IR Meeting for FY March 2024

1st Half (April-Sept 2023)

Financial Results

on Nov 1, 2023

Contents

Hori, CEO (Hori) : Good morning, I'm Kenichi Hori, CEO.

Thank you for joining us today.

I will begin with an overview of the first half operating results and the full-year forecast.

I will then hand over to Masao Kurihara, General Manager of the Global Controller Division, who will speak on this in more detail.

During the first half, the overall global economy continued to slow. Even in such an environment, Mitsui has been able to generate earnings exceeding the figures laid out in our business plan, that we announced in May, through our global business portfolio that spans across a wide range of industries.

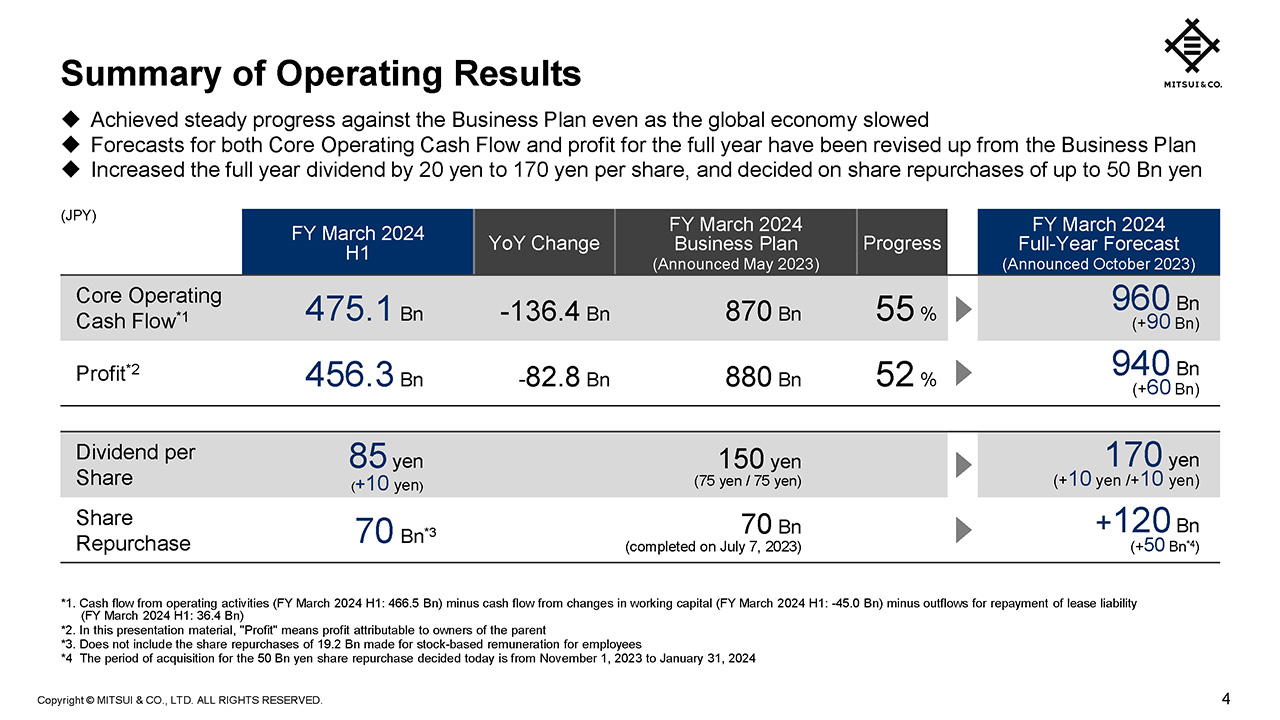

Summary of Operating Results

I will now summarize our operating results for the first half of this fiscal year.

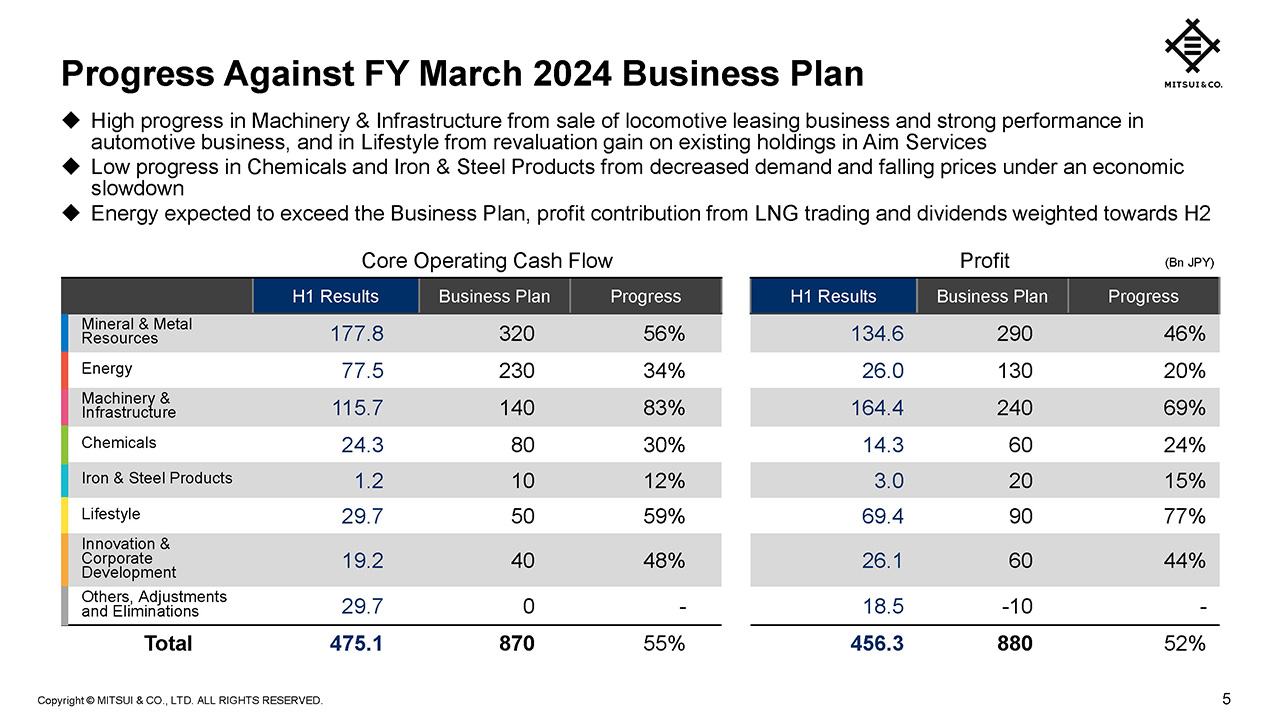

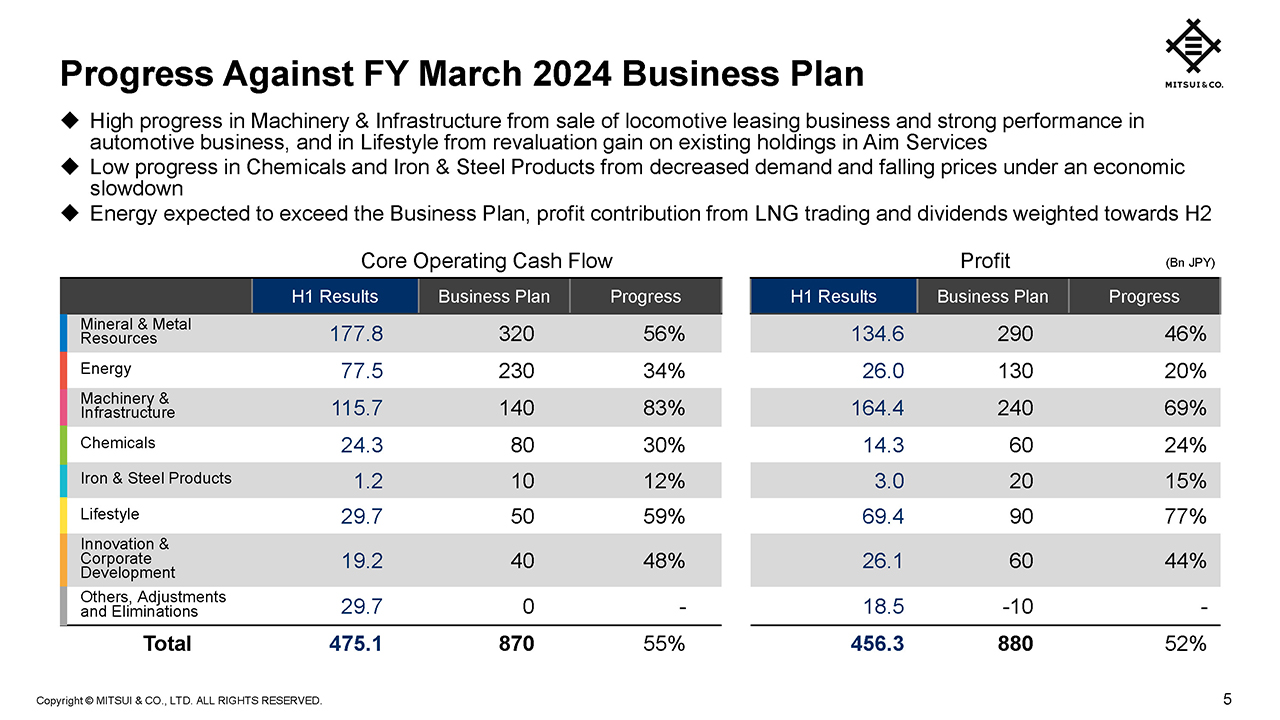

Core Operating Cash Flow (COCF) decreased by 136.4 billion yen year-on-year to 475.1 billion yen, and profit decreased by 82.8 billion yen to 456.3 billion yen, however both made solid progress against the business plan.

In light of this progress, we revised up the full-year forecast. Compared to the business plan, we have increased our forecast for COCF by 90 billion yen to 960 billion yen and profit by 60 billion yen to 940 billion yen.

