Growth Strategy

Opening Remarks

Hori, CEO (Hori) : Good afternoon, I’m Kenichi Hori, President and CEO. Thank you for taking the time to attend our Investor Day 2024.

Today, I will speak about Mitsui’s growth strategy.

Growth Strategy Framework

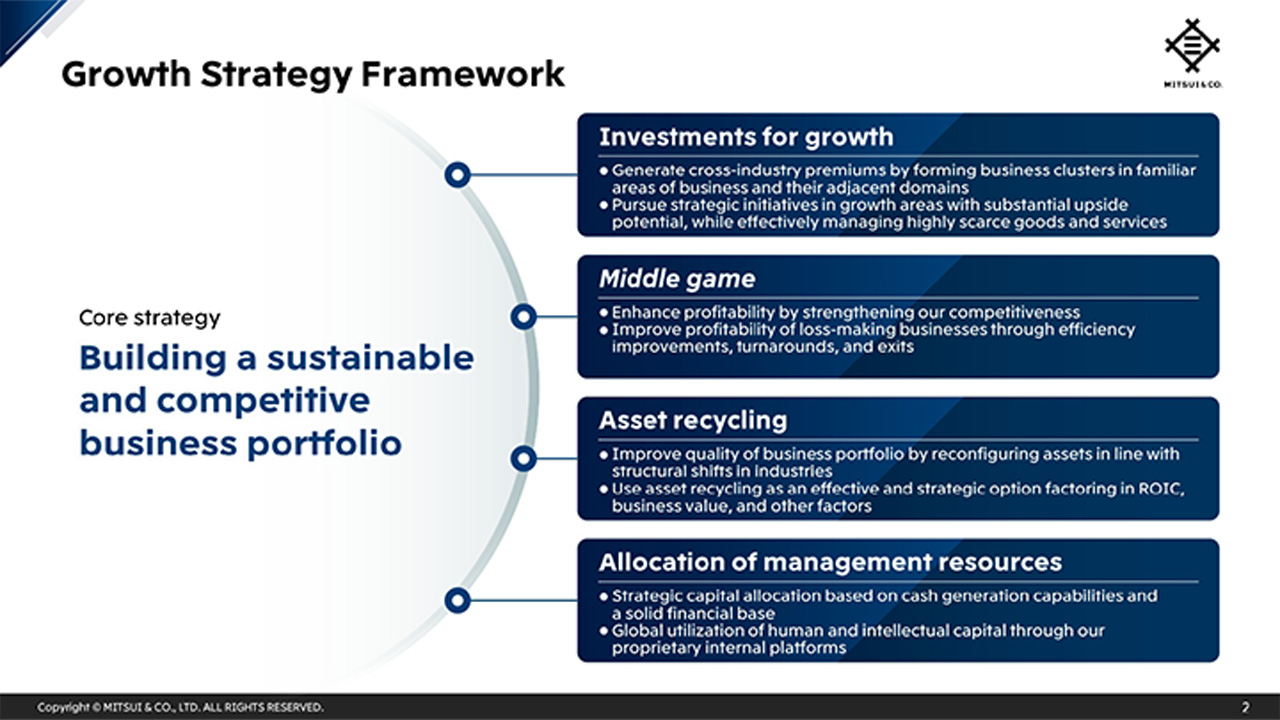

The core of our growth strategy is building a sustainable and competitive business portfolio.

Mitsui has worked tirelessly to provide real solutions through its business activities, to social issues that evolve across time. We have done that by continuing to transform our business portfolio by deepening our efforts in investments for growth, middle game initiatives, asset recycling, and allocation of management resources.

Investments for growth are made in familiar areas of business, where we possess deep knowledge, and their adjacent areas, and we carefully select such investment projects from a rich project pipeline. Under the current Medium-term Management Plan, or MTMP, we have made progress in forming business clusters through investments for growth in areas such as mobility and protein.

We also place importance on creating cross-industry premiums. Taking our clean ammonia business as an example, it is essential to work across both the chemicals and energy domains. We place importance on the creation of new growth opportunities and added value by combining knowledge from multiple industries, which we call cross-industry premiums.

The middle game refers to all the efforts to improve competitiveness, streamline, and achieve turnarounds, made in stages between investment execution and divestiture, toward increasing profitability.

Asset recycling is also constantly required to improve the quality of our business portfolio. We have a panoramic view of the entire value chain in a variety of industries. Leveraging this position, we anticipate structural shifts in industries, including profit pool changes and responses to climate change and other global issues, and we seize opportunities to reconfigure assets as an effective strategic option based on ROIC, business value, and other factors.

In addition, the appropriate allocation of limited management resources is important to drive these initiatives.

