Mitsui & Co. Global Strategic Studies Institute

The Future of a TPP Without the US

Nov. 27, 2017

Shinya Matano

Asia, China & Oceania Dept.

Mitsui & Co. Global Strategic Studies Institute

Main Contents

Shifting to a TPP Without the US

In 2010, the first formal round of the Trans-Pacific Partnership (TPP) negotiations was held, with the participation of eight countries including the US and Australia. In addition, Malaysia, Canada, Mexico, and Japan also started to join the negotiations one after another, which led to the signing of the TPP agreement among these twelve countries in February 2016.

However, in January 2017, President Trump, advocator of the “America First” principle, went against the idea of free trade and made a decision on US withdrawal from the TPP. With this decision, there became no clear prospect for the TPP coming into force. Under such circumstances, with a positive attitude toward free trade, Japan took the lead and decided to aim for the early entry into force of a TPP agreement without the US. It was agreed at the ministerial meeting of eleven participating countries (except the US) in May 2017. However, those countries are expecting the US to return to the TPP. That is why they set up a TPP without the US as a new deal different from the original one. When the US returns to the TPP, they intend to make the original TPP take effect.

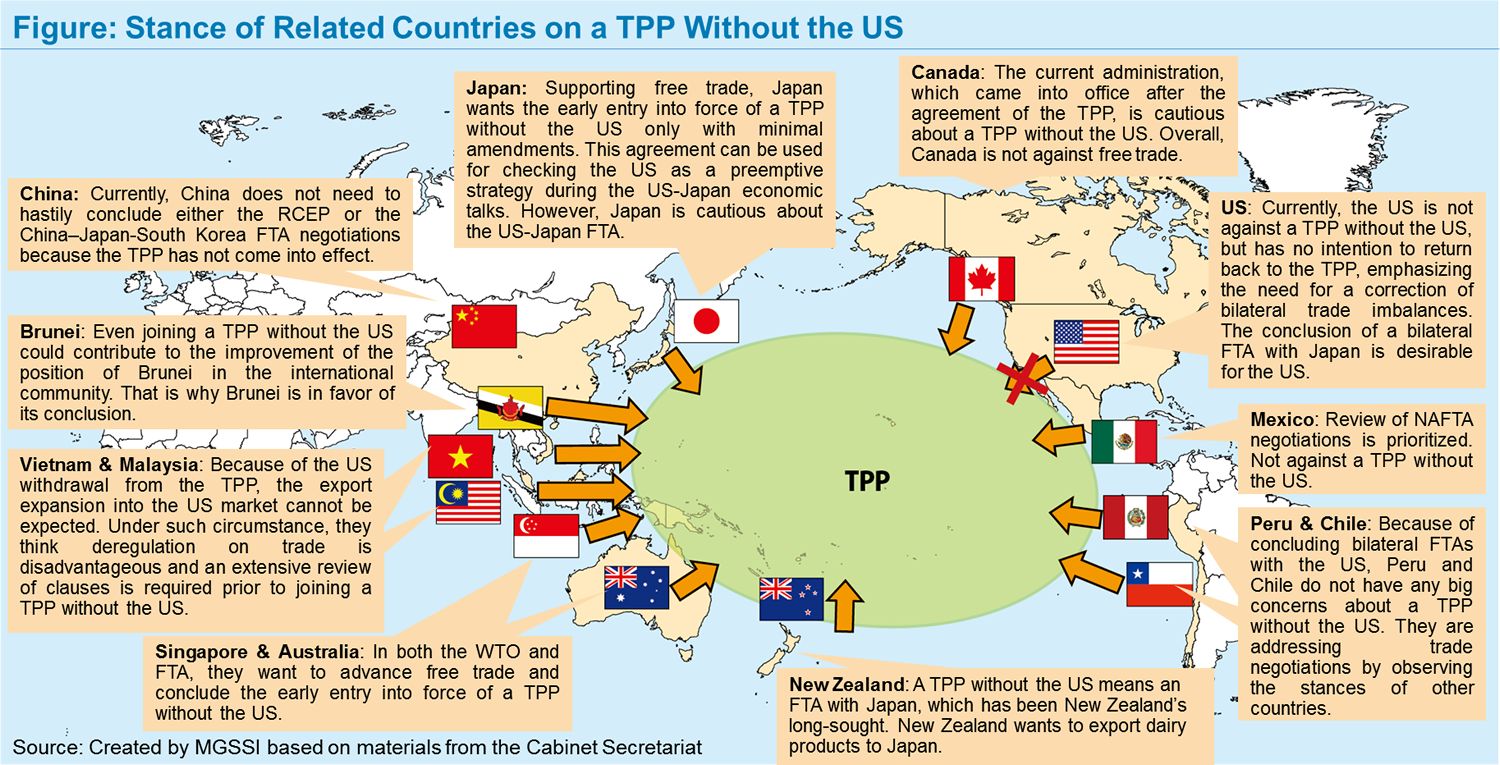

Stance of Major Participating Countries for a TPP Without the US

Although TPP was initially assumed to be entered into force by twelve countries, the US withdrawal from the TPP now brings about differences in the stances among the remaining eleven countries. From the beginning, all these member states agreed on the general agenda, such as the early entry into force of the highly standardized TPP without the US. Meanwhile, they did not come into line with detailed discussions, and therefore continued to negotiate with each other. Behind the situation is the fact that when a TPP without the US was in place, some countries wished to rectify or freeze the clauses of the US requirements which they had once accepted during the TPP negotiations as inevitable. Consequently, the ministerial meeting of eleven participating countries was held in November 2017, and reached a broad agreement at the ministerial level. Although Canada largely agreed at the meeting, immediately afterwards it retracted that agreement. As a result of this process, the summit meeting could not be held. A broad agreement at the summit level was originally supposed to have been confirmed, but that confirmation was eventually passed over. It also became obvious that before having a broad agreement, these eleven countries did not agree on some issues such as whether to rectify or freeze requirements. Whether or not the eleven participating countries can solve these issues is the key factor for the entry into force of a TPP without the US. Also, we cannot avoid considering the stance of the US in withdrawing from the TPP, as well as China’s stance of tackling problems without participating in the TPP from the start and instead choosing to join other alliances such as the RCEP (Regional Comprehensive Economic Partnership). The stances of the major participating countries can be analyzed as follows.

(1) The US