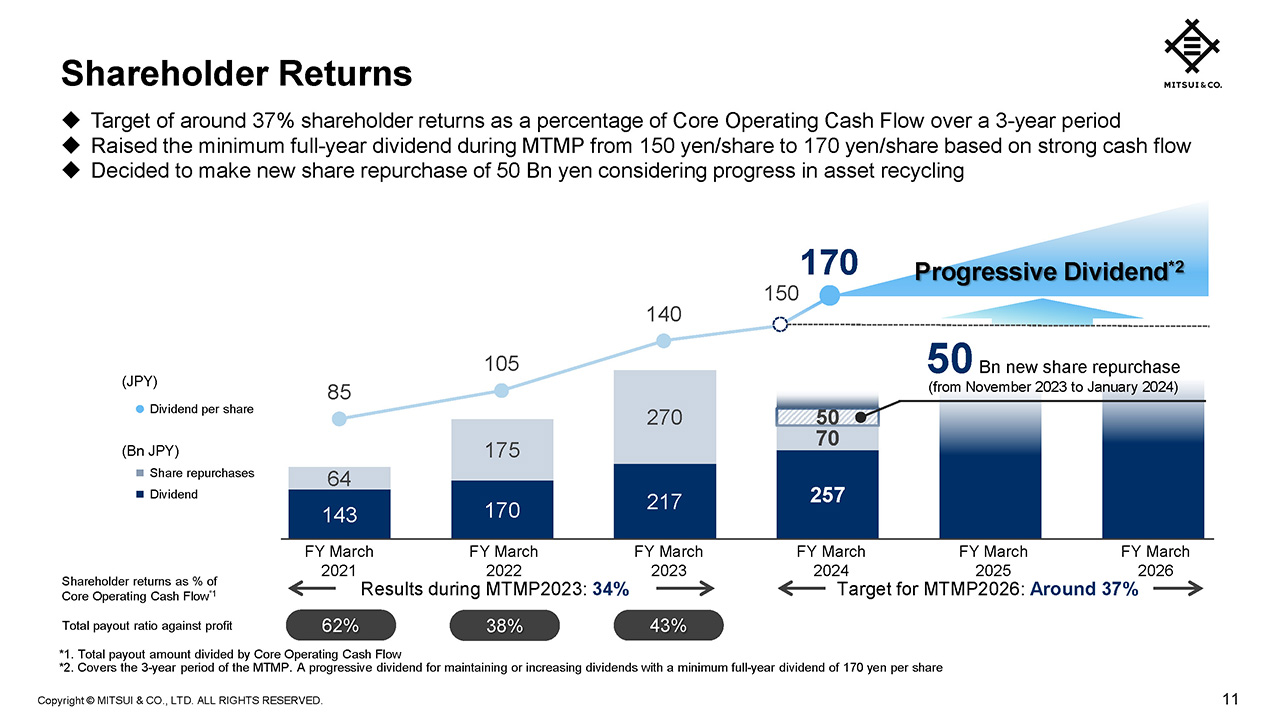

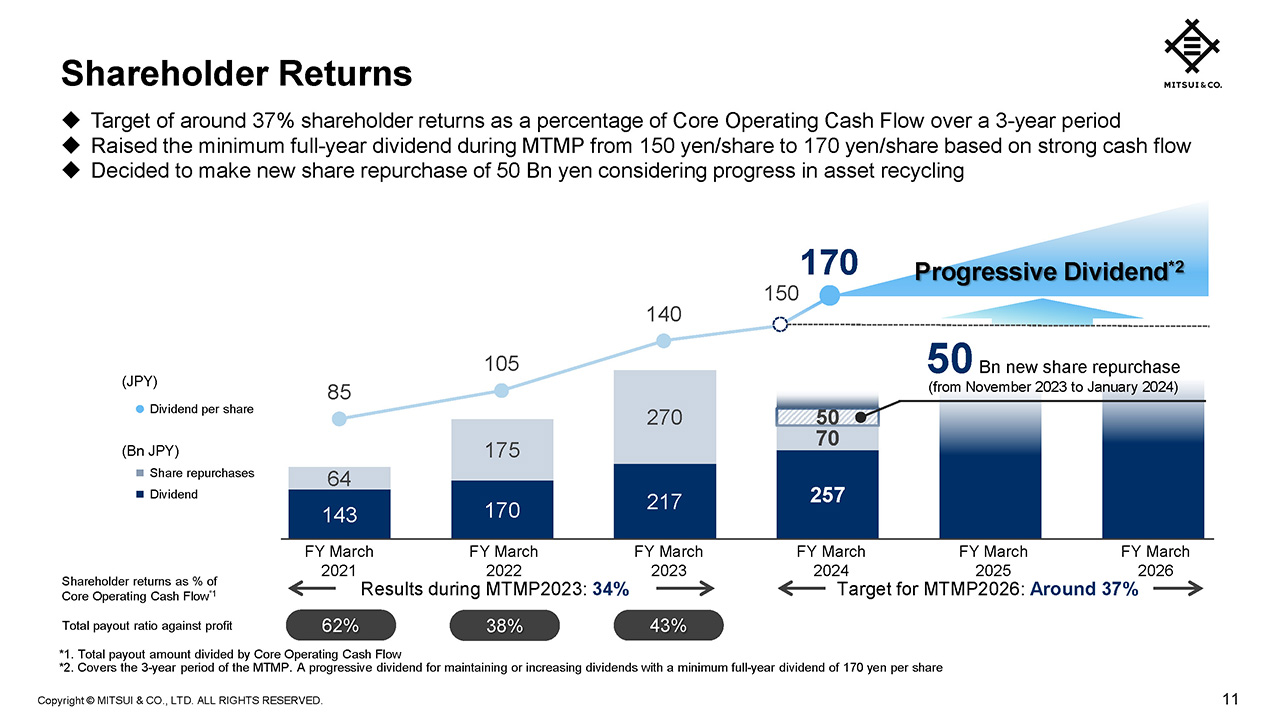

Furthermore, as we were able to reconfirm the robustness in our cash flow which was enhanced through the previous Medium-term Management Plan (MTMP), we have raised the full-year dividend by 20 yen per share to 170 yen, which will be the new minimum level during the current MTMP, ending in FY March 2026. In addition, as we made progress with several asset sales, including a large-scale one, we have decided to implement additional share repurchases of up to 50 billion yen.