We will allocate funds based on our cash generation capabilities and strong financial base, and utilize our proprietary human capital platform Bloom, which just launched globally this week on December 2, and intellectual capital platform Value Creation Palette to optimally utilize personnel and expertise across the Group.

Through these initiatives, we will build a business portfolio that drives sustainable growth.

Enhancement of Business Portfolio and Asset Recycling

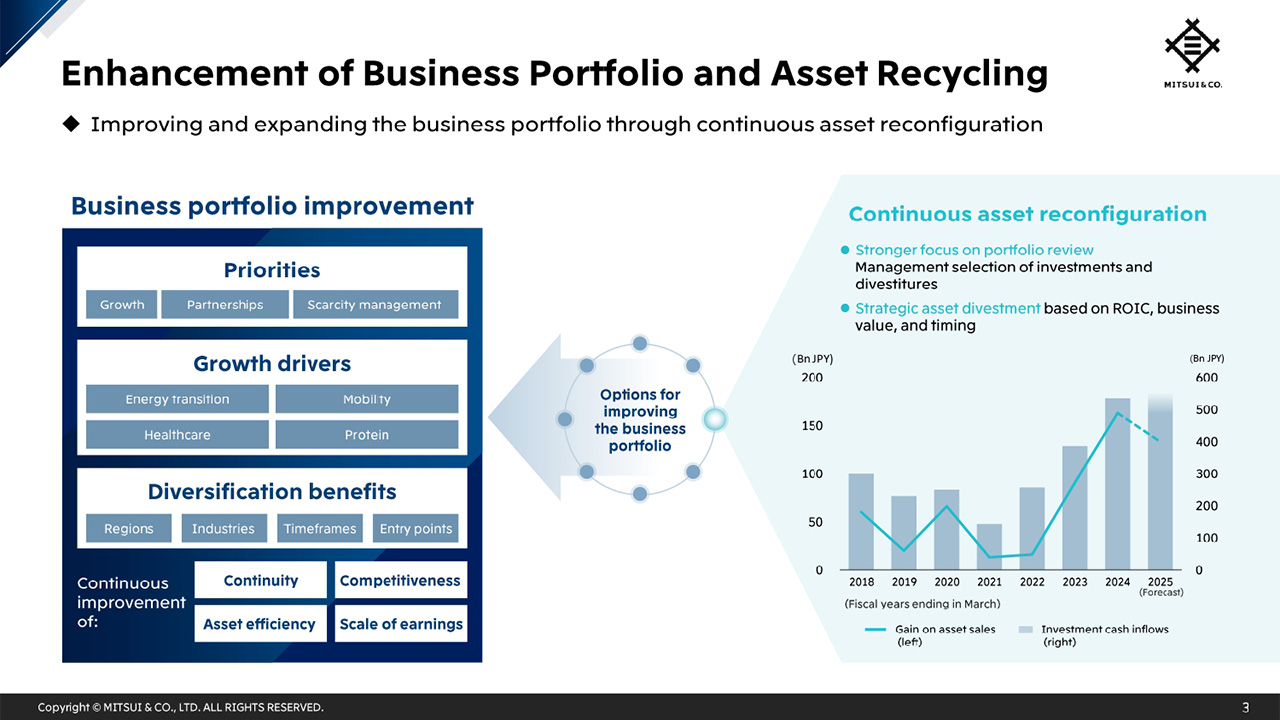

I will now talk in more detail about our initiatives to improve and expand our business portfolio and asset recycling.

When selecting targets for investment, we place importance on initiatives in growth areas, the trusted relationships that we have fostered over many years with our partners and customers, and managing the scarcity of products and services. We have identified energy transition, mobility, healthcare, and protein as growth drivers, as we work to strengthen the competitiveness and expand earnings of both new investments and projects in which we are driving forward middle game initiatives.

Benefits of portfolio diversification is another key aspect. We maintain a good balance in our business portfolio by diversifying across regions, industries, and profit contribution timeframes, as well as the investment entry point such as early stage, growth stage, etc.

These efforts have led to continuous improvements to continuity, competitiveness, asset efficiency, and scale of earnings, and to the improvement and expansion of our business portfolio.

Asset reconfiguration is an important strategic option for business portfolio improvement. We continue to carry out annual portfolio reviews, and carefully select investments and divestitures from management perspective. We are driving forward strategic asset divestment based on ROIC, business value, and timing, and the pace of this has accelerated since entering the current MTMP.

