Main Contents

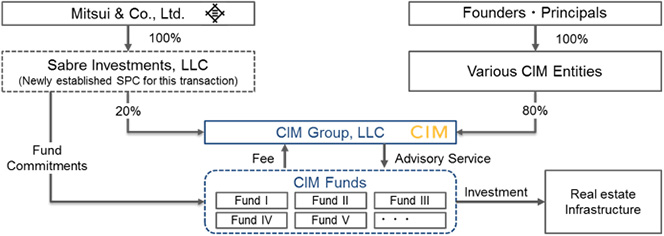

Mitsui & Co., Ltd. ("Mitsui", Head Office: Tokyo, President and CEO: Tatsuo Yasunaga) and CIM Group, LLC ("CIM") have agreed to enter into a strategic partnership whereby Mitsui will acquire an interest in CIM, a full-service US urban real estate and infrastructure fund management firm, and will also invest in funds managed by CIM. Through its newly established special purpose entity Sabre Investments, LLC, Mitsui will acquire 20% of CIM and invest in several funds that CIM manages. Mitsui's total investment will be US$450-550 million (approx. ¥52-¥63 billion) with adjustments based on terms of the agreement.

CIM manages private funds and public REITs (Note 1) primarily targeting urban real estate assets such as office buildings, retail centers and multi-family properties and infrastructure assets, mainly in North America. Since its inception in 1994, CIM has achieved excellent management performance, an outstanding investor base of global institutions, and assets under management ("AUM") of over ¥2 trillion.

Global investments in alternative assets (Note 2) is expected to grow firmly, with US real estate expected to remain as the largest and most attractive segment in the alternative investment market, solidifying Mitsui's view that the US real estate environment will continue to be favorable mid-to-long term. In Japan, due to poor performance caused by lasting low interest rates, Japanese investors' capital is expected to flow increasingly into overseas real estate and infrastructure investments.

Mitsui, through its subsidiaries, manages a public logistics REIT (Japan Logistics Fund, Inc.), a listed comprehensive J-REIT (MIRAI Corporation) and private funds, and has accumulated extensive knowledge and expertise in the real estate asset management business over the years mainly in Japan. Through its partnership with CIM, Mitsui will enter the US real estate asset management market, the largest globally, and will enhance its steady profit base with CIM positioned at the core of its international asset management strategy. Mitsui will also strongly support marketing activities of CIM's funds to the Japanese market through Japan Alternative Investment Co., Ltd., Mitsui's wholly-owned subsidiary, with an aim to raise several hundred billion yen of new capital from Japanese investors in the coming years.

Note 1: "REIT" is an acronym for "Real Estate Investment Trust." A REIT uses funds gathered from many investors to acquire multiple properties, such as office buildings, commercial facilities, and apartment buildings. Rental income and trading gains are distributed to the investors.

Note 2: In the asset management market, any non-traditional assets are generally known as "alternative assets", including real estate, infrastructure, private equity, hedge funds etc.

Outline of CIM

| Official name | CIM Group, LLC |

|---|---|

| Head office | Los Angeles, CA (U.S.A.) |

| Establishment | 1994 |

| Representative | Avi Shemesh, Co-Founder and Principal |

| Business | Asset management business primarily targeting urban real estate and infrastructure assets in North America. |

| Employees | 615+ (as of end of September, 2016) |

| AUM | US$ 19.2 billion (as of end of September, 2016) |

| Website |

Investment Structure

Notice:

This announcement contains forward-looking statements. These forward-looking statements are based on Mitsui's current assumptions, expectations and beliefs in light of the information currently possessed by it and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause Mitsui's actual results, financial position or cash flows to be materially different from any future results, financial position or cash flows expressed or implied by these forward-looking statements. These risks, uncertainties and other factors referred to above include, but are not limited to, those contained in Mitsui's latest Annual Securities Report and Semi-annual Securities Report, and Mitsui undertakes no obligation to publicly update or revise any forward-looking statements.

This announcement is published in order to publicly announce specific facts stated above, and does not constitute a solicitation of investments or any similar act inside or outside of Japan, regarding the shares, bonds or other securities issued by us.