Mitsui & Co. Global Strategic Studies Institute

Industrial Digitalization in Europe - The Growth of Startups and the Transformation of Established Firms -

Oct. 4, 2017

Michiyo Sakai

Industrial Research Dept. II

Mitsui & Co. Global Strategic Studies Institute

Main Contents

US tech giants such as Google have risen to global prominence since the early 2000s. In addition to moving into various industrial fields, including automobiles, these companies are stepping up their efforts to create new products and services integrated with innovative technologies, in line with the restoration of domestic manufacturing in the US. There has also been a rapid improvement in the technological capabilities of Chinese companies in recent years. In Europe, too, with the launch of high-tech strategy “Industrie 4.0”, Germany, the region’s largest economy, is working to strengthen the competitiveness of its manufacturing industries, and the launch of new businesses model in the digital age, which has the potential to energize manufacturing industries, is becoming active. In France, boosted by the “La French Tech” project to support startup companies as a means of contributing to economic value and creating employment, which President Emmanuel Macron has been promoting since his time as Minister of Economy, Industry and Digital Affairs, there has been an unprecedented upsurge in entrepreneurial activity. Moreover, in both countries, there is a pronounced move by established firms wary of the danger of stagnation to pursue change by working with startups. This report examines the industrial strategy and the activities of corporations in Germany and France, the two major economies of continental Europe, and considers what lessons they may provide for corporate strategy in Japan.