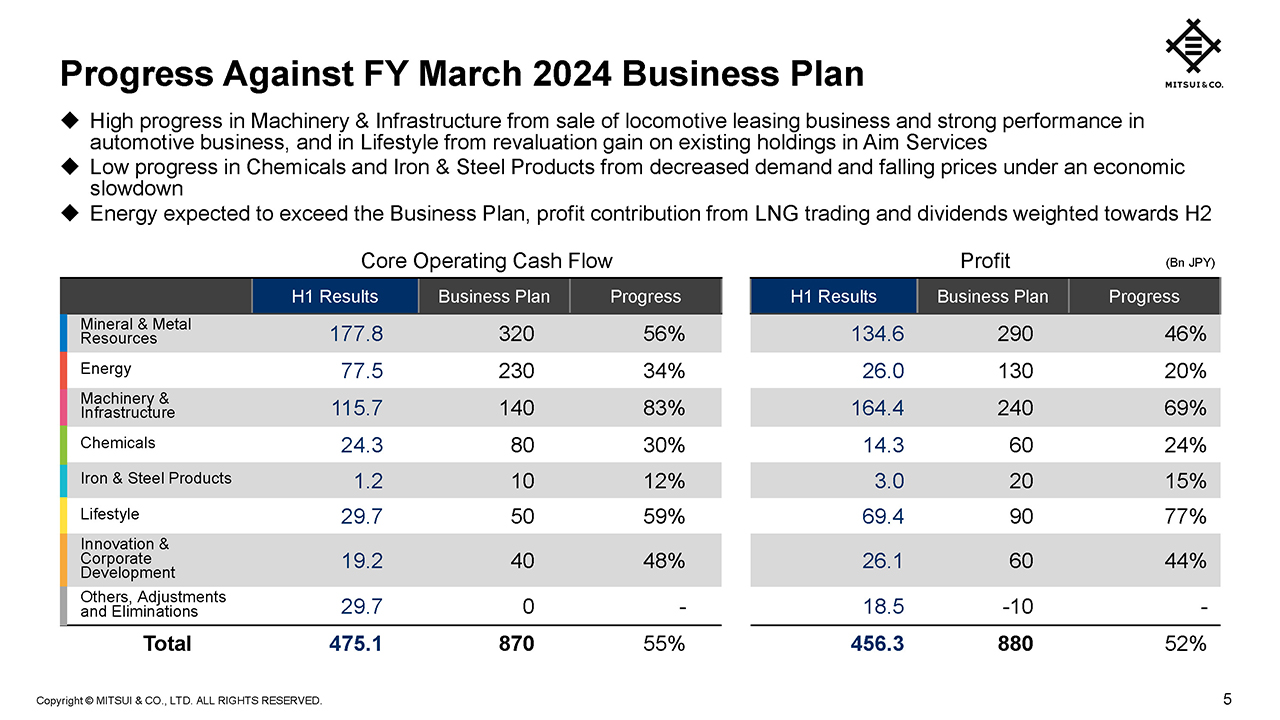

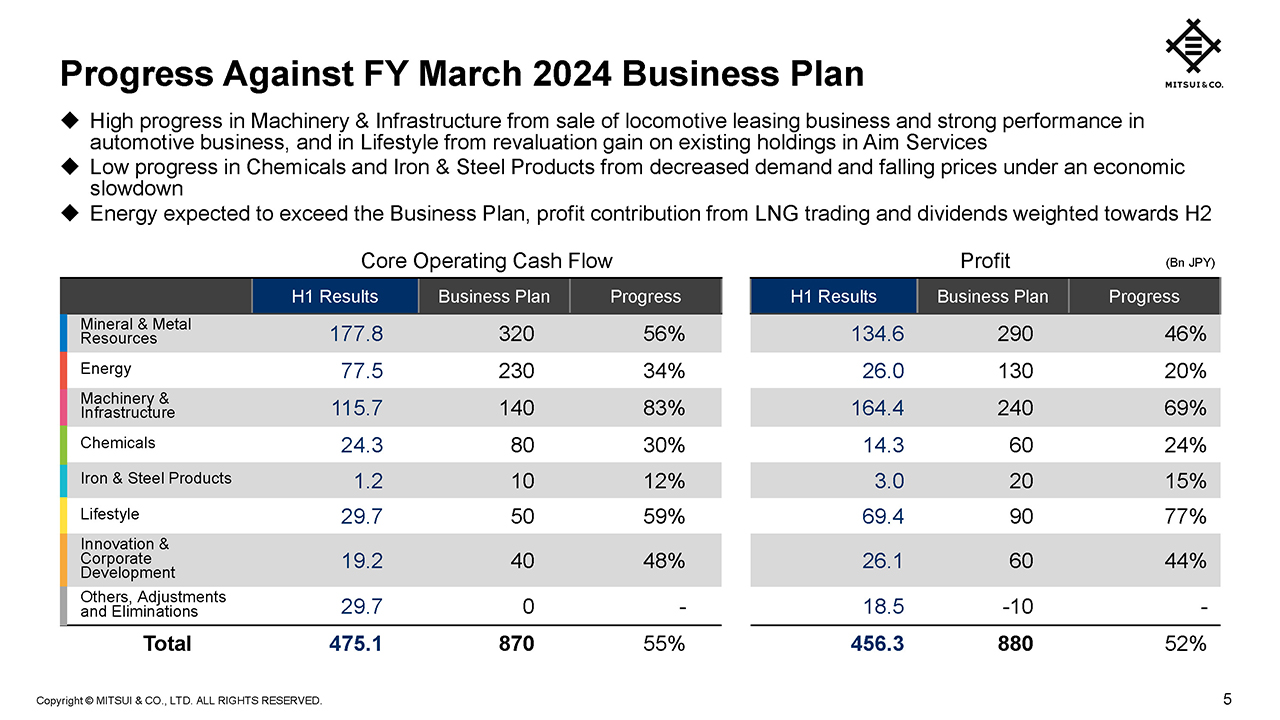

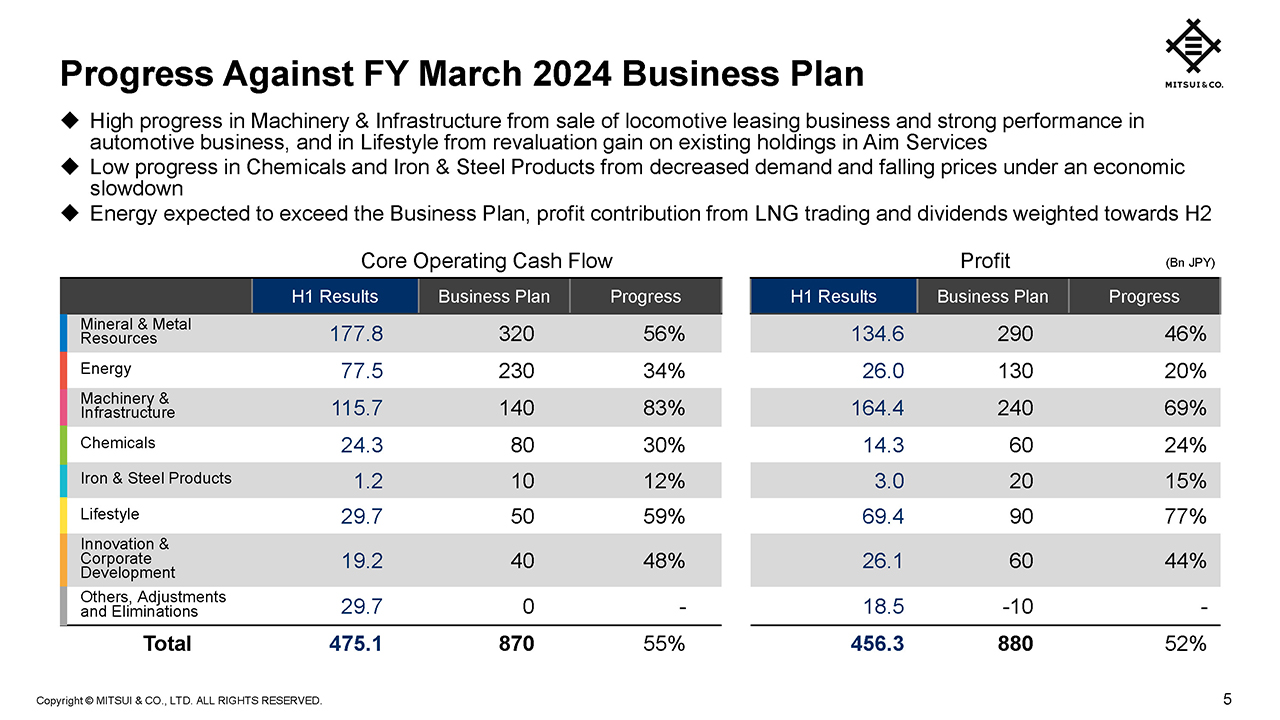

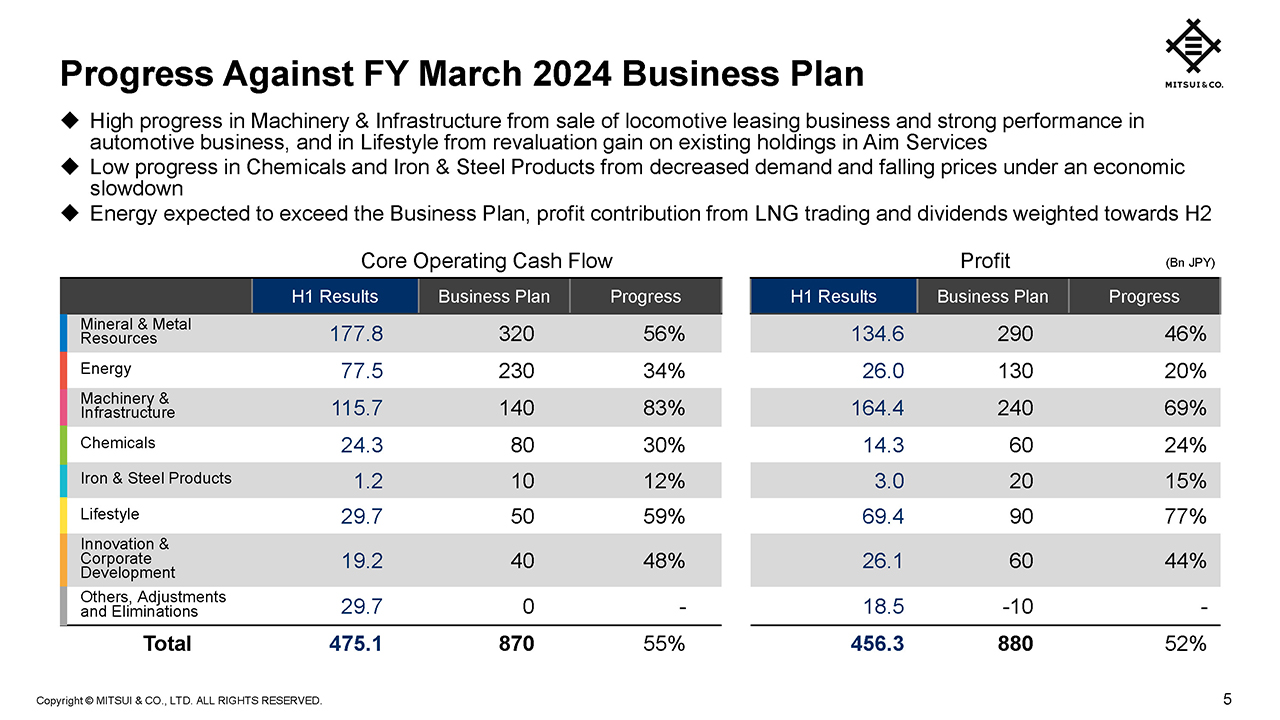

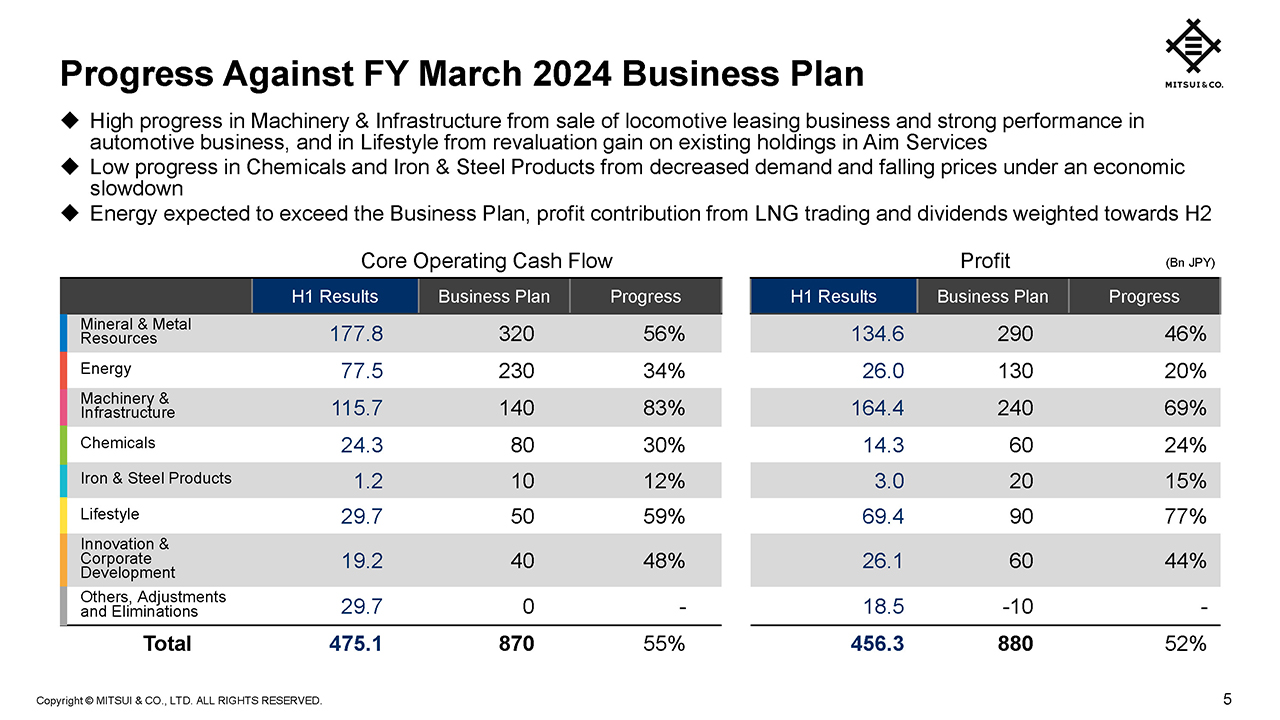

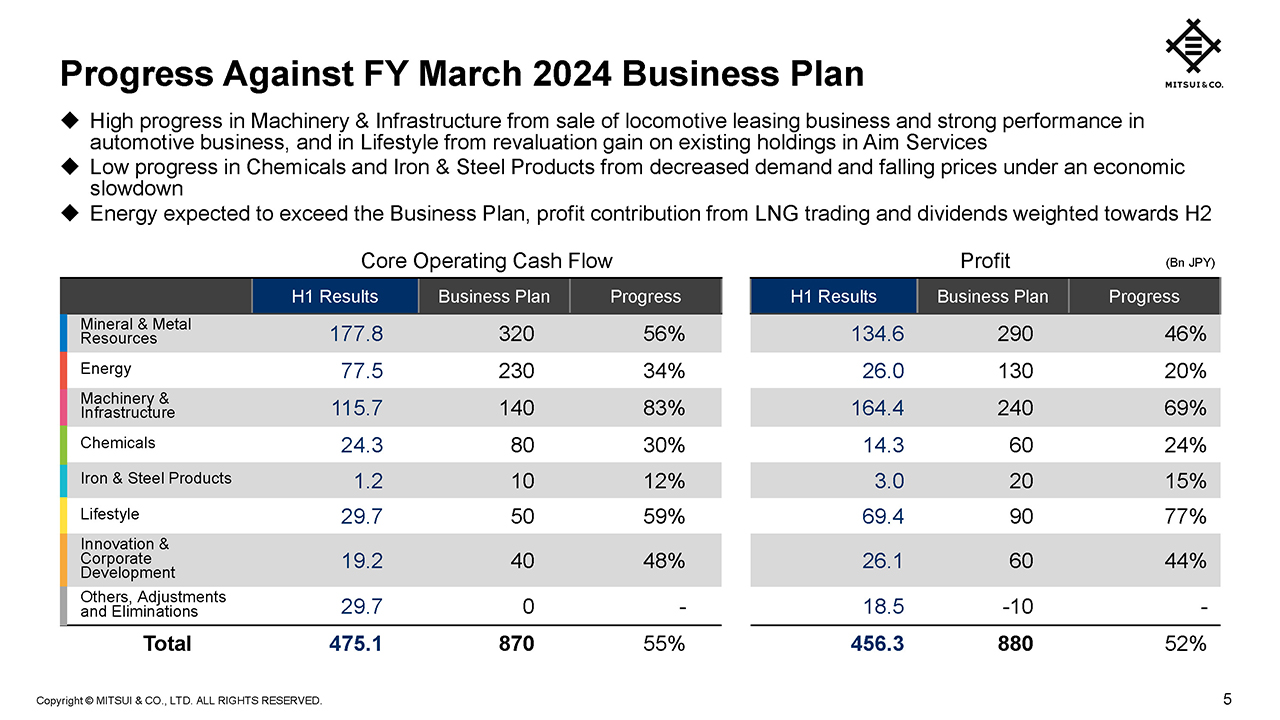

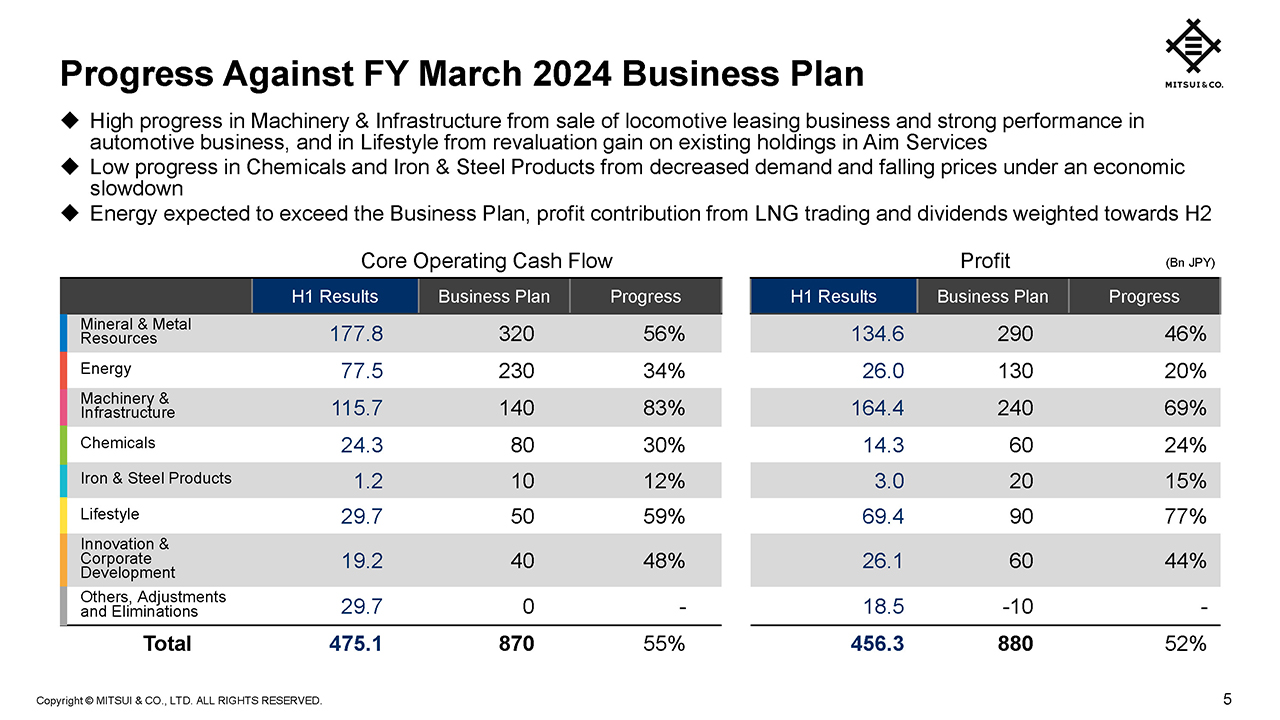

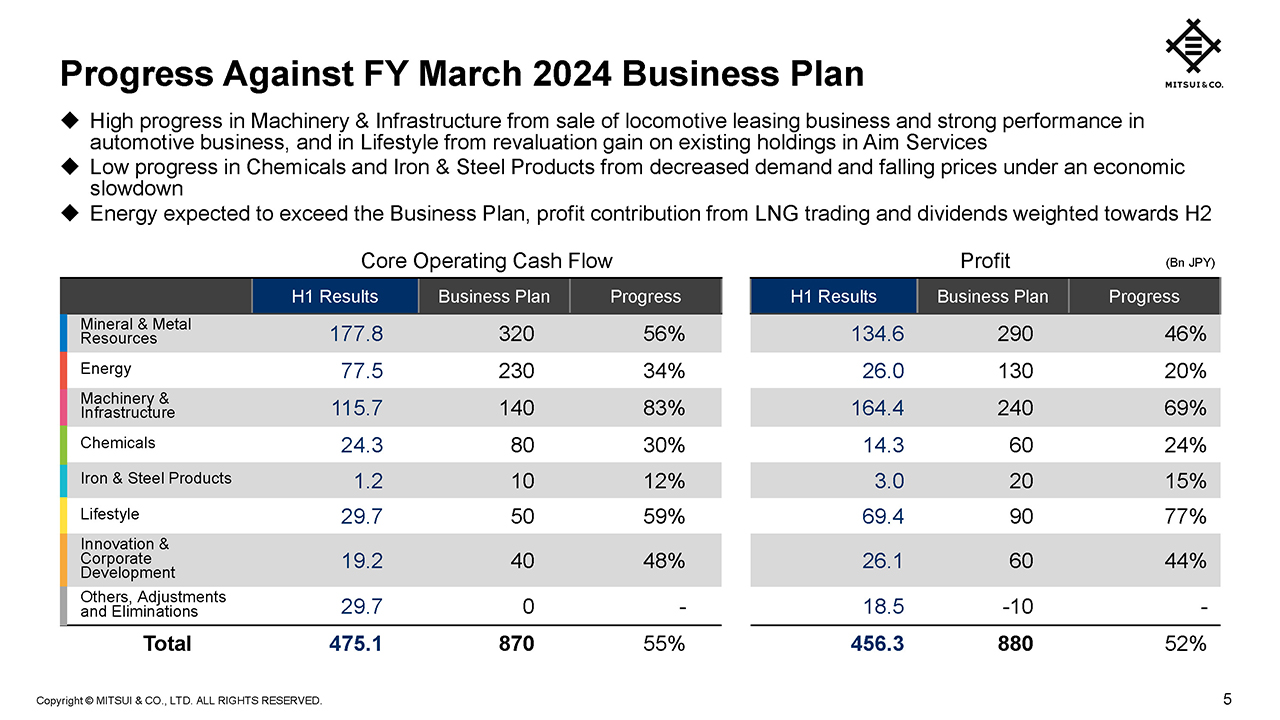

Progress Against FY March 2024 Business Plan

I will now explain our progress against the business plan.

In the Machinery & Infrastructure segment, there was a gain on sale of the electric locomotive leasing business in Europe and good performance in the automotive business. In the Lifestyle segment a revaluation gain on previously held equity in Aim Services was recorded. These and other factors have led to these segments maintaining a high rate of progress against the business plan.

In the Chemicals and Iron & Steel Products segments, the rate of progress was low due to the decrease in demand associated with the slowing of the global economy and the impact of the fall in prices.

In the Energy segment, profit contribution from LNG trading and dividends will be weighted towards the second half and on a full-year basis we expect earnings to be above those set out in the business plan.

