Global Energy Transition

Opening Remarks

Matsui : Good afternoon, I’m Toru Matsui, in charge of Energy Business Unit I, together with Energy Business Unit II, Basic Materials Business Unit, Performance Materials Business Unit, IT & Communication Business Unit, and Integrated Digital Strategy Division.

I will speak about our Global Energy Transition initiatives, one of the Key Strategic Initiatives in the Medium-term Management Plan.

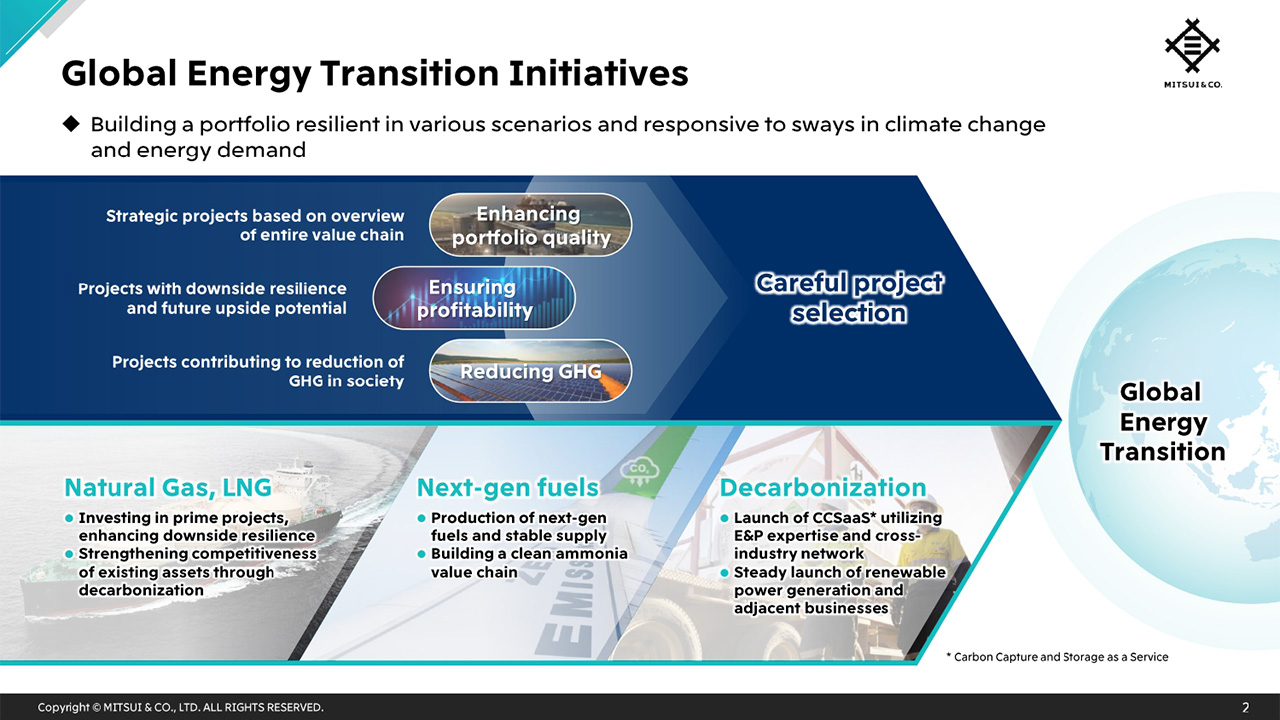

Global Energy Transition Initiatives

In driving forward our Global Energy Transition initiatives, we are carefully selecting projects from three perspectives: enhancing portfolio quality, ensuring profitability, and reducing GHG. In order to respond to sways in response to climate change and energy demand, it is important to build a flexible portfolio that is resilient against various scenarios. Within this framework, we are conducting business development that makes the most of our strengths, focusing on three key areas: natural gas and LNG, next-generation fuels, and decarbonization solutions. Through this approach, we aim to achieve both a stable earnings base and a reduction in GHG emissions.