Strengthening our Global Earnings Base

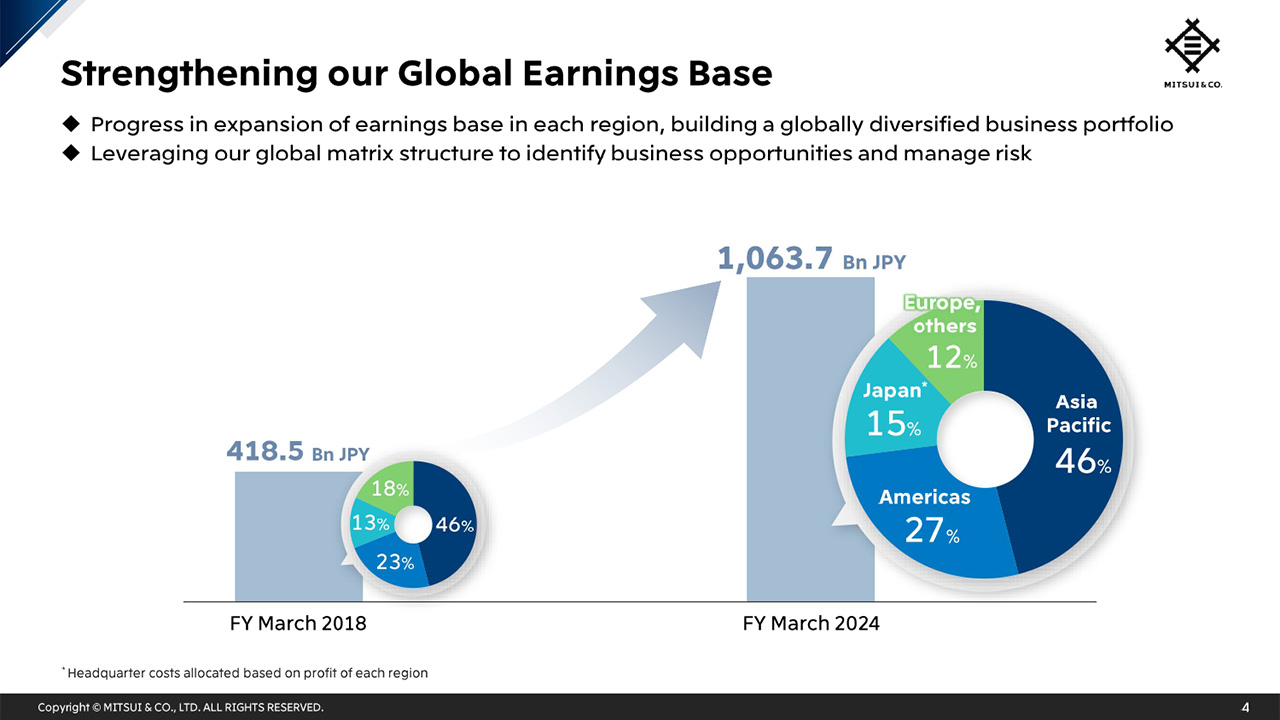

One result of the business portfolio improvement has been the progress of earnings base expansion in each region, and the development of a global, geographically diversified business portfolio.

This slide shows profit growth between FY March 2018 and FY March 2024, and profit ratio by region. Profit from Australia is included in Asia Pacific. Each region has grown in a balanced manner in line with the overall expansion of Mitsui’s profit. From the perspective of global growth potential and regional balance, we believe that we have made good progress in improving the diversified business portfolio.

Our global matrix structure, which is one of many features of Mitsui, has been functioning as an essential part of our regional diversification efforts. By leveraging this organizational structure to pursue cross-industry initiatives on a global scale, we are able to identify business opportunities around the world and better respond to country-specific risks.

