“Challenge and Innovation” Case Study

Anticipating an increase in the scarcity of iron ore, we took on risk and quickly gained a first-mover advantage by securing long-term offtake agreements with steel companies. Even during a difficult period in terms of the business environment, we maintained a long-term perspective and persistently pursued a strategy of selection and concentration, building and deepening relationships of trust with our partners. This allowed us to form an unshakeable position in the iron ore industry, which became the foundation for the progress we have made since the 2000s.

History of initiatives

1960–1970

- During Japan’s period of rapid economic growth in the 1960s, a series of large-scale integrated steel plants were constructed in Japan, driven by the surging growth of industries requiring steel, such as automotive, home appliance, shipbuilding, and construction. Concurrently, with the stable procurement of raw material for steel — iron ore — becoming a critical issue, based on long-term off-take agreements with steel companies, Mitsui decided to invest in the development and acquisition of interests in iron ore mines, going beyond traditional import agency services. The pioneering examples of these efforts were the investments in the Mt. Newman joint venture and Robe River joint venture in Western Australia. At the time, iron ore prices were below 20 US dollars per ton, but an enormous amount of capital was required for development of infrastructure such as mines, railways, and ports. Mitsui had a long-term vision anticipating a future in which supply and demand would be constrained due to the continuous increase in demand for steel products in line with global economic growth and the uneven distribution of high-quality iron ore reserves in certain regions. It was based on this vision that Mitsui decided to take the risk and acquire these interests. Furthermore, we pushed ahead with diversifying our supply sources through our investment in MBR of Brazil (which, after restructuring through corporate acquisitions and integrations, became part of the current Vale).

Source: State Library of Western Australia BA2817/1866

1970–1990

- The iron ore business was not always smooth sailing. During the 1970s and 1980s, amidst stagnating iron ore prices, we were further afflicted by a decrease in demand due to the oil crisis and repeated labor disputes in Western Australia, and in some years we recorded losses. However, Mitsui maintained a long-term perspective and continued making investments while diversifying the business. A new investment was made in the Canadian mining company Québec Cartier Mining along with the expansion of our iron ore assets in Australia and Brazil. In Australia, in 1990, we invested in Yandi and Mt. Goldsworthy joint ventures, based on an identical shareholder composition and ownership ratio with Mt. Newman, in which we had been involved in since 1967. This established a structure allowing for integrated operation of the three joint ventures (Mt. Newman, Yandi, and Mt. Goldsworthy) with BHP, enabling efficient operations. Furthermore, when opportunities for additional investment in MBR in Brazil arose, of the existing shareholders at the time, Mitsui was the sole company to make an additional investment.

Source: BHP

1990–2005

- Foreseeing significant growth in the Asian market, we acquired further expertise and market information, including making our first majority investment in Sesa Goa of India. Additionally, regarding our investments in Brazil, which began with MBR, we strategically reconfigured assets while continuing to undertake new developments, which ultimately led to our acquisition of shares in Vale. As a result, our iron ore business portfolio which began in Australia expanded to Brazil, India, and Canada, but Mitsui reached a new turning point. Anticipating a sharp increase in demand aligned with global economic growth, we shifted our policy to further strengthen our Australian and Brazilian assets, which possessed overwhelming expansion potential. Consequently, we sold our Canadian and Indian assets, establishing our current positioning with assets concentrated in Australia and Brazil.

©Eny Miranda / Cia da Foto / Vale

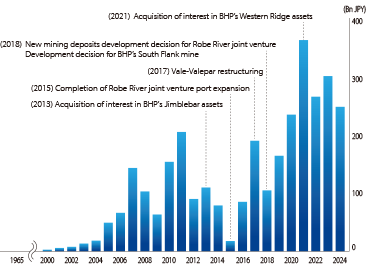

Capital expenditure and production efficiency improvements

- As anticipated, in line with global economic development, and specifically related to the growth of China, demand for steel products for construction and infrastructure rapidly increased in the 2000s. This led to tight supply and demand for iron ore, causing iron ore prices to sharply rise from around 30 dollars per ton at the start of the decade to over 170 dollars in 2008. The potential for expansion of our Australian and Brazilian assets to meet this strong demand became a differentiating factor that kept competition at bay. In Australia, we expanded mine, rail and port capacity through the Robe River joint venture with Rio Tinto and joint ventures with BHP, and further acquired a new interest in BHP’s Jimblebar iron ore mine and pushed ahead with its development. In Brazil, we worked to expand production capacity through Vale’s large-scale iron ore mine development. By responding to the rapidly increasing iron ore demand, we increased earnings, generating a profit of over 100 billion yen in FY March 2008.

