Mitsui & Co. Global Strategic Studies Institute

Behind the Emergence of Manufacturing Ventures in Shenzhen, China, and Their Future Development

Mar. 8, 2017

Koichi Fujishiro

Industrial Research Dept. I

Mitsui Global Strategic Studies Institute

Main Contents

New companies have been springing up in the City of Shenzhen, China. By the end of 2016, the number of small and medium-sized enterprises (SMEs) in Shenzhen had reached about 1.4 million, a large increase of about 260,000 from a year earlier1. Since labor-intensive manufacturing used to be the pillar of Shenzhen’s economy, it was thought that rising labor costs would leave Shenzhen trapped between two types of economic groups―low-income countries with a cost advantage in Southeast Asia, and the most technologically advanced countries―and eventually weaken the city. However, today Shenzhen is known as the “Asian Silicon Valley,” a place where startups are mushrooming within existing industrial infrastructures.

Moves to Create New Industries

In China, wages have continued to rise in line with the country’s economic development. Particularly in Shenzhen, where manufacturers have clustered, its assembly manufacturing model dependent on cheap labor no longer works because wages have increased three to four times from over a decade ago. China’s economic growth rate, which used to top 10% per annum, has now fallen to the 6% level. Given this situation, the Chinese economy is facing the need to create new businesses and transform the nation’s industrial structure.

The Chinese government has hammered out various policies such as the one which encourages corporate research and development as well as the development and launch of high value-added products. Another policy to promote “mass entrepreneurship and innovation” puts weight on the creation of innovation at grass-root levels (announced in June 2015). The government has developed over 2,300 incubation facilities called “public spaces” (衆創空間) 2 nationwide, in which startups are spawned every day.

Thanks partly to this political support, China’s business startup rate (the number of new establishments out of the total number of companies) rose from 18% in 2013 to 25% in 2016. These figures are far higher than the 10% startup rate of the US, to say nothing of Japan’s 5%, which indicates that China has been producing a great number of entrepreneurs starting new businesses.

These startups include many IT companies related to consumption centering on smartphones3, which have achieved rapid penetration in China4. A bicycle-sharing service developed by Mobike gained in popularity quickly in 2016. Its “Mobike” smartphone app enables users to check the map for the location of bikes available nearby, to rent one for a small charge (an average of JPY 8 per 30 minutes), and even to drop it off at a convenient location. As of December 2016, the app had been downloaded 19 million times, and the number of downloads of this app will likely reach 100 million in the future. With an accumulation of data on the activity patterns of these numerous users, Mobike is producing new developments by expanding its services to banks, tourism, hotels, eating establishments, education, etc. In 2017, to prepare for rollouts in Europe and the US, the company has raised over USD 300 million from investors including Temasek (a fund owned by the Government of Singapore), Tencent (a leading IT firm), and Foxconn5 (a Hon Hai Precision Industry affiliate).

Shenzhen Model Not Found in Silicon Valley

While the rise of the IT service industry is prominent, manufacturing has also seen notable moves, one of which is clusters of manufacturing ventures that are emerging successively in Shenzhen.

DJI (a private company), a leading manufacturing venture in Shenzhen and the largest player in the drone industry, was founded in 2006 in the city and has since grown into a large enterprise with about 6,000 employees. The company’s share of the global drone market is more than 70%. Hangzhou-born Frank Wang, the founder and CEO of DJI, developed core technologies used in drones (flight controls) with friends at the Hong Kong University of Science & Technology. Based in Shenzhen, he dominated the market with high-performance, low-cost products, expanding its business rapidly. The question is, why was DJI started in Shenzhen?

It is said that the manufacturing industry in the Shenzhen area originally began by making fake digital watches. Thereafter, it has grown to manufacture electronic circuits, then semiconductors, and finally smartphones. Because many of the components used in drones are the same as those used in smartphones, it was a great advantage for DJI to be able to utilize the business cluster in Shenzhen for its production.

DJI has gained a cost advantage through mass production by leveraging the gigantic Chinese market, jumping straight to a leading position in this field. The company is still developing smartphone-related product lines, including high-performance stabilizers6, and marketing them one after another. Unlike many other Chinese companies in the past, DJI became not only dominant in a small market but also a leader in the global market.

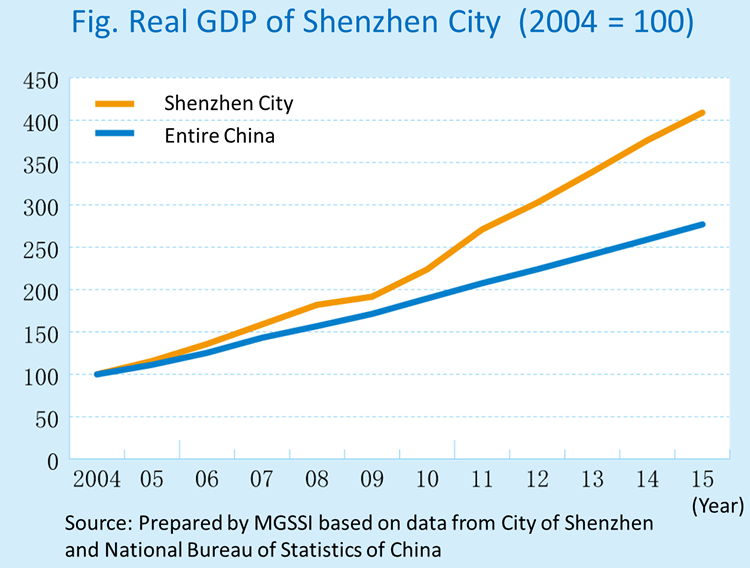

In addition, Shenzhen has seen an array of unique manufacturers such as Makeblock, a developer and manufacturer of educational robotics, and Royole Corporation, a developer of the world’s thinnest touch panels. Supported by these corporations, Shenzhen’s GDP growth has significantly surpassed the national average. (See Fig.)

