Mitsui & Co. Global Strategic Studies Institute

The Food Manufacturing Industry -- Direction and Potential of Its Growth --

Jul. 7, 2016

Katsuhide Takashima

Industrial Studies Dept. II, Mitsui Global Strategic Studies Institute

Main Contents

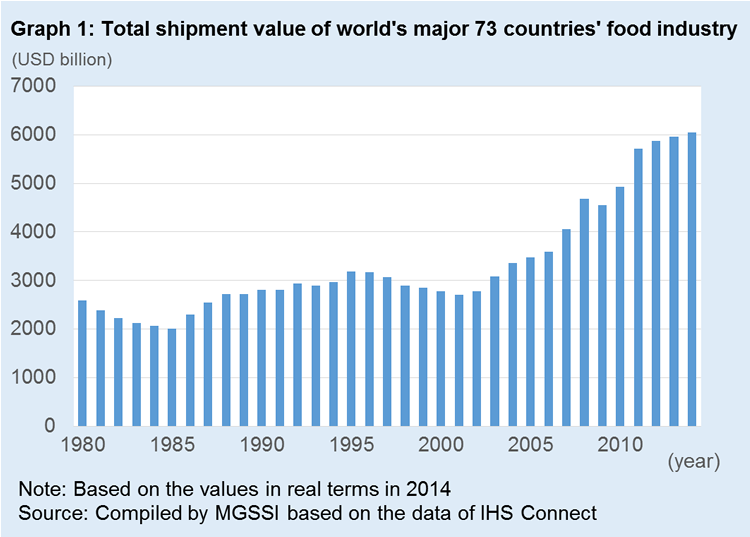

The world’s food manufacturing industry was stagnant until 2000. Since 2000, however, it has grown remarkably, mostly in emerging countries. The total shipment value of the food industry (including beverages) of the world’s major 73 countries in 2014 hit USD 6.0468 trillion, 2.2 times as much as that in 2001 in real terms (Graph 1). Although global growth has been dull on the whole since 2011, situations vary widely from country to country. While the average annual growth rate from 2001 to 2011 was positive in all of the 73 countries, in regard to the period from 2011 to 2014, the rate was negative in almost half thereof (35 countries), thereby exposing the position of each country’s food industry as well as the disparities of their strength as an industry.

The Exports, Key Factors of Recent Growth

Since 2000, when the total shipment value of the world’s food manufacturing industry started to rise sharply, exports have also surged. The average annual growth rate of the exports of the world’s food manufacturing industry from 2001 to 2011 was 9.6%, above that of the shipment value thereof for the same period, which was 7.7%. While the average annual growth rate of the exports fell to -2.6% in 2012, the rate bounced back to 2.1% and 5.7% in 2013 and 2014, respectively, both of which are higher than the 1.5% and 1.4%, respectively, of the average annual growth rates of the shipment value for the same years. When we examine the food manufacturing industry by country, it is apparent that the industry tends to have a high export ratio in countries where it has a strong presence in the country’s whole economy. In developed countries where the domestic market is generally saturated and other industries are developed, the food manufacturing industry tends to be a relatively small share in the country’s economy. In Ireland, the Netherlands, and Hungary, however, the ratio of the food industry’s shipment value to the country’s GDP (“Ratio to GDP”) trends at a higher level, compared to that of the global average, which is 8.1% (Ratio to GDP of Ireland is 13.4%; the Netherlands, 10.2%; and Hungary, 10.6%). A close look at the increase in the exports of the food manufacturing industry of these countries in recent years reveals that their average annual exports growth rate from 2011 to 2014 was also high: Ireland (4.7%); the Netherlands (6.9%); and Hungary (7.7%). Their major exports are as follows: in the case of Ireland, dairy products (such as cheese and baby food) and alcoholic beverages (such as distilled liquor and beer); the Netherlands, dairy products (such as cheese); and Hungary, traditional wine and others. Meanwhile, in the cases of Belgium and Denmark, although their Ratio to GDP is not high, the export ratio of the food manufacturing industry of these two countries are markedly high: Belgium, 71.3%; and Denmark, 73.3%. Belgium’s major exports include chocolate products, and those of Denmark include dairy products (such as cheese) and processed meat (such as bacon and ham).

Likewise, Germany, Italy, Spain, and Portugal have a low Ratio to GDP and a high export ratio. These countries export highly-processed food (such as ready meals, including frozen food), alcoholic beverages (such as wine and beer), processed vegetables (such as tomato puree), pasta, cooking oil (such as olive oil), and seasonings.

A common thread of the countries above is their history of traditionally producing and consuming food whose value has been appreciated worldwide, such as chocolate and wine. Meanwhile, attention should also be paid to another type of food exports expansion, which has been achieved through the emigration of people to other countries. In the case of Poland, for example, a large number of immigrants moved from Poland to the U.K., prompting an increase in the number of Polish grocery stores in the U.K., as well as the exports of processed meat (such as sausages) to the U.K.. This contributes to the high export ratio of Poland’s food manufacturing industry, which is 23.0%.