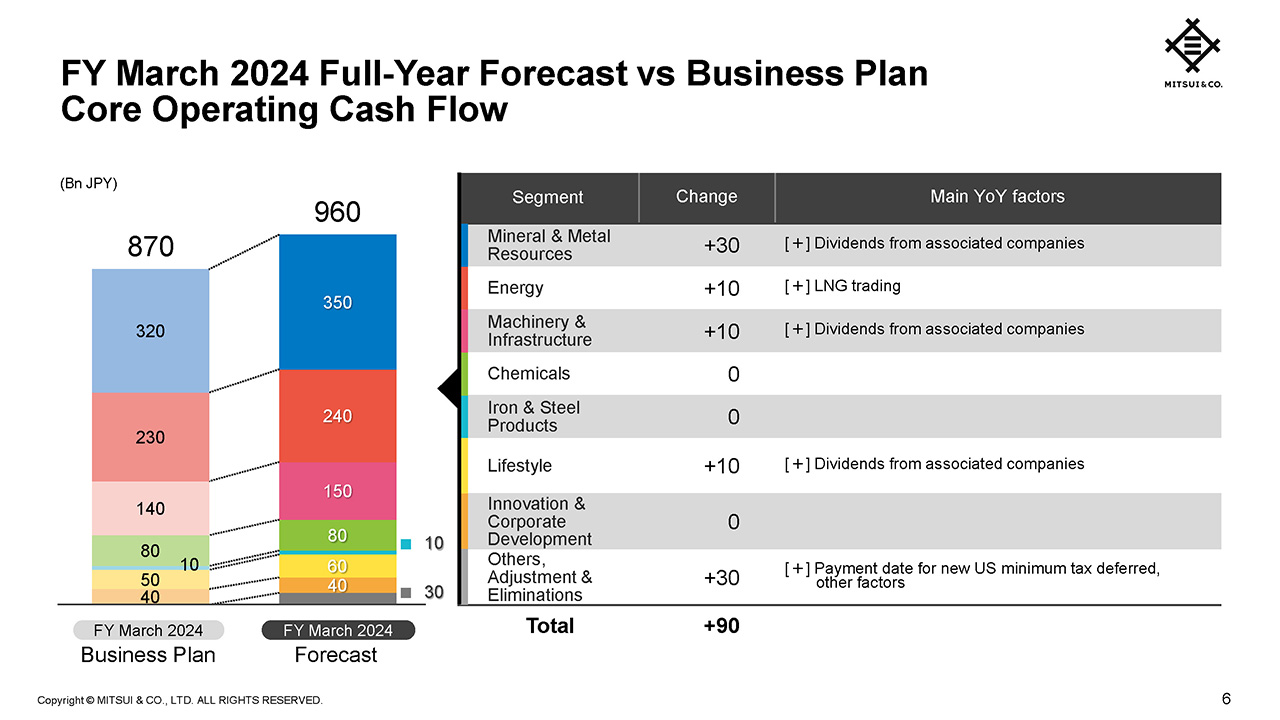

FY March 2024 Full-Year Forecast vs Business Plan

Core Operating Cash Flow

As I mentioned at the start of my presentation, we have revised up our full-year COCF forecast to 960 billion yen.

The Mineral & Metal Resources segment was revised up by 30 billion yen mainly due to an increase in dividends from associated companies. The Energy, Machinery & Infrastructure, and Lifestyle segments were each revised up by 10 billion yen. COCF for the company as a whole is now forecasted to be 90 billion yen higher compared to 870 billion yen in the business plan.

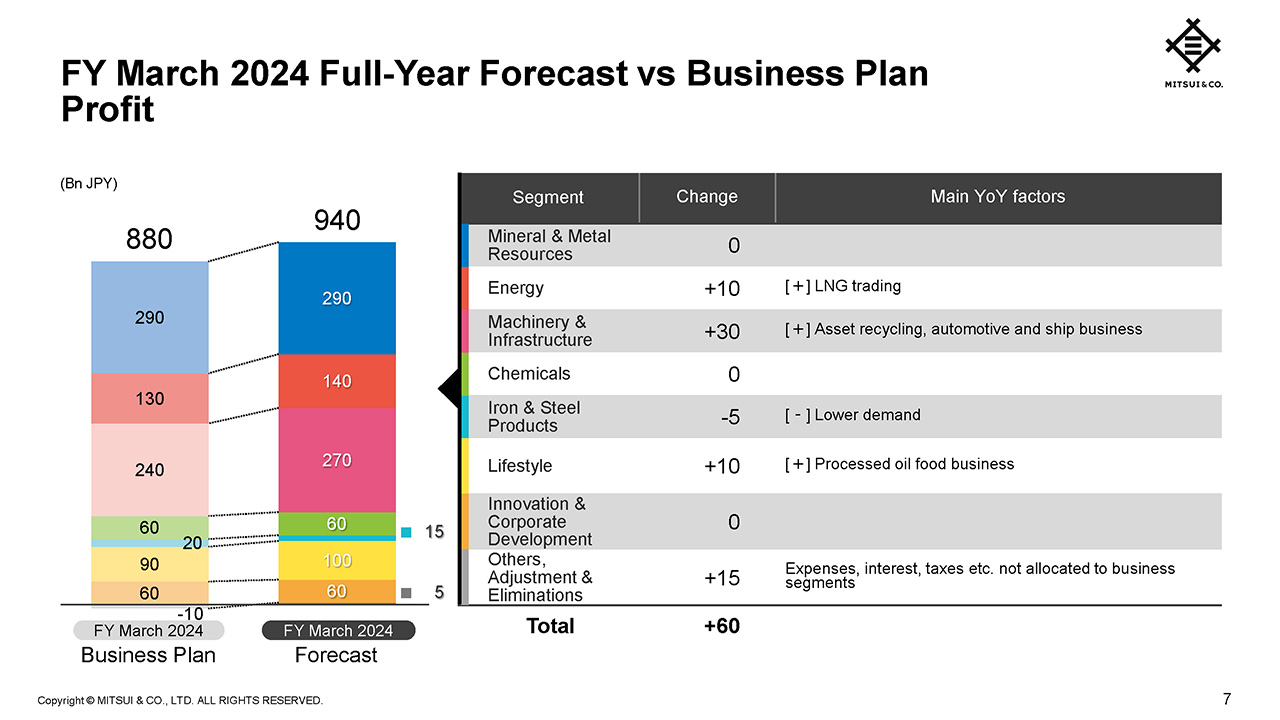

FY March 2024 Full-Year Forecast vs Business Plan Profit

We have also revised up our full-year profit forecast to 940 billion yen.

Based on the progress in the first half, the revised forecast for the Iron & Steel Products segment is lower than the business plan, whereas it is higher for the Machinery & Infrastructure, Energy, and Lifestyle segments. COCF for the company as a whole was revised up by 60 billion yen compared to 880 billion yen in the business plan.

