Mitsui & Co. Global Strategic Studies Institute

The Juncker Plan -- European Commission Investment Plan for Europe: Current Situation and Challenges --

Jun. 7, 2016

Shigeo Sugimoto

Strategic Information & Research Department, MITSUI & CO. BENELUX S. A./N. V.

Main Contents

Investment Stimulus Challenge Under Many Constraints

The Investment Plan for Europe, known as the “Juncker Plan,” is attracting attention as a trump card for the European Union (EU) to break through an investment slump.

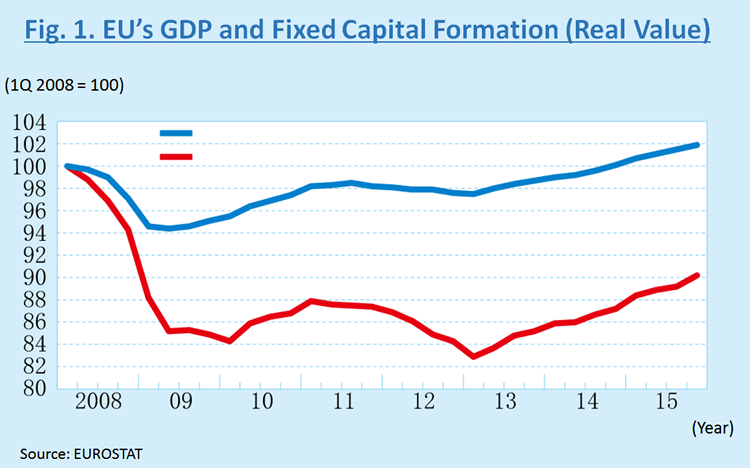

Currently, the economy of the EU is gradually recovering from past significant falls triggered by the collapse of Lehman Brothers in 2008 and the subsequent European debt crisis from 2010 onward, partly due to the effect of quantitative easing by the European Central Bank (ECB) and also the impact of the euro's depreciation. On the other hand, real fixed capital formation (private non-residential investment, private residential investment, and public investment) is still weak due largely to an unclear outlook and banks’ reluctance to lend, particularly in Southern European countries, including Spain, Italy, and Greece, remaining at 10% below the levels prior to the collapse of Lehman Brothers (Fig. 1).

The slump of real fixed capital formation not only pushes down demand and destabilizes economic recovery in the short term, but also slows the potential growth rate, causing a long-term economic slump.

In response to these situations, Jean-Claude Juncker, president of the new European Commission launched in November 2014, hammered out the Investment Plan for Europe with the aim of promoting employment and growth by inviting investment. Given that the EU budget is small for the EU’s economic scale (which is almost equivalent to 1% of its nominal GDP) and that many of the member states are under constraints to carry out austerity measures, it is revolutionary that the EU is activating investment by inviting private capital based on limited public capital. After the elapse of almost one year since the launch of the plan in July 2015, this report analyzes the current situation and issues.

The Scheme of the Juncker Plan

The Investment Plan for Europe consists of three pillars: (1) establishing the European Fund for Strategic Investments (EFSI), aimed at a total investment of €315 billion over three years (2015-2017) (2.2% of the EU’s nominal GDP); (2) setting up the European Investment Advisory Hub (EIAH), as a point of contact to provide support for project participants and establishing the European Investment Project Portal (EIPP), on which users can check projects, propose new projects, and find investors within the EU; and (3) promoting structural reforms within member states, such as improving the investment environment in the EU and standardizing cross-border business rules. The EFSI, positioned at the center of the Investment Plan for Europe, is discussed as follows.