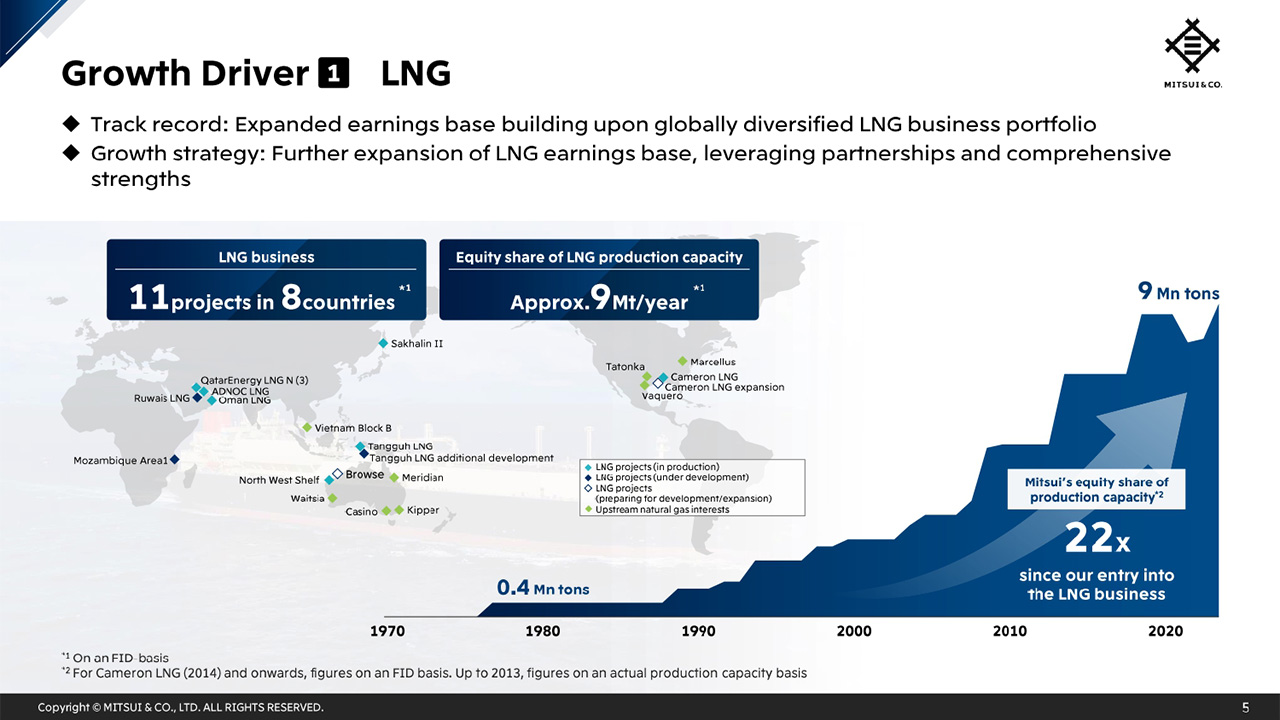

Growth Driver 1: LNG

I will now introduce some specific growth drivers, the first of which is LNG.

Mitsui has been engaged in the LNG business since the 1970s. We have pursued regional diversification as we carry out new investments and expand existing projects in step with rising LNG demand. This has allowed us to expand the earnings base of our LNG business while contributing to a stable supply.

We believe that LNG will continue to play a role over the long term as a real solution within Global Energy Transition. We will continue to expand our LNG earnings base by leveraging our partnerships and comprehensive strengths to capture scarce opportunities.

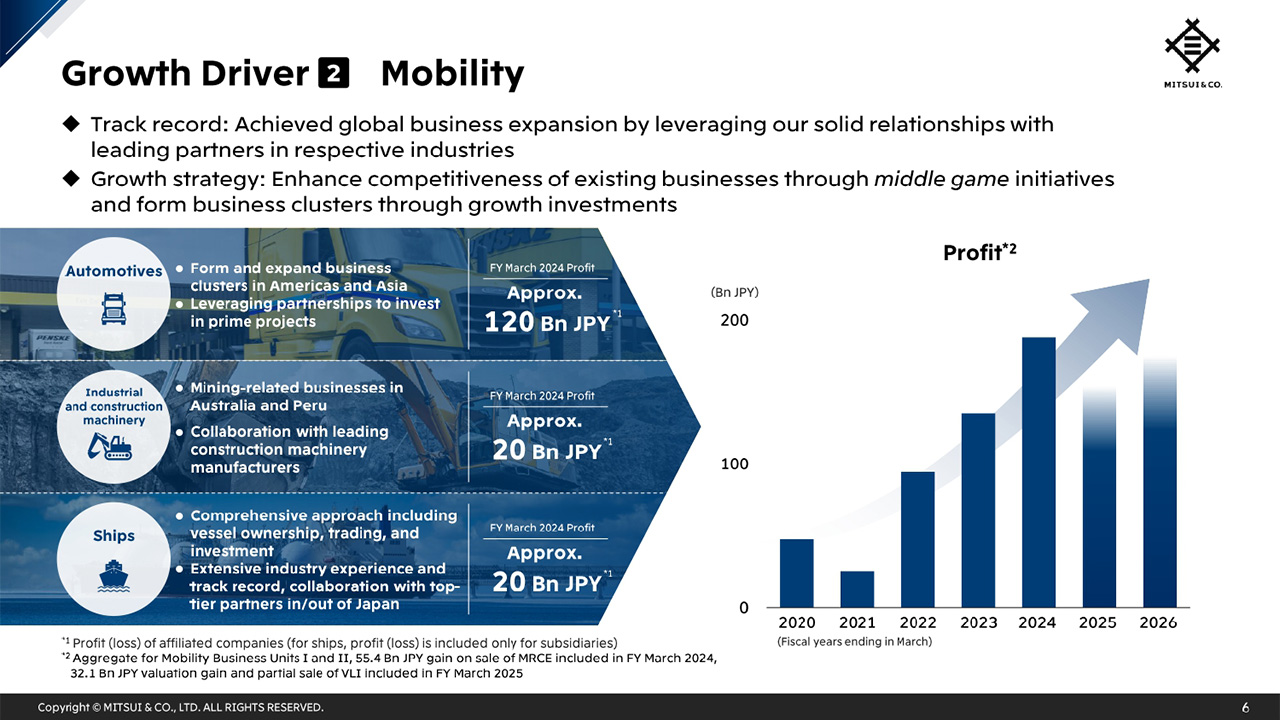

Growth Driver 2: Mobility

Our second growth driver is mobility.

