Mitsui & Co. Global Strategic Studies Institute

The Maturity of Emerging Economies and New Developments in the Global Economy

Apr. 6, 2017

Tomohiro Omura

Industrial Research Dept. II

Mitsui Global Strategic Studies Institute

Main Contents

The Impact of China's Economic Maturity

As symbolized by the UK’s withdrawal from the European Union, known as Brexit, and the advent of the Trump administration in the US, globalization is facing increasingly strong headwinds. However, when it comes to globalization as an economic phenomenon—the expansion and progress of the global unification of economic activities, signs of change were already emerging in the first half of the 2010s.

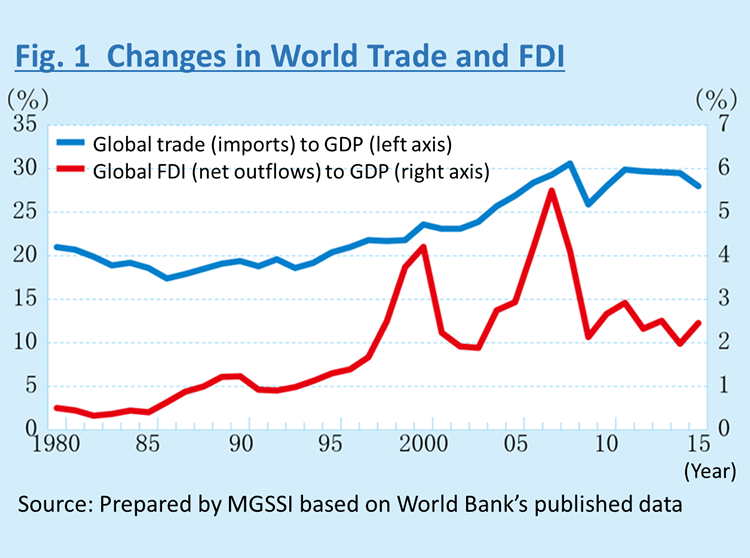

In the world economy in recent years, companies from developed countries, which are experiencing a slowdown in their domestic markets, have been obtaining growth opportunities through business in emerging countries with cheap labor and market growth potential. On the other hand, emerging countries have been accelerating their economic growth by using capital and technologies brought by developed-country companies. With a kind of “reciprocal relationship” being a cornerstone, global unification has progressed through the expansion of trade and foreign domestic investment (FDI). This led to the formation of the “global economy,” where the economies of countries around the world are deeply connected through the production and consumption of goods and services. Statistical data also indicate that global trade and FDI have been growing faster than GDP (Fig. 1). However, the pace of growth slowed in the 2010s, and the respective ratios of trade and investment to GDP have since remained almost flat. One of the factors in that change is a slowdown in China’s economy, which became the second largest in the world on the back of reciprocal relationships between developed and emerging countries.

The Chinese economy had continued to grow at a high rate of 10% since 2000, until the global financial crisis occurred in late 2008. Despite having survived subsequent impact of the crisis with massive economic stimulus packages by around 2011, the economy began to lose its momentum thereafter. China’s economic growth rate has dropped to the 6% level. This decline is surely attributed to factors unique to China, including dependence on investment and excessive production capacity, as well as an accumulation of non-performing assets, which is an adverse effect of the economic stimulus packages, but the economy’s “maturity” as the outcome of its growth is also considered as a significant factor.

Looking at the history of economic development of countries worldwide, more than a few countries with low income levels and unmet basic needs have achieved high growth rates of around 10% per year, as with China in recent years. However, in most countries, as a result of high growth, while their income levels improved and basic needs were met, the creation of new demand became difficult, which inevitably slowed the pace of growth. Higher wages also put a break on the expansion of exports by taking advantage of a cost competitive edge. This process matches a state referred to as “New Normal” in China, but in a more general sense, it is a phenomenon that can be called economic “maturity.” As was the case with its predecessors, China is thought to have entered a maturity stage after realizing economic development.

Now China is fading out of the framework of the reciprocal relationships between developed and emerging countries because it has gradually been losing preconditions such as low wages and high growth. The world’s second-largest economy shifting out of the framework is one of the primary factors in the slowdown of the world’s trade and investments, as indicated in Fig. 1.

Emerging Countries on the Path to Maturity

In response to the maturity of the Chinese economy, companies in developed countries are accelerating their moves to find countries that will be the “next China.” Even with China excluded from the list of targets, quite a number of emerging economies meet the low-wage and high-growth requirements; therefore, the framework of the reciprocal relationships between developed and emerging countries seems as it will remain effective for the time being. That said, emerging countries, currently characterized by low wages and high growth, will, sooner or later, reach a maturity stage after enjoying the strong growth of their economies, and be removed from the reciprocal-relationship framework, as China is currently experiencing.