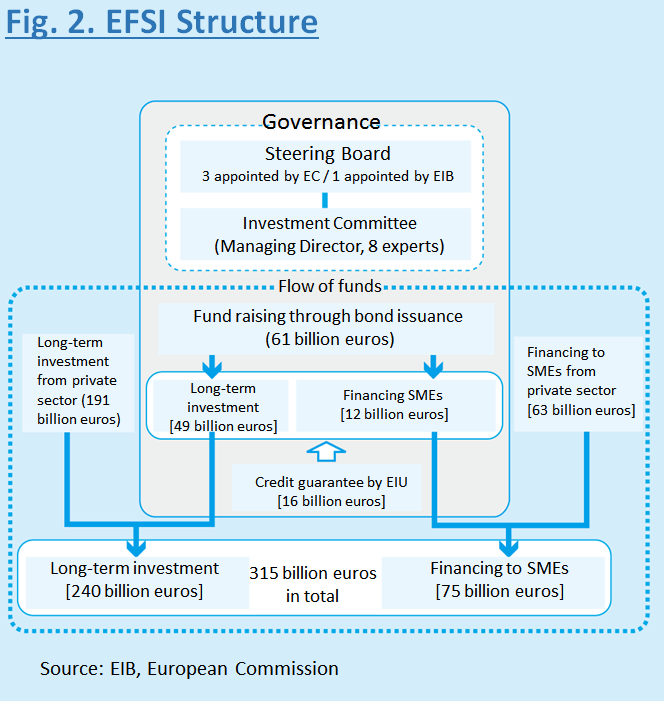

The EFSI, co-operated by the Europe Committee and the European Investment Bank (EIB), has an independent governance structure, while it is organizationally a part of the EIB. The Steering Board composed of four members (three from the EU Commission and one from the EIB) decides on EFSI strategies and performs required procedures for operations and risk management. The Investment Committee, a subcommittee of eight independent experts, selects projects, conducts due diligence, and provides funds under the Managing Director.

For the EFSI, the EIB raises capital from markets by issuing bonds or using other measures, and allocates €49 billion to long-term investment and €12 billion to small and medium-sized enterprises (SMEs)1. A credit guarantee of €16 billion from the EU budget is provided for a total of €61 billion investment and loans from the EFSI. The scheme is designed to organically combine the EIB’s creditworthiness (AAA rating) and highly advanced investment expertise with the EU’s credit guarantee, and effectively utilize mezzanine finance such as subordinated loans or subordinated bonds. This promotes long-term investment, as well as financing to SMEs, from the private sector. The ultimate goal is to invest a total of €315 billion, including €240 billion in long-term investment and €75 in financing to SMEs (Fig. 2).

In addition, investment and loans in projects supported by the EFSI are not subject to the EU Stability and Growth Pact (requiring general governments to maintain fiscal deficit and debt balance at not more than 3% and 60%, respectively, of nominal GDP). Nine countries in the EU, including the UK and Germany, have already financed EFSI-supported projects through governmental financial institutions. If cooperation with governmental financial institutions in member states is strengthened, coordinated investment will be promoted in line with EU policy. Not only speed is emphasized as in a shortened approval process, but flexibility is also secured through combined use of the EFSI with other EU budgets, among others.

Project Selection Criteria

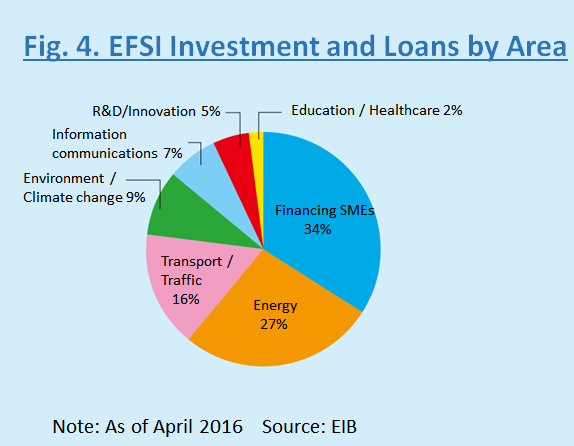

Each project must be worth at least €10 million, be infeasible without support from the EFSI, and ideally increase international competitiveness and raise potential growth rates in the mid- and long-term, thus contributing to job creation. The main targets are areas that correspond to EU policy, specifically the following: (1) Energy: upgrading intra-EU energy infrastructure, connecting power transmission, and distribution networks, etc., for EU energy market integration; (2) Transportation: expanding port facilities, and laying and connecting railways and highways; and (3) Information Communication: expanding high-speed communications infrastructure, digital contents, digital services, etc. ; (4) Environment and Climate Change: renewable energy facilities and energy-saving technologies; (5) Education and Health: human capital support such as vocational training, and social welfare such as healthcare; (6) Research and Development (R&D) and Innovation: support for R&D infrastructure and research institutions engaged in industry-academia projects (categorized into the “Long-term investment” in Graph 2); (7) Financing to SMEs: provision of risk finance to venture companies, etc., that own innovative technologies.