In the mobility area, we have used our long-standing relationships with key industry players to expand our business globally.

Automotives, industrial and construction machinery, and ships, are areas in which we expect to see sustained growth.

In each of these areas, we will continue to form and expand business clusters, leverage our partnerships to capture quality projects, and deepen our collaboration with leading industry partners.

Earnings in the mobility business, excluding one-time gains, have reached 160 billion yen per year. Going forward, we will achieve further growth by strengthening the competitiveness of existing businesses through middle game initiatives, while forming and expanding business clusters through investments, including bolt-ons.

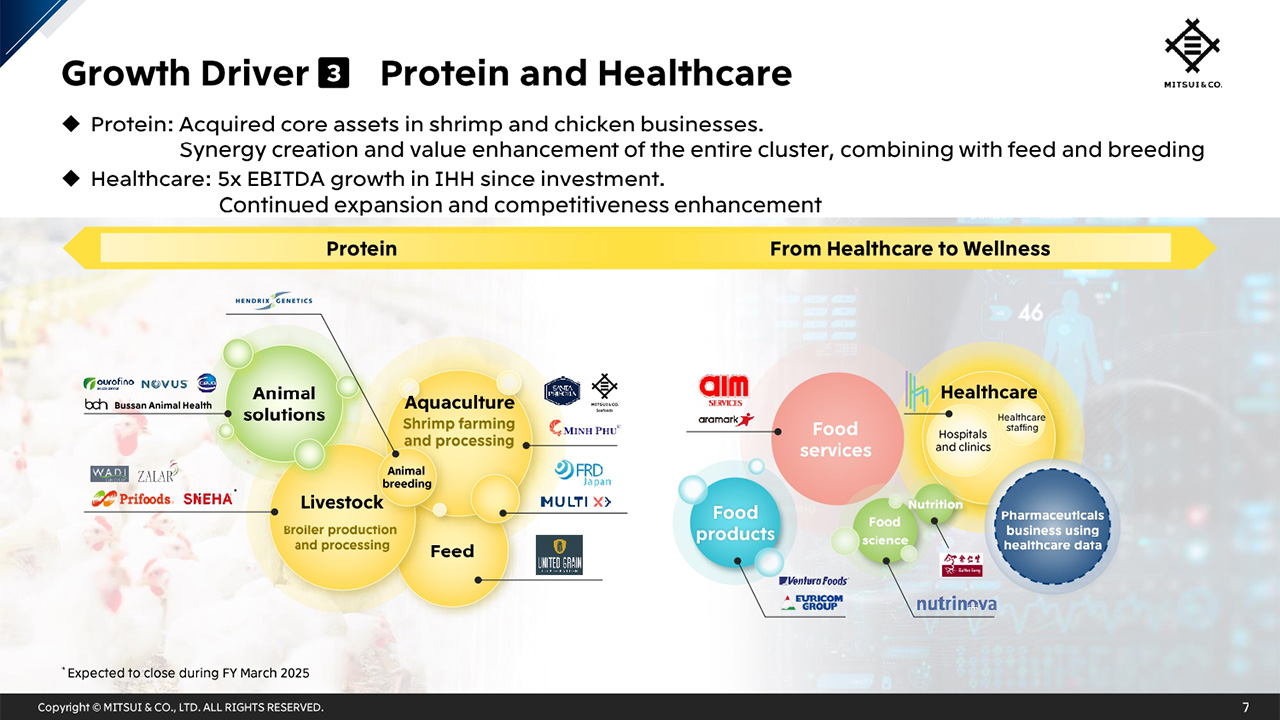

Growth Driver 3: Protein and Healthcare

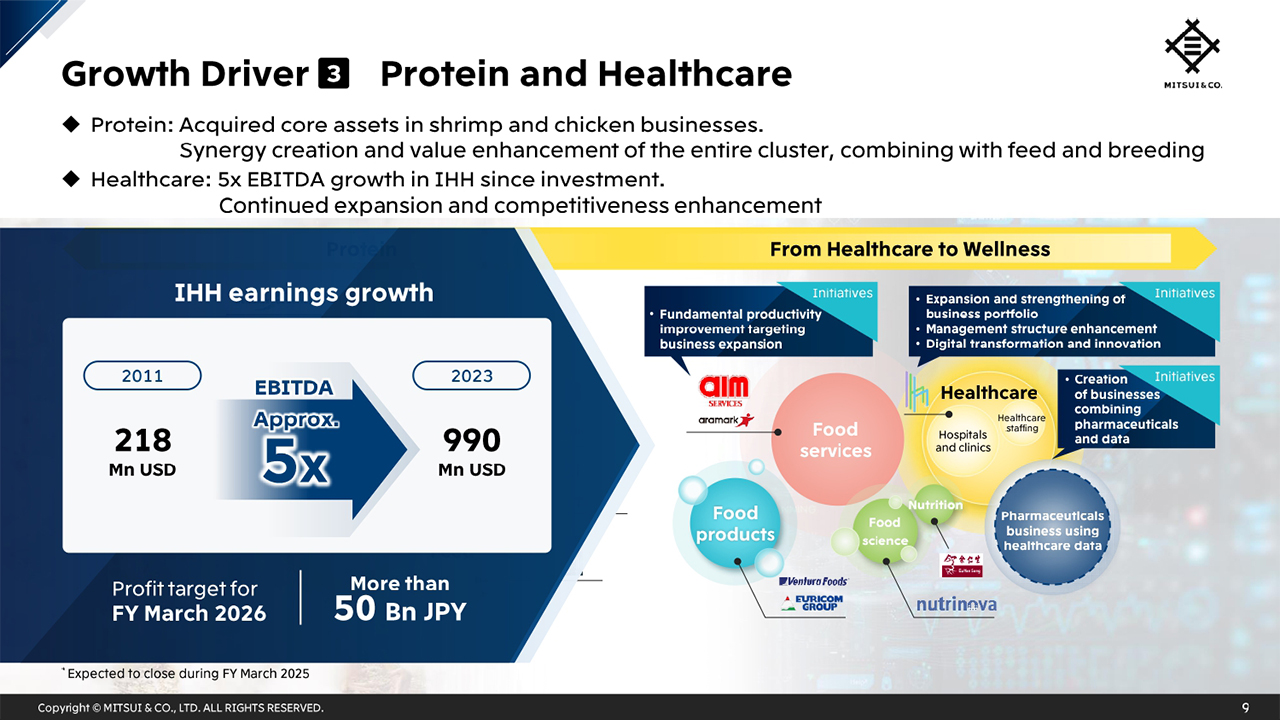

The third growth driver is protein and healthcare. In Wellness Ecosystem Creation, one of the three Key Strategic Initiatives in our current MTMP, we have made good progress in strengthening existing businesses while forming business clusters around them.