Iron Ore Profit

Profitability

Since the 1960s, Mitsui took the risk at an early stage to secure large-scale interests in assets superior in terms of quality, costs, and reserves. Furthermore, we completed infrastructure development, such as railways and ports, at a lower cost compared to current levels, where depreciation of major assets has already taken place. Moreover, we have established long-standing partnerships with all three major iron ore suppliers, that cumulatively account for more than half of the seaborne trading volume. This positions Mitsui uniquely in the industry.

Due to these factors, all iron ore businesses in which Mitsui participates boast extremely high cost-competitiveness and abundant production volumes, with stable operations. Alongside expansion of production since the 2000s, we have simultaneously pushed ahead with automation and remote operation of production facilities in a pro-active manner, working to reduce costs and improve safety and production efficiency.

As a result of continuous expansion of production capacity and cost reduction, despite the annual iron ore price in FY March 2014 and FY March 2024 being almost the same, over the same period profit grew from approximately 110 billion yen to 310 billion yen, roughly 2.8 times higher.

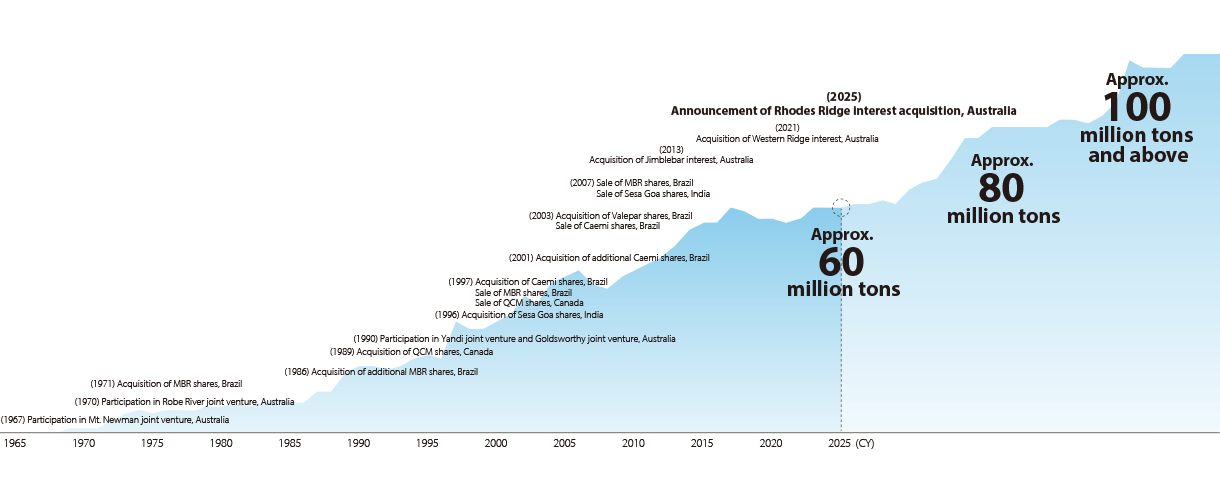

Mitsui’s Equity Share of Production

Toward new “Challenge and Innovation”

In order to further build on our overwhelming strength in the iron ore business, expanding ore reserves was essential. Rhodes Ridge is a project in Western Australia, an area in which we have been involved in the iron ore business for around 60 years, and one in which we have continuously sought participation opportunities for the past 20 years. It can be said that this project adheres to our basic principle of investing in business areas and geographical regions where we have expertise and a track record, alongside partners with whom we have built trust.

This mine possesses the highest-grade iron ore in Australia, the world’s largest supplier of iron ore, and boasts abundant reserves. Through a joint venture spanning over 50 years, we have built a long-term trusting relationship with our partner, Rio Tinto.

Furthermore, it is close to the Robe River joint venture, in which we have an interest, and Rio Tinto’s other iron ore mines, allowing for the utilization of existing infrastructure such as railways and ports. Through our participation, we aim to create value in a way that would not be achievable by another company.

