Mitsui & Co. Global Strategic Studies Institute

New Business Opportunities and Challenges Created by the Diversification of Raw Materials for Fish Feed

Apr. 6, 2017

Satoshi Okada

New Business & Technology Dept.

Mitsui Global Strategic Studies Institute

Main Contents

According to the Food and Agriculture Organization of the United Nations (FAO), annual global demand for fish and shellfish averaged 150 million tons between 2013 and 2015 and is expected to reach almost 180 million tons in 2025. Since no increase is expected in the production of wild fish and shellfish, which is forecast to remain steady at around 90 million tons per annum, the ability to meet future demand for fish and shellfish will depend on aquaculture. While fish meal produced by drying and powdering fish such as anchovy has been used as feed for aquaculture, there is concern that the supply of fish meal is insufficient, and it is said that 1.2 to 1.6 million tons of raw materials for fish feed will be required in 2025 as an alternative to fish meal. This report describes the current status of fish meal alternatives required under these circumstances, as well as the future business opportunities and challenges.

Current status of fish meal alternatives and the challenges involved

Fish meal’s high protein content of 60% or more and its excellent amino acid composition have made it an ideal feed for aquaculture. However, fish meal production, which stood at 7 million tons in 2000, has fallen to around 4.5 million tons since 2010. Moreover, fish catches in Peru, the world’s largest producer of fish meal, are controlled for the purpose of conserving resources and stabilizing prices, and no increase in fish meal production can be expected. At US$1,200 to $1,500 per ton fish meal is expensive, and the large share of fish and shellfish production costs accounted for by feed costs is also an issue.

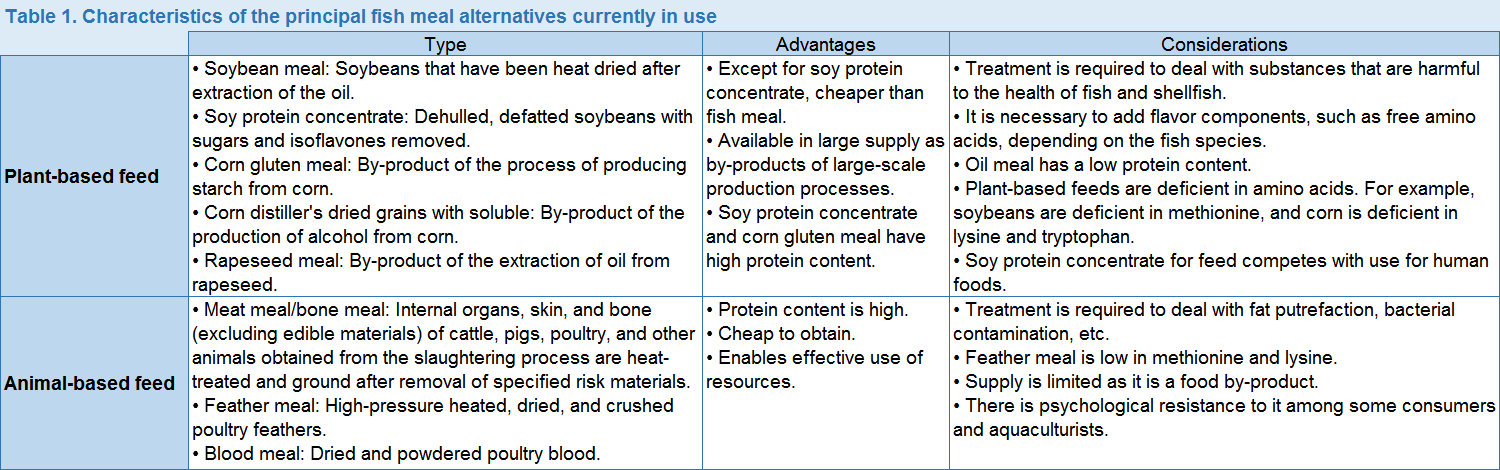

For these reasons, it is necessary to develop raw materials for feed as alternatives to fish meal. The main fish meal alternatives in current use are plant based and animal based, as shown in Table 1. In looking at fish meal alternatives there are six important points to be taken into consideration: (1) safety, (2) palatability, (3) nutritional value, (4) price, (5) supply, and (6) public acceptability.

