Mitsui & Co. Global Strategic Studies Institute

Global Progress Toward PPP Innovations

Feb. 8, 2017

Yoshio Kurihara

Industrial Research Dept. II

Mitsui Global Strategic Studies Institute

Main Contents

Public-Private Partnership (PPP) in construction and operation of infrastructure originates in water utility concessions, which started in the middle of the 19th century in France. In the early 1990s, Public Finance Initiative (PFI), which focuses on utilization of private capital, were introduced in the UK. Thus, the basic concept of PPP was established as a general term referring to various kinds of public-private partnerships, including PFI. PPP thereby spread from Europe to countries all over the world and has been utilized for a lot of infrastructure projects up to now. In the 1990s, PPP projects mainly adopted a purely self-contained method, which means that the user fee revenues recover invested capital and operating costs and thereby generate profits. In those projects, where fare revenue could be expected in infrastructure projects such as transportation, water utilities, and electric power facilities, private-sector operators handled all activities, from funding to construction and operation. In the case of the first PFI project for a toll road in the U.K., the construction and operation of the Queen Elizabeth II Bridge (Dartford Bridge), the amount of traffic successfully increased after the start of service in 1991. Accordingly, its operating company realized the recovery of invested capital in 10 and a half years instead of 20 years, the initially scheduled operating period. Other than Europe, at Indianapolis International Airport in the U.S., the operating company decreased the operating cost and increased the commercial revenue after operational delegation in 1995. This project eventually succeeded in cutting takeoff and landing fees by 70%. While cases of best practices have accumulated, there have been many failures, mainly in transportation infrastructure, where demand risk is huge. Considering such a risk, recently various kinds of new schemes for PPP have been developed, mainly for road infrastructure projects.

PPP Failures and the Cause

Construction and operation of the Clem Jones Tunnel in Brisbane, Australia, which was opened to traffic in 2010, is mentioned as a typical failed PPP project that uses the self-contained method. In this project, the amount of traffic after the opening of the bridge was substantially below the demand forecast, which caused its management to stall the year after it opened. The actual amount of traffic is around one third that of the demand forecast. This result led to litigation where the private-sector operators are suing their commissioned consultant. In the U.S., the case of the operator of the Indiana Toll Road, which filed for bankruptcy in 2014, is a similar failure. Though this operator, whose operating right was assigned by the state government in 2006, succeeded in reduction of administrative cost after the start of the project, it faced debt repayment difficulties. This financial problem was caused by the substantial burden of the loan interest rate, which was required for acquisition of the operating right. This was because the economic slowdown due to the 2008 global economic crisis had an impact on actual traffic amount of large-scale vehicles, which resulted in far less than the estimated amount. Along with this, the balance worsened. Likewise in emerging countries, similar problems have occurred. In India, the market has expanded sharply with the introduction of PPP for National Highway Development projects since 2005. However, many projects have been abandoned because profitable projects have become fewer, though competition for orders has intensified among domestic companies. Since the financial institutions that financed such abandoned projects had bad loans and became cautious about financing in 2012, the market has been shrinking rapidly.

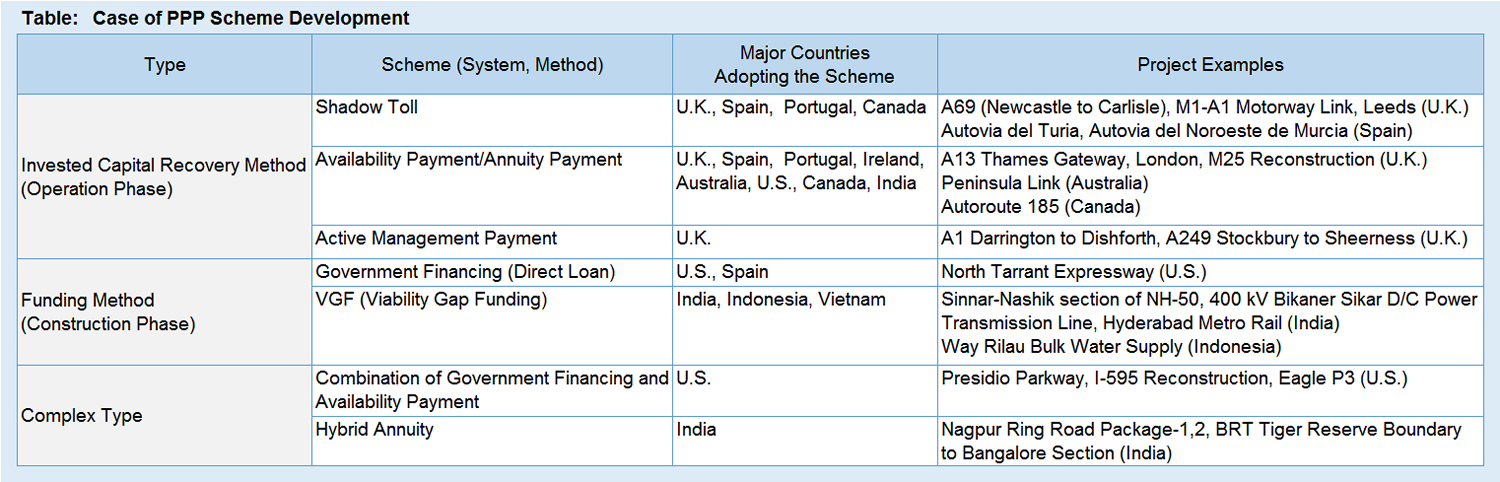

Common factors causing these failures are as follows: 1) gaps between bullish demand forecast by private-sector operators and actual amount of usage; 2) unreasonable funding, such as high loan ratio, and borrowing at high interest rates. In particular, after the global economic crisis in 2008, due to a decrease in economic activity and a rise in funding costs, these risks expanded, and therefore, securing profitability in PPP projects has become more difficult. Due to this social and economic background, various types of schemes have been developed and executed, focusing on response to demand risks and funding risks in PPP projects. (Refer to Table.)