Characteristics of German and French industrial structures

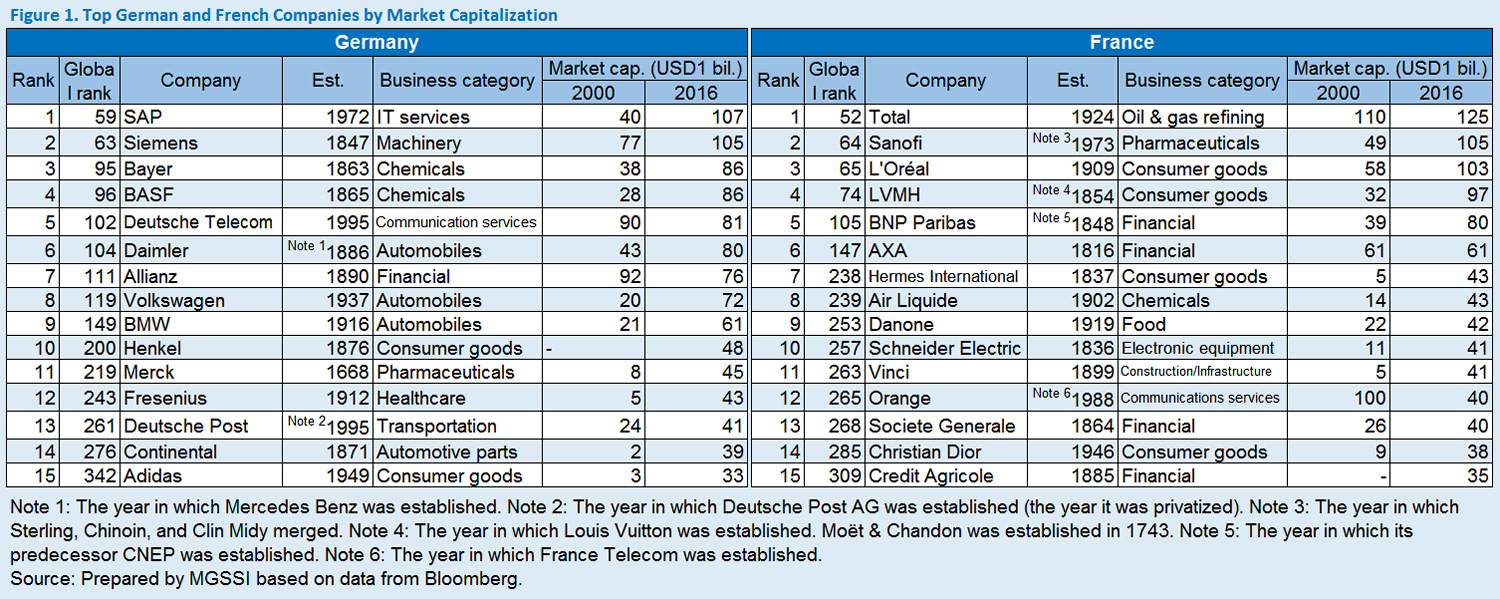

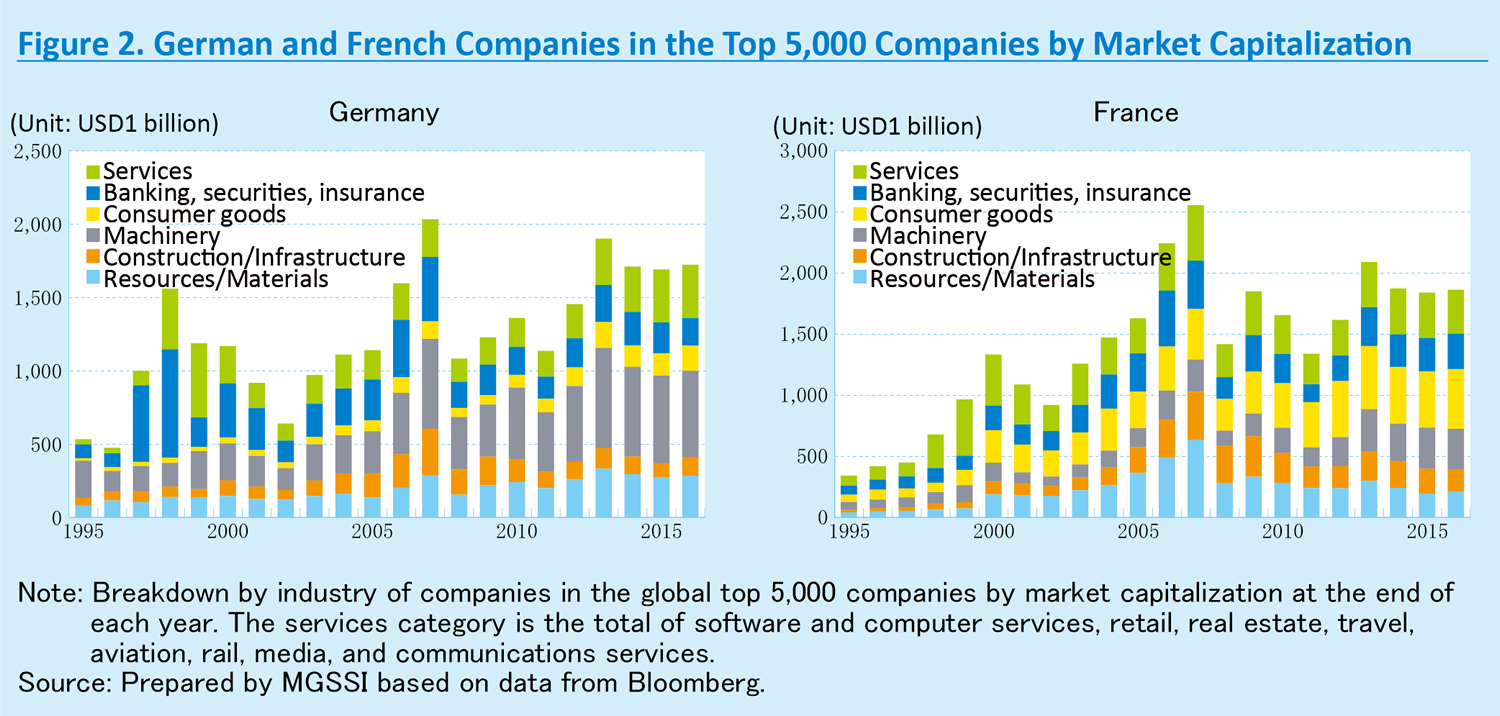

One thing that Germany and France have in common in terms of industrial structure is the prominent presence of established companies with long histories from a global standpoint (Fig. 1). However, the industrial structures of the two countries differ widely in terms of factors such as the total number of companies, the proportion of small and medium-sized enterprises, and the industrial composition. Germany has approximately 25 times more companies than France, and a distinguishing feature of the German industrial structure is its large number of profitable small and medium-sized companies (Mittelstand), also referred to as the “hidden champions”. In contrast, France is home to many giant corporations. In the top 5,000 global companies by market capitalization, France has as many entries as Germany, which has a larger economy. Furthermore, Germany’s machinery industry is particularly robust, whereas in France, companies relating to consumer goods have significant presence (Fig. 2).

Looking at technology & software companies established since 2000, as of the end of 2016, Germany had just two companies ranked among the top 5,000 global companies by market capitalization, Rocket Internet, a technology business incubator, and the travel booking site Trivago, while France had only one, the digital advertising company Criteo.

