Mitsui & Co. Global Strategic Studies Institute

NAFTA Renegotiations ー Implications for the Automotive Industry ー

May 10, 2017

Kosuke Nishino

Industrial Studies Dept. I

Mitsui & Co. Global Strategic Studies Institute

Main Contents

The History and Background of the Conclusion of NAFTA

The North American Free Trade Agreement (NAFTA) was envisaged in response to Mexico’s economic reforms in 1983. Mexico had restricted foreign investment to protect its domestic industries for many years, which resulted in the preservation of inefficient industries. However, a debt crisis in August 1982 became a major turning point for Mexico to steer its economic policy towards opening its doors to foreign investment, as well as market liberalization and enterprise privatization.

While pressing forward with trade liberalization and tariff reduction, the Mexican government also expanded inward foreign direct investment (FDI). Many of the companies that made inroads into Mexico were multinational corporations from the US, and they divided their internal processes between the US and Mexico. This division of labor became a large part of US-Mexico trade, many of which was from transportation equipment industries, including the automotive industry.

Amid this situation, NAFTA came into force in 1994. On the US’s part, what was the intention behind its accession to NAFTA? By that time, the US trade deficit had ballooned due to export thrusts from Asian countries, including Japan, and the revitalization of American manufacturing was a great challenge. NAFTA, if in effect, could create conditions for US companies to be able to operate in the three North American countries as they do at home. Particularly, the US hoped to take advantage of cheap labor in Mexico in order to regain a competitive edge in its products that had been exposed to competition from other countries. On the other hand, there was a concern that moving production sites to Mexico would decrease the number of jobs within the US, which would add to downward pressure on wages.

How NAFTA Has Contributed to US Industrial Competitiveness

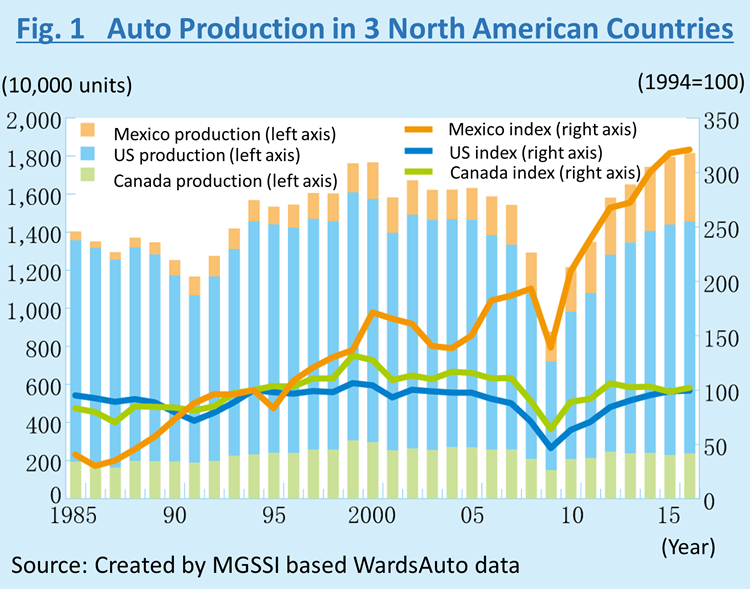

Since the mid-1990s, when NAFTA was concluded, automakers have aggressively expanded their automotive assembly capabilities in Mexico; as a result, though, auto production in the US has never seen a decline (Fig. 1). The expansion of production capacity in Mexico was absorbed by the growth in demand in the US, where its automotive market was experiencing a period of expansion. Meanwhile, the Mexican auto market did not develop as expected. Cheap labor, the mainstay of the auto industry, has been maintained to date, underlying automakers’ earnings structure. On the flip side of the coin, income did not increase for workers engaged in the auto industry, a pillar of the Mexican economy; thus the middle-class—who are supposed to be car buyers—did not grow enough. Consequently, the expansion of Mexico’s auto market progressed at a slower pace.