Positioning of LNG in the Energy Transition

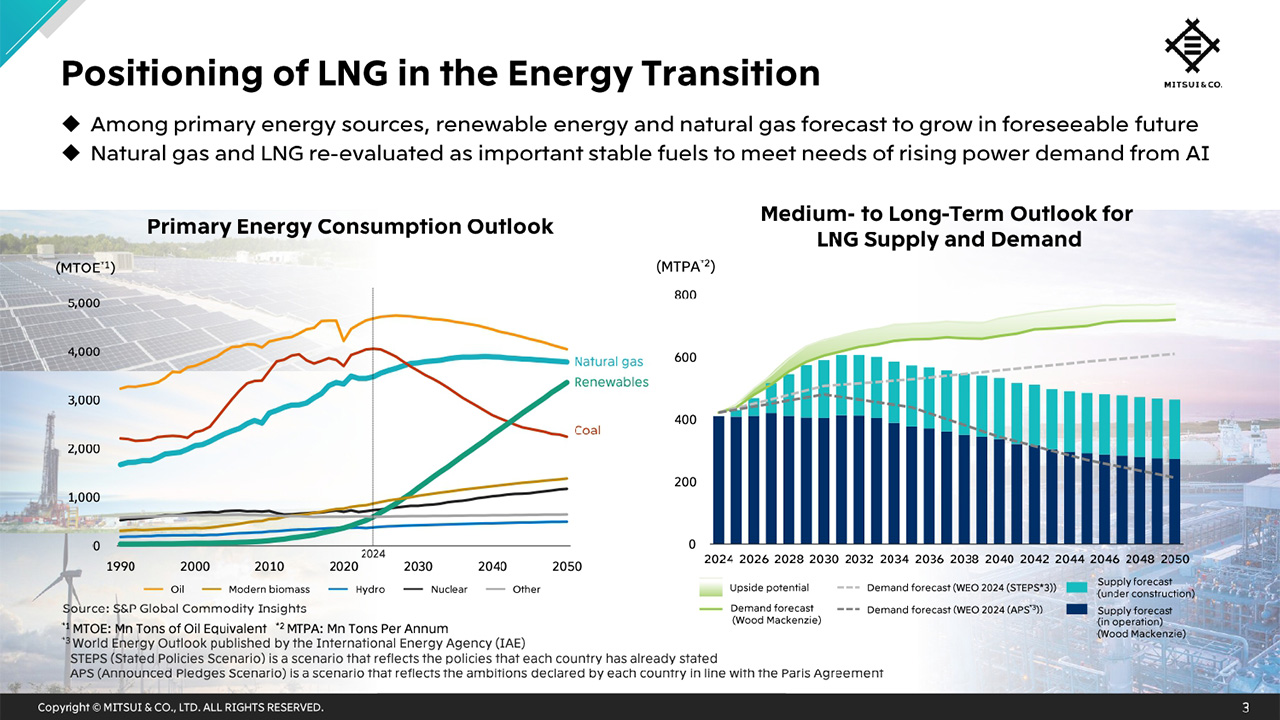

Next, I will speak on the positioning of LNG in the energy transition.

Among the world’s primary energy sources, renewable energy and natural gas are expected to grow in the foreseeable future. Although there are high expectations for renewable energy, there are constraints such as geographic location, weather conditions, daytime and nighttime yield differential, costs, etc., and so the importance of natural gas and LNG as a real solution is being re-evaluated.

In addition to economic growth in emerging countries, more recently, the global expansion of generative AI is expected to significantly increase the demand for power, such as for data centers. Again, the importance of natural gas and LNG is being re-evaluated as stable fuel sources to meet this new demand for power.

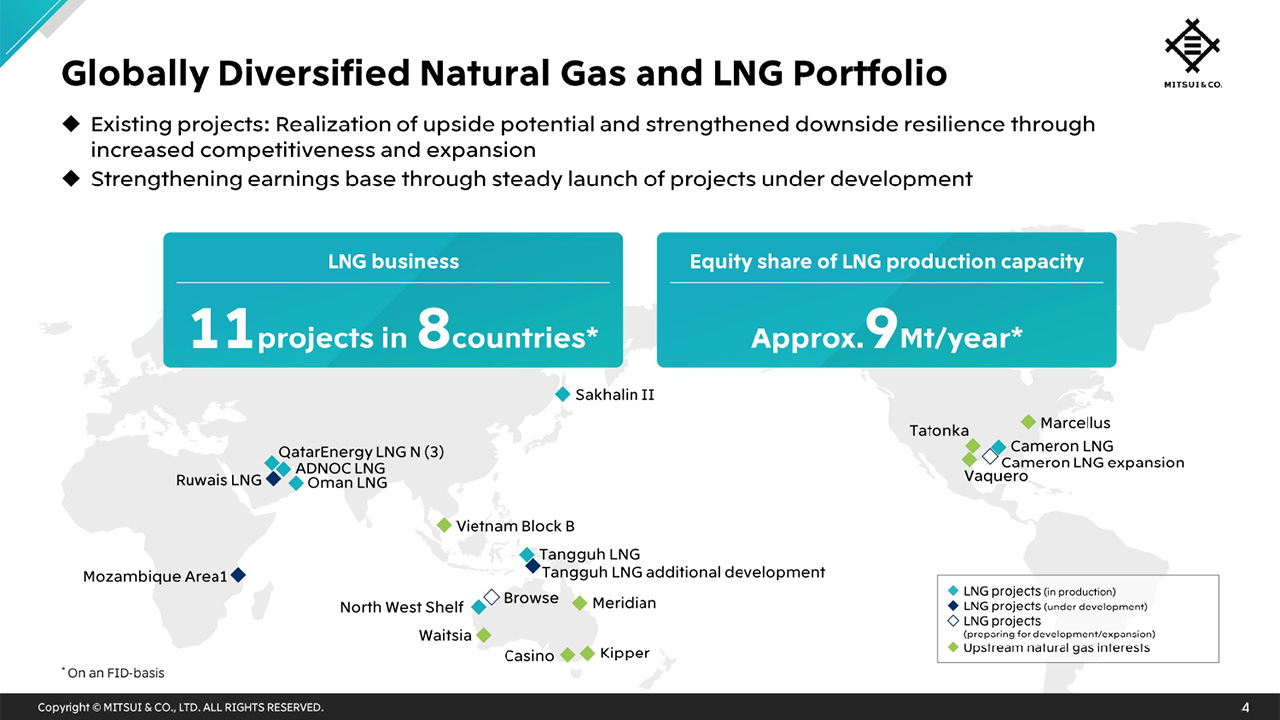

Globally Diversified Natural Gas and LNG Portfolio

The characteristics of our natural gas and LNG portfolio are that the regions and projects are well diversified. In our LNG business, we have 11 projects spread across 8 countries, with an equity share of production capacity of approximately 9 million tons per year. In July, we made a final investment decision, or FID, on the Ruwais LNG project in the UAE. Also, an FID was made last month on the Tangguh LNG additional development project in Indonesia.

We will continue to diligently capture the upside potential of existing projects and strengthen our downside resilience. Additionally we will steadily launch projects under development to enhance our earnings base.

