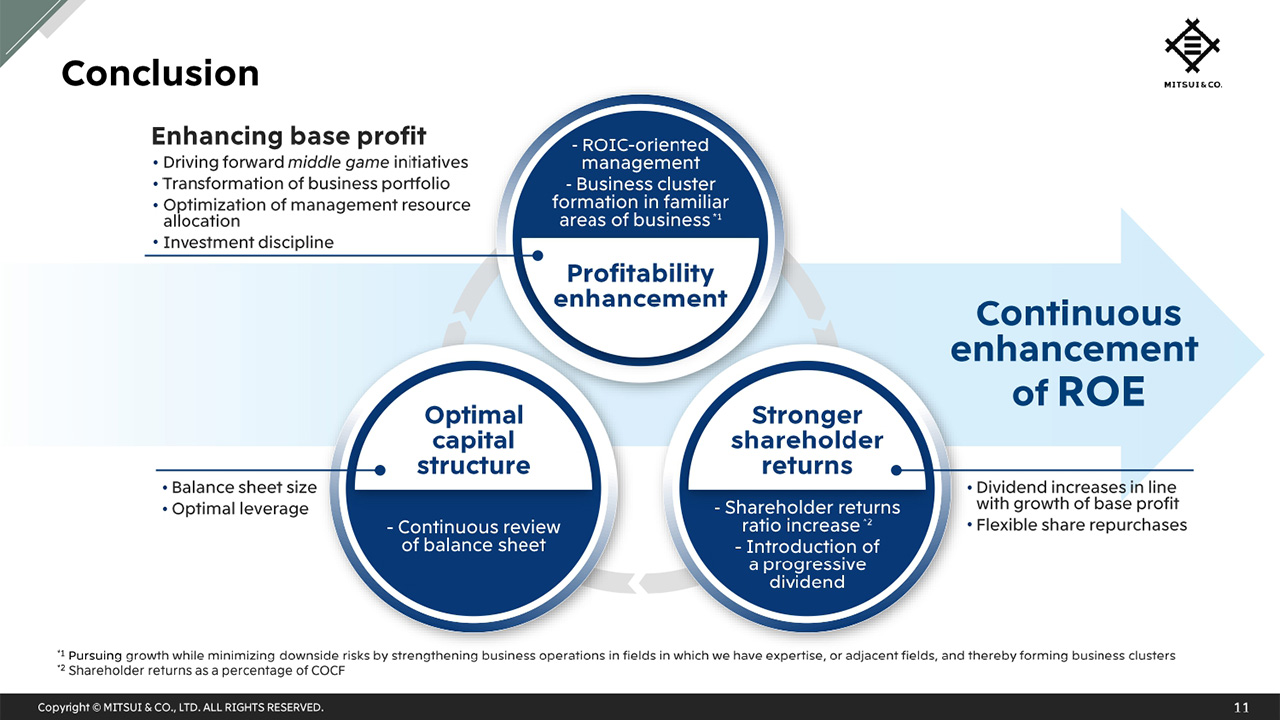

Conclusion

Today, I explained the transformation of our business portfolio and the strengthening of our financial position by looking back on our past efforts, eyeing sustainable growth of ROE for the future. At the investor day we held two years ago, I talked about wanting to achieve double-digit ROE as a standard level, and in MTMP 2026 announced last year, we set a target of 12% ROE as a three-year average. First, we will endeavor to achieve this goal by producing solid results in the current and next fiscal years. At the same time, we will take measures that will contribute to the sustainable enhancement of ROE.

In addition to financial results announcements, we would like to use opportunities like today’s investor day to detail our track record and engage in dialogue with investors, so that we can further earn your confidence in our management and growth potential.

We ensure that your suggestions and comments received through our dialogue continue to be shared internally and utilized in order to improve the management of the Company. That completes my part of the presentation today. We will now move on to Q&A.