The Trump administration has its position of not returning to the TPP and not opposing a TPP without the US, emphasizing the need for solutions to address bilateral trade imbalances. In this regard, Japan is also targeted by the US. Due to this policy, it is desirable for the Trump administration to conclude bilateral free trade agreements (FTAs). Backed by the idea that trade is not a win-win relationship but a zero sum relationship, the Trump administration has adopted a stance that sees FTAs, where the negotiating counterparty consists of only one country, as an easier measure to realize benefits for America, rather than the TPP whose negotiation counterparties are eleven countries.Among the TPP participants, there are four countries, namely Vietnam, Malaysia, Brunei, and New Zealand, aside from Japan, with which the US has not yet concluded an FTA. The review of NAFTA and the US-Korea FTA, as well as the conclusion of the US-Japan FTA, are regarded as higher priority in the US FTA policy. Therefore, for the time being, the move toward conclusion of FTAs with the above-mentioned four countries is not likely to materialize. Actually, there are not any noticeable moves among these four countries with the intention to conclude a bilateral FTA with the US.

While looking at the situation in the US, not all stakeholders support the US’s withdrawal from the TPP. For example, the American Chamber of Commerce supported the realization of the TPP from its negotiation phase, and maintained its stance against the US’s withdrawal from the TPP even after Mr. Trump won the presidential election. Also, the National Cattlemen's Beef Association complained that US beef producers are incurring a substantial loss of profits with the TPP not being put into effect as Japan is lowering its tariff on beef produced in Australia, which will therefore make it cheaper than US beef.

(2) Japan

Japan is now taking the lead in a TPP without the US, aiming for its early entry into force. Initially, Japan was cautious of pursuing that TPP, and expected the US to return to the TPP negotiations as early as possible. However, around April 2017, the US started to request fixing the trade imbalance with Japan, which triggered Japan to make efforts to realize a TPP without the US. This is a preemptive move or strategy to check the US. Specifically, Japan utilizes this strategy as a way of avoiding the bilateral US-Japan FTA negotiations, or accounting for its rejection of US requests which are more demanding than those in the TPP, in the case that Japan can’t avoid entering FTA negotiations. Moreover, Japan, instead of adopting the US stance of protectionism, will utilize this effort as a restraint upon the expansion of China’s influence over the Asian and Pan Pacific areas.Currently, among TPP participating nations, there remain a few nations which Japan has not concluded an FTA with, namely, the US, New Zealand, and Canada (only Canada is currently under negotiation). Although New Zealand once offered to conclude a bilateral FTA with Japan, Japan declined that offer against the backdrop of the small amount of profits to be expected from the said FTA, as well as being cautious about increasing the import volume of dairy products. Should a TPP without the US not be realized in the future, Japan will not likely agree with concluding that sort of FTA, even though the bilateral FTA will be proposed again in the future.

