For inquiries on this matter, please contact

- Mitsui & Co., Ltd.

Investor Relations Division - Contact form

- Mitsui & Co., Ltd.

Corporate Communications Division

Telephone: +81-80-5912-0321

Facsimile: +81-3-3285-9819 - Contact form

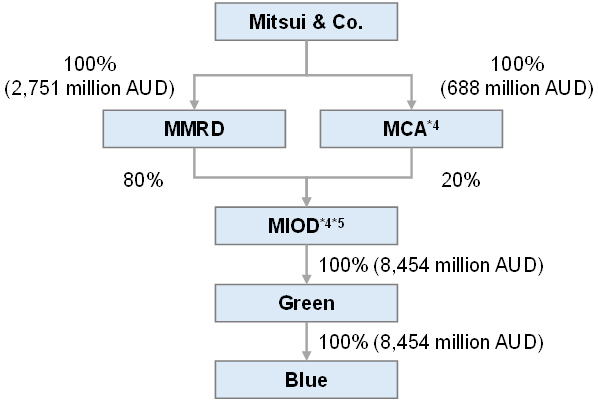

Mitsui & Co., Ltd. ("Mitsui," head office: Tokyo, President and CEO: Kenichi Hori) previously announced the acquisition of an interest ("Interest") in the Rhodes Ridge iron ore project in Australia ("Rhodes Ridge") in the timely disclosures "Acquisition of Interest in Rhodes Ridge Iron Ore Project in Australia" dated February 19, 2025 and "Update on Previous Disclosure: Acquisition of Interest in Rhodes Ridge Iron Ore Project in Australia" dated March 12, 2025. Today, Mitsui decided to increase capital in several of its wholly owned subsidiaries for the purpose of making payment for the acquisition of the Interest.

As a result of the capital increase, Mitsui & Co. Mineral Resources Development Pty. Ltd. ("MMRD"), SPC Green Pty. Ltd. ("Green") and SPC Blue Pty. Ltd. ("Blue") have been designated as specified subsidiaries*1 of Mitsui, as the capital of each company is now equivalent to 10% or more of Mitsui's capital.

The acquisition of the Interest is planned to be completed within FY March 2026, after the fulfillment of conditions precedent, including obtaining the necessary approvals from relevant authorities.

Please scroll horizontally to look at table below.

| (1) Name | Mitsui & Co. Mineral Resources Development Pty. Ltd. | |||

|---|---|---|---|---|

| (2) Location | Western Australia, Australia | |||

| (3) Title and name of representative | Director, Hideaki Kusaka Director, Masafumi Kikumoto |

|||

| (4) Description of business | Investments in companies involved in the iron ore business in Australia and investment management | |||

| (5) Capital*2 | Before the capital increase: 21 million AUD After the capital increase: 2,772 million AUD |

|||

| (6) Date of establishment | September 13, 2012 | |||

| (7) Major shareholder and ownership ratio | Mitsui (100%) | |||

| (8) Relationship between Mitsui and the said company | Capital relationship | Mitsui owns 100% | ||

| Personnel relationship | Two part-time directors appointed by Mitsui | |||

| Business relationship | None | |||

| (9) Consolidated operating results and financial position of the said company for the last three fiscal years in million JPY (conversion rate: AUD/JPY 95) | ||||

| Fiscal years ended | March 2022 | March 2023 | March 2024 | |

| Total assets | 1,386,145 | 1,260,175 | 1,391,560 | |

| Total net assets | 1,209,825 | 1,092,120 | 1,205,550 | |

| Revenue | 620,160 | 505,495 | 556,605 | |

| Profit for the year | 349,315 | 252,320 | 282,910 | |

| Profit for the year attributable to owners of the parent | 264,904 | 192,876 | 214,240 | |

| (1) Name | SPC Green Pty. Ltd. | |

|---|---|---|

| (2) Location | Western Australia, Australia | |

| (3) Title and name of representative | Director, Toru Kojima Director, Hideaki Kusaka |

|

| (4) Description of business | Investment in SPC Blue Pty. Ltd. | |

| (5) Capital*2 | Before the capital increase: 2 AUD After the capital increase: 8,454 million AUD |

|

| (6) Date of establishment | April 9, 2024 | |

| (7) Major shareholder and ownership ratio | MITSUI IRON ORE DEVELOPMENT PTY. LTD. (100%)*3 | |

| (8) Relationship between Mitsui and the said company | Capital relationship | Mitsui owns 100% through subsidiaries |

| Personnel relationship | Two part-time directors appointed by Mitsui | |

| Business relationship | None | |

| (1) Name | SPC Blue Pty. Ltd. | |

|---|---|---|

| (2) Location | Western Australia, Australia | |

| (3) Title and name of representative | Director, Toru Kojima Director, Hideaki Kusaka |

|

| (4) Description of business | Ownership of interest in the Rhodes Ridge iron ore project | |

| (5) Capital*2 | Before the capital increase: 1 AUD After the capital increase: 8,454 million AUD |

|

| (6) Date of establishment | April 9, 2024 | |

| (7) Major shareholder and ownership ratio | SPC Green Pty. Ltd. (100%) | |

| (8) Relationship between Mitsui and the said company | Capital relationship | Mitsui owns 100% through subsidiaries |

| Personnel relationship | Two part-time directors appointed by Mitsui | |

| Business relationship | None | |

Interest expenses (interest to be paid on borrowings) are expected to be incurred in connection with the financing of the capital increase, however, the impact has already been incorporated into the business plan for FY March 2026 announced on May 1, 2025.

*1 A subsidiary that meets any of the following thresholds (following Article 19, Paragraph 10 of the Cabinet Office Ordinance on Disclosure of Corporate Information).

(1) Sales to or purchases from the Company (the parent company) account for 10% or more of the Company's (the parent company's) purchases or sales.

(2) Total equity is 30% or more of the net assets of the Company (the parent company).

(3) The amount of capital or investment is 10% or more of the capital of the Company (the parent company).

*2 Converted at a rate of AUD/JPY 95 and AUD/USD 0.63.

*3 Mitsui owns 100% through subsidiaries.

*4 Although Mitsui & Co. (Australia) Ltd. (MCA) and MITSUI IRON ORE DEVELOPMENT PTY. LTD. (MIOD) are expected to become specified subsidiaries as a result of the capital increase, they fall under the definition of "subsidiary company" as stipulated in Article 166, Paragraph 5 of the Financial Instruments and Exchange Act, and are therefore not included in this disclosure regarding changes in specified subsidiaries.

*5 In addition to the capital increase in MIOD, there are plans to utilize internal reserves and borrowings for funding.