Q1: Investment track record

Could you please tell us more about the lessons learned regarding the single underperforming project of the listed 17 projects on slide 7?

Shigeta : As detailed in Appendix 1, this is Mainstream, which develops renewable energy assets, and we recorded a loss in our latest financial report. We have invested in it as a platform for renewable energy and are working on solar and wind power generation businesses globally, but we are currently facing issues in Chile, including local regulations, and are facing difficulties in getting things going. We would like to achieve a turnaround while reconsidering our regional focus.

Even amid the global trend toward decarbonization, renewable energy business seems to be struggling overall, so we would like to investigate and accumulate expertise on whether we could have foreseen this when making the investment decision and whether we were spread too thin in terms of geographical distribution.

From past impairments, provisions, and losses, the accumulated lessons learned have provided insights into the items that need to be checked at the entry stage, including the business model, partners, and legal systems in the regions or countries of investment. Our CEO, Mr. Hori, also mentioned the Value Creation Palette, and I sense that we are gradually developing our own methodology of not repeating mistakes through a system that organizes these lessons learned and enables all employees to share this knowledge.

Q2: Shareholder returns policy

Regarding the shareholder returns policy, Mitsui expects to maintain a payout ratio of over 45% of Core Operating Cash Flow, or COCF, over the three years of the current Medium-term Management Plan. We pay attention to the balance of Management Allocation in trying to estimate the future shareholder returns, but it includes cash inflows from asset sales in addition to COCF.

Asset recycling has become a consistent part of your business model and we believe it is expected to continue to a certain extent. In that event, a gap will emerge between total cash inflows and the COCF, which serves as the basis for the returns policy.

With the payout ratio increasing and getting close to top level, how do you view shareholder returns in relation to total cash inflows, including asset recycling? Could you share your thoughts or concerns about this approach?

Shigeta :We base shareholder returns on COCF, combining dividends and share repurchases into a total payout ratio. Since we aim to avoid dividend cuts, dividends are sourced from the highly stable and recurring part of COCF. By increasing both COCF and the dividend payout ratio, we intend to raise the dividend per share.

Share repurchases, on the other hand, are more difficult to directly tie to specific funding sources. Asset recycling is indeed a core and consistent part of our business model, and while it will undoubtedly continue over several years, controlling the timing of such activities is challenging. Nevertheless, if asset recycling and upside opportunities are realized, we remain committed to flexibly executing share repurchases. Some were surprised by the 200 billion yen additional share repurchase announced in September, but we believe it demonstrated our ability to act flexibly and swiftly.

In the US, some companies have a payout ratio of 100%, but we believe we are nearing the average payout ratio in the Japanese market. From the perspective of maintaining and enhancing ROE, my theme for the day, we aim to appropriately expand returns while also managing the size of our equity that aligns with those returns.

With ROE as the focal point, we aim to carefully assess the returns from investments for growth and strike a good balance between making new investments for growth and shareholder returns. We welcome your candid feedback on the expected returns from investments and the appropriate level of shareholder returns moving forward.

Q3: Net DER level and other leverage indicators

While Mitsui hasn’t explicitly stated what it deems to be the appropriate level of leverage, could you share your views on how high net DER could go? With more investments and an increase in higher-risk assets, I’d like to understand how much net DER could rise. Additionally, are there any other financial metrics besides net DER that you pay attention to?

Shigeta : Historically speaking, our net DER is at its lowest level, and we are maintaining strong financial soundness, so we see no need to reduce it further as a priority. That said, if solid business performance continues, there is a possibility that our net DER could decrease further.

We have also stated here the ratio of net interest-bearing debt to COCF, which we believe is monitored by credit rating agencies. Currently, all our financial indicators show our financial state to be extremely robust. Consequently, we are well-prepared to explore various options while ensuring that we strike a good balance between attractive investments for growth and shareholder returns that meet expectations.

While there is a chance that net DER could decline further, I won’t deny that new investments could lead to this changing.