Mitsui & Co. Global Strategic Studies Institute

Growth of Online Shopping and Transformation of the Retail Industry

Jun. 6, 2017

Katsuhide Takashima

Industrial Research Dept. II

Mitsui & Co. Global Strategic Studies Institute

Main Contents

The online retail market is witnessing not only the dominance of the global giant Amazon but also the rapid growth of local players such as Alibaba, a Chinese company with the second largest share of the world’s total online retail sales. Online shopping now has an impact throughout the retail and distribution industries. In addition to Amazon, Alibaba, and other Internet-based companies, leading retailers such as Walmart and Tesco have tapped into the online market, expanding their business from brick-and-mortar stores to enhance their presence. Today, the overall retail industry, including brick-and-mortar stores, is under fierce competition. This report outlines the current situations of online shopping, and projects how this form of electronic commerce will impact the retail and distribution industries.

Expansion of Online Retail Market

According to the UK research firm Euromonitor, the world’s online retail market in 2016 was valued at USD 1,161.7 billion, and online sales as a percentage of the world’s retail sales (online sales ratio) were 8.5%, a jump from 2.0% a decade ago. During the same period, while the retail market grew 1.4-fold as a whole, the online retail market alone expanded 5.8-fold, making remarkable growth. By country, the US, China, Japan, and the UK are big four markets. These four countries combined account for about 50% of the world’s retail sales, and when it comes to online shopping, the percentage rises to approximately 70%.

In terms of online sales ratios by country, South Korea stood at 16.4%, followed by China at 13.9% and the UK at 13.4%. There seem to be different factors in these high ratios: In South Korea, online shopping became popular in line with the rapid proliferation of the Internet and smart devices; in China, retail chains with physical stores had yet to be developed; and in the UK, popularity shifted from traditional mail order to online shopping.

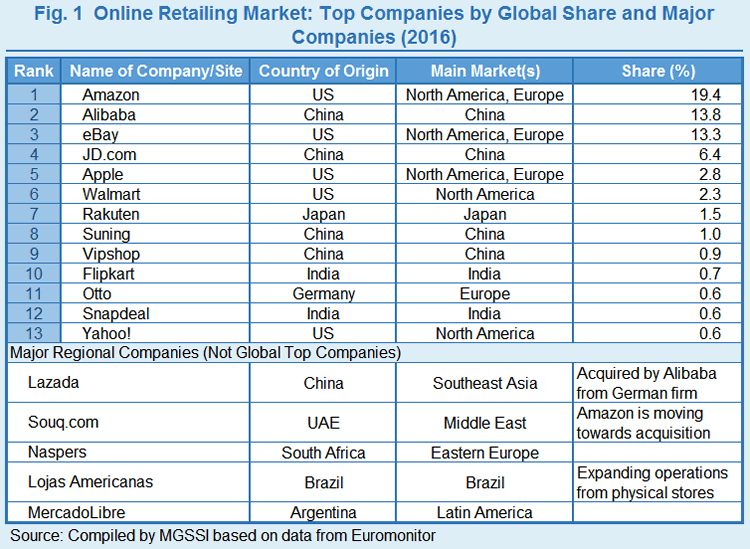

Looking at major online retailers, many began as an Internet company such as Amazon, a global company that operates online sites in 14 countries, and Alibaba, a Chinese company seeking to tap into Southeast Asia. The world’s largest retailer Walmart and other companies have also forayed into the online business arena while operating physical stores (Fig. 1). In emerging countries, Flipkart and Snapdeal, two local companies in the fast-growing Indian market, are ranked high on the list of the world’s top online retailers by sales. Moreover, some companies are becoming main players on a regional level. In Southeast Asia, Lazada, a company founded by Rocket Internet of Germany, has a large share of the regional market, and it was acquired by Alibaba in April 2016. A local company in the Middle East, Souq.com, holds a large share in countries across the region, and Amazon is showing moves to acquire the company.

