Mitsui & Co. Global Strategic Studies Institute

Reality of Japanese Companies’ “Refluence”

Jun. 7, 2016

Tomohiro Omura and Tetsuya Urakawa

Industrial Studies Dept. II

Mitsui Global Strategic Studies Institute

Main Contents

Rise ofChinese companies, while Japanese companies are under pressure

The trend of globalization gained momentum at the dawn of the 21st century. Amid this trend, companies from developed countries where domestic markets are sluggish have expanded their business by advancing into markets of emerging countries, and emerging countries have accelerated growth utilizing funds and technologies brought by these companies from developed countries. In this manner, the two sides have co-created mutually beneficial relations. However, companies of emerging countries such as ones in China, which have risen rapidly on the back of its growing domestic markets, have encroached upon business opportunities for companies of Japan and other developed countries, by significantly increasing exports of industrial goods.

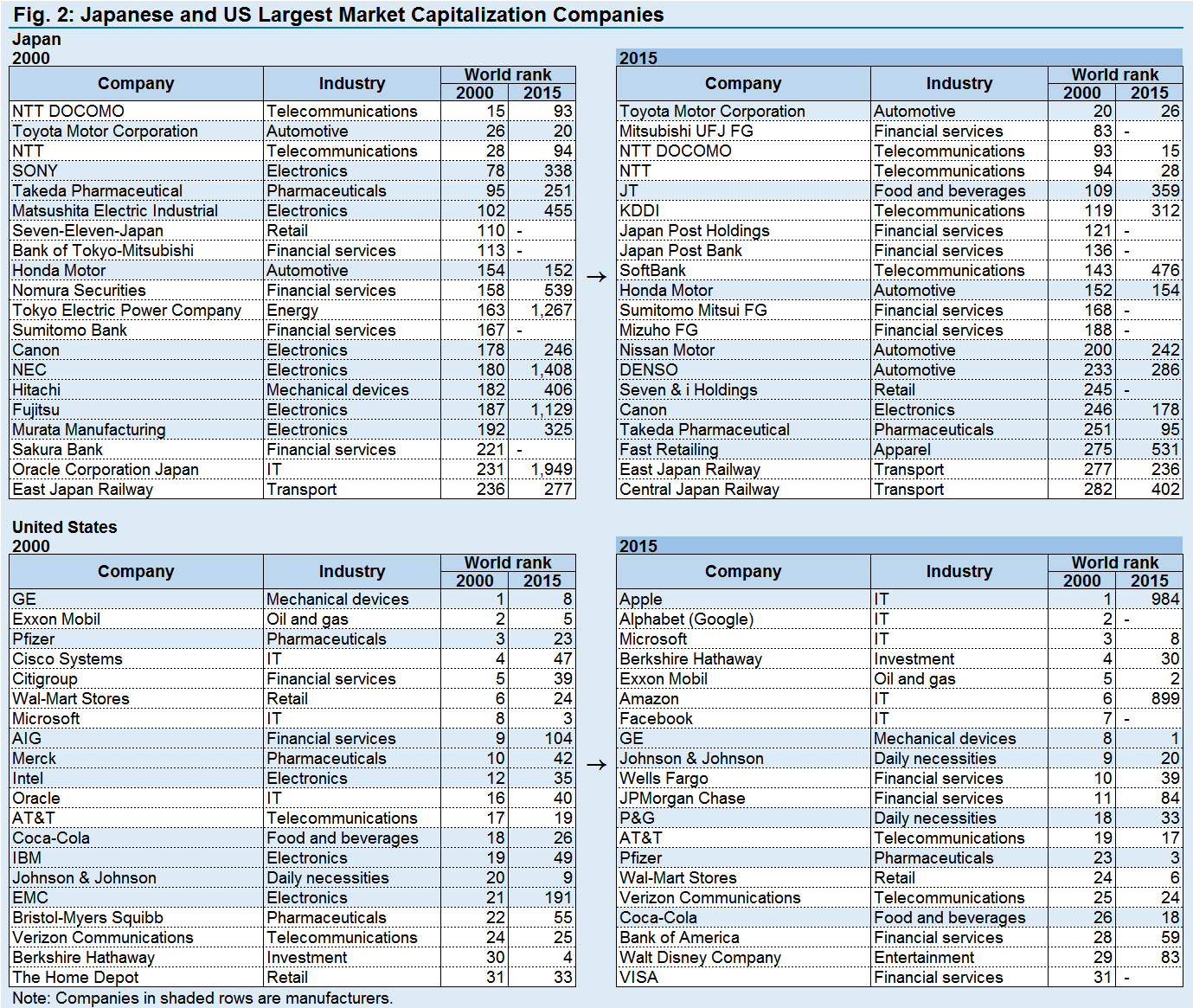

To give an example of this, the number of Chinese companies (including companies based in Hong Kong, Macau, and Taiwan) ranked in the world’s top 5,000 companies by market capitalization (publicly-traded company ranking on a USD basis; the same applies hereafter) sharply increased from 512 as of the end of 2000 to 1,301 as of the end of 2015 (Fig. 1). Companies in the manufacturing sector account for nearly half of the net increase of 789 companies. In the meantime, the number of ranked Japanese companies significantly decreased from 667 to 424, and nearly 60% of the net decrease of 243 companies are in the manufacturing sector. This example shows that Chinese manufacturing companies, armed with cheap labor, have been chipping away at the business footing that Japanese companies established across the world making best use of its highly efficient and low cost manufacturing processes. Japanese companies fought back by taking their production shift to emerging countries with low labor costs one step further, but couldn’t contain the momentum of offensives by Chinese companies. As shown in the top 20 Japanese companies by market capitalization, instead of manufacturers such as Sony and Matsushita Electric Industrial (Panasonic), which significantly receded from their positions between 2000 and 2015, companies with high public aspects based on domestic markets in Japan, such as those of telecommunications, transport, and financial services, were pushed up and gained their positions (Fig. 2).

Still vulnerable after the fiscal and financial crisis, European companies also lost their positions noticeably in the world ranking by market capitalization just as Japanese companies did. Nevertheless, 70% or more of the net decrease in the number of European companies ranked in the top 5,000 are financial services and other non-manufacturing companies, presenting a situation that is quite different from Japan. Compared with Japanese and European companies, the setback of North American companies in the ranking is minor. Looking at the top 20 US companies by market capitalization, manufacturers in the US lost their