Mitsui & Co. Global Strategic Studies Institute

Factors behind Rise in Startups in China

Feb. 16, 2018

Koichi Fujishiro

Industrial Research Dept. I

Mitsui & Co. Global Strategic Studies Institute

Main Contents

The number of new companies registered in China is growing rapidly. It stood at 1.76 million in 2010 but reached 5.53 million in 2016. According to CB Insights, there were 220 unicorns (startup companies valued in excess of $1 billion) globally as of December 2, 2017, of which 109 were in the US, and China placed second with 59. In terms of corporate value, the second, third, and fourth places in the unicorn ranking were held by Chinese firms. Major factors behind the booming startups in China include the government policy to develop new industries. The direction of policy facilitates investments in companies in the early stages of business development (so-called startups), and ample funds help attract high-performing talent, including graduates from prominent universities in the US and prestigious universities in China. Another factor is that Chinese authorities intend to promote innovations by minimizing regulations. Also backed by the national characteristic of Chinese people not to care much about consumer data privacy, the country has evolved into a huge testing ground for the creation of new business models. In this report, we will analyze such factors behind the rise in startups, which are driving the new economy, as well as the mechanism of how new industries are being developed in China. We will also discuss implications for development of new industries in Japan.

Chinese Government Measures to Create New Industries

The Chinese government began to create an accommodating environment for startups after the 2008 financial crisis. A number of export-oriented companies, which used to be a driver of the Chinese economy, went into bankruptcy at that time. As part of its economic revitalization measures, the central government announced the Decision on Accelerating the Cultivation and Development of Strategic Emerging Industries in 2010. Then, it conducted measures to boost the R&D capability of Chinese companies and eased regulations so that corporate pension funds could be invested in startup companies. In September 2014, Premier Li Keqiang proposed the concept of “mass entrepreneurship and innovation” in his keynote speech at the Summer Davos forum. Accordingly, the government activity report in 2015 incorporated its policy to promote startups through such measures as revisions of laws and regulations, preferential taxes, and support for funding and human resource development. In two and half years after the announcement of the “mass entrepreneurship and innovation” concept, the State Council and local governments together implemented a total of more than 400 measures.

Investments Led by Government and Ample Supply of Talent

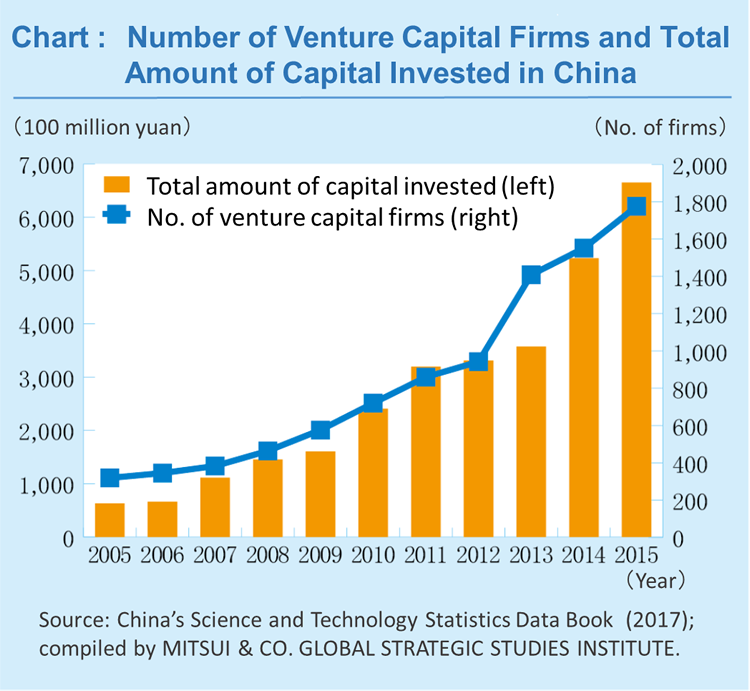

As the government-led efforts are bearing fruit, ample cash is flowing into the venture capital market in China. The number of venture capital firms in China increased from 319 in 2005 to 1,775 in 2015, up more than five-fold in ten years, with the amount of capital invested surging roughly ten-fold from 63.1 billion yuan to 665.3 billion yuan during the same period (Chart). In terms of capital invested in 2015, China came second only to the US.