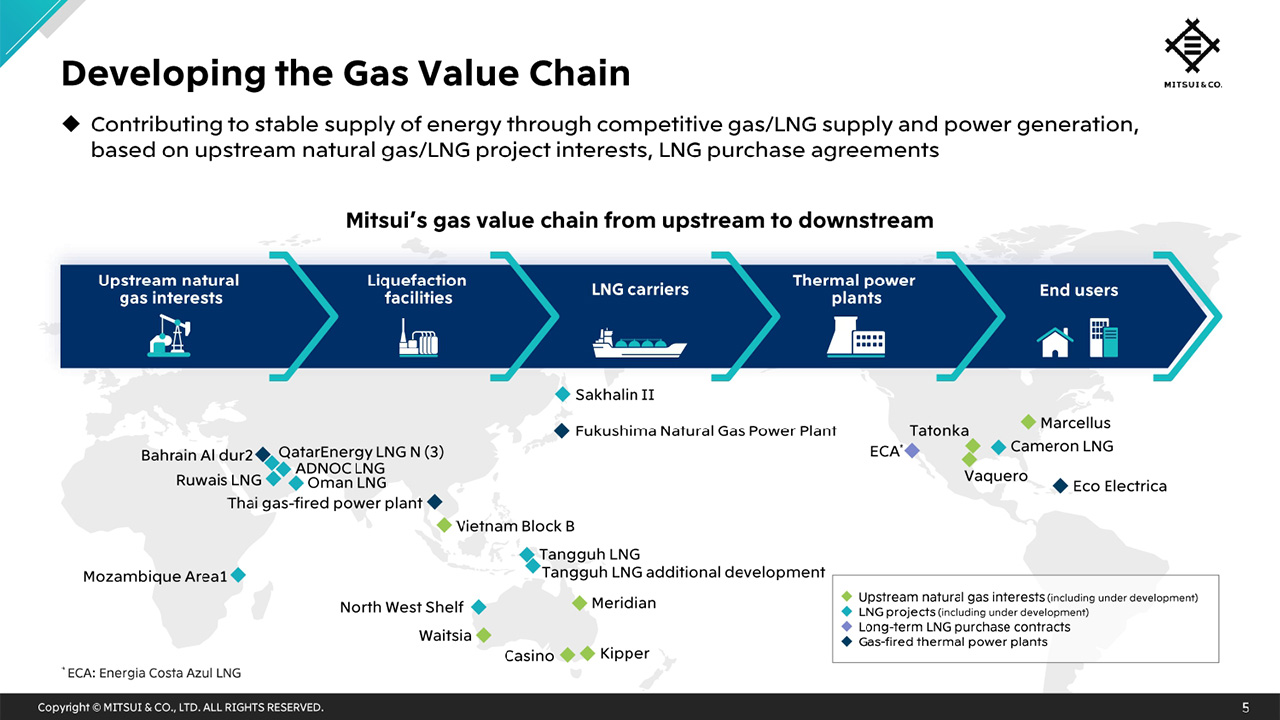

Developing the Gas Value Chain

Next, I will speak on our strategic initiatives across the entire gas value chain. We are contributing towards a stable supply of natural gas and LNG through various involvements, such as upstream interests in natural gas, LNG project interests, and LNG purchase agreements. We are deeply involved in the entire value chain, from fuel supply to power generation, and are contributing to the sustainable supply of energy.

For example, at Fukushima Natural Gas Power Plant, in addition to participating in the power generation business, we supply LNG as fuel, to support a stable supply of competitive energy.

LNG Trading Portfolio

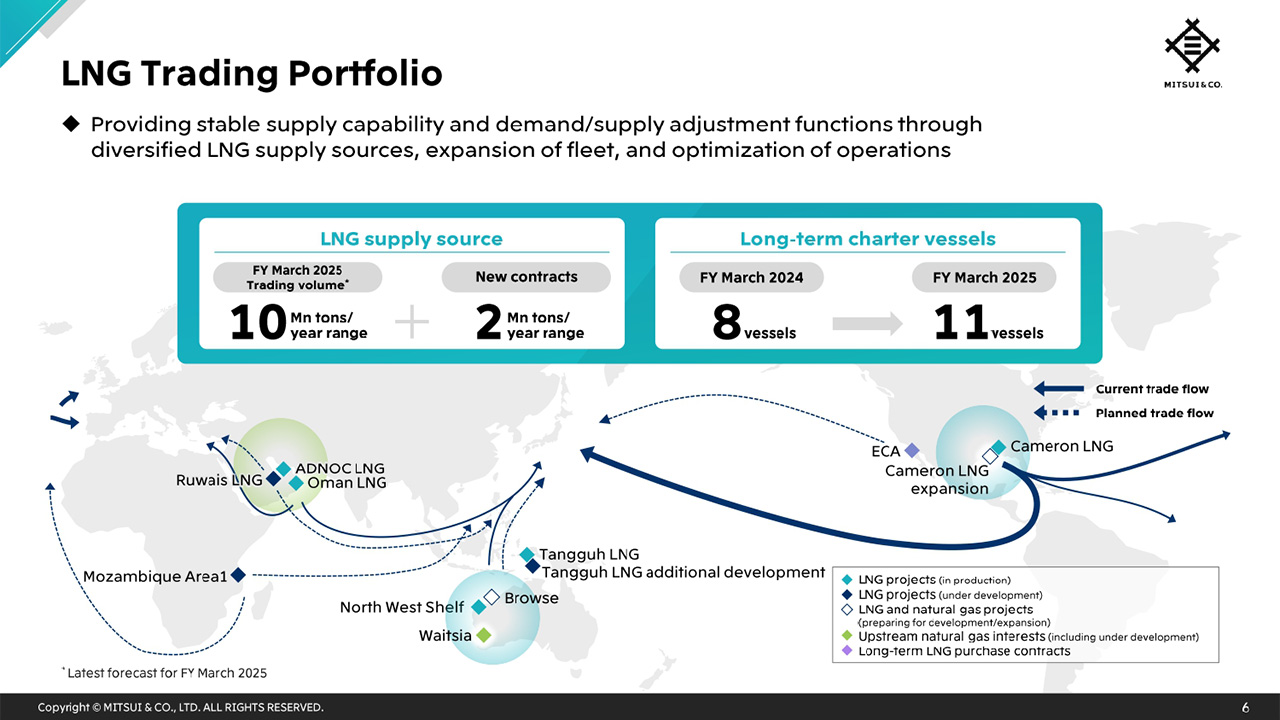

We are building an LNG trading portfolio based on diversified LNG supply sources and our own fleet. Our LNG trading volume under our account for this fiscal year is expected to reach 10 million tons. In the future, we plan to add two million tons per year based on new purchase contracts.