positions between 2000 and 2015 just like the ones in Japan. However, IT companies have been rapidly gaining power seemingly filling in the places occupied by manufacturers (Fig. 2). We can see that the dynamism in the US economy, in which the outcome of technological innovation is immediately put into practice as a new business and giant companies are created in succession, has lasted since the second industrial revolution era in the late 19th century and is still sustained today.

In Japan, a number of companies such as the internet retailer Rakuten (ranked 720th in the world’s largest market capitalization ranking in 2015), the social networking service Mixi (3,384th), and the smartphone game developer GungHo (3,666th) have grown as well, but the pace of their growth is limited compared with their US counterparts, Amazon (6th) and Facebook (7th), or even with Chinese counterparts, the online retailer Alibaba (21st) and the social networking service Tencent (27th), which have become giants by benefitting from growing domestic markets.

Electronics industry suffered

Whereas a large fraction of the decrease in the number of Japanese companies ranked in the world’s top market capitalization companies was made up of companies in the manufacturing sector, the situations greatly differ among various industries. The electronics industry in Japan was driven into the most severe situation by companies of emerging countries against which the industry fiercely competed. Over 84 companies, or 10%, of 667 Japanese companies that were ranked in the top 5,000 companies by market capitalization in 2000 were electronics, constituting one of the key industries underpinning the Japanese economy. However, in 2015, more than half of them (49 companies, including companies eliminated from the ranking due to merger, etc.) dropped out of the ranking. Most of the still-ranked companies as well, including Sony and Matsushita as shown in Fig. 2, moved down in the ranking considerably. On top of that, not only did they lose their positions to high-growth companies but also their market capitalization value dropped, showing an unmistakable decline in the overall electronics industry. By contrast, in the other Japanese key industry, the automotive industry, only four dropped out of the ranking out of 29 companies (including automotive components manufacturers) ranked in the top 5,000 in 2000, and most of the remaining companies still retained their positions, more or less, in the world ranking.

The reasons for this contrast are as follows: (1) Automobiles require that a product manufacturer and components manufacturer work closely together. Integration of processes from the stages of development through manufacturing constitutes an essential part of the production of automobiles. This has made it difficult for companies of emerging countries to manufacture high-quality products. Meanwhile, (2) electronics are module assembly products in which large portions can be manufactured by fabricating general-purpose components. This has helped companies of emerging countries in becoming able to produce high-quality products relatively easily at low cost, leading to intensified price-cutting competitions.

