Mitsui & Co. Global Strategic Studies Institute

Hong Kong Increasing its Presence as Springboard for Chinese Companies to Go Global

Feb. 16, 2018

Takuma Yatsui

Asia, China & Oceania Dept.

Mitsui & Co. Global Strategic Studies Institute

Main Contents

Since China launched its reform and opening-up policy in the late 1970s and started to aim for economic development by inviting foreign investment, Hong Kong has been an attractive destination for overseas companies wanting to gain a foothold in China. More recently, Hong Kong has increasingly served as an investment hub for Chinese companies seeking to expand overseas, as direct investment from China rises. In this report, we will look at changes in the role of Hong Kong in doing business in China, with a focus on Hong Kong’s strengths in assisting Chinese companies going global.

Chinese Companies Taking Advantage of Hong Kong's Unique Edge in Expanding Overseas

First, we will look at direct investment from China and establishment of business entities/offices by Chinese companies in Hong Kong.

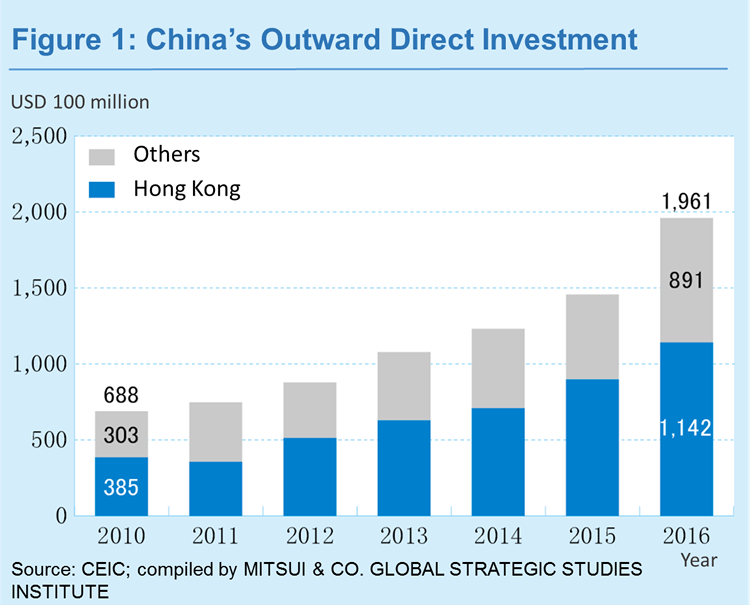

Hong Kong is the largest destination of China’s outward direct investment. In 2016, China’s direct investment in Hong Kong came to USD 114.2 billion, accounting for 58.2% of total outward direct investment (Figure 1). Most of this amount was actually invested in third countries via Hong Kong. Data released by China’s Ministry of Commerce shows that among Chinese outbound M&A deals in 2016, the following were conducted via Hong Kong: (1) Quingdao Haier’s acquisition of US industrial giant General Electric’s (GE) appliance business (acquisition price: USD 5.58 billion), (2) Tencent and other companies’ purchase of a Finish gaming company (USD 4.1 billion), and (3) China Three Gorges Corporation’s acquisition of hydroelectric dam operations in Brazil (USD 3.77 billion).