German manufacturing industries are expanding into service sector, and it drives startups

With the introduction of the Industrie 4.0 initiative, Germany is implementing a nationwide project with the collaboration of industry, academia, and government, with a view to promoting IoT, which originated in production plants, and achieving global standardization. While the initiative is focused mainly on the manufacturing industry, Germany has announced a wide variety of measures relating to the transformation of industry and society in the digital age, and in 2016 launched the “Digital Hub Initiative” modeled on Silicon Valley, and to date has designated 12 cities as digital hubs. In association with this, Germany is actively supporting business incubation and is strengthening the formation of industry-academia-government collaborative networks. In Germany, R&D is conducted by universities and independent research institutes, such as the Fraunhofer Society, the Max Planck Society, and the Helmholtz Association, and in recent years these independent bodies have been increasingly creating startups.

In Berlin, which has a fast-growing startup scene in Germany, foreign entrepreneurs are increasing because of the low rents and labor costs, and an environment that makes it easy to conduct business in English. Another factor that attracts foreigners to the city is its international and liberal atmosphere that derives from its history as the center of Germany before the Second World War and that it was sandwiched between East and West in the post-war period. A particular feature of Berlin is the prominence of startups providing e-commerce and other internet services, as manufacturing industries, one of German great strengths, have not much developed in the city. Berlin has given birth to a succession of unicorn companies, including the business incubator Rocket Internet (established 2007, listed 2014, market capitalization of USD 4.1 billion as of September 21, 2017), which launches more than 10 startups every year, as well as Europe’s largest e-commerce player Zalando, and the food delivery platform Delivery Hero. In 2015, venture capital investment in startups based in Berlin reached EUR 2.1 billion, surpassing London for the first time (Ernst & Young “Start-up Barometer”). A growing number of companies from leading SMEs to large corporations are establishing offices in Berlin as part of their digital strategy, taking advantage of the city’s favorable environment for funding and financing and information gathering.

Other than Berlin, established companies are actively engaging with startups both in Germany and overseas, thereby expanding their business operations from the manufacturing industry to the consumer services sector. Through BMW i Ventures, which was established in New York in 2011 and moved its base to Silicon Valley in 2016, BMW has made an equity investment in Moovit, a public transportation information application developer based in Israel, and is partnering with the company to integrate BMW’s sharing service “Drive Now” into the Moovit app. In addition, BMW launched BMW Startup Garage in Munich in 2015, and the company is strengthening its efforts to identify startups that offer products and services that synergize with BMW’s business.

The Bosch Group, an unlisted company in business for 131 years, also promotes the use of startups, and is expanding its business into the consumer market. The platform for Bosch’s Coup electric scooter sharing service (launched in 2016) was developed in collaboration with the Taiwanese electric scooter manufacturer Gogoro (established in 2011) and the Boston Consulting Group. In addition, the Silicon Valley start-up Mayfield Robotics, which was created by Robert Bosch Start-up, a new business development arm launched in the suburbs of Stuttgart, has announced the introduction of its home robot Kuri. In 2015, the Bosch-Siemens home appliance joint venture company BSM Bosch und Siemens Hausgeräte became a wholly-owned Bosch subsidiary, and Bosch is thereby strengthening its presence in the home appliances sector. The sector had grown to account for 20% of the group’s sales in 2016. The company has also announced the development of the “My Kitchen Elf (Mykie)” personal assistant robot. The concept of this product is to provide instant answers to questions about the content of the refrigerator, cooking methods, how long before household appliances in use finish cooking, the weather, and other information, as well as to control all the networked appliances in the home. With a view to expanding the business of the IoT sector, which will connect cars, home appliances, and houses, Bosch has set itself the target of making all its electronic products capable of being network connected, and plans to join forces with various startups involved in the development of digital home appliances. The company also announced the launch of the Bosch Center for Artificial Intelligence in January 2017, along with its plans to invest EUR 300 million in the project. Bosch is actively gathering a wide range of data required to strengthen its AI capabilities, which includes utilizing apps the company offers.