(3) Australia

Australia takes a positive stance toward a TPP without the US. Factors such as the geographical condition of being surrounded by oceans and far from other continents, in addition to competitiveness in exporting natural resources and agricultural products, lie behind its positive stance. That is why Australia has traditionally been aggressively instigating free trade. In particular, it is considering to utilize a TPP without the US as the tool to strengthen its economic partnerships with Asian countries.Although Australia asked to shorten the length of the period for protecting data on bio-pharmaceuticals to five years at the TPP negotiations, for the purpose of facilitating the use of generic drugs, it accepted the US request at the final phase of the negotiations, and agreed to adopt the compromise proposal of an eight-year protection period. In light of this, during the negotiations of a TPP without the US, Australia appeared to have requested a revision of that period to five years.

(4) New Zealand

Traditionally, New Zealand has taken a positive stance on instigating free trade because of its geographical condition of being far away from other countries and strong competitiveness in exporting dairy products. Also, the TPP without the US negotiations encourage the signing of an FTA with Japan, which New Zealand has been aspiring to realizing for many years with the hope for expanding exports to Japan. In light of this background, there is a likelihood that New Zealand will not withdraw from negotiations for a TPP without the US in line with its change of administration in October 2017.(5) Canada

The current administration has been cautious about involvement in the TPP since the change of government in 2015, taking a similar stance toward the TPP without the US. However, Canada does not oppose free trade. As mentioned above, Canada rescinded a TPP without the US immediately after the broad agreement confirmed at the ministerial meeting. This is because Canada apparently took into account the impact on the negotiations for reviewing NAFTA. If similar items as those conceded in a TPP without the US are requested in the NAFTA negotiations, Canada cannot help but concede those items also. Likewise, Mexico is also under the process of review and renegotiation of NAFTA and, like Canada seems to be in a similar position.(6) Vietnam, Malaysia

Both countries are deliberately considering joining a TPP without the US because they had great expectations of expanding exports to the US, and therefore, in return, accepted the relaxing of their domestic regulations. Because of this, Vietnam is concerned about suffering from the pains derived from deregulation, while it cannot obtain most of the benefits to be expected through the TPP without the US. In addition, Vietnam already concluded an EPA agreement with Japan, and therefore, Vietnam sees that expansion of exports to Japan, in particular, cannot be expected. As a result, Vietnam seems to be requesting the TPP counterparties to review the acceptance of relaxing domestic regulations, before it agrees to join a TPP without the US.(7) China

China is paying attention to where a TPP without the US is heading. Under the current situation, it is difficult for China to join the high-standard and comprehensive TPP. If the TPP had been realized, China had concerns about unfavorable conditions for trade negotiations with the US. These concerns allowed China to plan the strategy of alleviating China’s disadvantages by concluding the RCEP with acceptable and moderate standards. However, due to the postponement of the TPP, China, for the time being, does not need to hastily conclude the RCEP negotiations. Meanwhile, China has concerns about suffering losses because of the realization of a TPP without the US, which might be not as large as the TPP that was supposed to include the US, as well as the likelihood that the US will return to the TPP in the future.

Future Outlook

Given the above mentioned factors, against a backdrop of differences in position among eleven countries, there remained uncertainty over the path to take towards achieving an agreement in the future, even after largely agreeing to the said TPP at the ministerial level. For example, required signatures might not be prepared by its effective date, or domestic procedures might be late for its deadline, depending on countries such as Canada. In such cases, it seems difficult to put it into effect early within 2018. If some countries delay conducting domestic procedures, all eleven countries would not together be able to achieve an agreement due to the requirement which allows an agreement to go into effect with the completion of six countries’ domestic procedures. However, the idea of trying not to make the TPP a thing of the past is shared among these member states. At any rate, efforts to realize a TPP without the US are likely to continue.