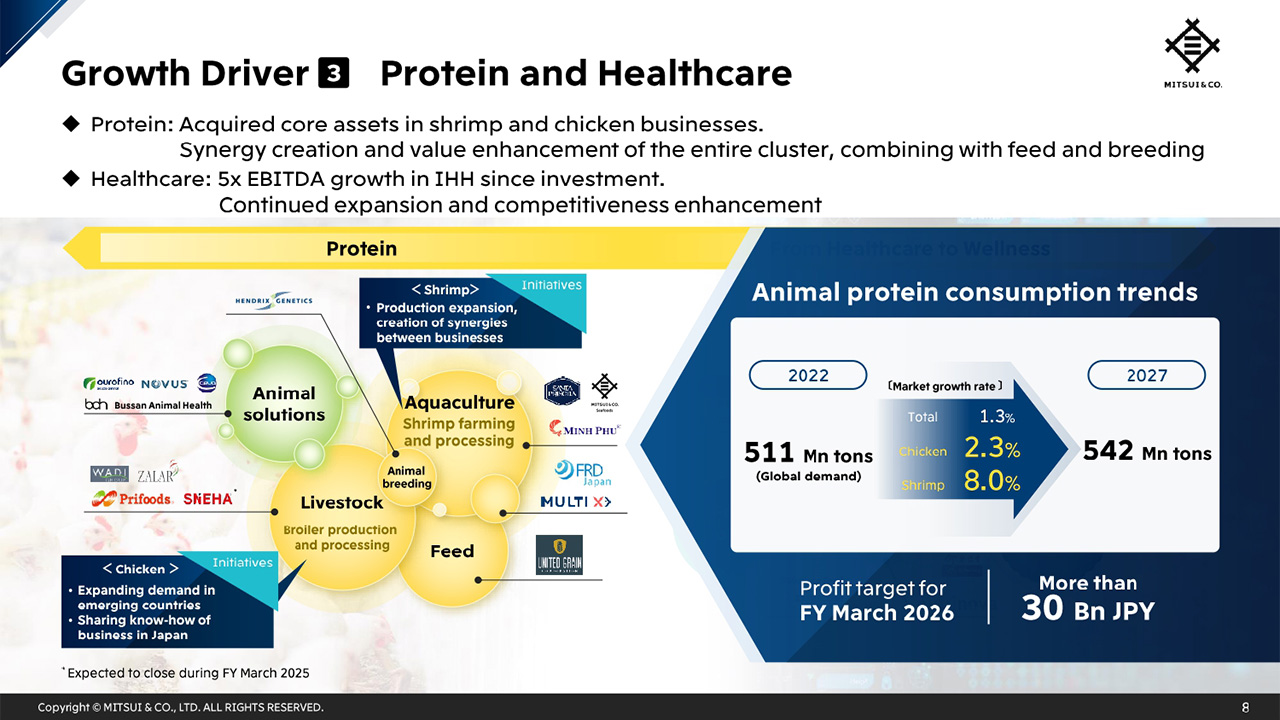

Growth Driver 3: Protein and Healthcare

In the protein area, we have invested in shrimp farming and broiler businesses during the current MTMP period, and by linking these to our existing livestock, aquaculture, and feed businesses, we have formed an animal protein business cluster.

Driven by population expansion and economic growth, especially in emerging economies, the demand for protein is expected to grow steadily. There are few religious constraints on the consumption of shrimp and chicken, compared with other animal protein products, and market growth rates are high. Also, growth cycles are short and they have good feed efficiency. We aim to increase our earnings by capturing the growing demand in emerging economies, as well as improving the production efficiency and expanding the scale of assets we have acquired, through application of our expertise accumulated through feed and livestock businesses.

Growth Driver 3: Protein and Healthcare

In healthcare, IHH is driving the growth. We first invested in IHH in 2011, and became the largest shareholder after an additional investment in 2019. IHH’s EBITDA has increased 5x since our investment in 2011, due to an increase in the number of hospitals and beds, operational improvements, and cost reductions. IHH plans to increase the number of beds by 30% by 2028 and expects continued growth through the expansion and strengthening of its business portfolio.

In addition, taking into account the accumulation and utilization of healthcare data in the hospitals, we are studying the creation of a pharmaceutical business that utilizes data. In the medium to long term, we plan to make this one of the pillars of our healthcare business.

We are also working to expand the ecosystem from healthcare to wellness by bringing together Aim Services and other businesses in the food science and nutrition areas. We will tackle making comprehensive improvements in the productivity of each business, linking them to the hospitals and clinics, especially IHH, and aim to create and expand a wellness ecosystem.