Quality Ingredients, Driving Forces for Growth

In the cases of Malaysia, Indonesia, Thailand, Turkey, Morocco, Chile, and Vietnam, both the Ratio to GDP and the export ratio are high. In Malaysia and Indonesia, palm oil is a major export. In the case of Indonesia, besides palm oil, instant noodles are manufactured and exported by Indofood, a major local food manufacturer. From Thailand, canned chicken and processed shrimps are exported mostly to developed countries in Europe, as are processed nut products (such as those using hazelnuts), dried fruit (such as figs), tomato puree, and others from Turkey. Morocco is active in exporting canned and bottled processed seafood (such as octopus and squid), and olive oil as well. In the case of Chile, a country blessed with abundant grape yields, wine is a major export. In Vietnam, Vinamilk, a major local company, manufactures and exports dairy products to its neighboring countries in Southeast Asia. Besides its high export ratio, Vietnam has a noticeably high Ratio to GDP (33.9%), which attests to the fact that, in Vietnam, the food manufacturing industry occupies a substantial position in the country’s economy. A common factor found in the countries above is the ample production of quality food ingredients. Meanwhile, with regard to developed countries, attention should be paid to New Zealand, a country that is active in farming and produces a large amount of fresh milk. As typified by Fonterra, a major company in the country, the value of processing in and the exports of dairy products from New Zealand are surging. In addition to the high export ratio, New Zealand has a relatively high Ratio to GDP compared to other developed countries.

In the countries mentioned above, the surge of both the exports of food and the food industry’s shipment values has continued even beyond 2011, with the rise of the exports serving as the driving force of the industry’s growth. Although the exports of Thailand fell due to political instability, as did those of Malaysia and Chile due to sluggish agricultural yields resulting from bad weather, the exports of Malaysia and Chile are recovering. In 2014, Malaysia’s and Chile’s exports increased by 17.0% and 5.5%, respectively, on a year-on-year basis.

Countries with Growth Potential

When we look at various countries’ track records, it is evident that there are a number of cases where the food manufacturing industry grew substantially, stimulated by a surge of domestic demand, as has been seen in China. As such, countries with a large population, such as India, might well hope for an expansion of domestic demand. That said, the growth of the domestic food market is inclined to slow down as the income level goes up. Hence, it is not realistic to try to sustain the industry’s long-term growth only through domestic demand. For the food manufacturing industry’s sustainable growth, an increase in exports is the key. Going forward, it will most likely be in those countries that have quality ingredients for processed food that will have the potential for their food manufacturing industry to develop into an export industry and major national industry.

Except for the U.S. and the Netherlands, where the food manufacturing industry has already matured, the countries that have large export value of unprocessed agricultural products (excluding non-food items (such as gum), and grains (which are processed mostly in the countries of consumption)) are Brazil, China, Argentina, Indonesia, and India, among others. The ratio of the exports of unprocessed agricultural products to the country’s GDP in 2013 was noticeably high in Argentina (5.8%; beef and others), Kenya (5.0%; tea leaves and coffee beans), Jordan (4.3%; tomatoes and others), Senegal (3.6%; peanuts, millet, and others), Sri Lanka (3.4%; coconuts and tea leaves), and Cameroon (2.4%; cocoa and coffee beans).

The food manufacturing industry in the countries above has the potential to grow by domestically processing the food ingredients that they currently export unprocessed. In the case of Kenya, for example, coffee, tea, dried fruit, etc. are already manufactured as export items, and the export ratio of the food manufacturing industry in 2014 was as high as 46.0%. That said, some export items of the country, such as mangos, peanuts, and tomatoes, are exported unprocessed. Considering Kenya’s low Ratio to GDP (6.6%), there is plenty of room for the country’s food manufacturing industry to grow into an export industry, taking advantage of the food ingredients Kenya has. The Kenyan government aims to expand the country’s food manufacturing industry by processing agricultural products, thereby heightening their added value. Furthermore, industrialization of the food business is gaining momentum in Kenya, as seen in the circulation of processed herb products (such as ground ones) in the market, an outcome of the industrialization of simple processes in the course of herb processing that used to be performed at home.

The underdevelopment of the food manufacturing industry in the countries above is attributable to the deficiencies in machinery, equipment, and workforce required to industrialize the ingredients processing. These countries’ food manufacturing industry is highly likely to expand if more capital is injected going forward. In such case, collaboration with corporations from developed countries may well trigger growth. Indeed, there are cases where, as a result of foreign capital injection, manufacturing equipment was improved and the company that received the capital became a manufacturing base of the products intended for neighboring countries. Let us take Nigeria, a beverage bottling hub, as an example. The Nigerian Bottling Company, which manufactures and distributes beverages (such as Coca-Cola), and Guinness of Ireland export products manufactured in Nigeria to neighboring countries. Nigeria’s food manufacturing industry’s high export ratio, which stands at 38.7%, is partly attributable to them. Since Nigeria is an active producer of agricultural products, such as sesame and cocoa beans, the country has an option to, first, process, and then export these products. Nigeria’s domestic company, Dangote Group, has a large presence in the country’s domestic food processing market, such as in sugar processing and flour milling. It is arguably hard to say that the food manufacturing industry is developed in Nigeria, with the Ratio to GDP being as low as 1.4%. Nevertheless, given the existence of large corporations, such as Dangote Group, the country’s growth potential appears huge. Continued attention should be paid to the future trends of the country’s food industry.