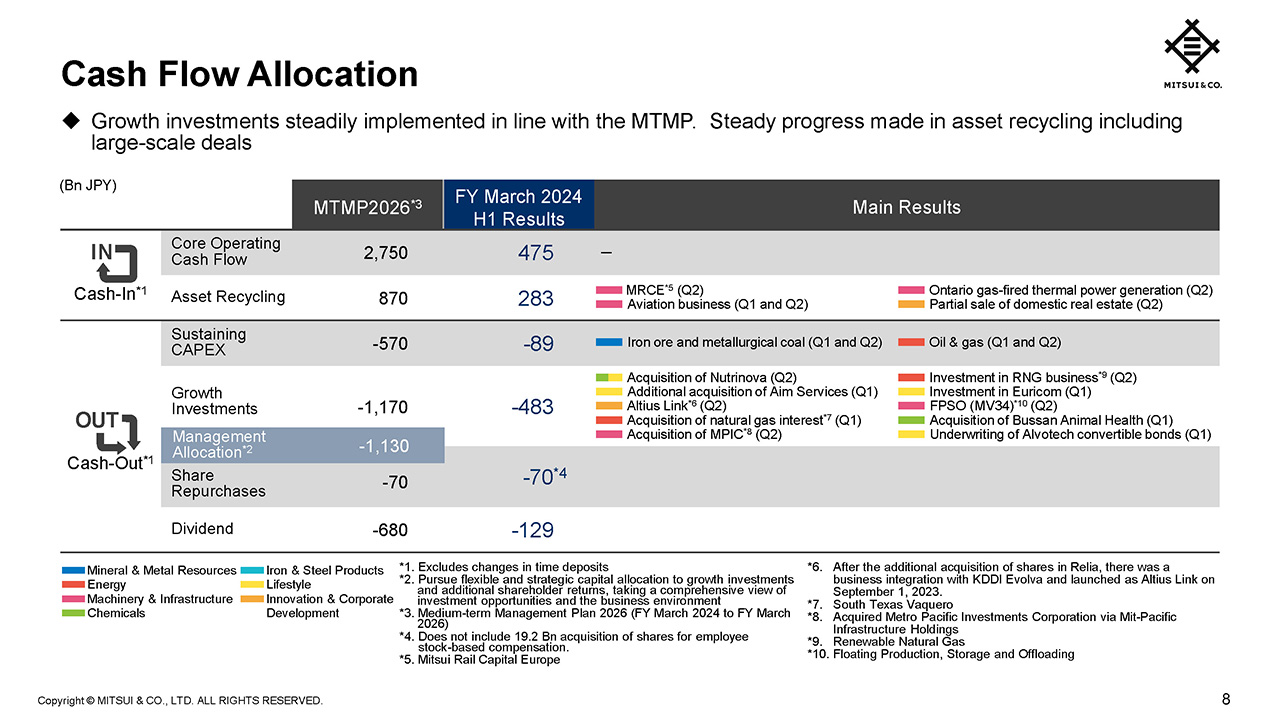

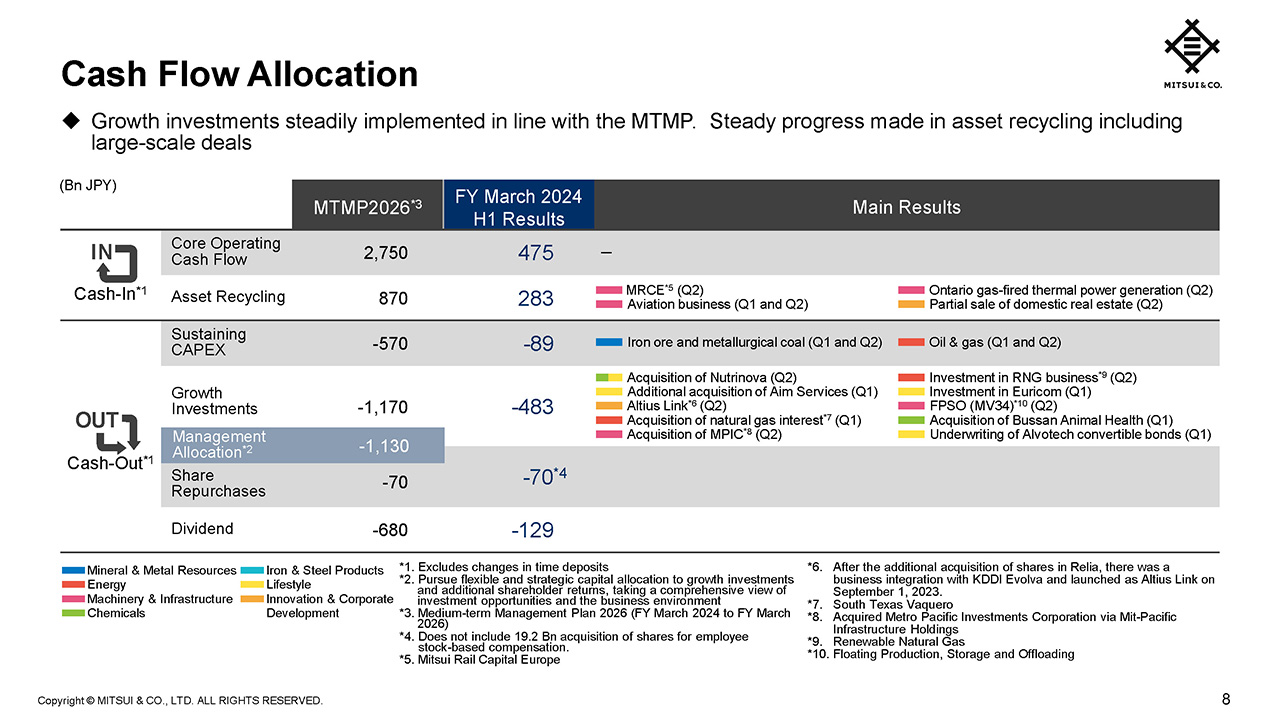

Cash Flow Allocation

In this section, I will discuss Cash Flow Allocation for the first half. In the first half, we steadily made growth investments in line with the Key Strategic Initiatives set out in the MTMP, and also had major asset sales.

Cash-in for the period was 758 billion yen, comprising COCF of 475 billion yen and asset recycling of 283 billion yen. Out of the asset recycling carried out in the first half, in particular, we view the electric locomotive leasing business in Europe, MRCE, as a well-timed large-scale asset sale that will also contribute to ROIC improvement.

Cash-out will be 771 billion yen, comprising investments and loans of 572 billion yen and shareholder returns of 199 billion yen. The main investments and loans in the first half included growth investments such as the acquisition of shares in Nutrinova, which manufactures and sells functional food ingredients, Aim Services becoming a wholly-owned subsidiary, and completing the additional acquisition of shares in Relia. There was a business integration between Relia and KDDI Evolva and a new company known as Altius Link was formed on September 1.

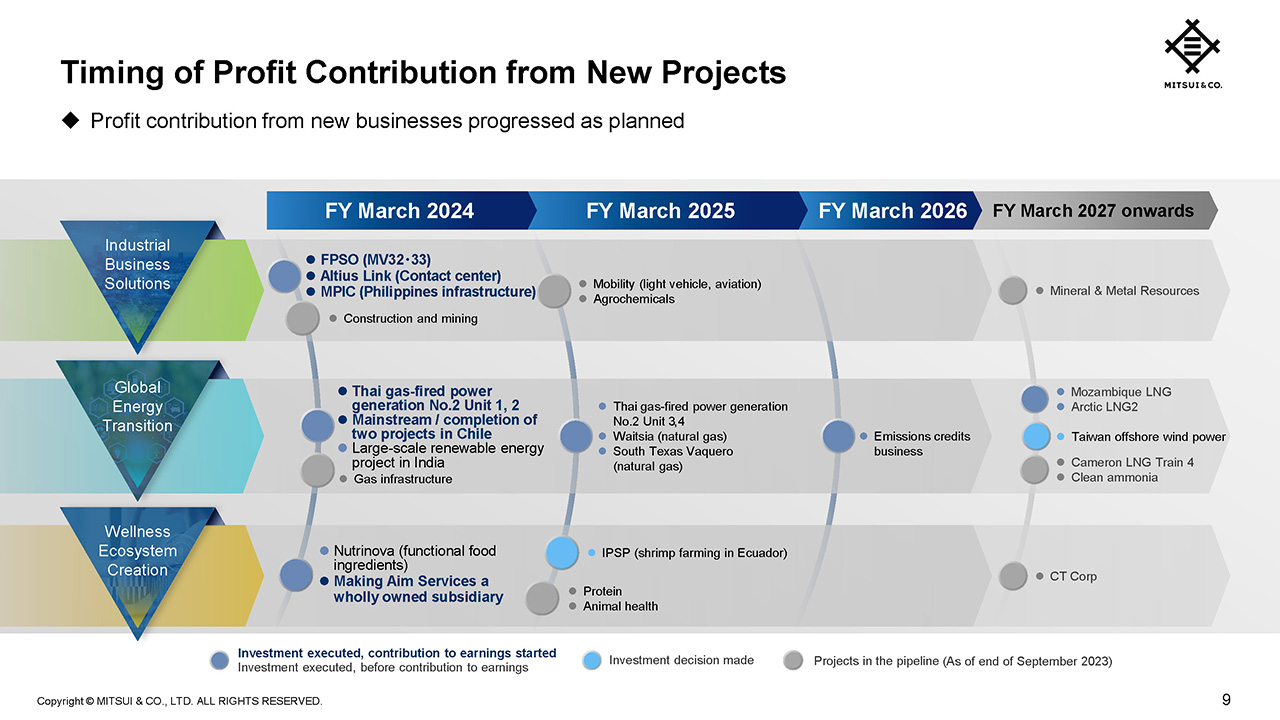

Timing of Profit Contribution from New Projects

As I just mentioned, Mitsui is actively executing growth investments in the Key Strategic Initiatives specified in the MTMP. The start of contribution to profit by these new projects is also progressing as planned.

The projects shown on this slide in bold have started to contribute to profit. As you can see, most of the new projects that were scheduled to start contributing to profit in FY March 2024 have already been implemented.

Furthermore, for projects that are expected to start contributing to profit from FY March 2025 onwards, investment executions or investment policy decisions have also been proceeding as planned. In the second quarter, we announced investment in a shrimp farming business, IPSP, in Ecuador, and a final investment decision on an offshore wind power project in Taiwan.