La French Tech boosts transformation of the large corporation-oriented industrial structure

Launched in France at the end of 2013, “La French Tech”, a project that supports startups and accelerates innovation, sets forth a support mechanism consisting of three pillars, namely community building, support for growth, and support for globalization. Based on them, various measures to support startups are being implemented, such as funding support, preferential tax treatment, simplification of administrative procedures, etc. The project has been promoted by President Macron, who has taken the podium at several events and conducted various other promotional activities since he was still serving as Minister of Economy, Industry and Digital Affairs (2014-2016), and his promotional activities have started to show their effect. For the past two years or so, the term “French Tech” has enjoyed increasing recognition at the CES, a global technology show held each year in the US. In the past, French entrepreneurs have moved to the US and the UK where fund-raising is relatively easier, but the various measures introduced to support startups have turned the situation around, and an increasing number of entrepreneurs are returning to France from overseas. Moreover, traditionally in France, people have preferred to work for large corporations and the public sector, but more young people now aspire to start up their own businesses. Venture capital investment in France stood at EUR 2.7 billion in 2016, which is second in scale only to the UK in Europe. In the 2016 Delloite Technology Fast 500TM Europe, Middle East & Africa list, which ranks technology companies based on their growth rates, France took the top spot in terms of the number of companies in the list by country.

There are also companies that are bringing about a change in the country’s industrial structure. As a result of the increase in the number of users of the BlaBlaCar (established in 2006), the world’s largest long-distance ride sharing company that operates in 22 countries, France’s national rail company, SNCF, has reviewed its traditional offerings, launching new services including low-price high-speed train journeys and bus travel. In response, in May 2017, BlaBlaCar announced the launch of “BlaBlaCar Lines”, which provides car sharing along regular routes where demand is high in an attempt to provide a service similar to local scheduled bus services. In addition, the IoT network provider Sigfox (established in 2009) makes it possible to connect several devices and sensors over the Internet at low cost, and as a leading global LPWA (Low-Power, Wide-Area) communications service provider, the company currently operates in more than 26 countries. Sigfox’s technology is now a leading candidate for adoption as the global standard.

As such, many large enterprises have begun to formulate programs to respond to digitalization and to collaborate with startups, and long-standing consumer service companies, such as LVMH and L'Oreal, which have had little connection with digital technology, also see the potential to use startups to promote innovation. Words such as “Luxury Tech” and “Beauty Tech”, which reflect the type of their business, have entered the language. The leading luxury consumer products company LVMH has begun pursuing integration of its operations with the Internet. It has appointed Ian Rogers, a former executive of Apple Music division, as its Chief Digital Officer, and in June 2017, established the “24 Sèvres” e-commerce site that can be accessed and used to purchase and receive goods in 70 countries (the site is named after the Paris address of the long-established Le Bon Marché department store that is a part of the LVMH Group and that operates the site together with LVMH). The site sells 150 luxury womenswear brands, including affiliated brands, and is equipped with a variety of functions, such as a video consultation service that allows customers to consult with stylists by a face-to-face video chat using a smart phone app, and a style bot function that automatically recommends products based on a customer’s preferences via the Facebook messaging app. The specialist cosmetics chain Sephora, another LVMH affiliate, collaborates with several startups, including companies providing platforms offering personal beauty advice to individuals, and utilizes knowledge and information gained through these services for product development and new services. In addition, LVMH established the “LVMH Innovation Awards” in February 2017, and after receiving entries from a large number of startups, the award went to a startup that analyzes trends for retail service companies using artificial intelligence.

While L'Oreal also promotes collaboration with various startups, particularly notable is that it also conducts joint R&D with a company possessing advanced biotechnology, and is working on a project to develop bioprinting of hair follicles with the French company Poietis that possesses laser-assisted bioprinting technology for creating biological tissue. Poietis has also concluded an R&D contract with BASF in the area of functional skin care cosmetics.

Expectations for evolution and suggestions for Japanese companies

While Germany has seen a remarkable rise in the emergence of fledgling companies in Berlin in the retail service sector, including e-commerce, leading established German manufacturers are also focusing attention on global innovation, and are seeking to evolve into companies that retain a leadership role in Europe and the world through the incorporation of startups. In France, too, large established companies are also expected to incorporate startups and evolve in areas such as the consumer goods and services sectors where France has a competitive edge in design.

Among startups in Germany, where many unlisted family firms have taken root, there is a culture that considers it undesirable for a firm to be purchased by a foreign company. In France, many entrepreneurs prefer their ideas to be bought by large companies rather than growing a company into a large corporation themselves. In both countries, it is possible that the mainstream method used by startups will be to collaborate with established companies and not necessarily aim to become listed.

This approach characterizes the industrial ecosystem of the European continent and is clearly different from the style prevalent in the US and China where startups exploit new, revolutionary business models to grow into giant global corporations. In Japan, as in Germany and France, established companies have a large presence while the growth of startups is limited. In considering both the future of Japanese industries and the growth of corporations therein, the industrial and corporate strategies in Germany and France will serve as a source of suggestions.