For the US, another benefit of NAFTA was the export of parts and materials for auto assembly to Mexico, where these goods were procurable only to a limited extent. For a vehicle to qualify as NAFTA originating, at least 62.5% of its components must be sourced in the NAFTA countries, and there are no tariffs imposed on cross-border goods within this region. In contrast, auto parts from outside the NAFTA region are subject to duties, which gives an edge to US auto parts. The US exports of auto parts and materials increased in proportion to the increase in the volume of finished cars assembled in Mexico.

To sum this (these?) up, the US and its automakers aimed to redraw economic borders that had once been between the US and other countries, by adding Mexico and Canada through NAFTA, so that they could lead competition from non-NAFTA companies to their advantage. And the main destination for these products was their domestic markets in the US.

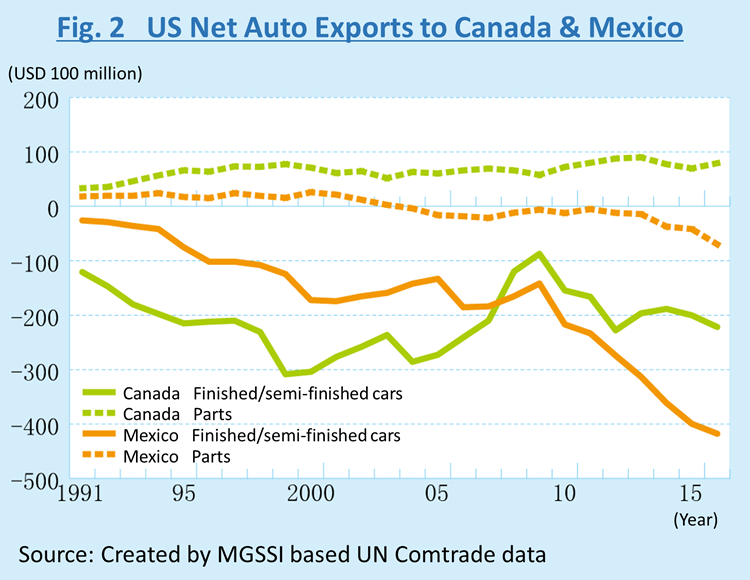

In terms of the US automotive trade with Mexico in 1994, the year when NAFTA took effect, the US had a deficit of approximately USD 4.2 billion in finished cars. In contrast, auto parts brought a surplus of USD 2.4 billion, which partly offset the deficit. However, looking at the trade of auto parts over the following 20 years or so, exports increased 3.5 times, and imports surged almost tenfold. Consequently, the US turned to a net importer of auto parts in 2004. Mexico decreased auto part imports from the US as it formed its own auto parts industry.

Meanwhile, the US’s exports of finished cars to Mexico grew more than six times from USD 700 million in 1994 to USD 4.6 billion in 2016. This, however, was approximately one-tenth of the value of finished cars that the US imported from Mexico last year. While the Mexican auto market showed limited growth, US imports of finished cars from Mexico exponentially increased from USD 4.9 billion to USD 48.8 billion. Eventually, the US trade deficit expanded 27-fold. Through structural change over 20 years, the US economy has remarkably expanded the import of finished cars and auto parts, while Mexico has increased the export of finished cars and decreased the import of auto parts; thus, the US deficit with Mexico has swollen. Regarding the relationship between the US and Canada, one of the NAFTA countries, there has been no significant change in the trade structure. From the US’s perspective, NAFTA may have evolved centering on the changes in the relationship between the US and Mexico (Fig. 2).

Looking at US trade with Japan, which caused trade friction in the 1990s, the US’s net imports of both automobiles and parts increased 1.5 times, from USD 31 billion in 1994 to USD 48 billion in 2016. During this period, Japanese automakers significantly expanded their production in the US and also increased their efforts to procure auto parts locally, but in terms of absolute value, NAFTA does not seem to have been effective in reducing the US trade deficit (Fig. 3).