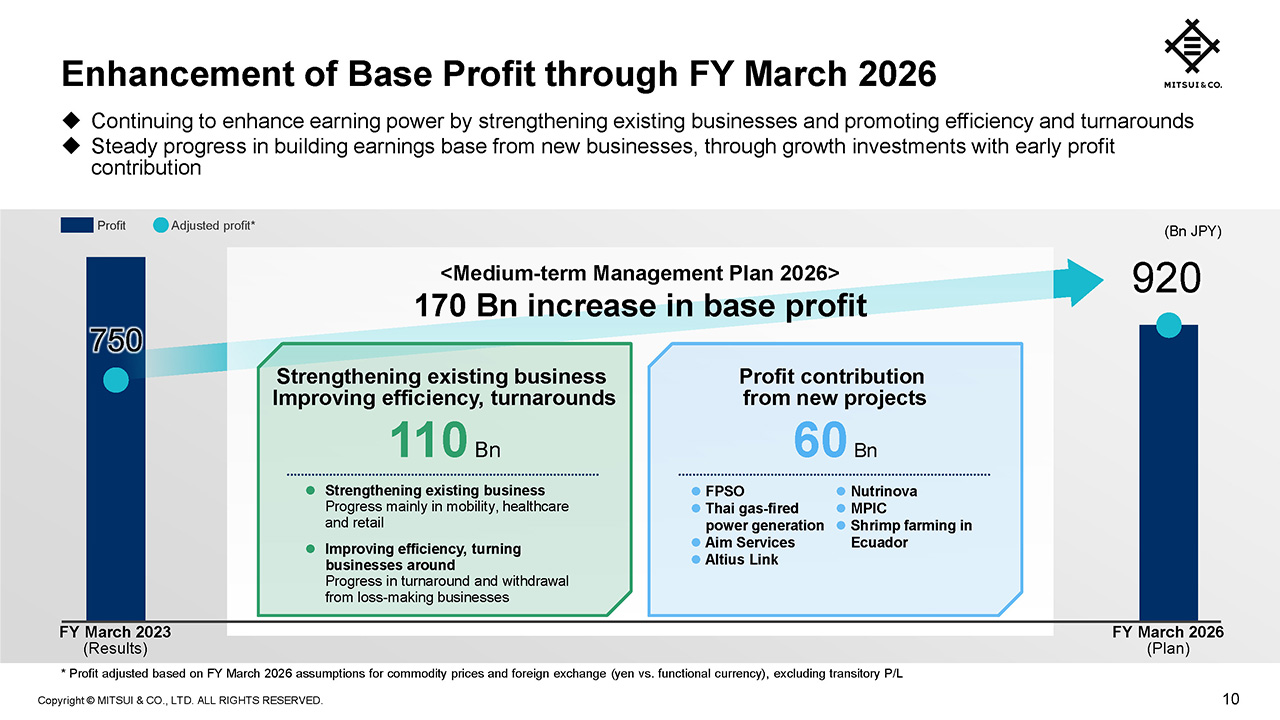

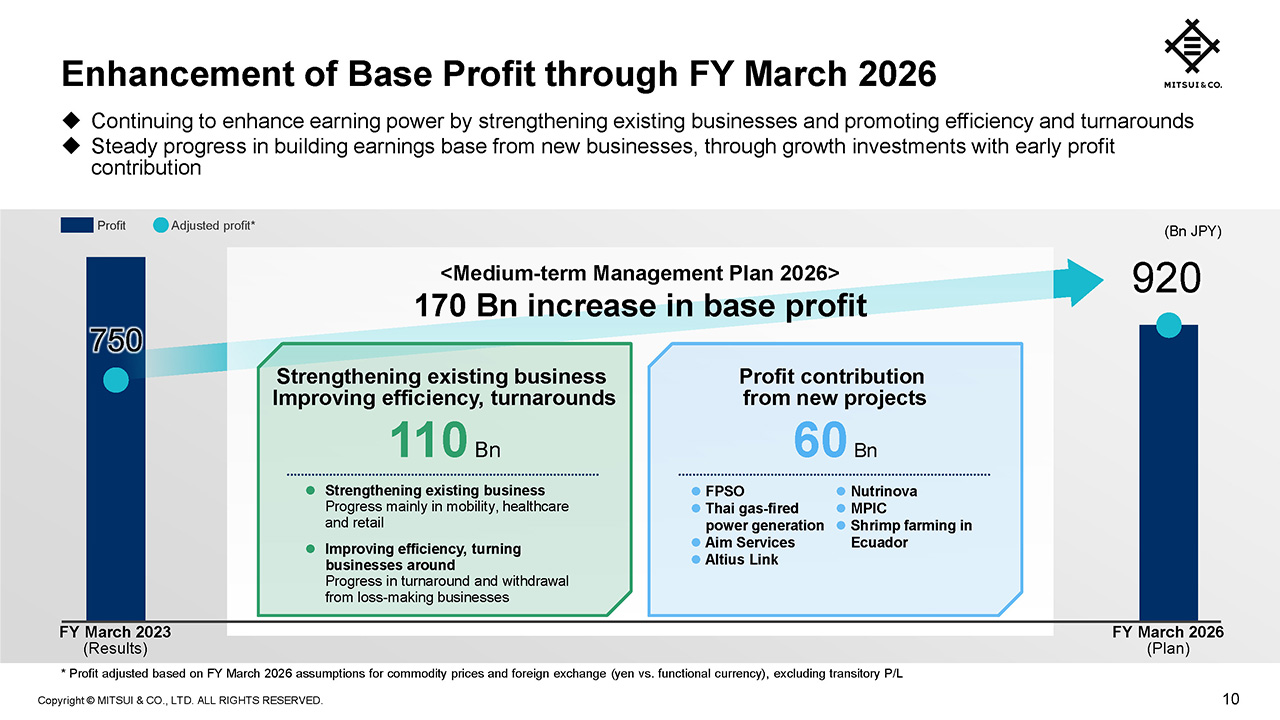

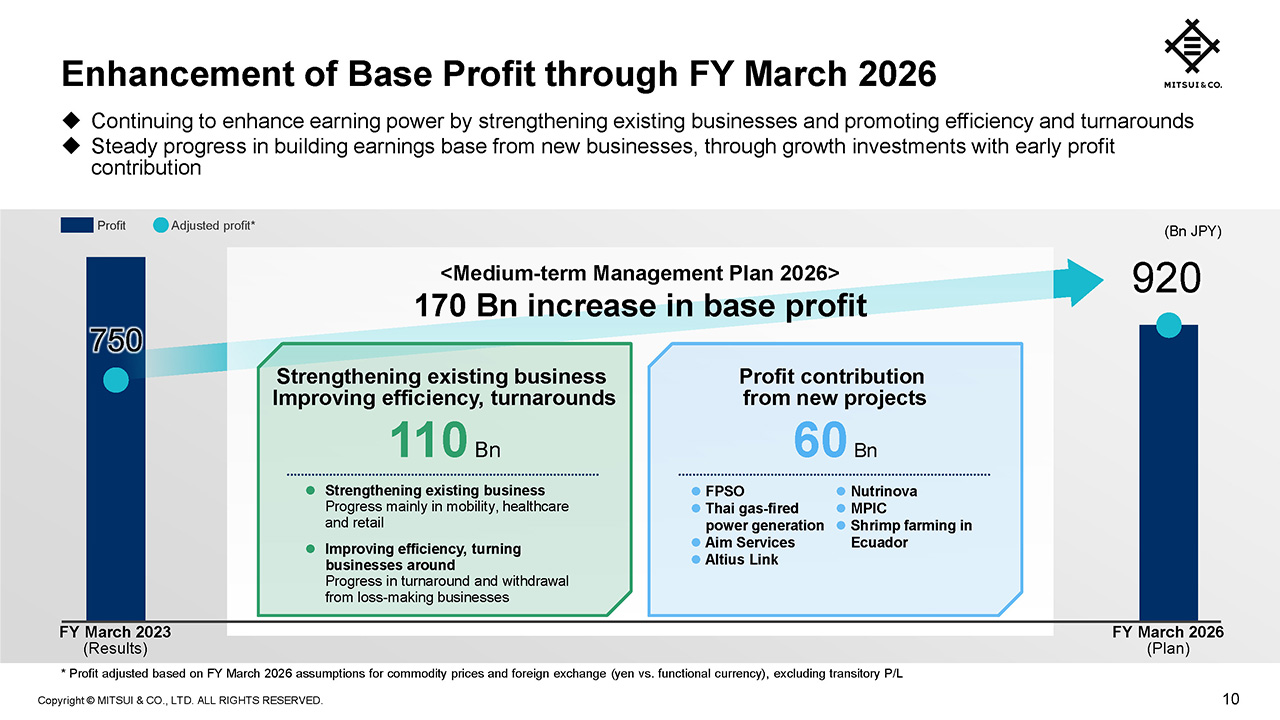

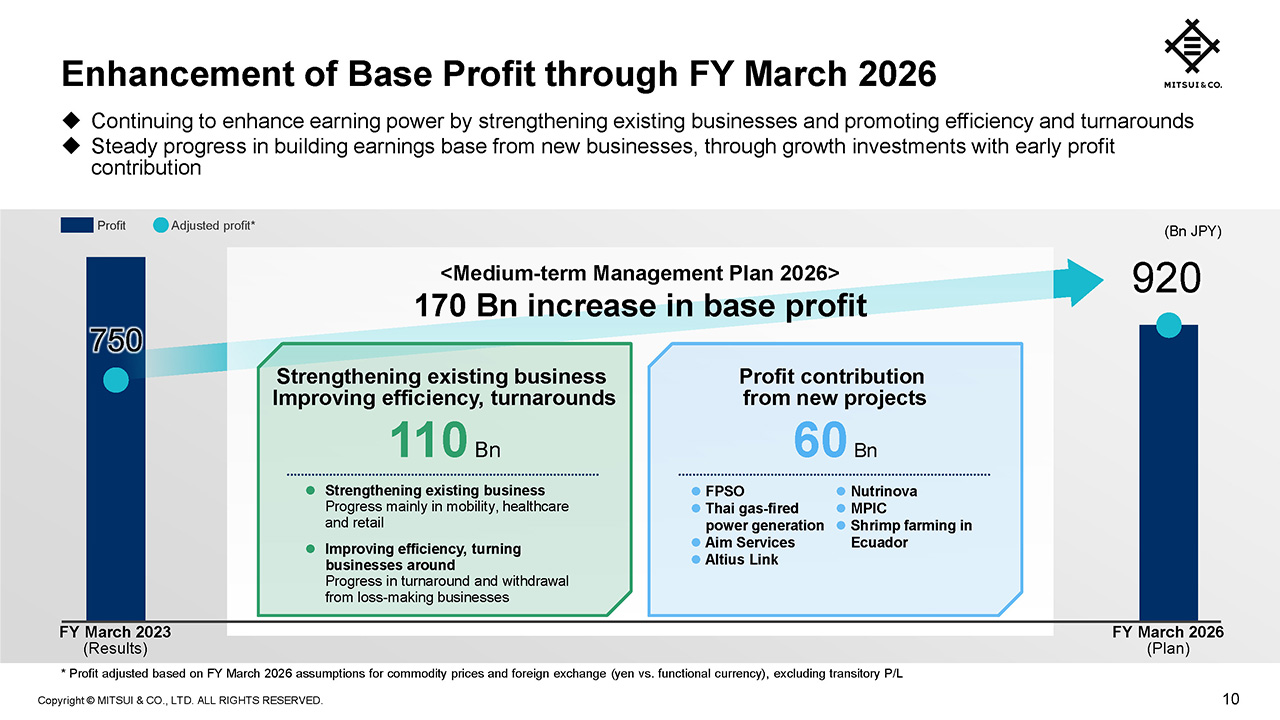

Enhancement of Base Profit through FY March 2026

Next, I will explain the progress on enhancement of base profit as laid out in the MTMP.

This slide shows the FY March 2023 profit, excluding one-time factors and adjusted for commodity prices and exchange rates based on our FY March 2026 assumptions. Based on these assumptions, we will increase base profit by 170 billion yen over the three years of the MTMP.

With regard to the enhancement of base profit from existing businesses, we aim to improve this by 110 billion yen over the three years of the MTMP. Specific initiatives aimed at strengthening existing businesses are progressing mainly in mobility, healthcare and retail.

An example of enhancement of base profit through efficiency improvements and turning businesses around is the steady progress being made in improvement of operations in the coffee business that recorded a loss in the previous fiscal year. Furthermore, progress was also made in initiatives aimed at exiting of several loss-making businesses.

As explained earlier, growth investments in new businesses are proceeding according to plan in each Key Strategic Initiative. Based on current progress, we have already accounted for around half of the 60 billion yen contribution to profit from new businesses expected in FY March 2026.

Shareholder Returns

Regarding our shareholder returns policy, as we were able to reconfirm the firmness in our cash flow we will raise the interim dividend by 10 yen to 85 yen, raising the minimum full-year dividend by 20 yen to 170 yen throughout the period covered by the current MTMP. Furthermore, as part of our flexible shareholder returns, based on the progress made in asset recycling, we have decided to make additional share repurchases of up to 50 billion yen. We will continue to consider the enhancement of shareholder returns offering both stability and flexibility, with a view to sustainably increasing ROE.

That completes my part of the presentation today.

I will now hand over to General Manager of the Global Controller Division, Masao Kurihara, for details of performance in the first half.

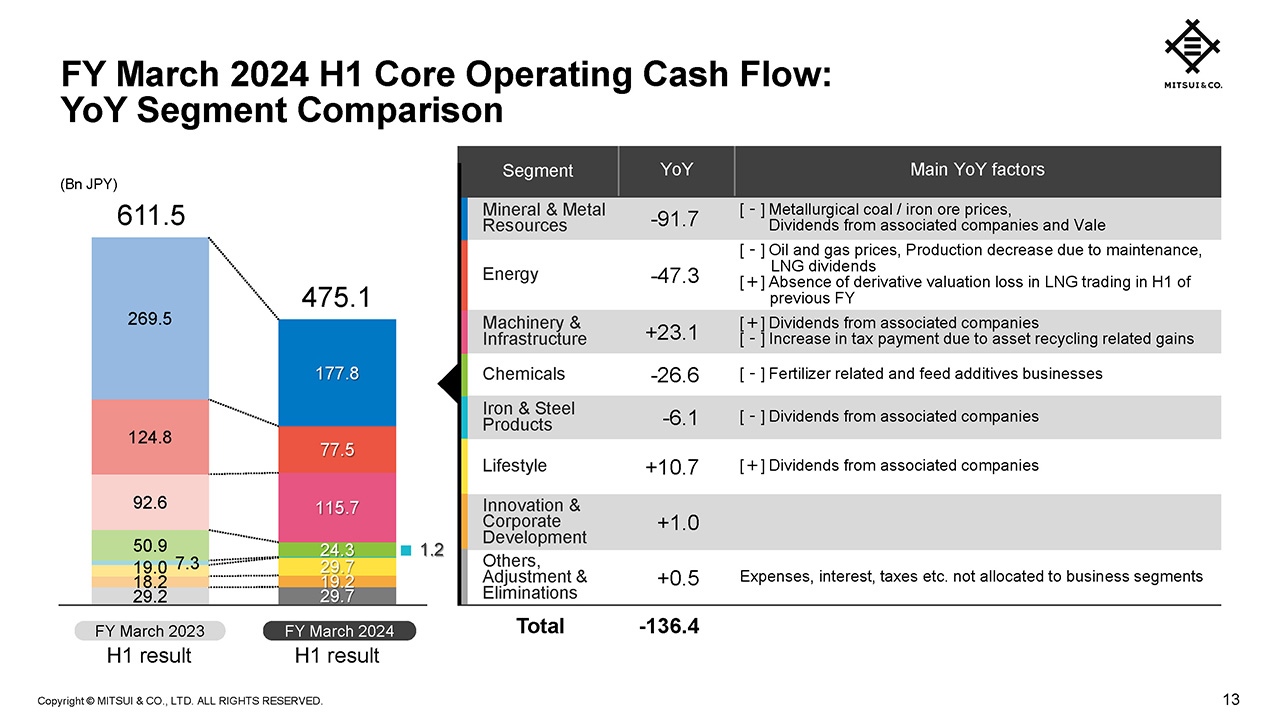

FY March 2024 H1 Core Operating Cash Flow: YoY Segment Comparison

Kurihara, General Manager of the Global Controller Division (Kurihara) :

I am Masao Kurihara, General Manager of the Global Controller Division.