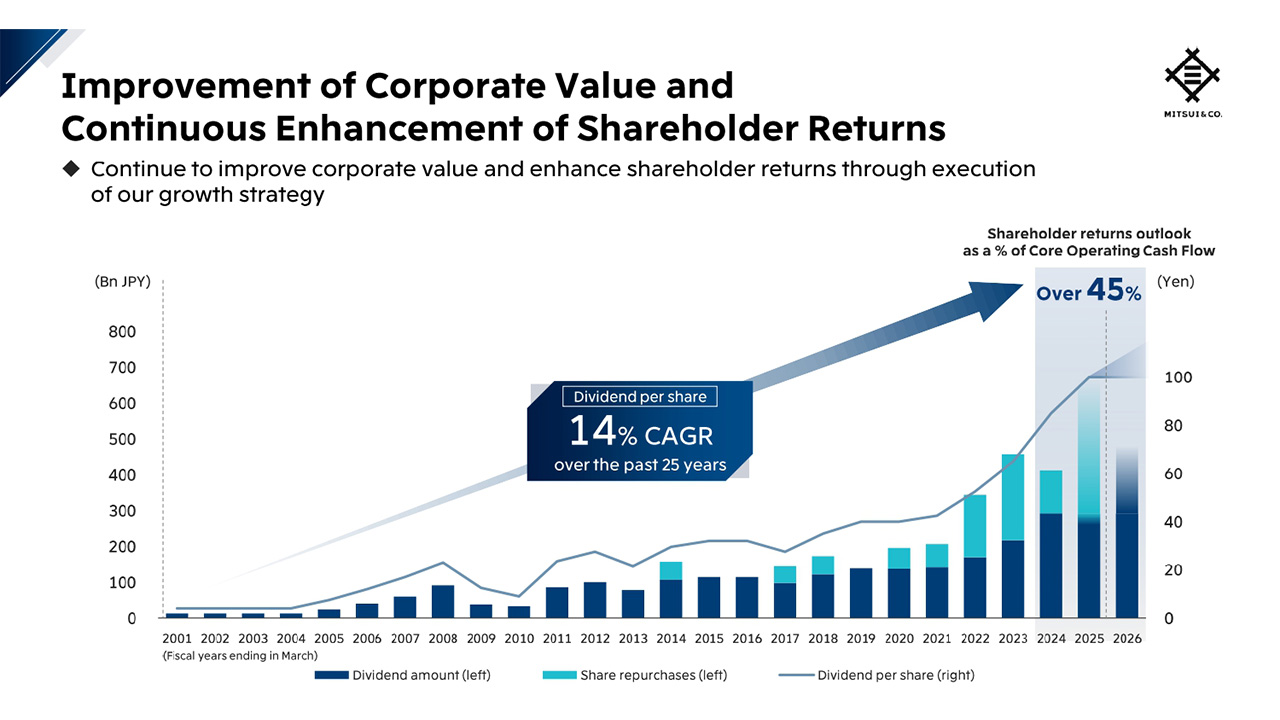

Improvement of Corporate Value and Continuous Enhancement of Shareholder Returns

Mitsui has continuously expanded profit and cash flow, while also enhancing shareholder returns. By implementing our growth strategy, we will achieve further expansion of cash flow and continuously enhance shareholder returns, thereby improving ROE and corporate value, and in doing so, we hope to meet the expectations of our shareholders.

This concludes my presentation. Thank you.

Q1: Growth targets in the mobility business

I think the last large-scale investment in the mobility business goes all the way back to Penske Truck Leasing. During the current Medium-term Management Plan (MTMP) period, you invested in a truck auction business in the US. What are your targets for future profit growth in the mobility business, and in particular, where will you be looking to make new investments?

Hori : In the area of mobility, we have a long-term strategy of increasing our three business clusters to eight or nine during this MTMP, and the core regions are Canada and the US. In North America, we can expect continued growth in the mobility business, through the combination of dealerships, services, and financing, for commercial trucks as well as passenger vehicles, and I think this is a growth area for us.

In addition, in the mobility business in Latin America, although each project is limited in size, we have been able to build these up. We are also expanding our menu of mobility businesses in Southeast Asia in line with the growth trajectory of each country in the region.

Looking ahead to next year and beyond, I think the mobility business, which is somewhat self-contained in North America and in the US in particular, is very promising. We are looking at various projects, and if there are projects that meet our investment criteria, we would like to follow through.

Taylor & Martin's business is also an exciting one for the future with its position on the truck auction market. We would like to focus on how to increase the scale of our current business, including in adjacent businesses like in this case.

The industrial and construction machinery business is also very strong, mainly in South America and Australia, where we are involved. We would like to broaden our menu by capturing mining related replacement demand and demand for construction machinery that utilizes new technology.

In ships, we are steadily expanding globally with our customers and partners, including alternative fuel projects. Our business base is expanding considerably, that includes our strong partners in Europe and our expansion into Asia. We would like to continue to focus on business expansion by combining various business models within our broader ships business.

Q2: Initiatives in emerging countries

The Trump administration will be coming into power, and separately, I think in many other countries there has been an increase in geopolitical risk. Please tell us your thoughts regarding your current portfolio, especially in relation to your undertakings in emerging countries.