Effects of Issuing a TPP Without the US

If a TPP without the US takes effect, what kind of effects will be generated might depend on the degree of amending and freezing of the original TPP deal. Estimating the effects of a TPP without the US by means of analyzing the degree of effects, in comparison with the original TPP (TPP12) with 12 countries including the US, the major trade effects can be seen as follows. (Given that there are “not any particular amendments” (so-called minimal amendments) except for a TPP being in place, limited only to 11 countries without the US)

(1)Trade Among TPP Participating Countries

In the TPP11, trade expansion effects can be expected, compared with the TPP12, though those effects are limited. In this regard, the Canadian research institute1 has calculated the estimate of the effect of boosting exports among the participating countries in the TPP12 and the TPP11. If the TPP12 takes effect, a positive effect worth 42,223 million USD can be expected. However, if the US withdraws from the TPP, in other words, as in the case of the TPP11, that effect is said to remain at 17,253 million USD with a huge decrease of 2,497 million USD.(2)Vietnam’s Textile Exports to the US

Vietnam joined the TPP with the expectation of expanding its export volume to the US, and focused in particular on highly globally competitive sewn products as export items. According to the above mentioned estimate, the positive effect on exports within Vietnam in the case of the TPP12 was worth 13,951 million USD, while that effect in the case of the TPP11 is said to remain at 4,531 million USD, with a decrease of 9,420 million USD. Most of the said decrease was thought to be due to the shedding of expanded exports of sewn products to the US. The Vietnam textile industry, with a production capacity exceeding its export capacity, is now being forced to diversify export destinations because of the US withdrawal from the TPP. Specifically, by utilizing the EU-Vietnam FTA, which is aimed at being effective in 2018, the export expansion of sewn products to the EU is expected to be focused on.(3)Australia’s Beef Exports to Japan

The Japan-Australia Economic Partnership Agreement (JAEPA) has already taken effect, and thereby tariff reductions on Australian beef in Japan are on going. In this regard, compared to the US, Australia has an advantage in exporting beef to Japan2. If the TPP12 had taken effect, Australia and the US could have realized equal footing in terms of beef tariffs in Japan. According to the above stated estimate, 179 million USD will be lost for Australia’s export amount for the TPP12 participating countries. This reduction in the export amount might be partly because of that equal footing. The reductions of beef tariffs in Japan in the TPP are much greater than those in the Japan-Australia EPA. Moreover, in the case of the TPP11, Australia has further advantages. According to that estimate, the positive effect of Australia’s exports for the TPP11 participating countries amounts to 88 million USD.(4)New Zealand’s Dairy Exports to Japan

New Zealand participated in the TPP mainly because of achieving the FTA with Japan. Therefore, even a TPP without the US meets the needs of New Zealand. Particularly, New Zealand is aiming at expanding its highly competitive dairy products. The tariff reductions for dairy products that Japan pledged in the TPP12 are likely to be realized also in the TPP11. According to the above mentioned estimate, the positive effect of New Zealand’s exports for the TPP12 participating countries amounts to 1,742 million USD, while that positive effect for the TPP11 amounts to 1,556 million USD. Any large drop in that amount cannot be seen.Impact on the Global Trading System

There has been a trend of global trade liberalization until recently whereby many FTAs mainly based on bilateral agreements are integrated into some mega FTAs in which many countries are participating, and then those mega FTAs deals are reflected in the WTO agreement in which most of the countries in the world are participating. However, in January 2017, the US President Trump decided to withdraw from the TPP, the representative Mega FTA, which has halted this trend.

Even if a TPP without the US takes effect, this trend would not be revitalized by taking this opportunity. Other mega FTAs such as the RCEP are not expected to be concluded, except for the broad agreement on the Japan-EU EPA. Therefore, the possibility of realizing the Free Trade Area of the Asia-Pacific (FTAAP) in the conceptual phase has become highly unlikely. A US political change of administration would be needed for the global trading system to return to the previous trend of global trade liberation.

On the other hand, the efforts on realizing a TPP without the US will not necessarily have any impacts on the current global trading system. As mentioned above, even though the conventional trend of trade liberalization remains sluggish, the global free trade system is still being maintained even in the current situation. This can be seen in the fact that no countries in the world have withdrawn from the WTO, and there is no movement toward swapping the WTO agreement for protectionism. Moreover, even in the US, President Trump has changed his policy to one of reviewing NAFTA, instead of just unilaterally withdrawing from it, and has not raised tariffs in such a way as to be obviously against the WTO agreement. These evidences also show the global free trade system is secured. The efforts towards the realization of a TPP without the US will contribute to maintaining the global free trade system also in the future.

(As of November 15, 2017)

- “The Art of the Trade Deal: Quantifying the Benefits of a TPP without the United States” June 2017, Canada West Foundation. In the original text, the estimate value is described in terms of Canadian dollars. However, in this paper, the value is converted under an exchange rate of 1 CAD=0.76 USD.

- According to Ministry of Agriculture, Forestry and Fisheries, the amount of Japan’s beef imports in 2015 was 192.1 billion JPY (about 1.7 billion USD) from Australia, and 118.1 billion JPY (about 1.1 billion USD) from the US.