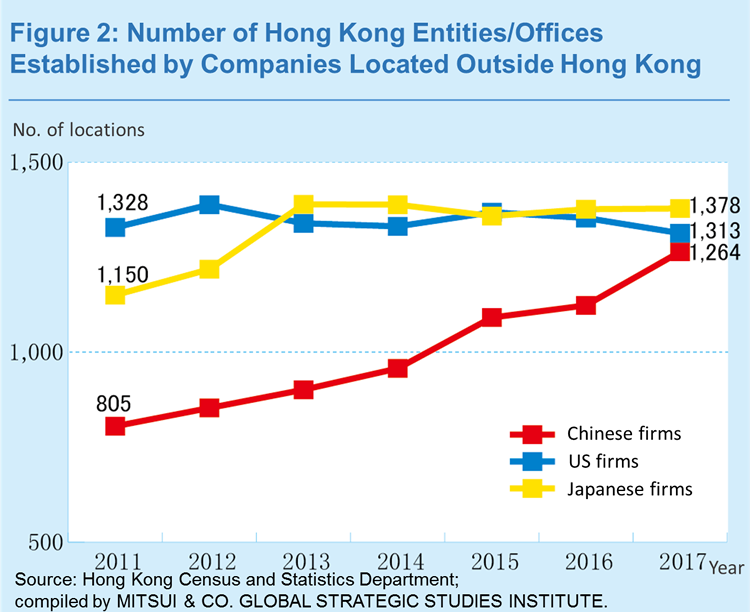

The number of Chinese companies setting up business entities/offices in Hong Kong is also increasing. According to a survey by the Hong Kong government, the number of entities/offices established by Chinese Mainland companies stood at 1,264 in 2017, coming close to those established by Japanese firms (1,378) and US firms (1,313) (Chart 2). Of note, 350 (about 28%) out of the 1,264 control and support operations not only in Hong Kong but also in other countries and regions. An increasing number of Chinese companies are using their Hong Kong entities/offices as a hub for global operations.

The reasons why Chinese companies use Hong Kong as a hub for global expansion include the fund-raising function of Hong Kong. The number of Chinese companies listed on the Stock Exchange of Hong Kong was 1,049 as of 15 December 2017, accounting for roughly 50% of the total listed companies. Chinese companies raised a total of HKD 322 billion (about USD 41.0 billion) in 2017 through initial public offerings and share sales on the Hong Kong market. They have utilized such funds in operations not only in Hong Kong and Mainland China, but also in other countries.

Another major reason is the freedom of capital movements, i.e., funds raised in Hong Kong can be invested overseas with few restrictions. In China, the government has stepped up its capital regulations to rein in capital outflow since mid-2016. In August 2017, it issued a directive that categorizes outbound investment into three groups – encouraged, restricted, and prohibited – and imposed tougher rules for outbound investment in the areas of real estate, hotel, and leisure. In Hong Kong, however, there is no direct restriction on Chinese companies investing funds raised in Hong Kong outside the territory, under the “one country, two systems” framework. As such, Chinese firms are taking advantage of Hong Kong for more efficient outbound investment and capital management.

Hong Kong's Efforts to Attract Chinese Companies Expanding Overseas

Meanwhile, Hong Kong is working aggressively to attract Chinese companies that accelerate their overseas expansion. One of the important policies taken by the Hong Kong government is preferential tax treatment for corporate treasury centers (implemented April 2016). When establishing a corporate treasury center that meets certain requirements, foreign companies and Chinese companies can benefit from (1) deduction of interest expenses associated with borrowings from overseas affiliates in calculating taxable income, and (2) reduction of the corporate tax rate applied to taxable income arising from financial activities (i.e., interest income associated with loans to overseas affiliates) from 16.5% to 8.25%.

China General Nuclear Power Group (CGN), a major state-owned energy company, is one of the Chinese firms that have established a corporate treasury center in Hong Kong. According to a case study booklet released by the Hong Kong Monetary Authority, which illustrates activities of corporate treasury centers, CGN established a Hong Kong-based subsidiary CGNPC Huasheng Investment Limited (CGN Huasheng) in 2010, through which the group conducts financing and cash management activities for overseas operations. In recent years, CGN has actively invested in overseas projects, including a project to construct a nuclear power plant in the UK, leading to greater funding needs and increasing necessity to manage foreign currency revenue earned through overseas operations. As such, the group set up a corporate treasury center in Hong Kong, where there are no limits on foreign exchange and flow of capital, to centralize their treasury activities overseas, and aims to enhance efficiency and reduce costs in its financial activities.

The favorable tax treatment for corporate treasury centers is not limited to Chinese companies. However, Hong Kong is apparently focusing on attracting Mainland enterprises, which are accelerating their global expansion. For example, Norman Chan, Chief Executive of the Hong Kong Monetary Authority, visited Mainland China in July 2017 and encouraged Chinese companies to set up their corporate treasury centers in Hong Kong. During his visit, large state-owned enterprises including China Huaneng Group, State Power Investment Corporation, and China Three Gorges Corporation expressed their intention to open or scale up their treasury centers in Hong Kong. Mr. Chan also pointed out that many multinational companies tend to set up their corporate treasury centers and regional headquarters in the same location and that the growing popularity of Hong Kong as a hub for corporate treasury centers will be conducive to inviting multinational companies’ regional headquarters and Chinese companies’ entities/offices to control their overseas operations.