Looking at sources of funding, the government sector plays a prominent role. In 2016, the sources of funding for venture capital firms in China broke down to government institutions and state-owned enterprises (35.3%), institutional investors in the private sector (14.4%), individuals (12.0%), and mixed ownership enterprises (5.2%). Of note, not only the central government but also local governments provide funds to venture capitals. In a typical example, a local government first establishes a parent fund. This parent fund invests in various industrial funds as a limited partner and also solicits investments from state-owned and private enterprises. Like this, funding by the government catalyzes investments in startup companies.

As for human resources, those who returned to China after having studied abroad for several years, graduates from universities in China, and midcareer workers (i.e., spinoff from existing business) are potential sources of talent. Graduates from foreign universities are called “haigui” in Chinese, meaning sea turtles, and they are highly sought after in the Chinese business world. The number of such people was only 12,000 in 2001, but it surged to 135,000 in 2010 and 430,000 in 2016, backed by local governments’ policy to bring them back. Not a few of them graduated from prestigious overseas universities, such as Massachusetts Institute of Technology and Stanford.

Chinese startups can attract such talented employees, with financial support from local governments, etc. For example, Shenzhen City provides grants of about 14-25 million yen per person and offers a maximum of 1.4 billion yen in subsidies for entrepreneurs with promising projects. Some of these projects have grown into unicorns, such as Royole, which was founded by a Stanford graduate and manufactures the thinnest flexible display in the world, and Obbitec, which was founded by a MIT graduate and provides face recognition technology to Alibaba.

Examples of Startups

“If we spread our wings in the rising air, we can fly without effort.” “China is an ideal market to start new business, because there are no fixed ways of doing things, and consumers do not much care about safety. It is very easy to take on risks and challenges in China.” “Most Japanese do not recognize the fact that young Chinese people are different from their elders. Young people study in the US and travel to the US and Europe, and their experience is leading to creation of new markets.”

These are words often heard from Chinese who studied aboard and returned to China to start new business. They may instinctively know that they can achieve greater success in in their home country than gaining employment overseas, given the attractive salaries and compensation packages offered by cash-rich Chinese startup companies.

Let’s take Mr. A (aged 37), who graduated from Osaka University in Japan and established a medical equipment manufacturer in Shenzhen, as an example. In Japan, he was engaged in repairing/revamping secondhand medical instruments and exporting them to developing countries. By making use of such experience in Japan, he formed a joint venture in Shenzhen in 2013 to develop and manufacture products utilizing technology and know-how of Japanese small- and midsize companies (SMEs). He currently runs three companies. Mr. A points out that SMEs have few chances to expand in Japan, but they have more chances in China. According to him, there is limited room for growth for SMEs in Japan, because large companies control distribution channels. In China, which is a huge market itself, SMEs will have easy access to funding as long as they have excellent technology.

Of note, Mr. A is also an angel investor. He has put money earned through his medical equipment business into other startups, and solicits investments from other investors. In this way, he has helped develop a number of startups and participated in the management of such companies. In China, there is an eco-system where successful business persons invest in and develop other new business.

Comparisons with the US and Japan

The current situation in China, where startups are booming as they benefit from early-stage funding by the government, is very similar to what happened in Silicon Valley in the US in the 1950s. At that time in the US, the Small Business Investment Act was enacted and preferential tax treatment for venture capitalists was introduced, as part of measures to promote venture business. Under the Small Business Investment Company (SBIC) program, which was introduced with the passage of the said act, about 600 venture capital firms were certified by the government agency. As in China today, young and competent entrepreneurs were attracted to Silicon Valley, where sufficient funds were provided. The establishment of Hewlett-Packard Company and Intel Corporation (spinoff from Fairchild Semiconductors) are a few of such examples.

Tolerance of failure is also commonly seen in both places. “People should be judged by how resilient they are in the face of setbacks, not on how successful they are” – these are the words of Mr. Chu Shijian, a legendary entrepreneur respected by many Chinese business leaders, including Lenovo’s founder Liu Chuanzhi. Mr. Chu is the founder and the former owner of the No. 1 tobacco brand in China, but he was arrested for illegal accounting practices at the age of 71. After being released from prison, he borrowed 10 million yen from his friends and started his orange business, which made him a billionaire again at the age of 85. In China, ties with people who come from the same region or graduate from the same school are strong. Such human networks support people who fail in startups. Chinese people also believe that lessons learnt from previous experiences are helpful in doing the next business, sometimes leading to higher credibility. As such, both Chinese and Americans are tolerant of failure.