Looking back, Shenzhen has provided a fertile ground for breeding manufacturing ventures like DJI. The city, which used to be just a small fishing village, was designated as a “special export zone” in 1979, and subsequently a “special economic zone” in 1980, in line with the Chinese government’s reform and open-door policy. Preferential policies encouraged foreign companies to set up many factories in Shenzhen, making the city the largest manufacturing complex in China. In 1988, Hon Hai Precision Industry, a major assembler for Apple, built its first overseas factory in Shenzhen.

It was also in the 1980s that today’s leading companies in China such as Huawei, Tencent, and ZTE were formed under generous administrative support, which ranged from the provision of land and buildings to financing. The support for companies provided by the government of Shenzhen City still excels that provided by other cities in China. With sufficient funds reserved for financial support, the city government provides up to RMB 5 million (about JPY 85 million) for promising projects as assistance for incubation.

An industrial cluster (supply chain) was formed during this development phase, which became the dominant characteristic of Shenzhen. Huaqiangbei, an electronics market 30 times larger than Akihabara, is crammed with shops that deal in any and all kinds of electronic components that go into electronics products, and it is said that you can get all the parts you need within two hours in Shenzhen. There is no other place in the world where such a wide range of electronics components are immediately available.

In Shenzhen, there used to be many Shanzhai factories (which illegally manufactured fake smartphones), but today, these small and mid-sized factories are manufacturing a stream of new products in small lots on contract. This accumulation has made the city one of the world’s major hubs for manufacturing ventures, and it is often said that “One week of work in Shenzhen is equal to one month at Silicon Valley” in regard to the process from parts procurement through prototype assembly.

Shenzhen, a Magnet for Funds and Talent

Another major reason for manufacturing ventures to gather in Shenzhen is the city’s strong links with massive investment funds which are seeking investees. There are said to be 50,000 venture capital (VC) and private equity funds in Shenzhen, with an aggregate worth of approximately JPY 48 trillion, almost equivalent to one-third of China’s total venture funds. These investors include Chinese IT giants and US VCs; they are important financial resources for manufacturing ventures in Shenzhen.

China’s large IT companies, represented by Huawei, Alibaba, and Tencent, set up their own incubation facilities in which they provide necessary technologies and funds to foster startups, expecting that those new ventures will serve their incubators and then start creating new businesses. In addition, IT giants and VCs from Silicon Valley are desirous of tapping into the opportunities provided by the booming city. They have started to build sites in Shenzhen, aiming to access the enormous Chinese markets and explore new talent and technologies.

Furthermore, the huge market and funds are attracting a wealth of talent from both within and outside of China. Many IT giants such as Huawei, Tencent, and ZTE have located research and development centers in Shenzhen. There are not a few cases where business executives leave their companies, taking their subordinates and start their own businesses. Many young, capable people seeking opportunities have also been flowing into the city. In 2016, Shuji Nakamura, who received the Nobel Prize in Physics, set up a laser lighting technology lab in Shenzhen. Having once been a pioneer for Chinese economic reform, the city is blessed with an atmosphere of openness to the outside world, which comes from its history of accepting a wide variety of talent from overseas, as well as other regions in China.

The city’s population, which was no more than 30,000 in the 1980s, is 12 million at present. People aged 65 or over account for 3% of Shenzhen’s total population while the national average is 8%, and the city’s average age is as young as 33.6 years. At the center stage of this population is China’s new generation called the “Post-'80s generation,” who share new values created from the 1980s onward.

Future Outlook

Today, anyone can have easy access to platforms such as cloud computing and smartphones. A continuous stream of new services capturing consumer needs is seen around the world, and it is particularly true of China. With the most smartphone users in the world, China is accelerating this move in fields close to consumers. However, even if someone comes up with an idea for a product (good) that could materialize a new service, it is impossible to put the idea into production without a platform that can actually make the good. Shenzhen’s unique strength, without parallel in Silicon Valley, is its manufacturing cluster that can materialize such new ideas into products, which can then be brought onto the market.

Meitu Inc., having recognized that most Chinese people upload their selfies on SNS, developed a camera app to enhance portraits, which became a big hit. The startup further pushed forward from that point; it launched smartphones which specially featured this camera app, and this success led the company to list itself on the Hong Kong Stock Exchange in December 2016. This is an example of how Shenzhen’s infrastructure has expanded the potential of business.

Ideas are generated from the variety of needs that occur all around the world. As a base for turning these ideas into a commercial reality, Shenzhen is expected to further increase its presence.

- According to an announcement by Shenzhen. As registration of a company may be conducted via a PC, it is said that one in 10 people is a company president in Shenzhen. (For reference, the number of Japan’s SMEs in 2014 was 3,809,000.)

- Facilities that support startup and early-stage companies by providing office space, marketing support, small amounts of funds, among others

- China’s smartphone penetration rate is over 58% (790 million users), higher than 39% in Japan. Smartphones are supporting China’s large consumption market.

- A new growth engine for the Chinese economy is the IT service industry, which includes three globally giant companies collectively dubbed by the acronym “BAT” (Baidu, Alibaba, and Tencent).

- Foxconn is said to be targeting Mobike’s production of 1,000 bikes (2017).

- A device that corrects blurring of images by employing a technology that controls the motion of a drone