Response to Demand Risks—Diversification of Invested Capital Recovery Method

Mainly in the U.K., as a method of responding to demand risks, a new alternative to the self-contained method has been developed. What was introduced in 1994 in the U.K., which has a strong resistance to toll roads, is the “Shadow Toll.” It is not collecting charges from road users, but receiving charges on virtual usage in response to traffic amount from a government fund. In this method, which is similar to the self-contained method, the operator of the project takes the demand risks; however, a decrease in traffic amount due to a worsening economic environment can be alleviated. Recently in Spain, a method to reduce further the risks of the project operator by way of combining the shadow toll with a minimum wage guarantee system by the government has been introduced in projects to widen existing toll-free roads.

The method introduced in road projects and hospital projects in the U.K. from the early 2000s following the Shadow Toll was “Availability Payment.” In this method, the government pays a fixed amount of money to the operator of the project regardless of infrastructure usage amount if the infrastructure is available under appropriate conditions. That is to say, the government bears the financial burden of demand risks. Moreover, when the service standard is higher than the evaluation standard agreed in advance, a bonus is to be offered to the operator. On the other hand, when the service standard is lower, payment is reduced as a penalty. These incentives encourage operators of projects to maintain and improve the standard of services. In India, a similar method called “Annuity Payment” was introduced in the middle of the 2000s, targeted at road projects of low profitability. In the U.S., this system was introduced in 2009 in a project for the reconstruction of Interstate 595 (I-595) in the state of Florida.

“Active Management Payment” is a method that was developed from availability payment. It was introduced in the U.K. in the middle of 2000s. This method sets multiple indicators for service standards for infrastructure operation to decide the payment amount through complex multiple evaluations. For example, average velocity and safety are set for evaluation standards in road projects. Though it is a given fact that setting evaluation standards and the evaluations based on them are appropriately conducted, active management payment can be said to be a scheme that enables project operators to develop various creative measures and enhance the value of infrastructure.

Response to Funding Risks—Enhancing Support from Government

As measures that respond to funding risks, systems or mechanisms have been created to support funding for private sector operators by government. These bring about benefits that reduce operators’ initial investment costs or funding costs and improve the profitability of PPP projects, as well as enable to expand the number of feasible PPP projects.

The Indian government introduced a mechanism called “Viability Gap Funding” (VGF) in 2005. It provides a government subsidy for construction costs in PPP projects to private sector operators. The amount is specified by bidder in the tendering process and is to be evaluated. In India, 20% of the total construction cost is set as the upper limit of VGF. Currently, other Asian countries also have come to adopt VGF, and Indonesia adopted it in 2012.

Whereas in developed countries, government support is mainly focused on investment and loan. In the U.S., the budget for Transportation Infrastructure Finance and Innovation Act (TIFIA) loans, which are part of an investment system set up for transportation infrastructure projects by the federal government in 2012, was substantially increased, and in June 2014 a similar program targeting water infrastructure was created.

In addition, each country has been preparing assistance measures, such as subsidies, investments and loans injected by means of government funds into PPP projects, and government guarantees for funding of private-sector operators.

Recent Trends and Expectations for Further Development

Mainly in the road sector, PPP schemes have been developed with the main aim of addressing challenges that occur during the implementation of PPP projects by the self-contained method. Subsequently, these schemes have been applied to other infrastructure sectors, such as railways and water utilities. The investment recovery method, which can be applied also to projects without user fee revenues, or to projects that have social significance but cannot be expected to have the charge setup available for the self-contained method, could have the potential to broaden the target sector for PPPs.

Recently, complex schemes where the investment recovery method and funding support are combined have been developed and introduced. In the U.S., the combined application of TIFIA loans and availability payments has been institutionalized since 2012 in order to accelerate introduction of PPPs by state governments. In India, a “Hybrid Annuity” method, where the above stated VGF and annuity payment are combined, was introduced in the early 2016 in order to revitalize sluggish PPP projects.

So far, every scheme has been advanced in such a way that encourages private-sector operators to participate in PPPs by increasing the risk burden for government. This trend has been accelerating since the global economic crisis in 2008. It can be said to be an appropriate move toward changes in the external environment. However, governments bearing too much risk could lead to financial deterioration and raise concerns over the sustainability of the schemes. The new Trump administration in the U.S. has outlined a massive expansion of infrastructure investment, and the president has declared that he would utilize PPPs actively, although that is likely to increase the financial burden on the government depending on the method. In addition, a precondition for introducing PPP is that economic advantage, or “Value For Money” (VFM), can be achieved through adopting PPP rather than traditional public sector provisions. However, there is much concern that government support might lead to hindering the originality and ingenuity of private sector operators, which is the source of VFM. In the future, the development of a new scheme intended to return to risk bearing to private sector operators would be required. To this end, it is supposed that finance related companies will develop new methods utilizing highly advanced finance technology. Also, as in the case of India, which has been developing and introducing methods such as VGF, emerging countries with bigger expectations for PPP might develop new approaches. Due to rising expectations for PPP in both developed and emerging economies, the innovation of PPP is likely to continue, aiming to increase the number of projects and expand the scope of its application.