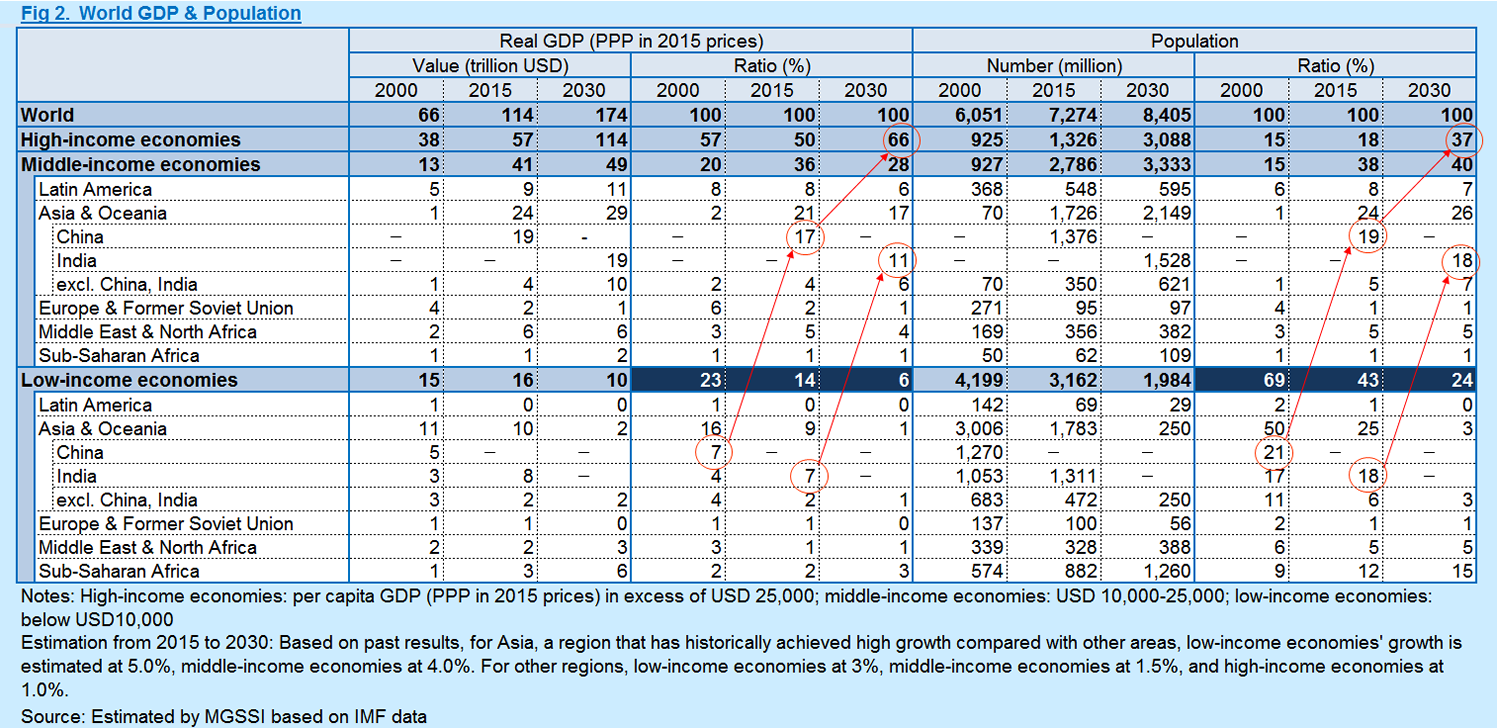

Based on the past cases of Japan, South Korea, and other countries, a nation’s economy is about to mature and loses growth potential around when GDP per capita, an indicator of economic development levels, exceeds USD 10,000 (by purchasing power parity (PPP), 2015 prices in real terms). In the case of Japan, in the 1960s, its rapid growth continued until GDP per capita surpassed USD 15,000, but there are few other cases in which a nation with an economy of a certain size continues to grow at 5% or more after its GDP per capita exceeds USD 10,000. China, too, began to slow down around the time that the indicator hit USD 10,000. Furthermore, for high-income economies with more than USD 25,000 GDP per capita, the rate of growth is even lower. It is 2% at the highest, usually hovering around 1%, except for under extraordinary circumstances causing prolonged and serious adverse effects, such as the Japanese asset price bubble and the US subprime boom.

In recent years, other than China, Indonesia hit the USD 10,000 line. Given the past pace of growth, it is possible that the Philippines will go beyond the USD 10,000 line in the first half of the 2020s, and that India, Vietnam, Myanmar, and Laos will follow suit in the second half of the 2020s. Meanwhile, China will presumably hit the USD 25,000 mark. Thereafter, only a few low-income economies, most of which are in sub-Saharan Africa, will be eligible for the reciprocal relationships between developed and emerging countries. Low-income economies accounted for 23% of the world economy in 2000, and 14% in 2015, when China shifted out, but the figure is projected to fall to 6% in 2030. Looking at the composition of the world’s population, the percentage of low-income economies in the world’s total population will also drop from 69% to24%. (Fig. 2)

As a result, it seems likely that the significance of the reciprocal relationships between developed and emerging countries will become limited. “Developed countries provide high value-added products, and emerging countries make basic goods.” “Product development is done in advanced countries, while production is assigned to developing countries.” The world’s economies were moving towards unification, premised on specialization in the manufacture of goods and services, but that trend is likely to taper off.

