Mitsui & Co. Global Strategic Studies Institute

Millennials—Their Reality and Impact on the US

May 10, 2017

Sawako Yasuda

North America & Latin America Dept.

Mitsui Global Strategic Studies Institute

Main Contents

Millennials, Saddled with More Student Loan Debt

Millennials are defined by the Oxford Dictionary as people who have reached young adulthood in the early 21st century and, typically, they were born between 1980 and 1999 (ages 18-37). In 2015, the millennial population (born 1982-2004) in the United States reached about 75.4 million, outnumbering the 70.9 million baby boomers (born 1946-1964, ages 53-71). Looking at the racial makeups of both generations, whites account for 55.7% of millennials, lower than the 72.2% of baby boomers.

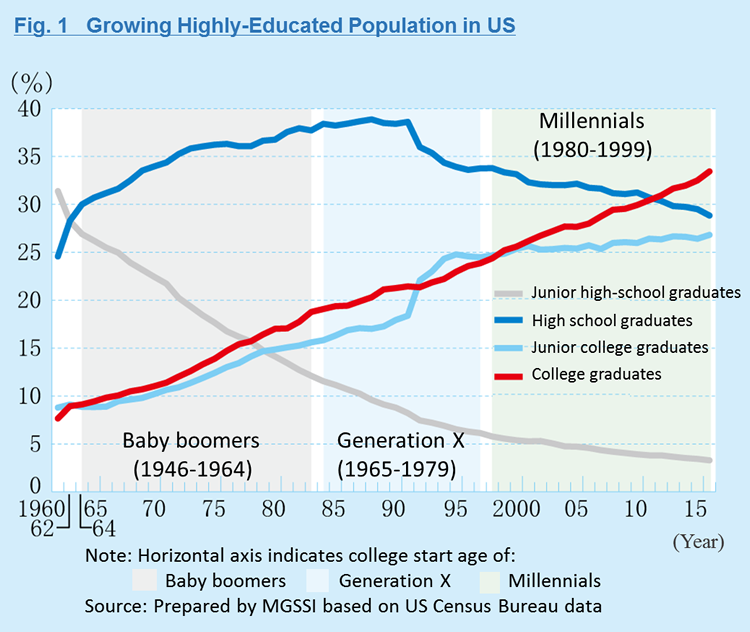

Millennials are more likely to attain higher education levels. In the US, the share of college graduates increased consistently during the post-war era, and after the financial crisis, in 2012, the population with a bachelor's or advanced degree surpassed that of high-school graduates. In 2016, the share of college graduates grew to 33.4%, outdistancing high-school graduates at 28.8% (Fig. 1). Blacks and Hispanics have also seen an increase in their populations with a bachelor’s or advanced degree, from 11.3% and 9.2% in 1990, to 22.5% and 15.2% in 2015, respectively. Expectations that higher education is linked to higher salaries served as an incentive for them to pursue a bachelor’s or advanced degree. In 2015, among the population aged 25 and above, the median income of those who have at least a bachelor’s degree was USD 58,000, more than double the USD 26,000 for high-school graduates.

Connected to this, the amount of student loan debt has swollen as the percentage of people with a bachelor’s or advanced degree has risen, and this is particularly true of millennials, who reached college age in 1998 and thereafter. The total student loans debt, which had been USD 240 billion at the end of March 2003, ballooned to a record-high USD 1.31 trillion by the end of 2016―a non-negligible level almost comparable to the amount of subprime loans that triggered the financial crisis (9% of the then-GDP).1 Moreover, as of 2016, 35% of all student loan borrowers had at least USD 25,000 in debt.

For many millennials, despite their bachelor’s or higher degrees, the labor market is no sellers’ market, which is a major factor behind the delayed repayment of student loans. As of March 2017, the employment rate among 25- to 34-year-olds was 78.6% (the percentage of the employed in the working population aged at least 16. The working population does not include any of those who are on active duty in the military, or who are in an institution such as a nursing home or prison.) The labor force participation rate (the percentage of those actively looking for work in the working population mentioned above) was 82.4%. Both are still below their respective pre-global financial crisis levels. Meanwhile, the unemployment rate stood at 4.5%, in parallel with the national level; however, it still seems relatively high compared to the 3.5% recorded in April 2000, when the labor force participation rate was higher.

Limited Discretionary Consumption Affects the Clothing and Auto Industries

Since the global financial crisis, slower growth in income has been recognized as a problem for all age groups, but that problem is especially serious for millennials. In 1980, the annual salary for men aged 25-34 was USD 43,000, which was higher than the US national median by nearly USD 10,000. However, amidst the twin trends of globalization and automation, by around 2005 their average annual salary level had decreased to around USD 38,000, almost the same level as the national median, and this trend has remained unchanged.

In addition to student loan repayments, millennials are also faced with soaring rents and housing prices as a result of the country’s easy money policy after the financial crisis, and health insurance mandates under the healthcare reform promoted by the former Obama administration. This has led to an increase in nondiscretionary consumption (defined in this report as expenditures on housing, food except eating out, education, and healthcare), which has dealt a blow to their household budgets. Nondiscretionary consumption accounted for 53.1% of the total spending of those aged under 25 and 49.4% for those aged 25-34 in 2015, up from 45.9% and 46.7% in 1995, respectively. On the other hand, the share of discretionary consumption (defined in this report as expenditures on eating out, clothing, entertainment, reading, and miscellaneous goods) in 2015 was 15.9% for those under 25 and 15.7% for those aged 25-34, down from 21.7% and 19.4% in 1995, respectively.