In addition, we took delivery of three new LNG vessels this fiscal year, expanding our long-term chartered fleet to a total of 11 vessels. With our strong LNG portfolio base and our optimized logistics system, we will provide stable supply capabilities and demand and supply adjustment functions to meet customer needs.

Ruwais LNG

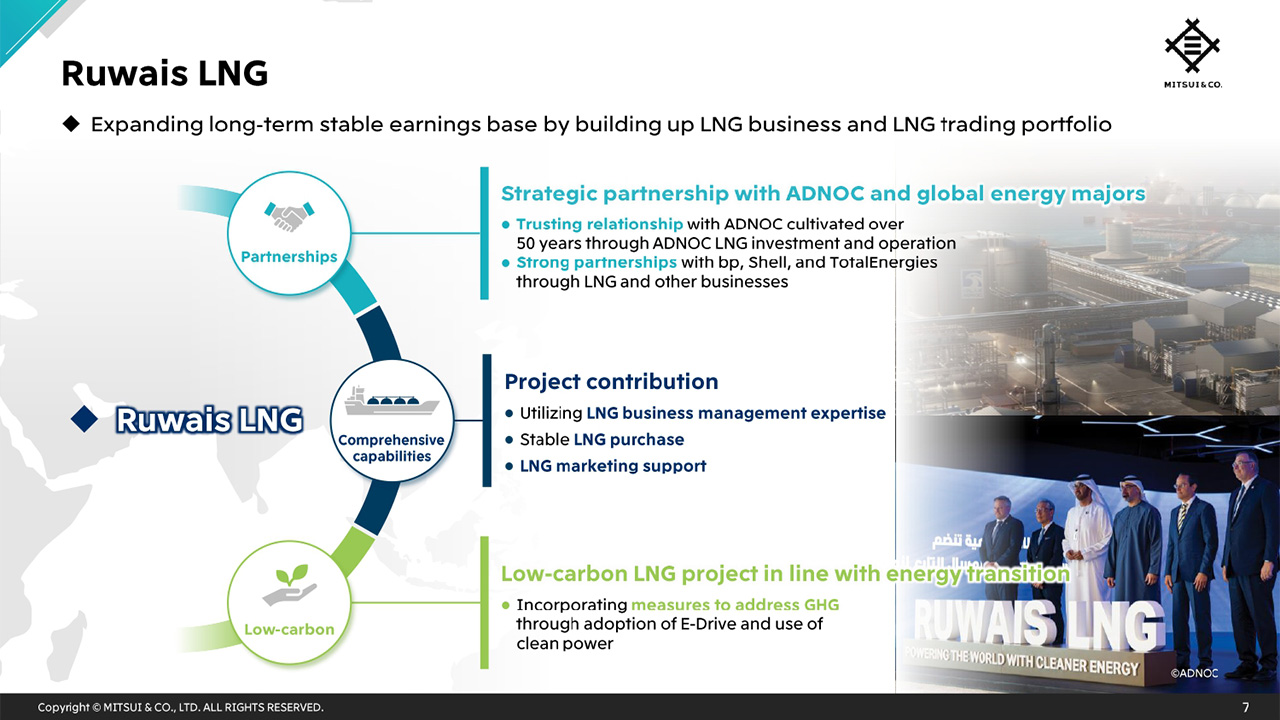

Next, I will talk about Ruwais LNG, for which we made an FID this year and newly added to our LNG portfolio.

At Ruwais LNG, our participation was realized due to the trust we have built up with our business partners, including the state-owned ADNOC over the past 50 years, and the comprehensive strength of our company. We will contribute to the sales aspect by ensuring stable purchase of LNG and dispatching a marketing manager to the project.

Additionally, as part of our efforts to reduce carbon emissions, this project will implement GHG measures through electrification and the use of clean power sources, making it an effective low-carbon LNG project that addresses climate change issues.

Beyond this project, we are also implementing measures to reduce carbon emissions in other LNG projects, which I will speak to on the next slide.