Most of the plant-based ingredients are by-products created during the processing of plants such as soybean, corn, and rapeseed that are produced in large quantities in parts of the world such as North and South America. At US$300 to $450 per ton, soybean meal is cheaper than fish meal. In terms of price and supply, the use of soybean meal offers significant benefits, and it is widely used as an ingredient of feed for salmon and other species. However, plant-based raw materials are inadequate from the point of view of safety, palatability, and nutritional value. Plant-based materials often contain substances that are harmful to the health of fish and shellfish, and these substances need to be removed. In terms of palatability, it is sometimes necessary to add a flavor component depending on the fish species. While essential amino acids are particularly important for nutritional value, the lack of these acids in oil meal means that it is often deficient in methionine, lysine, and tryptophan. For these reasons, only a certain amount of plant-based material can be included in feed, and other ingredients are required.

Animal-based material is another ingredient used for feed. This includes meat and bone meal produced as by-products in places such as meat processing plants. Many of these materials possess excellent amino acid composition, but supply is limited because of the small number of places producing such by-products. In addition, care is required to ensure safety, including measures to prevent putrefaction and bacterial contamination. Attention must also be paid to public acceptability in the case of bovine meat and bone meal, use of which was banned temporarily due to the effect of BSE.

The fish meal alternatives currently in use have their advantages and disadvantages, and these materials alone are not sufficient to meet the future demand for fish feed. For these reasons, development of new alternatives to fish meal is required.

Notable new alternatives to fish meal

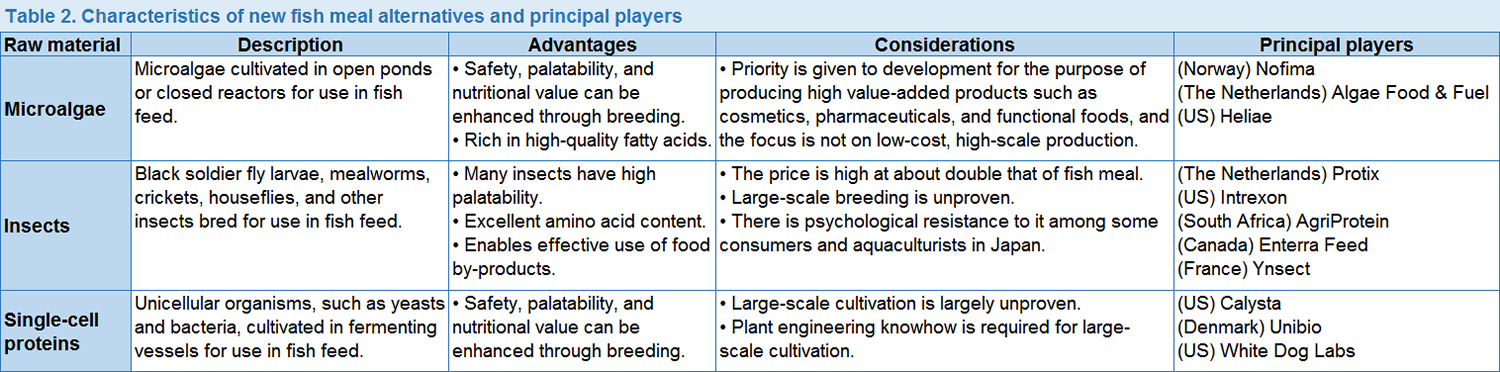

Microalgae, insects, and single-cell proteins are currently under development as new alternatives to fish meal (Table 2). While these new materials have the advantages of being safe, palatable, and high in nutritional value, they have not been developed into large-scale business operations due to the issues of price and supply volume. However, progress is now being made in solving the problems of price and supply volume in the case of insect and single-cell protein alternatives, and this is described in more detail below. In the case of microalgae, priority has been given to their development for use in high value-added products such as cosmetics and functional foods, and development for use in fish feed is just beginning. However, one of the characteristics of microalgae is that they contain abundant high-quality fatty acids, and they merit attention from the long-term viewpoint.