I will now provide details of our operating results for the first half.

First, I will explain the main changes in COCF by segment compared to the first half of the previous fiscal year.

COCF for the first half was 475.1 billion yen, a year-on-year decrease of 136.4 billion yen.

In Mineral & Metal Resources, COCF decreased by 91.7 billion yen to 177.8 billion yen mainly due to the decline in metallurgical coal and iron ore prices and the fall in dividends from associated companies and Vale.

In Energy, although there was an absence of the valuation loss on derivatives that was recorded in LNG trading in the previous fiscal year, COCF decreased by 47.3 billion yen to 77.5 billion yen mainly due to the impact of oil production facility maintenance, as well as a drop in oil & gas prices and a decrease in LNG dividends.

In Machinery & Infrastructure, although taxes associated with asset sales increased, COCF increased by 23.1 billion yen to 115.7 billion yen, mainly due to higher dividend income from associated companies.

In Chemicals, COCF decreased by 26.6 billion yen to 24.3 billion yen mainly due to a fall in prices of fertilizers, fertilizer raw materials and feed additives.

In Iron & Steel Products, COCF decreased by 6.1 billion yen to 1.2 billion yen, mainly due to lower dividend income from associated companies.

In Lifestyle, COCF increased by 10.7 billion yen to 29.7 billion yen, mainly due to higher dividend income from associated companies.

In Innovation & Corporate Development, COCF increased by 1 billion yen to 19.2 billion yen.

Other factors, such as expenses, interest, taxes, etc., which are not allocated to business segments, totaled 29.7 billion yen.

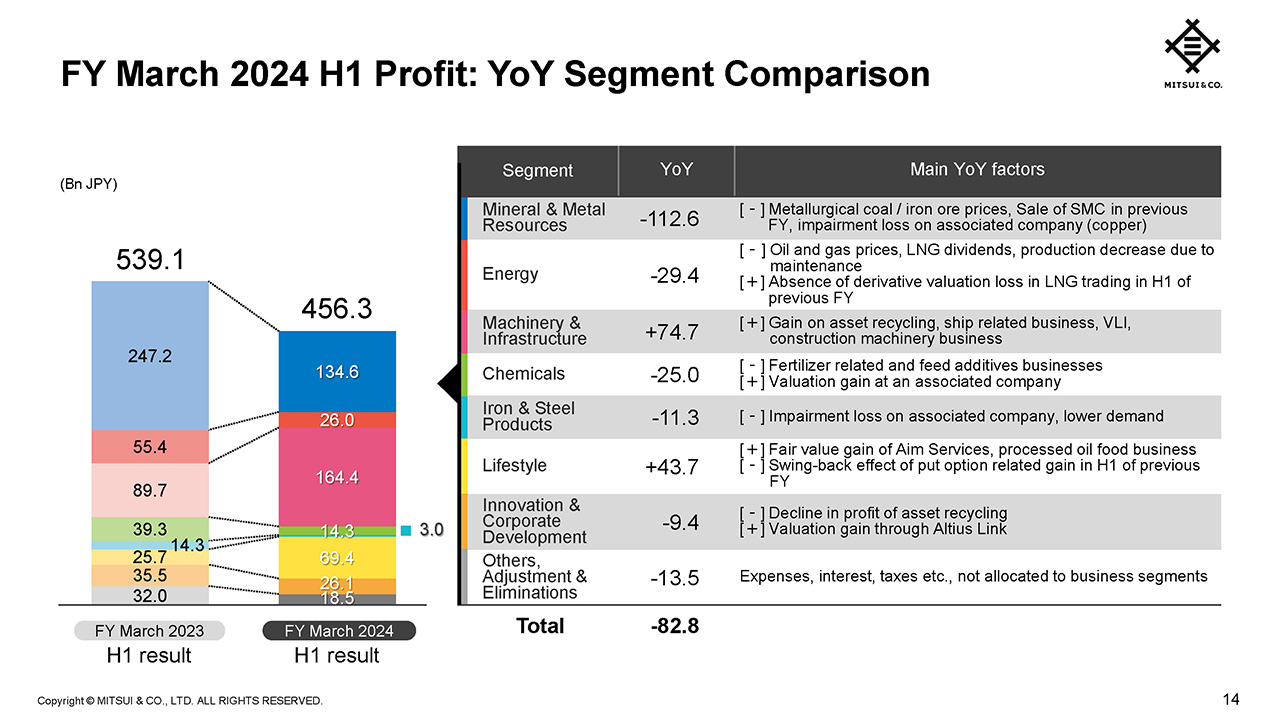

FY March 2024 H1 Profit: YoY Segment Comparison

Please turn to page 14.

I will now explain the main changes in profit by segment compared to the first half of the previous fiscal year.

Profit for the first half decreased by 82.8 billion yen to 456.3 billion yen.

In Mineral & Metal Resources, profit decreased by 112.6 billion yen to 134.6 billion yen due to the fall in prices of metallurgical coal and iron ore, the decrease in profit contribution following the sale of SMC, a metallurgical coal business in Australia, in the third quarter of the previous fiscal year, and impairment losses in the copper business in Chile.

In Energy, although there was an absence of the valuation loss on derivatives that was recorded in LNG trading in the previous fiscal year, profit decreased by 29.4 billion yen to 26.0 billion yen mainly due to the impact of oil production facility maintenance, as well as a drop in oil & gas prices and a decrease in LNG dividends.

In Machinery & Infrastructure, profits increased by 74.7 billion yen to 164.4 billion yen mainly due to the gain on sale of a European electric locomotive leasing business and good performance of multiple businesses such as ships, VLI, and construction machinery.

In Chemicals, although a valuation gain was posted, profit decreased by 25.0 billion yen to 14.3 billion yen mainly due to a fall in prices of fertilizers, fertilizer raw materials and feed additives.

In Iron & Steel Products, profits decreased by 11.3 billion yen to 3.0 billion yen, mainly due to impairment loss in associated companies and a lower demand.

In Lifestyle, although there was the absence of the valuation gain on R-Pharm put options recorded in the same period of the previous fiscal year, profits increased by 43.7 billion yen to 69.4 billion yen, mainly due to valuation gain on the fair value of Aim Services and good performance of the processed food business in North America.

In Innovation & Corporate Development, although a valuation gain on the fair value for Altius Link was recorded, profits decreased by 9.4 billion yen to 26.1 billion yen, mainly due to a year-on-year decrease in profit from asset sales.

Other factors, such as expenses, interest, taxes, etc., which are not allocated to business segments, totaled 18.5 billion yen.

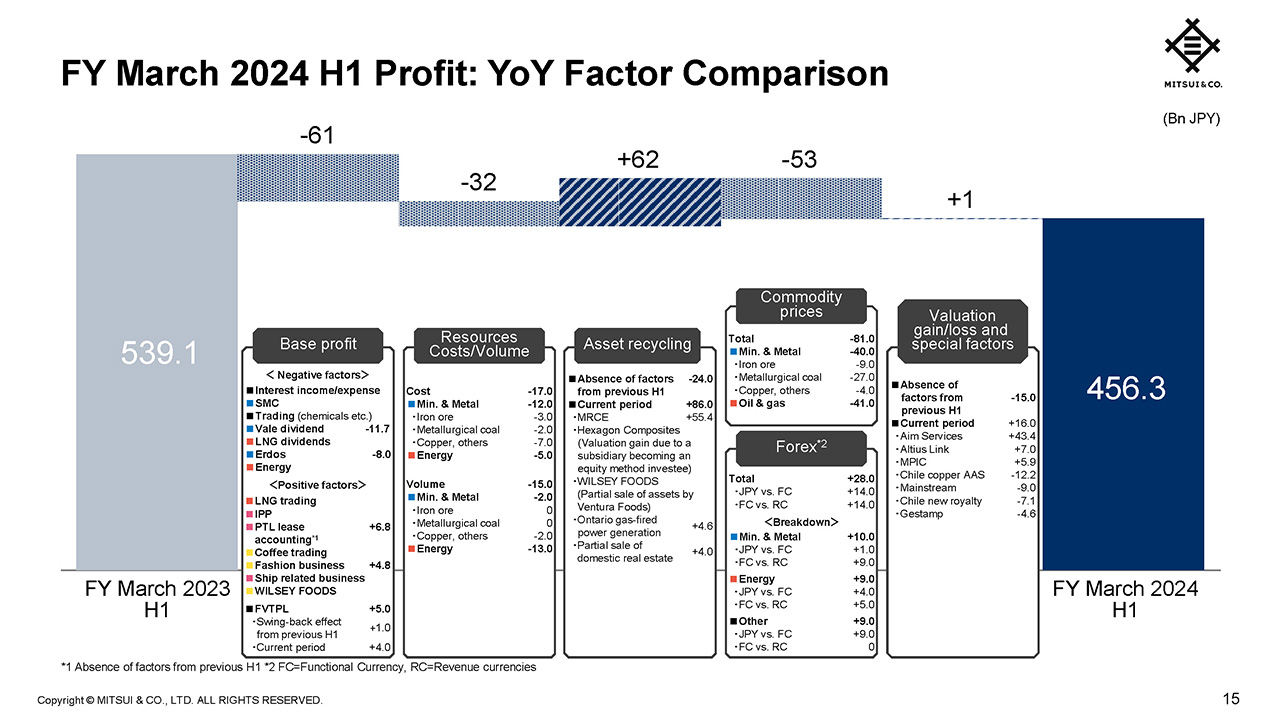

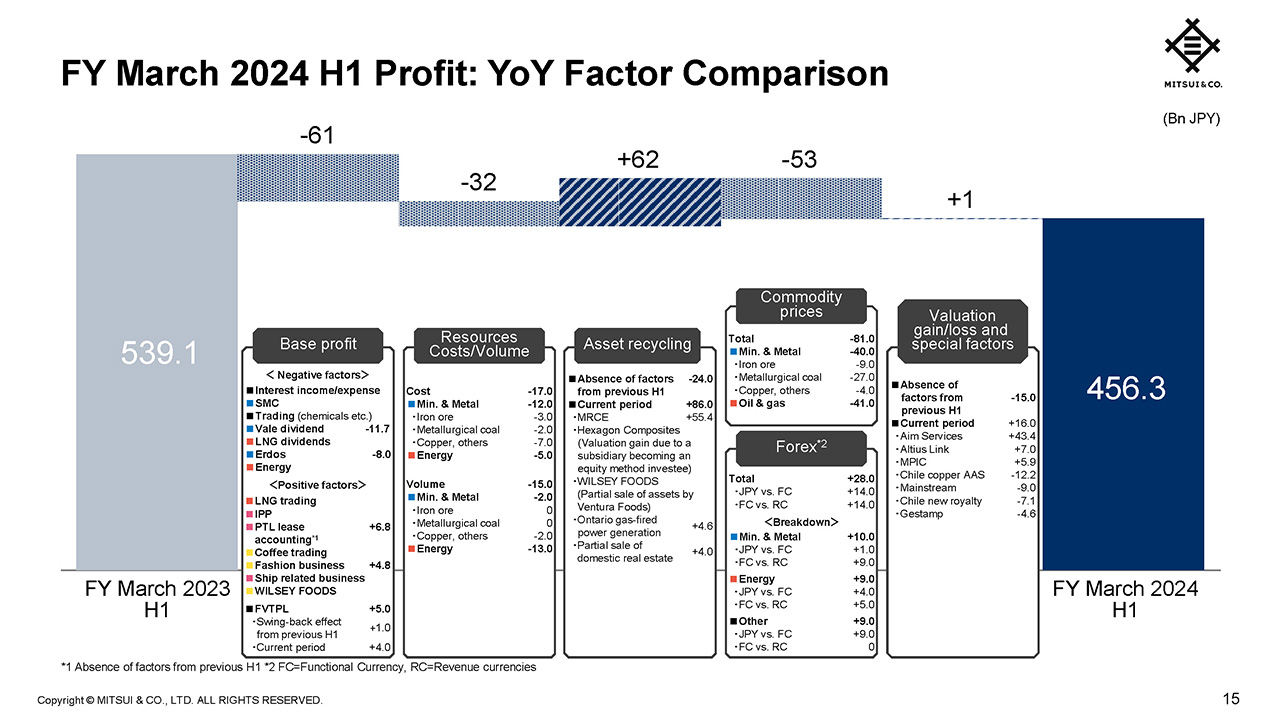

FY March 2024 H1 Profit: YoY Factor Comparison

This page shows the main factors that impacted year-on-year changes in profit.