Low-carbon Measures in LNG Projects

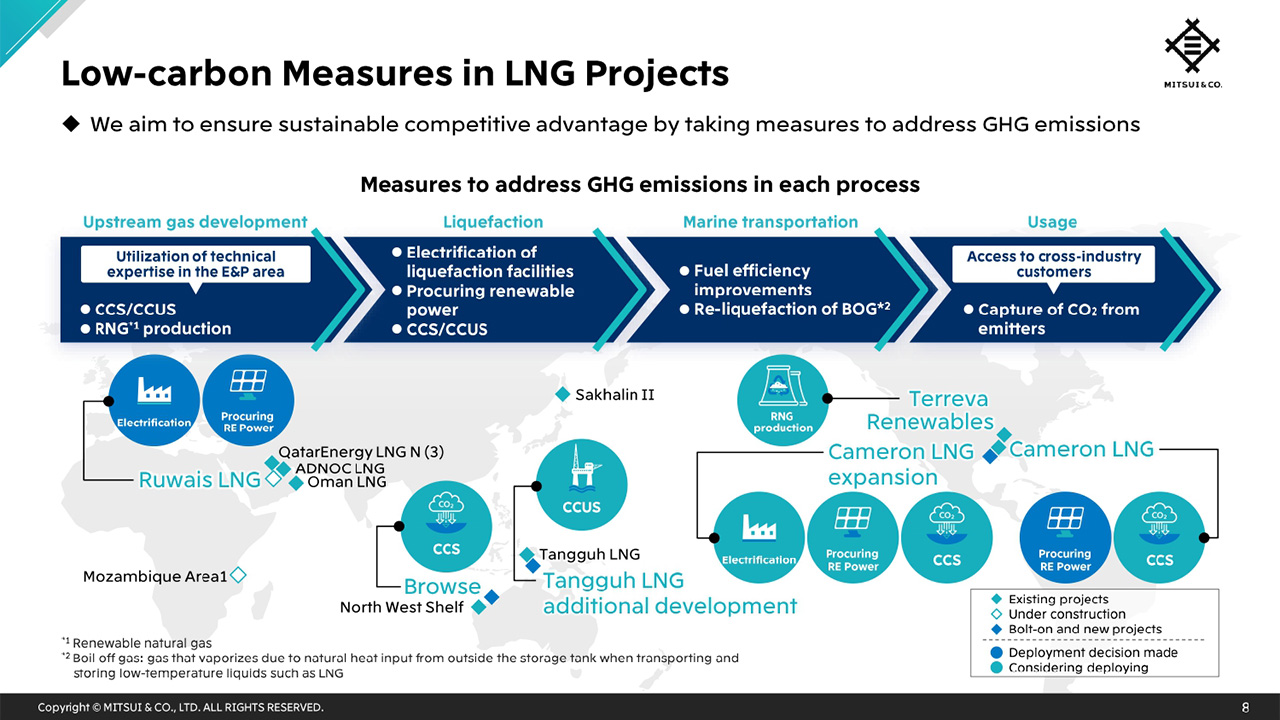

By implementing measures to address GHG emissions that match the characteristics of each project, we are working to reduce CO2 and methane emissions throughout the value chain, with the aim of differentiating ourselves to ensure sustainable competitive advantage.

As you can find from the slide, we are driving various low-carbon measures such as CCS/CCUS initiatives in upstream gas development and liquefaction process, as well as electrification. We are also planning to deploy CCUS in the Tangguh additional development project.

Clean Ammonia: Building a Value Chain

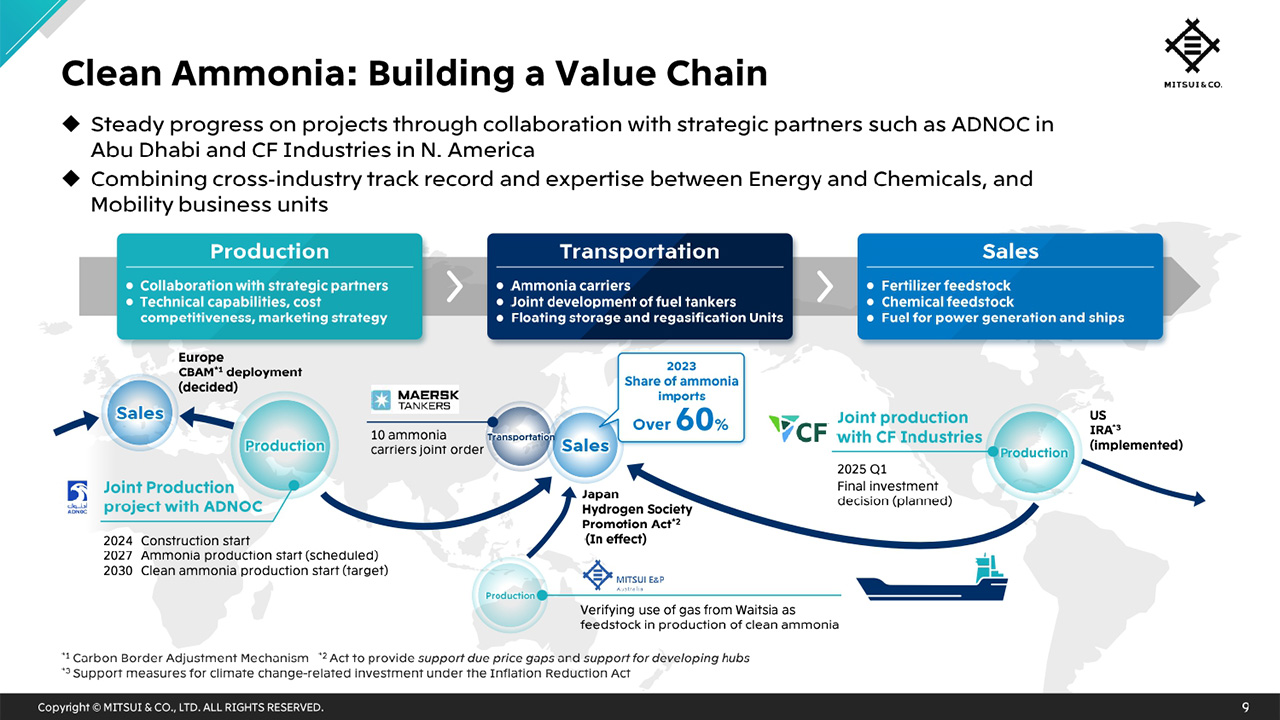

Next, I will speak on energy solutions. We are working on various next-generation fuels such as low-carbon methanol, SAF, and HVO. Today, I would like to speak about the clean ammonia value chain, which we are particularly focusing on.