Our equity share of production is currently approximately 60 million tons per year, already among the highest globally, but through this acquisition, it is expected to reach the 100 million tons per year scale in the future. We believe this project will further solidify our iron ore business and significantly enhance our earnings capability.

Additionally, in the low-carbon metallics business, which is expected to become increasingly important in the future, we are leveraging our expertise accumulated in iron ore and taking on the challenge of launching a direct reduced iron business in Oman jointly with Kobe Steel. Through this business, we aim to expand the products we handle and functions by being involved in direct reduced iron supply, not just iron ore.

-

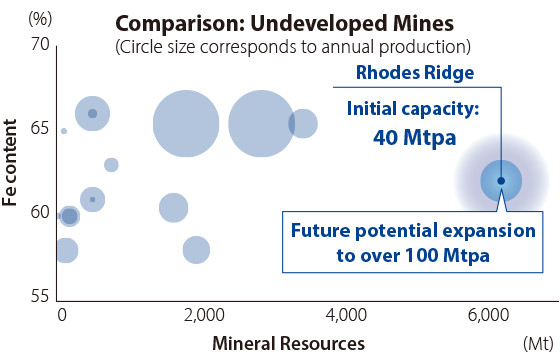

Competitiveness of Rhodes Ridge

・One of the world’s largest Mineral Resources

・Among the highest grade in Australia

・Joint partnership with a proven operator

・Proximal to existing infrastructure lowering capital cost and risk

Source: Wood Mackenzie

-

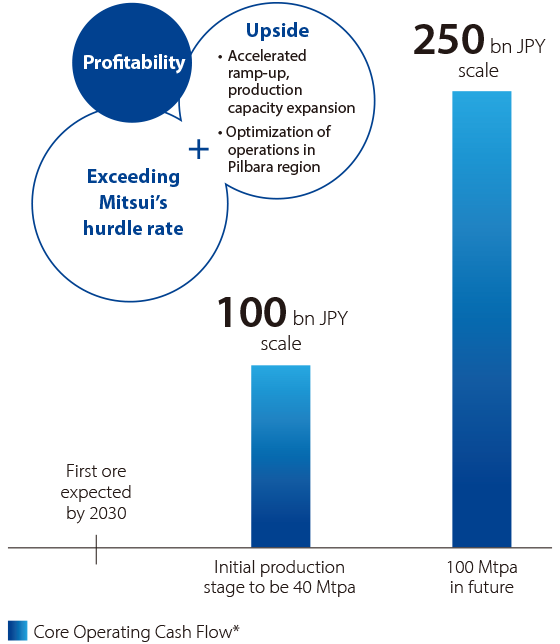

Production Outlook and Cash Generation of Rhodes Ridge

* Figures are based on Mitsui’s assumptions. Production figures represent project overall, Core Operating Cash Flow figures represent Mitsui’s equity share amount.

Hurdle rate calculation includes acquisition cost.

Simon Richmond

Chair of the Rhodes Ridge joint venture

Management Committee

Chief Financial Officer, Iron Ore, Rio Tinto

The Rhodes Ridge joint venture marks a significant milestone in our long-standing partnership with Mitsui, a relationship built over many decades of working together with shared objectives and values.

Rhodes Ridge is a world-class resource that will play a key role in meeting the future demand for steel and we welcome the deep expertise in this field that Mitsui brings. Together with Mitsui and AMB Holdings, whose strong commitment to responsible mining aligns closely with our own priorities, we are developing a project that aims to deliver enduring value for our stakeholders, local communities, and the environment.

This joint venture reflects our shared ambition: to support the global transition to cleaner steel production while generating lasting benefits for future generations.

Paul Bennett

Director

AMB Holdings

As a member of the Wright Prospecting Group, AMB has been a committed participant in the Rhodes Ridge joint venture since its inception in the early 1970s, with a long-standing interest in developing the Rhodes Ridge project. We were pleased that Mitsui decided to invest in this Tier 1 project and we are confident that their extensive experience and knowledge accumulated over 60 years in the global iron ore industry will bring valuable insights and expertise. Through direct discussions with Mitsui, we discovered a shared philosophy not only in the iron ore business but also in our approach to nature and climate. Both companies value sustainable development and positive social impact. Although our collaboration has only just begun, we are excited about the potential to work together and enhance our contributions to people and the planet.