Hori : Our company has had a focus on emerging markets for a long time, and given the rise in volatility in various parts of the world, we would like to continue to allocate a certain amount of management resources to work in this market.

However, as part of our business model, our businesses and partnerships in developed markets have enabled us to control the risk of our businesses in emerging countries, so based on this track record, we would like to continue in this direction going forward.

You also mentioned the Trump administration, and in the US, most of our businesses there operate domestically, so I think it would be good to strengthen our portfolio there.

With regard to trade between various countries, many customers are aware of the risk of supply chain disruption, but while we view this as a risk, we also believe that there may be more opportunities to present supply chain assurance and alternative solutions to customers, so we view this as an opportunity and will deploy our functionality here.

Emerging markets such as Brazil have particularly scarce resource and energy assets, ideal locations and natural environment for next-generation fuel development. As global issues develop, we believe the significance of and potential for business opportunities in the Global South are sizeable, so we would like to continue to devote efforts here.

Q3: LNG growth strategy

I think the investment in the Ruwais LNG project at this timing was very good given the relatively good ROI, especially for a Japanese company. Please summarize the growth strategy of the LNG business, including the current situation of Mozambique LNG, which is a growth driver for the future, and how other projects will be growth drivers.

Hori : It was indeed a great opportunity to partner with ADNOC and participate in the Ruwais LNG project under the same conditions as the oil majors. It is a highly competitive project, and we want to develop it as one of our core businesses.

In Mozambique, we are working with the operator, TotalEnergies, and the government of Mozambique, to finalize the security related work that needs to be done in order to resume construction. The situation regarding safety is improving, and we are working towards the resumption of construction while monitoring the progress of several key aspects.

If there are any developments, we will make prompt announcements, and we are making every effort towards the swift resumption of construction. The competitiveness, gas quality, and reserves potential of Mozambique LNG are all high, so we will take care to effectively control local risks as we proceed.

Another exciting project is the Cameron LNG project in North America. We are preparing for the expansion, and since export approval is already in place, we are working with our partners to make a final investment decision on the expansion. If we can make a final investment decision, we believe it will be competitive and will become a core of our future LNG business.