Regarding production on the left-hand side, we are collaborating with the ADNOC Group in an ammonia project as well, in which Mitsui was the only Japanese company invited to invest as a partner. Construction began in May this year and we are expecting production to begin in 2027. We are planning to switch to clean ammonia by 2030.

In the US, we are considering a clean ammonia project with CF Industries, the world’s largest producer of ammonia, and we are holding discussions with the relevant parties with the aim of making an FID by March 2025.

In order to secure a diverse range of customers, we are expanding our sales channels to Europe, which places importance on sustainability, and Africa, in addition to the Asian market including Japan, where we have a share of over 60% of ammonia imports.

In the future, a shift to clean ammonia is expected not only as fuel for power generation, but also as marine fuel, as well as fertilizers and chemical feedstocks, areas where our company has been engaged in trading for many years. Furthermore, we are making efforts to enhance transportation, and we jointly ordered 10 large ammonia carriers with the major shipping company Maersk Group. We are also working to develop receiving logistics hubs in Japan to ensure a stable supply of clean ammonia.

We will continue to work on the next-generation fuel business such as clean ammonia and develop it into a pillar of our business portfolio.

CCS and CCUS Initiatives

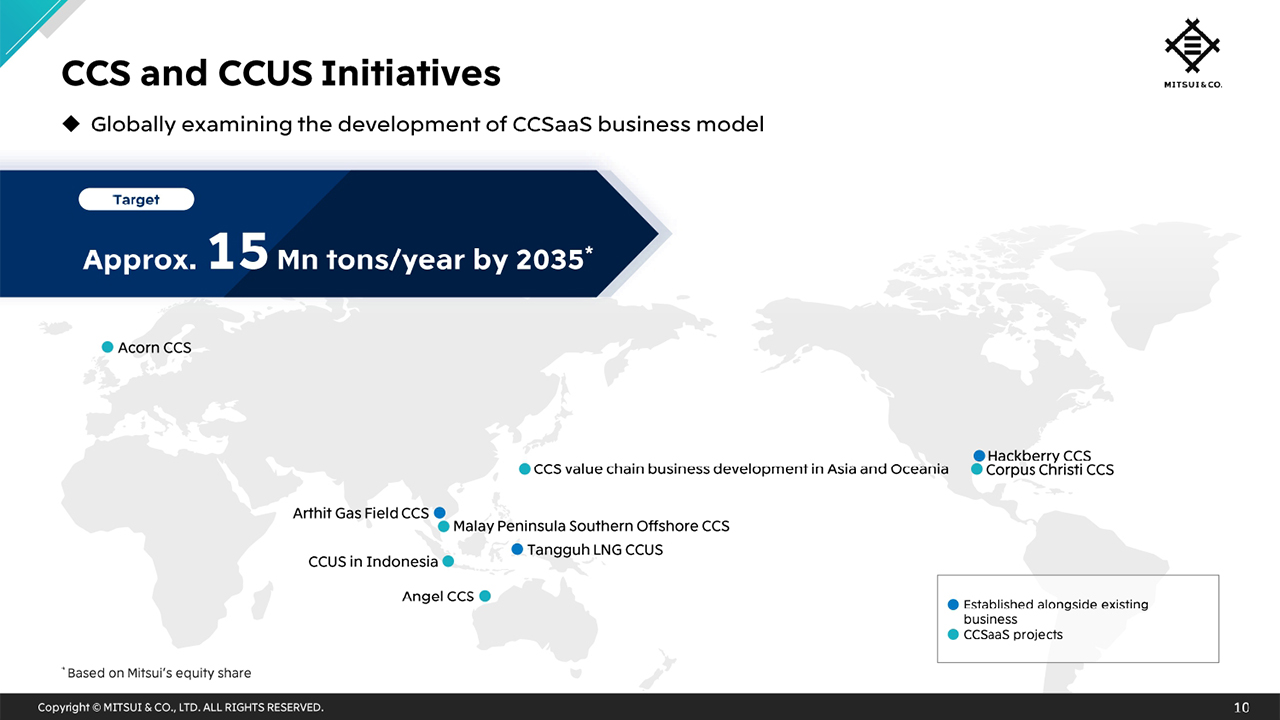

Next, I will explain about CCS, our efforts to capture, transport and store carbon dioxide. Mitsui has engineers with detailed knowledge of subsurface structures in various parts of the world, based on our experience in the energy resource development business. Taking full advantage of this expertise and our contact points across a wide range of industries, we are working to provide CCS as a service for CO2 emissions from various industries. We aim to build a business with an annual scale of approx. 15 million tons of sequestration by 2035.