Looking at people aged 18-34, a higher percentage of them find it difficult to earn enough money to make both ends meet. The term “Boomerang Generation" was coined to describe young adults who leave their parents’ homes to start college and school, and boomerang back to live with their parents when finishing school. The percentage of young adult children aged 18-34 living with their parents came to 30.3% as an annualized average from 2009 through 2013. The 30% mark was exceeded for the first time in 30 years. On an annualized basis from 2009 through 2013, the poverty rate was 19.7% (2013 poverty line: USD 11,490 annual income for a single person) and the percentage of unmarried people was 65.9%: Both figures marked record highs since 1980.

With limited discretionary consumption, millennials look weak as an economic driver. Partly due to the declining discretionary consumption, American Apparel Inc. closed all of its stores, and five apparel brands targeting 10- to 30-years-olds decided to close 521 stores from the beginning of 2017 to the end of March. The auto industry is no exception. For a decade from 2005 to 2015, although the number of households increased by 7.12 million in line with population growth, the number of households headed by 15- to 34-year-olds with a car decreased by 2.44 million.

“Sharing Experience” Instead of Owning Things—That Trend Changes with Age

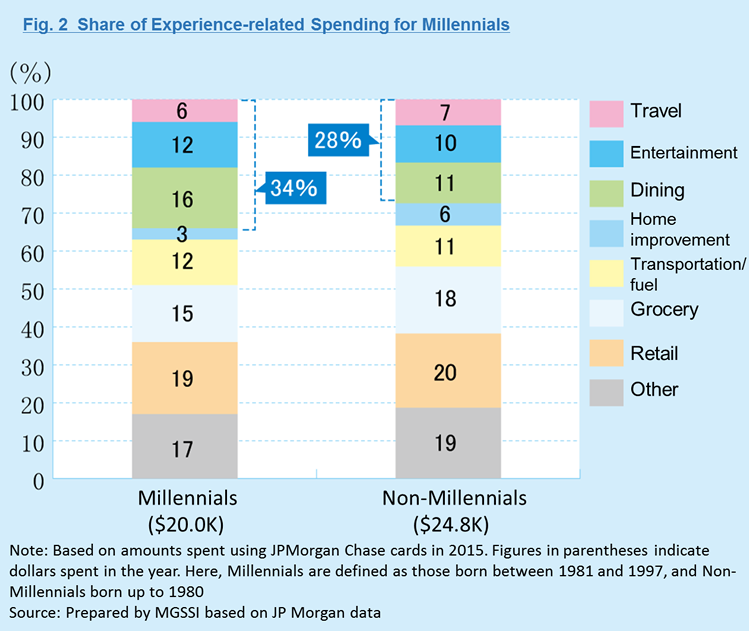

Nonetheless, millennials are more eager to spend their money on experiences than other generations. All experience-related categories such as travel, entertainment, and eating out make up 34% of millennials’ total expenditure, which is larger than the 28% share for non-millennials (Fig. 2). A higher percentage (92%) of 18- to 29-year-olds own smartphones than the average 68% of those aged 30 and above2. Thanks to the popularity of social networking services (SNS), they are now geared up to “share experiences.” In 2013, Oxford Dictionaries added a word, “FoMO” (Fear of Missing Out), which refers to not wanting to be left out of the information loop. As an extreme example, some millennials, who dislike feeling left out when looking at things others have shared on social media, seek experiences only for the purpose of sharing, creating something of an upside down world. Along with newly coined words that frequently appear on social media, including “BAE (Before Anyone Else)” and “ICYMI (In Case You Missed It),” this phenomenon demonstrates millennials’ high awareness of sharing experiences, in both good and bad ways.

Sharing-minded millennials have created new industries. One of these is the sharing economy, particularly known for the vacation rental service Airbnb. Not only delivering on convenience and affordability, this company has placed a priority on the sharing of information, i.e., experiences in the form of user reviews, which has made this business a successful example. Experience-sharing tools also became big hits. GoPro, a manufacturer of digital video cameras, and Fitbit, which produces wristbands for sharing activity data, went public in June 2014 and June 2015, respectively.

While millennials apparently value experience-related consumption, it is expected that their spending patterns will become less different from that of other generations as their life stages progress. For example, a survey conducted by the Federal National Mortgage Association (Fannie Mae) found that 95% of those aged 25-34 want to buy a home. According to another forecast by the US bank J.P. Morgan & Co., millennials’ expenditures are likely to expand from USD 600 billion to USD 1.4 trillion in 2020, which will underpin consumer spending.

An interview survey of millennials living in New York revealed their wish for home ownership. The dominant opinion among those respondents, regardless of their race and ethnicity (Asian, Hispanic, etc.), is that they want to buy a home in the future for marriage and child rearing, among other reasons. Asked about spending on expensive items such as automobiles and brand products, some respondents said that they were cutting back on spending on those items as they could not afford such luxuries, while some others were considering such purchases as a reward for themselves. This could be interpreted that millennials are, in fact, trying to prioritize their spending in line with their income level.

The advent of smartphones and social media not only encouraged millennials to spend their money on experiences, but also moved them to share them. And the economic environment is also affecting their spending habits. It is projected that millennials will come to spend more on material goods as their age and income advances in the future, and the share of material goods as part of their expenditures will improve. This would mean that a generation utilizing social media and seeking goods will play a key role in consumer spending.

- The Federal Reserve Bank of New York (NY Fed): https://www.newyorkfed.org/microeconomics/hhdc.html

- Pew Research Center 2017 survey: http://www.pewinternet.org/2015/10/29/the-demographics-of-device-ownership/