Of note, Hong Kong plays an active role in China’s Belt and Road Initiative, which is aimed at promoting economic corporation across Europe and Asia. In July 2016, the Hong Kong Monetary Authority (HKMA) established Infrastructure Financing Facilitation Office (IFFO) to facilitate infrastructure investments and associated financing activities via Hong Kong. A number of Chinese and multinational organizations, including large financial institutions and major players involved in infrastructure development have joined IFFO as partners. IFFO encourages them to utilize Hong Kong’s quality professional services (such as finances, legal, accounting, tax, and engineering) related to infrastructure investment and financing, by organizing workshops for information exchange and experience sharing among partners. The number of partners increased from 41 at the time of the establishment to 87 as of January 2018. IFFO is increasing its presence, as several key players in infrastructure development in China, three megabanks in Japan, as well as Mitsubishi Corporation (Hong Kong) Ltd. and Mitsui & Co. (Hong Kong) Ltd. joined as partners.

Utilizing Connections with Southeast Asia

With their foothold in Hong Kong, Chinese companies are making inroads into overseas markets, particularly those in Southeast Asia. Hong Kong is geographically close to Southeast Asia, and has close links with Chinese residents or people of Chinese descent living in the region. There are many ethnic Chinese conglomerates, such as Lippo Group in Indonesia, Charoen Pokphand (CP) Group in Thailand, and Kuok Group in Malaysia, which conduct business in China by establishing business entities/offices in Hong Kong.

The Bank of China Group, one of the four largest state-owned commercial banks in China, is one such company that supervises Southeast Asia business through a subsidiary in Hong Kong. The group has transferred assets and operations in Malaysia, Thailand, and Indonesia to Bank of China (Hong Kong) since October 2016, and plans to do so for operations in Cambodia, Vietnam, and the Philippines. The subsidiary has been enhancing its Southeast Asia business by opening a branch in Brunei in October 2016 and providing a USD 100 million loan to a fiber optic cable infrastructure project in Myanmar, with guarantees from the Multilateral Investment Guarantee Agency (MIGA), a member of the World Bank Group.

The relationships between Hong Kong and countries in Southeast Asia are expected to deepen through the free trade agreement (FTA) and the investment agreement signed by the Chinese territory and the Association of Southeast Asian Nations (ASEAN) in November 2017. The agreements will enter in force on 1 January 2019 at the earliest. On trade in goods, Singapore has agreed to eliminate its customs duties on goods originating from Hong Kong as soon as the FTA takes effect, and other ASEAN nations will also gradually reduce their customs duties on Hong Kong goods. As for trade in services, the FTA opens the doors of markets for Hong Kong’s competitive service sectors. According to the Hong Kong government, the ownership cap for Hong Kong companies in local companies in Thailand, the Philippines, and Vietnam, will be raised to 50-100% in many sectors. The strengthened economic cooperation between the two parties will likely serve as a tailwind for Chinese companies’ making inroads into Southeast Asia via Hong Kong.

In this report, we focus on the role of Hong Kong as a hub for Chinese companies to go global. Chinese companies are taking advantage of the unique business environment in Hong Kong, which has been developed under China’s “one country, two systems” principle. Hong Kong is attracting Chinese firms which are accelerating their overseas expansion, and the Chinese authorities are utilizing the territory to satisfy the need for Chinese companies to make inroads into international markets, while maintaining capital controls in Mainland China. In recent years, there have been some media reports focusing on political and social conflicts between Mainland China and Hong Kong, saying that the “one country, two systems” framework has become a mere facade. However, at least on the economic side, both Mainland China and Hong Kong are fully taking advantage of the “one country, two systems” principle, and Hong Kong is taking on a new role of assisting Chinese companies going global. As Hong Kong’s role in doing business in China is changing, Japanese companies may need to pay renewed attention to the competitive edge of Hong Kong when considering collaboration with Chinese companies in third countries.