CCSaaS Initiatives

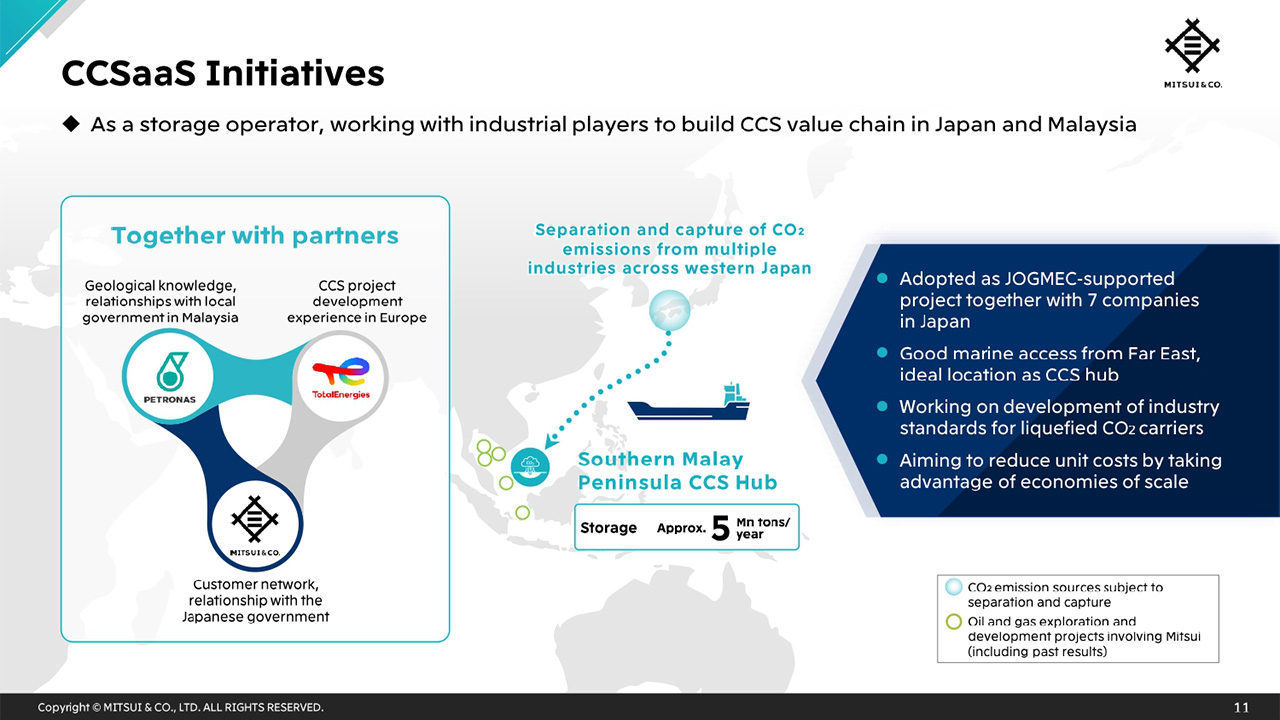

In particular, we believe that Malaysia is a region with great potential for CO2 storage, due to its geographical proximity to Japan and the characteristics of its subsurface structure.

We are working with Petronas, a Malaysian government-owned company, and TotalEnergies, which has project development experience in CCS, to explore a project for transporting and storing CO2 from Japan to Malaysia. In addition, in the ships business, we are also working on the development of industry standards for liquefied CO2 carriers, which will handle the transportation of CO2.

Outlook for Global Energy Transition

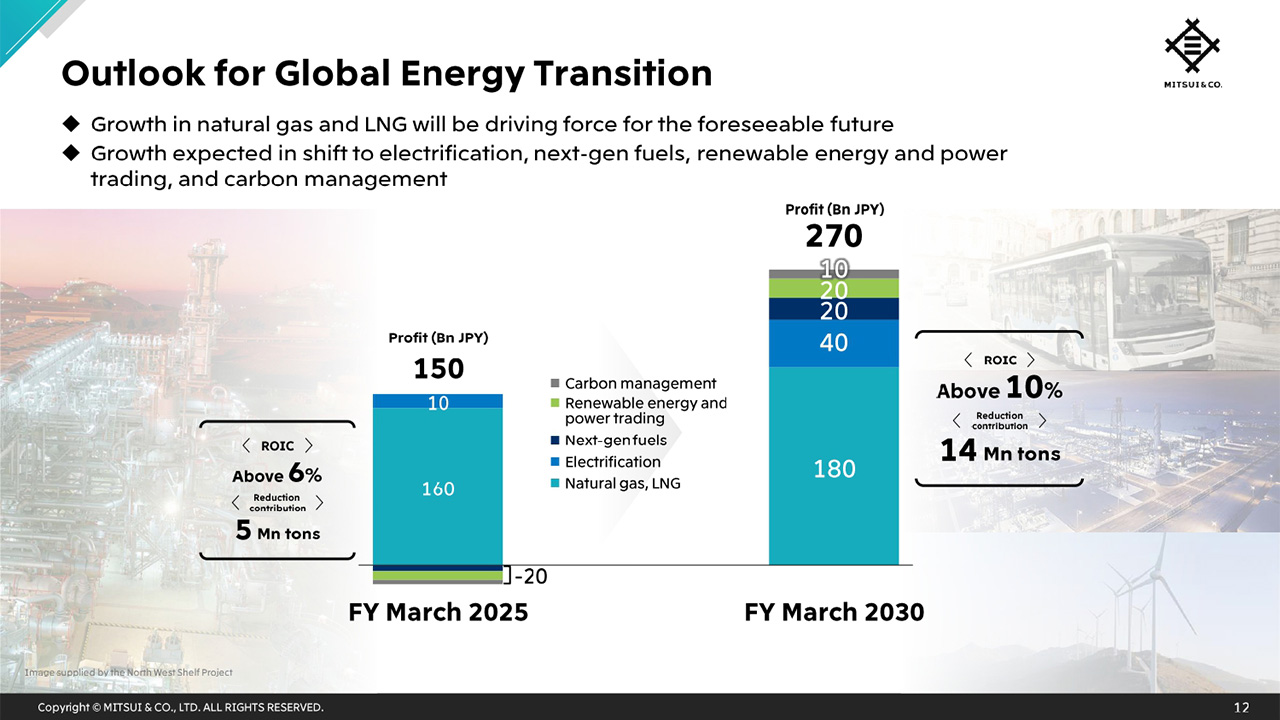

Today, I have delved into areas such as LNG, clean ammonia, and CCS. The level of profit for this fiscal year in Global Energy Transition is expected to be 150 billion yen. We plan to grow this to 270 billion yen by FY March 2030.

To achieve this, we will position natural gas and LNG as our growth drivers for the foreseeable future, while we will also work to build a new earnings base. Specifically, we expect profit contributions from next-generation fuels such as clean ammonia production and carbon management such as CCS which I explained today, as well as from the electrification shift, and renewable energy and power trading. The timeline for the energy transition is expected to continue to change. We will provide value to society and all stakeholders through real solutions to issues while always anticipating changes that lie ahead.