New Developments in the Global Economy

The maturity of emerging countries may dilute the traditional reciprocal relationships between developed and emerging countries, but add new developments to the structure of the global economy instead.

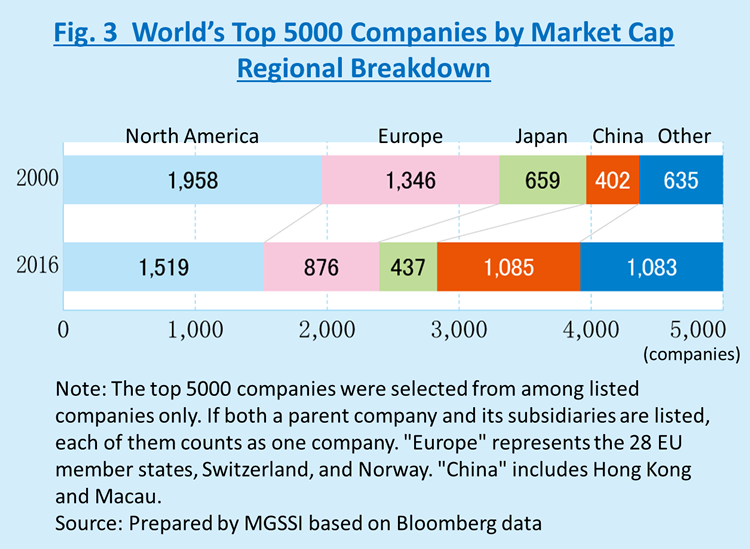

In emerging countries, the business sector has grown in line with economic development, producing a significantly increasing number of corporate giants comparable to those in developed countries (Fig. 3). Although the most remarkable is growth in companies from China, there is also the rise of companies from India and Southeast Asia. Corporate giants, albeit a small number, are emerging from low-income economies in Sub-Saharan Africa as well. Many of them have grown in their respective domestic markets, mostly in fields that lay the groundwork for citizens’ lives and industrial development. These fields include the electricity, telecommunications, transport, and financial sectors. Also, many companies have taken advantage of cheap labor, thereby bringing cheap goods and services to the overseas markets.

However, as the economy matures, its cost advantage will taper off over time. Such progress is already evident in China, and more Chinese companies are geared towards enhancing their research and development capabilities and bringing self-developed goods and services to overseas markets. To obtain necessary technology for this goal, they are making aggressive moves to acquire leading companies from developed countries, including those in state-of-the-art fields such as robots and biotechnology. Support systems for ventures to commercialize innovation are being gradually implemented along the side of financing, management, and production. At this point, China is taking the lead in this regard, but this move is expected to spread to other emerging economies as well.

On the other hand, companies in developed countries are intensifying research and development activities to maintain their technical advantages, and globally expanding business by capitalizing on the outcomes. It is thought that this move is behind growing attention to the fields of cutting-edge technologies such as artificial intelligence (AI) and the Internet of Things (IoT), as well as Germany’s industrial policy “Industry 4.0.”

In both developed and emerging countries, companies direct their research and development efforts at addressing the consumer needs and social challenges. That said, needs and challenges in emerging countries are changing with their economic maturity. Consumer needs shift from necessities, such as clothing, food, housing, and medicine, to health, beauty, nursing care, education, safety, entertainment, and infrastructure improvement. Social challenges become focused on urban development, aging population, securing and conservation of resources, and environmental protection. All in all, needs and challenges will be converging as universal themes.

Consequently, the innovation that helps satisfy these universal needs and solve problems leads to the enhancement of its own economic value by adding markets that provide business opportunities for companies. As emerging countries join as new entrants that create innovation, following developed-country companies as forerunners, it is expected that a wider variety of innovation will come out at a faster pace. This means that technological development and business creation will have greater weight in global economic activities.

Some companies will roll out technologies and business that they develop on their own, while others will incorporate innovations created not by themselves. In addition to further expansion of FDI, including business acquisition, there will also be moves such as copying ideas and headhunting. Moreover, compared with developed countries, where existing systems, rights, and interests can be barriers, emerging countries have relatively few constraints; thus, emerging economies may be able to introduce the outcomes of innovation before developed countries do.

These moves will be a new engine to unify economic activities on a global scale. Shifting its focus to a different level—from the conventional production and consumption of goods and services, to the creation and introduction of innovation, the global economy will usher in a new development phase.