(1) Insects

The main insects being developed for use as fish feed include the larvae of Hermetia illucens, commonly known as the black soldier fly larvae (BSFL), and mealworms (the generic term for the larvae of the Tenebrionidae family of beetles). BSFL are safe as they are not vectors of pathogens. In addition, they are highly palatable to fish and shellfish, and have a high protein content. According to an FAO report, BSFL can replace 25% of fish meal used in the raising of rainbow trout. Although BSFL are expected to become a new alternative to fish meal for these reasons, the technology for large-scale breeding of BSFL has not been established up to now. However, the Dutch company Protix and the US biotechnology firm Intrexon have announced plans to produce BSFL feed material on a large scale. According to the Dutch research institute Wageningen UR, at US$2,000 per ton, BSFL is currently more expensive than fish meal, but the aim is to reduce the price through large-scale production. In January 2017, Protix founded a joint venture company in China with the Swiss company Bühler, which possesses food processing technology. The new company is already producing 300 tons/year of BSFL, and plans to increase annual production to 25,000 tons or more. In February 2016, Intrexon announced that it had acquired the US company EnvrioFlight, which owns technology capable of producing 300 tons/year of BSFL, after which it set up a joint venture company with the US feed manufacturer Darling Ingredients for the purpose of establishing large-scale BSFL production technology. Although the actual scale is not clear, construction of a commercial scale plant is due to start in the near future.While the technology for the large-scale production of BSFL is being established, procurement of food for the larvae is an issue affecting commercial expansion. Various food by-products can be used to feed BSFL, including alcohol fermentation residue, and by-products from confectionery and meat processing plants, but the volume of food required is about double that of the BSFL themselves. For this reason, countries undergoing significant population and economic growth, where the production of food by-products is expected to increase and where large quantities of fish and shellfish are produced, can be seen as regions well suited to the development of new raw materials for feed to replace fish meal. These would include countries such as China, India, and Indonesia. In Europe, too, where initiatives for sustainability are actively pursued, the use of insect protein for fish feed was approved in December 2016, and its use for feed is promoted as a matter of policy. In these regions, there are business opportunities in this sector for companies collaborating with food and beverage manufacturers, as well as feed manufacturers and aquaculturists.

(2) Single-cell proteins

Single-cell proteins are cells produced by cultivating and proliferating unicellular organisms, such as yeast and bacteria, and attempts are being made to use these materials as feed. Even unicellular organisms that are inadequate in terms of safety, palatability, and nutritional value in their natural state can be improved by breeding. While there have been issues with single-cell proteins in terms of price and supply volume, there are moves underway towards the large-scale production of single-cell proteins using methane contained in natural gas that is available at low cost in the United States.The US biotech start-up Calysta is seeking to achieve the large-scale production of single-cell proteins using bacteria fed on methane. The company plans to have a plant producing 20,000 tons/year in operation by the end of 2018, and to increase production to 200,000 tons/year in future. US grain major Cargill is supporting Calysta in this initiative. As part of its plans to expand its fish feed business, Cargill purchased EWOS, a Norwegian manufacturer of feed for use in salmon farming, in August 2015 at a price of EUR1.35 billion. Cargill’s support is likely to be aimed at building a diverse portfolio of fish feed raw materials. According to Calysta, its single-cell protein feed is cost-competitive to fish meal price, and has a long shelf life of one year. It appears that the feed will still be cheaper than fish meal even if the price of natural gas rises to US$10/mmBTU, and developing the business in the US, where low-priced natural gas of around US$3/mmBTU is available, makes sound business sense. Cultivating bacteria requires plant engineering capabilities, and Calysta acquired the element technologies required for large-scale production through its 2014 acquisition of Norway’s BioProtein, which has a track record in this field. Denmark’s Unibio and the US company White Dog Labs also have similar technologies, but the keys to business success are networks with feed manufacturers and aquaculturists, the procurement of low-cost natural gas, and plant engineering capabilities.

Future opportunities and challenges in the fish feed industry

Up to now, the most important requirement for the fish feed industry has been the stable procurement of fish meal. However, in the future, fish feed manufacturers will need to learn how to choose between a diverse array of feed material, and to meet the demands of aquaculturists in order to maintain and enhance their competitiveness. In addition, opportunities to enter new business will arise in the development of new alternatives to fish meal. As described above, the cultivation of insects and methane-based single-cell proteins are promising new alternatives to fish meal, but at the scale of production that has been announced to date, they will still not be able to make up for the shortage of fish meal expected in 2025. In addition to technological improvements to further increase the supply of these products and lower their price, the development of new technologies, including technologies for producing single-cell proteins from microalgae and other types of microorganisms, is likely to become increasingly important.

Business opportunities will also arise in other industries at the production stage of new fish meal alternatives. For example, in the case of insects, the key to success in business is collaboration with food and beverage manufacturers, while for single-cell proteins, it is collaboration with shale gas companies and engineering firms. By involving business sectors that have until now had no connection at all with the feed business, new industries will be created.

Although new business opportunities will be generated, we need to bear in mind that some regions are suitable for producing fish feed, while others are not. For example, existing feed meal alternatives and insects need to be produced close to locations where food by-products are produced, while methane-based single-cell proteins should be produced in locations where low-cost shale gas can be procured. Production of fish meal alternatives should be undertaken in accordance with the characteristics of the region concerned after ascertaining what resources can be stably procured in the region.