In contrast, there are few systems in Japan to support those who fail in startups. With limited funds and greater risks, Japanese tend to seek a job at a large company rather than starting a business by themselves. Funds invested in startup companies amount to roughly ten trillion yen in the US and China, while those in Japan are only about 200 billion yen (one-fiftieth of those in the US and China).

China as a Testing Ground

In China, which is witnessing a rise in startups, companies engage in trial and error to create new business or new business models all the time. There are two major factors behind why the country has become a huge testing ground. One is the stance of the administrative authorities. They let companies try new things and consider regulating them when problems occur. The other is the national characteristic of Chinese people not to care about their personal information being collected and used as much as people in the US, Europe, and Japan. As such, speedy collection and analysis of consumer data, etc. is available.

Well-known examples that show the authorities’ generous stance include bike sharing services provided by Mobike and Ofo. Their bike sharing services, which let users pick up and drop off a bike anywhere in the city, have grown explosively as an alternative to public transportation, including busses and subways. Of note, such services can be provided because the Chinese traffic regulations are not strict. Another example is Guangzhou City’s support for Ehang. The company, which is based in the city, developed the world’s first passenger drone and aims to introduce air-taxi services using such drones in Dubai. Guangzhou City gave approval to test flights, helping the commercialization of the vehicles. Moreover, in November 2017, European airplane manufacturer Airbus announced that it will establish its second innovation center in Shenzhen (first center in Silicon Valley). “China will be the leader of the future flight and Airbus is willing to define and build the future of the global sky in joint hands with China”, said Chief Technology Officer Paul Eremenko. Under the Urban Air Mobility concept, Airbus is developing air taxies for four passengers.

As for the collection and analysis of consumer data, credit scoring system Zhima Credit (or Sesame Credit) is a good example. The system is offered by Ant Financial Services, which operates mobile/online payment platform Alipay. It accumulates/analyzes user credit history and gives users a credit score based on the five categories of metrics: (1) purchasing environment (social status), (2) credit history, (3) payment capacity, (4) associations, and (5) personal preferences. Users with a high score can benefit from various rewards in their daily life, such as no deposit required at hotels, an easier process to obtain a tourist visa in Singapore, and an invitation to a matchmaking party for high scorers. Of note, the operator of Zhima Credit is an affiliate of online and mobile commerce giant Alibaba. Personal information including purchase history is collected through Alibaba websites and used to determine users’ credit scores.

A vast amount of data obtained through Alibaba’s platforms is also used to provide a wide range of services such as loans, insurance, and advertisement. In the mobile commerce market in China, which has the largest number of users in the world, a cycle in which various consumer behavior data is accumulated and used to develop new services, is being established. While many companies around the world are stepping up their efforts to collect such data, they will have chances to do so surprisingly quickly in China, the most populous nation on earth.

Starting Point for Global Business Expansion

As described above, it is possible to develop a new business model and accumulate know-how at a faster pace in China than in Japan, the US, and Europe, thanks to looser regulations and a more tolerant stance on using personal information. Going forward, Chinese companies will likely expand their business models, developed in the domestic market, into emerging markets (countries in Southeast Asia, Africa, etc.). If Japanese companies try to do the same thing, they will face many challenges and take more time. In the areas where China seems to be take the lead, Japanese companies can accelerate their business expansion overseas by obtaining information through collaboration with Chinese partners, or getting know-how through joint ventures/projects.

In December 2017, an R&D subsidiary of Honda Motor Co., Ltd. announced that it signed a joint research and development contract with SenseTime Group Limited, a China-based IT company, as part of its efforts to establish advanced automated driving technologies. SenseTime is developing artificial intelligence (AI) technologies based on a huge amount of image data accumulated in China. Through the collaboration, the Japanese automaker will not only be able to save time for collecting data necessary for product development but also have chances to get information in the Chinese market, which is expected to be the main battlefield for autonomous vehicles.

Going forward, some Japanese companies may take on new challenges and accumulate know-how in China, and then apply that in other countries. China will play a more active role as an incubator of new business ideas.