Basically, these situations will not change anytime soon. Nevertheless, with rising wages and economic growth slowdown expected in China, which is becoming a middle-income country, price-cutting pressure from Chinese companies is more likely to dwindle away. The next major trend in Japanese electronics industry could be: (1) segregation from companies of emerging countries by focusing on devices that Japanese companies have technological advantages over those of emerging countries and industrial-use electronics with less volume efficiency; or (2) business restructuring including forming business alliances with companies of emerging countries as symbolized by the acquisition cases of SANYO Electric’s home appliance business by the Haier Group and Sharp Corporation by Hon Hai, and subsequent industrial recovery. Meanwhile, Japanese advantageous positions in automobiles, the manufacture of which requires coordination between a product manufacturer and components manufacturer, are widely thought to be solid. However, an acceleration in the shift to electric vehicles (EVs), each of which has more module assemblies than a vehicle driven by an internal combustion engine, would offer more business opportunities for Chinese companies and the US IT companies, undermining the relative advantages of Japanese companies. The trend of EV shift is very limited at the moment, yet it’s possible for the situation to change remarkably if any movements arise to drastically tighten environmental regulations confronting climate change.

In the non-manufacturing industry, as a result of the selection and regrouping process in the retail and banking sectors, which experienced critical situations in the 1990s and the 2000s, the number of companies ranked in the world’s top market capitalization companies decreased substantially. In the retail sector, which fell into grueling, excessive competitions when new store opening rush intensified in the wake of the eased Large-Scale Retail Store Law, consolidation into two major groups (Seven & i Holdings and Aeon) and to leading companies of each category, such as department stores and home improvement stores, took place. As a consequence, while the number of Japanese companies ranked in the world’s top 5,000 companies by market capitalization decreased from 47 in 2000 to 28 in 2015, the total of their market capitalization saw a 1.4-fold increase, which is translated into an increase of approximately 5% in real terms and means that the market’s evaluation of the potential of the retail sector as an industry has sustained. In the banking sector, whose financial standing deteriorated significantly due to the burst in the 1990s of the “bubble economy”, consolidation into leading companies such as the three megabanks and major regional banks had occurred. The number of companies ranked in the world’s top 5,000 companies by market capitalization decreased from 75 in 2000 to 27 in 2015. Yet, the total of their market capitalization saw a 1.5-fold increase.

The selection and reorganization phase in the retail and banking sectors is about to end at this point in time. Top retailers have established new business models for the development and production of private brand (PB) merchandise, the provision of a wide range of services utilizing store networks, the development and administration of commercial facilities, and so forth. After the consolidation to leading companies and strengthening of the financial base of each new organization progressed, the Japanese banking sector recovered well enough to earn a reputation as the steadiest financial system in the world at the time of the global financial crisis in late 2008. Now that overall corporate strength has been regained, both retail and banking companies are ramping up their business activities for advancing into emerging countries in recent years in an effort to profit from globalization.

Anticipation of transformation and creation

In view of the trend in top market capitalization companies, the decline of Japanese companies that started in the 2000s can be considered as a phenomena seen only in few limited industries. However, the electronics industry was at its core, one of the key Japanese industries with a broad base of small and medium-size companies, which deepened the sense of stagnation in the overall Japanese economy. In order to get out of this situation, the creation of new key industries is called for, in addition to the recovery of the electronics industry itself as described above.

In the United States where the stock markets and investment funds have been developed, numerous cases were seen in which while companies in declining industries either drastically downsized or retreated from the markets, start-up companies opened up new business and grew into global giants. By contrast, in Japan where the indirect financing is predominant, it is less likely to quickly developing start-ups. But quite a number of companies in sunset industries have succeeded in the transformation of their business by incorporating new business domains and maintained their existence. In recent years, in the photographic film industry whose markets sharply shrank on the back of the prevalence of digital cameras, the US company Eastman Kodak (ranked 467th in the world by market capitalization in 2000) filed Chapter 11 bankruptcy protection and downsized its operations. On the contrary, Fujifilm in Japan symbolically maintained its operations by making a shift to printing equipment and materials, recording media, and medical equipment and pharmaceuticals businesses. The company’s position in the world’s market capitalization ranking was down from 264th in 2000 to 533rd in 2015, but its value itself showed a modest increase.

The companies that achieved the transformation of their business, in most cases, have chosen fields where (i) they are able to make the most of their technologies and know-how they have accumulated and (ii) they can also expect market growth, as their new stages. In the field of healthcare, not only Fujifilm, which selected as one of its focus fields to replace photographic films, but also other companies are entering the market from various industries in anticipation of market growth on the back of the aging society. This situation may lead to the formation of a new industry inclusive of pharmaceuticals, equipment and materials, services, etc. With one of the key industries in a predicament, the decline of Japanese companies is irrefutable. Even so, we look forward to new key industries being created amid the movement of companies that fight back and strive to transform their business.