Convergence into Online Malls and Intensifying Competition

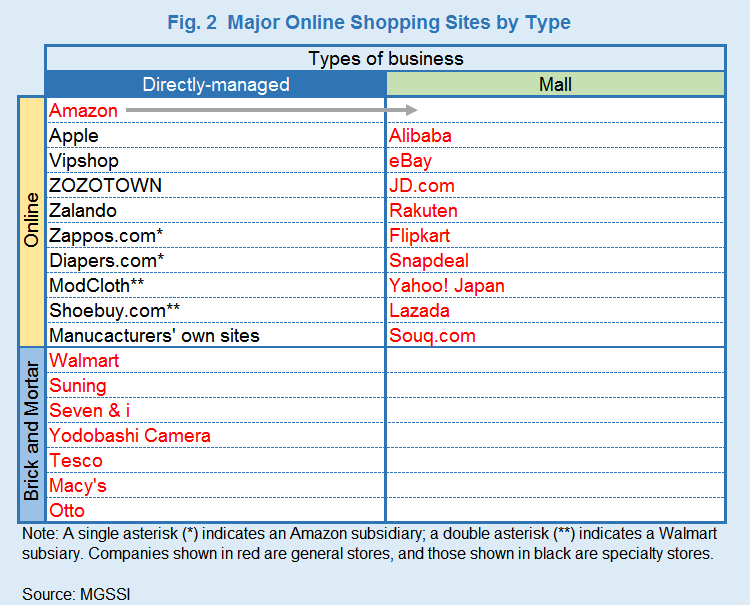

In general, online retailing is largely categorized into two types: (1) directly-managed stores: the retailer produces or purchases goods and sell them on its own; and (2) online malls: the operator of a virtual shopping mall solicits merchants to open stores there, and receive fees from the merchants as a source of revenue. Most market leaders are categorized as online malls (Fig. 2). Online malls have the following advantages: (1) As even a new entrant can launch a website by utilizing information technology, the barrier to entry is low; (2) it is possible to secure a stable source of revenue such as store fees, etc., from merchants; and (3) an overwhelmingly wide array of merchandise can differentiate the virtual mall from physical stores. In comparison with brick-and-mortar stores, when a retailer opens and operates its own online store, it can save investment and labor costs, etc., and this advantage is common to online malls. However, unlike online malls, the retailer’s own stores have to bear costs for inventory control, as well as risks of unsold items. The diversity of merchandise is a benefit of online retailing; at the same time, the retailer’s strong pursuit of diversity could also bring higher risks and costs to its business structure. That being said, if online retailers narrow down the selection of their merchandise to the best-selling items, they can no longer differentiate themselves from general merchandise retailers that operate physical stores, such as Walmart and Seven & i Holdings. What is worse, securing revenue will become difficult due to price competition.

Amazon, founded in 1995 as a specialty shop that sells books on the Internet, has gradually increased the number of offerings and grown to be a general-merchandise online shopping site of its own, but this case is exceptional among online retailers. Currently, while general-merchandise retailers with physical stores provide online shopping service as an extension of their mainstay business, Amazon is the only retailer that manages its stores exclusively among online-driven retailers. Meanwhile, however, Amazon also launched an online mall (marketplace) in 2000. In recent years the share of this service in the company’s total sales has been growing, and its shift from its directly-managed store to the online mall is becoming notable (Fig. 3). Although not made public, looking at the company’s online retail sales, it seems that its online mall has exceeded its directly-managed store.

Competing with Brick-and-Mortar Stores

The continued expansion of online shopping has an overall impact on the existing retail and distribution industries. As for the largest online retailer Amazon, its online sales in 2016 are estimated at approximately USD 250 billion, almost 50% of the world’s largest retailer Walmart’s sales of USD 481.3 billion. Walmart also entered the online retail market, and its online business generated sales of about USD 5 billion. This amount is no more than 5% of the sales from the company’s overall operations, but it corresponds to about 10% of Amazon’s. The Gap, known as an SPA (specialty store retailer of private label apparel), has put its efforts into online retailing. About USD 3 billion, or 20% of the company’s total sales of USD 15.5 billion, were generated from online shopping. These dominant retailers are competing with one another, particularly in North America, a key market for them, and the competition is unfolding across the online-offline boundary.

Under a fiercely competitive environment, profitability is limited even for burgeoning online retailers. For the largest online retailer Amazon, its North America business (online business with Prime membership fee revenue) posted USD 79.7 billion in operating revenue, which accounts for 60% of the company’s total revenue from its all operations, but operating income was USD 2.4 with an operating margin of 3.0%, remaining at a low level compared with other retailers’ figures such as Walmart’s 5.8% and GAP’s 7.7%. In addition to this, its international online business has continued posting losses.1

Three-Way Battle in the Retail Industry

The retail market now has a three-way battle between online retailers, physical store operators, and SPAs (which produce their own goods and sell them exclusively, such as GAP and Ikea). For online retailers, the abundance of merchandise will be at the core of their competitiveness. To this end, as platform operators, they need to attract merchants, as well as consumers. There is a variety of business models for online malls. Looking at primary sources of revenue, Rakuten and many other companies charge merchants fees when opening a shop on their platforms. On the contrary, Yahoo! Japan has waived such startup fees since October 2013, and instead made online advertising fees a source of revenue. As a result, this contributed to boosting the number of merchants who open their stores with Yahoo! Japan. In the case of Alibaba, selling promotional tools related to online retailing has become a revenue stream with high profitability. Amazon, which began as an online retailer that sold goods at its own store, is striving to differentiate itself from online-mall competitors by enhancing the functionality of online retailing-related services for its merchants, such as fulfillment services (for logistics, payments, etc.). However, rising home delivery costs have recently arisen as a problem for online retailers.

On the other hand, as for SPAs, at the core of their competitive power is the capability to develop attractive merchandise. Apparel retailers The GAP and Uniqlo are recognized as typical SPAs, but Tesco, Seven & i, and others private brands also fall under this category. In recent years, there have been widespread moves to enhance competitive power by developing unique merchandise across the retail industry, and many companies now sell their private-label products on the Internet as well as at their physical stores.

In contrast, looking at conventional retailers, which do not have production capabilities, and purchase goods and sell them at physical stores as their primary outlets, many of them are having a hard time. Retailers dependent on physical stores can make their prices competitive by taking advantage of not only the economies of scale from volume purchasing, but also global sourcing, which allows them to obtain goods from any place at a lower cost. However, in reality, because of “showrooming”—a purchase behavior whereby a consumer visits a shop(s) to examine a product before buying it online at a lower price, many physical-store retailers are no longer able to maintain a price advantage. Today, the economies of scale can contribute to growth for only a handful of retailers such as Walmart and German hard discounters2 Aldi and Lidl. Many others that lack this strength are seeking a way to survive, turning themselves into SPAs, like Tesco and Seven & i.

It is anticipated that future competitions will weed out more incompetent companies, and that SPAs will use online mall platforms through cooperation between different types of retailers. Large companies may accelerate mergers and acquisitions, targeting small- and mid-sized enterprises (SMEs) and emerging companies as a means of survival. Changes in the competitive environment will likely take on a complicated aspect.

- The mainstay of Amazon’s profit is the cloud computing service business, a component of Amazon Web Services (AWS). Although its share of the company’s total revenue is merely 9%, it accounts for three-fourths of its operating income.

- Hard discounters carry private-label products, with an emphasis on low price, to reduce the total number of offerings, and sell foodstuffs and individual items in shipping boxes as they came in. Aldi and Lidl, which originate in Germany, have opened stores across Europe.