That completes my part of the presentation today, thank you for listening.

Q1: Initiatives to increase profit from electrification

I find the future profit projections on the final slide very compelling. Could you please explain what specific initiatives are being implemented related to electrification to achieve these profit increases?

Matsui : For electrification, we are considering various projects, particularly related to the shift towards electrification in mobility.

For example, in the EV sector, this includes investments related to materials for EV batteries and to materials for the vehicles themselves involved in EV manufacturing. Initiatives related to the electrification of mobility constitute a major portion of our efforts. For example, we have invested in Forsee Power for the EV battery pack business.

Q2: LNG as a real solution

LNG as a real solution was previously mentioned, which I think is very good phrasing. On the other hand, there are a many, including those involved in financial markets, who view fossil fuels negatively, which can sometimes impact our investment decisions too.

In this context, could you share your thoughts on whether LNG as a real solution is a concept that is shared or valued by partners, such as energy majors, natural gas producing or consuming countries?

Matsui : First, let me explain the background behind our view of LNG as a real solution. There is no doubt that we must reduce GHG emissions and address climate change issues. Mitsui is also striving towards the goals of halving our GHG impact by 2030 and achieving net zero by 2050.

On the other hand, it is not possible for renewable energy to replace all energy sources in a single day, nor for GHG emissions to become zero overnight. Therefore, we believe that we must achieve a stable energy supply, reduce GHG emissions, and ensure economic efficiency, including for consumers, as well as the affordability of energy.

We believe that LNG, as a fuel with relatively low GHG emissions during combustion, will continue to play an important role over the long term.

Addressing climate change issues is not about reducing fossil fuels, but about reducing the GHGs emitted from fossil fuels. We provide services such as CCS to customers using LNG, contributing to GHG reduction.

At the same time, regarding our investments in LNG projects, including the previously mentioned Ruwais LNG and the recently invested Tangguh LNG additional development, we are continuing our LNG business while also implementing GHG reduction measures in the LNG production process.

The concept of reducing GHG emissions across the value chain is shared with our partners, including oil-producing countries and energy majors. The fact that we are working on low-carbon LNG in the Ruwais LNG project with energy majors and oil-producing countries such as ADNOC, Shell, TotalEnergies, and bp reflects these shared values.

Q3: Expansion of business opportunities through GX League mandatory participation

Regarding decarbonization, the topic of mandatory participation of certain companies in Japan to the GX (green transformation) League (a platform initiated by Japan's Ministry of Economy, Trade and Industry to advance the country’s efforts toward achieving carbon neutrality by 2050), has recently become a discussed topic. In this context, I have the impression that the importance of CCS as a practical solution, as well as its business opportunities, is significantly increasing.

There is a trend to implement CCS into existing projects, and this year, there was news that Mitsui signed lease contracts for access to the CO2 storage in Texas. Considering the technical aspects and regional utilization, as well as what is practical, could you please share your thoughts on whether the mandatory participation in the GX League will enhance business opportunities for Mitsui?

Matsui : Initiatives such as CCS and CCUS that utilize CO2 are indeed gaining attention as real solutions in the global shift towards decarbonization and lower carbon.

We also view GHG, rather than fossil fuels, as the main factor affecting climate change issues. We believe that CCS is a highly promising business area as an effective method to reduce GHG emissions. Therefore, we are initially prioritizing regions where there are regulatory advancements or substantial demand.

For example, the Acorn CCS project in the North Sea illustrates this point. In the UK, in a sense, CO2 already has a defined cost associated with it. Many GHG-emitting businesses are willing to pay for CCS services to avoid penalties for not reducing CO2 emissions, making the service viable.

In the US, although regulations are not yet as clear, AI and tech companies, which consume large amounts of electricity for data centers, are committed to using renewable energy.

Such regulatory and demand trends are already emerging at the corporate level in Europe and the US. Consequently, we anticipate significant demand for our CCS project in Texas and are pursuing it as a first mover.

In Japan, the GX League has started as an initiative to reduce CO2 emissions through proactive corporate efforts. By next year or the year after, there will likely be national movements to assign a numerical value to CO2 for reduction purposes.

We believe this trend will continue globally, eventually giving CO2 a market price. We expect demand for our Malaysia project from industries emitting CO2 in Japan, and many companies have already joined as partners for the Japanese capturing facilities.

As we advance our global CCS business to manage our customers’ CO2, we anticipate that such trends will accelerate in Japan as well.

Q4: Competitive edge in Global Energy Transition

In Global Energy Transition, we understand that many other trading companies and global firms are engaged in similar activities outside of LNG.

For example, in areas such as clean ammonia and CCS, where do you believe Mitsui has the most competitive advantage or edge? Which areas do you feel you will be able to achieve monetization quickly?

Matsui : We believe that our edge and primary advantage lie in our industrial connections as a global investment and trading company, deeply embedded across various industries.

For example, while we are engaged in CCS projects, we also have numerous connections with industries that need to store the CO2 they emit. A clear example is in Malaysia, where we can simultaneously manage CCS projects and aggregate CO2 from industries such as in the chemicals and power sectors.

Additionally, our strength is not only in launching projects or listening to the needs of customers who emit CO2 but also in connecting these elements comprehensively.

This applies not only to CCS projects but also to renewable energy generation. Our comprehensive capabilities come into play here as we invest in renewable energy projects. While there may be challenges in power generation, we also operate a power trading businesses, making it easy to find customers who have a demand for power.

In the US, we can create value in conducting vertically integrated businesses that combine renewable energy generation with power trading. We believe that this comprehensive capability and industrial connections are our competitive edge.