Entities eligible for EFSI support are “Investment Platforms2,” including both public and private businesses, project promoters, and government-affiliated financial institutions. Project promoters must be corporations in the EU, but investment from outside the EU is also allowed3. It also allows co-financing with funds or institutional investors outside the EU, as well as joint operation with government-affiliated lenders in member states through “Investment Platforms4.”

Evaluation and Challenges

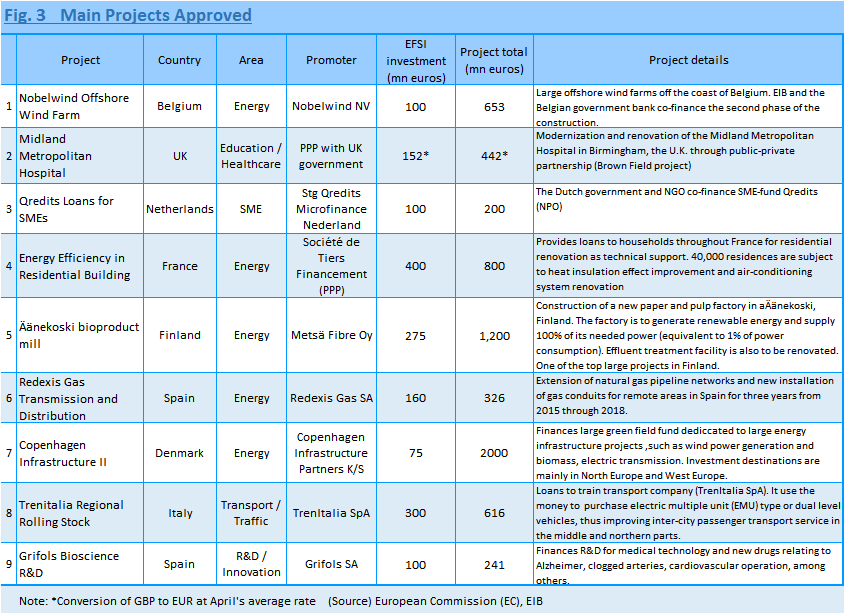

As of April 16, 2016, projects totaling €82.1 billion had been approved (€11.2 billion allotted by the EFSI), achieving 26% of the target amount. EFSI investment and loans include long-term investment in 57 projects, a majority of which are occupied by energy (22 projects) and transportation (11 projects) (Fig. 3 and Fig. 4). Twenty-six countries other than Malta and Cyprus have received approval, and by the number of projects, including the provision of finance to SMEs, Italy ranks first with 35 projects, followed by France with 33, the UK with 20, and Germany with 19.

There are the following challenges: (1) Although the achievement rate to the target amount is relatively high, new investment targets are not actively explored. Thus, approved projects may have been feasible, even without EFSI support; (2) Funding destinations are mostly in Western Europe, and sufficient funds may have not reached Southern European countries, including Spain, Greece, and Portugal, faced with difficulties in financing investment due to the separation of financial markets, as well as Central and Eastern European countries; and (3) For large social infrastructure projects with a payback period of several tens of years, there is expected to be a need for other EU budgets in addition to EFSI support, so EU budget application procedures may need to be simplified. Moreover, in order to secure private capital steadily, the third pillar of the Investment Plan for Europe as mentioned earlier must be ensured. Different rules among member states become a barrier to doing business in a single market, making it difficult to gain the benefits of scale. Cross-border aggressive investment will be essential, particularly in the energy and communications areas.

The EFSI began with a limited timeframe of three years, but a proposal for its extension is expected to be submitted soon, which will allow the EFSI to continue from 2018 onward. Amidst a prolonging slump due to global investment slowdown, the EU’s challenges deserve to be noted.

- The provision of finance to SMEs is implemented by the European Investment Fund (EIF), a subsidiary of the EIB.

- Special-purpose entities that enable the provision of finance to multiple projects categorized by theme, region, and country level (Investment Platform).

- Concerning Japanese-affiliated companies, the Nobelwind Offshore Wind Farm in Belgium, an offshore wind power business participated in by Sumitomo Corporation, is receiving EFSI support.

- China announced its participation in the Juncker Plan. Specifically, there may be the formation of a “Joint Investment Platform” coupled with the EU / the EIB and a contribution of €5 billion to €10 billion by China’s Silk Road Fund. According to the European Commission (EC), it may be outside the EFSI framework.