Changing the Framework: Challenge and Consequences

If the NAFTA framework were modified, it would be tariff-related changes that could have the most significant impact on the auto industry. If tariffs are to be imposed on the NAFTA countries, production sites in Mexico will be treated the same as those in Japan and Germany. This means that the US would give away Mexico—the US’s backyard that has been freely used by American automakers for automotive production. Conversely, the US’s finished car exports to Mexico would be subject to a WTO bound tariff rate of 20% on average, which would, in effect, make it difficult for the US to export finished cars to Mexico. Naturally, Detroit's Big Three automakers are opposed to reviewing NAFTA.

Another issue on the discussion table is border tax adjustments. Currently, in the US, income from exports of goods and services are subject to a corporate tax rate of 35%, but a new plan would exempt exports from such corporate taxes and instead levy taxes on imports to the US, with the aim of promoting exports and hindering imports. If this plan were in place, automobiles and auto parts exported from the US, valued at USD 110 billion, would be tax-exempt, and imports worth USD 267 billion would be subject to tariffs. It may appear that this measure offers an advantage to exports from the US, thus increasing auto production and employment, as well as reducing the trade deficit. However, for the US, a country whose imports exceed its exports by USD 800 billion, domestic consumption may be significantly affected by price hikes for all products, including not only automobiles but also parts and materials, and that impact would be greater than the benefit of increased exports. Moreover, there are risks that the measure may infringe on the WTO rules, if it is considered an export subsidy in real terms. From this perspective, it is unlikely that institutional changes that could have a great impact on the auto industry will take place.

What Is Brought by “Result-Oriented” Negotiations

The Trump administration has indicated its intention to shift from multilateral negotiations to bilateral negotiations. It has also stated that the US will place priority on US laws over international rules, and correct imbalances through separate negotiations by state and sector based on the principle of fairness and bilateralism with trading partners. That concept is said to be not much different from how the US put pressure on the other party to induce concession from the 1980s to the 1990s. Back in those days, the US forced numerical targets for the import and procurement of automobiles and auto parts through Japan’s voluntary export restraint (VER) policy to the US and the Japan-US Structural Impediments Initiative. It is likely that the US will count on the efforts of its trading partners to “ultimately” reduce its trade deficit that has expanded within the WTO and NAFTA frameworks.

At this point, it is hard to predict how the NAFTA renegotiations will proceed, but it has already begun to influence automakers’ decision-making. Prior to the inauguration of the Trump administration, scores of automakers, including Japanese manufacturers, had expanded their production operations to Mexico, and it has been expected that Mexico’s production capacity would have exceeded five million units by 2020. As is known worldwide, Ford withdrew its plan to move its production site to Mexico in response to a series of messages from the Trump administration. Toyota Motors, on the other hand, has not announced any change to its expansion plan in Mexico. Up to 2020, the Nissan-Daimler joint venture and BMW also have plans for production in Mexico, but it is becoming increasingly uncertain that these companies will be able to commence operations as scheduled and increase production as initially projected.

This could have a tremendous impact on automakers, but it would have a more severe impact on the auto parts sector. From 2010 onward, in order to meet the growing production of finished cars in Mexico, tier-1 suppliers of auto parts in Japan have made inroads in the country. Many of them advanced to Mexico based on NAFTA, expecting to supply products from Mexico throughout North America. In particular, for any sector where cost competitiveness is essential, Mexico’s cheap labor is a requirement. Regarding tier-2 and tier-3 suppliers of auto parts, many of which are small- and medium-sized companies, the number of those with operations in Mexico used to be relatively small, but has gradually begun to increase. However, they would immediately find themselves in trouble if finished car manufacturers did not place orders as planned.

Pressure by the Trump administration might help reduce the US trade deficit and increase employment for the time being, but this could only hold down the deficit for the US temporarily on the surface level. From the long-term perspective, it would slow down the development of supporting industries in Mexico, which could be a bottleneck in building an efficient international supply chain. As a result, Mexico and Japan would suffer a huge loss, but it seems that the US and its auto industry also have much to lose.