Base profit decreased by approximately 61 billion yen. Although there was absence of the derivative valuation loss in the previous fiscal year in LNG trading, and performance improvements in IPP business as well as coffee trading, there was an increase in interest expenses, a decrease in profit contribution following the sale of SMC in the previous fiscal year, and lower profit from trading mainly in Chemicals.

Resources costs/volume decreased by approximately 32 billion yen mainly due to a decrease in production volume resulting from maintenance of some production facilities, as well as an increase in exploration costs in energy upstream businesses, and increases in fuel and labor costs in the Mineral & Metal Resources business.

Asset recycling resulted in an increase of approximately 62 billion yen mainly due to gains from the sale of MRCE, a European electric locomotive leasing business.

In commodity prices and forex, profit decreased by approximately 53 billion yen. For commodity prices, profit decreased by approximately 41 billion due to lower oil & gas prices, and 40 billion due to a fall in metallurgical coal, iron ore, and copper prices, which resulted in profit decrease by approximately 81 billion yen in total. For forex, profit increased by approximately 28 billion yen mainly due to the weaker yen.

Finally, for valuation gain/loss and special factors, although there was the impact of impairments in the copper business in Chile and the renewable energy business, there were also valuation gains through new growth investments leading to an increase of approximately 1 billion yen.

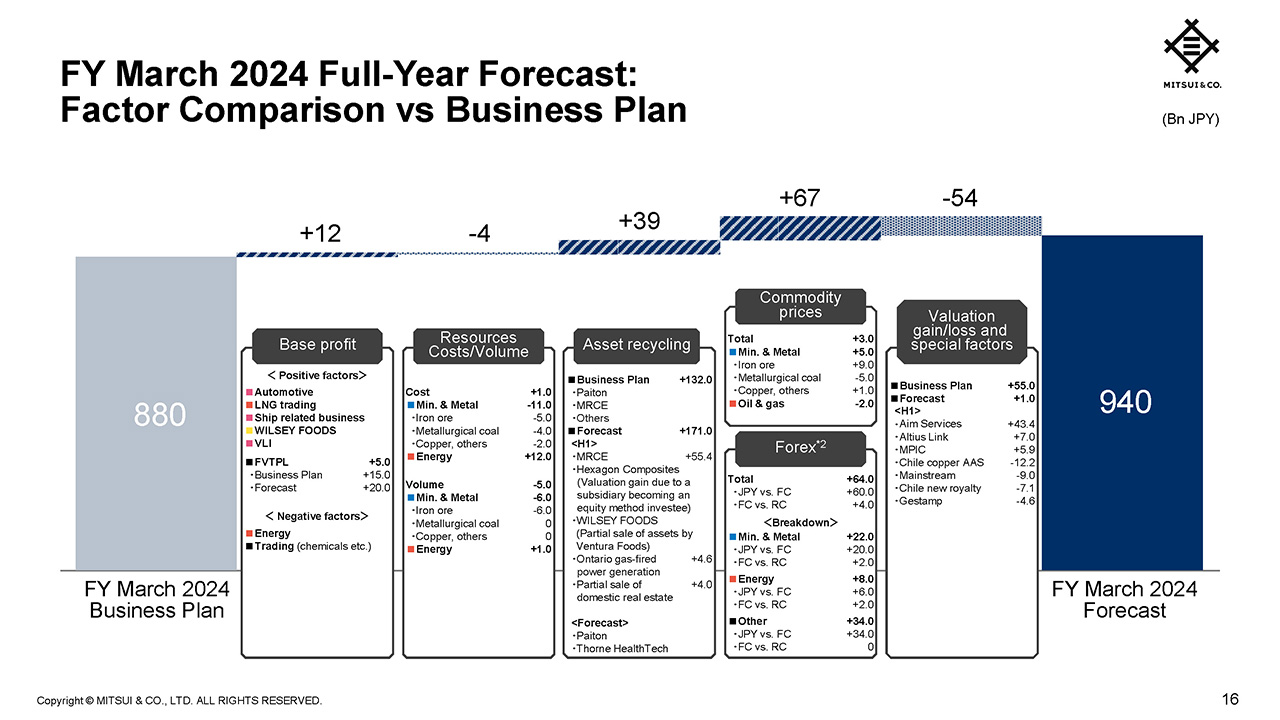

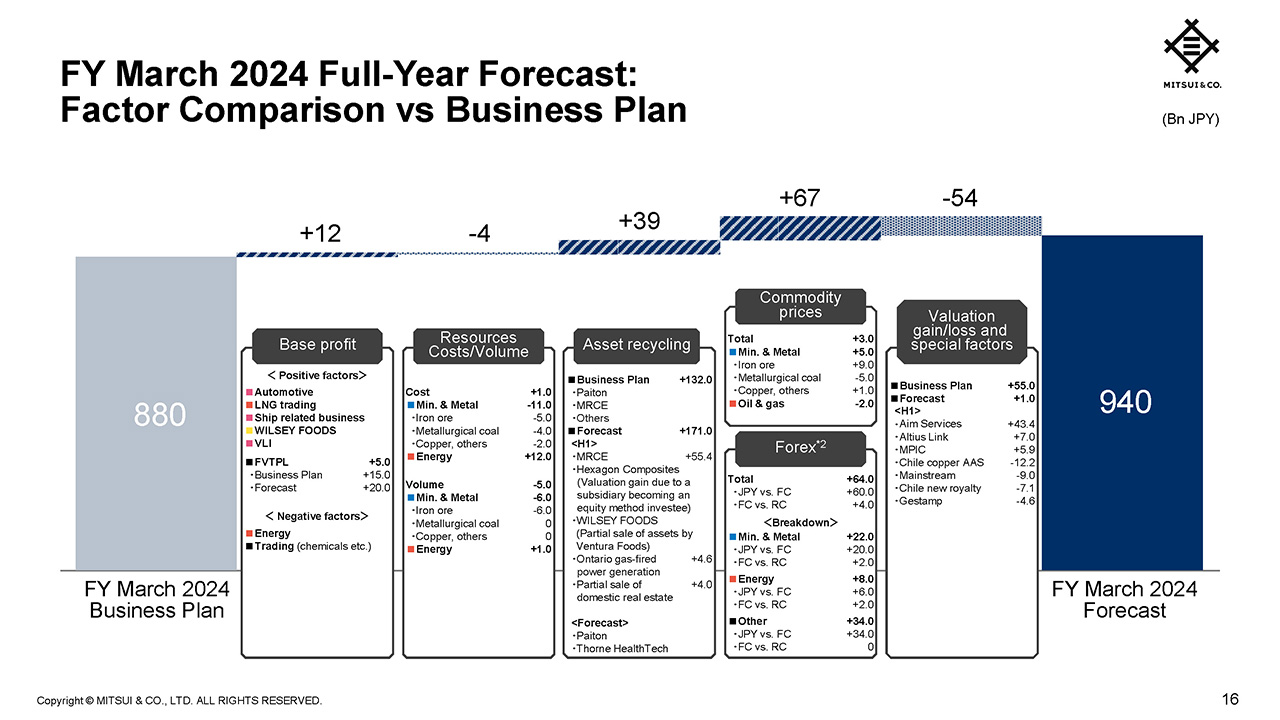

FY March 2024 Full-Year Forecast:

Factor Comparison vs Business Plan

Here we have a comparison of the newly announced full-year forecast against the business plan announced in May, with a summary of the factors involved.

Base profit is expected to increase by 12 billion yen. Although we expect lower dividends from the LNG business, good performance in the automotive business as well as contribution from LNG trading and the ship related business should lead to higher profits.

For resources costs/volume, although we anticipate cost improvements in exploration and other areas in the upstream energy business, inflation in Australia and Chile is continuing and there has been lower production volume in the Australian iron ore business. Mainly due to the above factors, we expect a 4 billion yen decrease.

For asset recycling, we expect an increase of approximately 39 billion yen mainly due to an increase in gains from the sale of MRCE, a European electric locomotive leasing business, as well as a timely sale of Thorne HealthTech, among others.

Commodity prices/forex is expected to generate a profit increase of approximately 67 billion yen. In forex, an increase in profit of approximately 64 billion yen is expected, mainly due to the weaker yen.

Finally, for valuation gain/loss and special factors, mainly owing to impairments in the first half, we expect a decrease of approximately 54 billion yen.

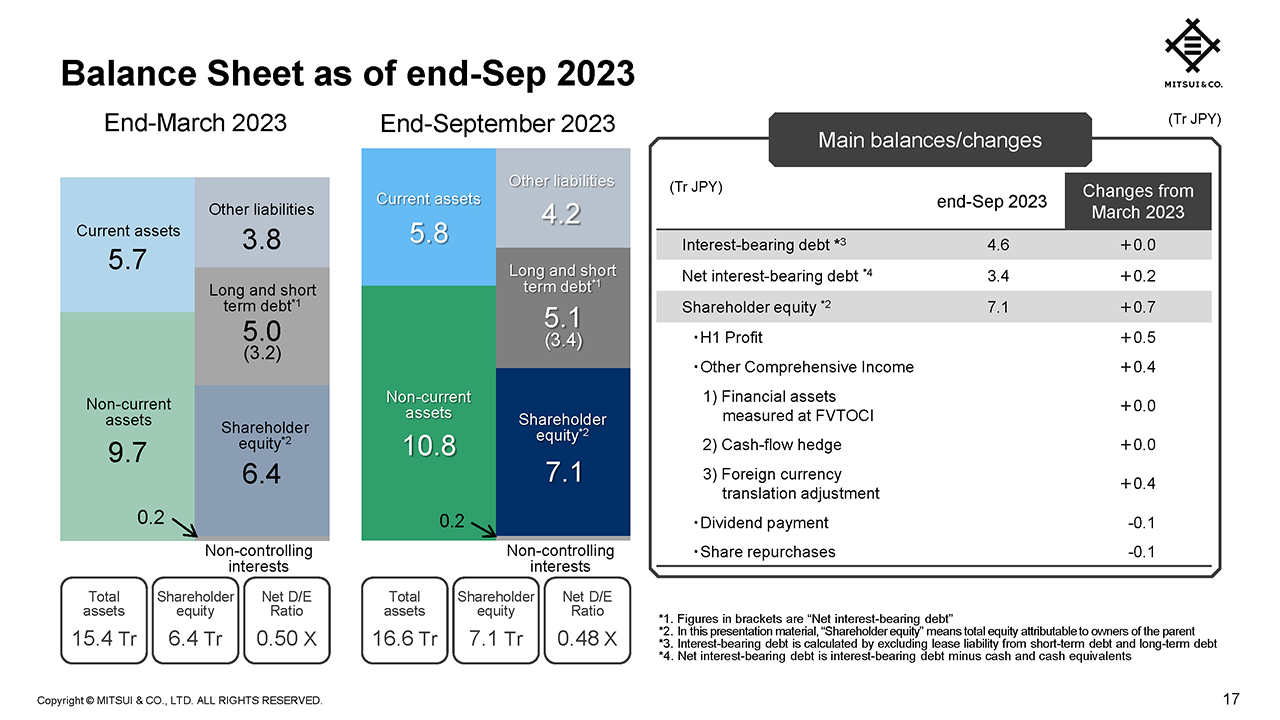

Balance Sheet as of end-Sep 2023

Now let's take a look at the balance sheet as of the end of the first half of the current fiscal year.

Compared to the end of March 2023, net interest-bearing debt increased by approximately 200 billion yen to 3.4 trillion yen. Meanwhile, shareholder equity increased by approximately 700 billion yen to 7.1 trillion yen. As a result, net DER is 0.48 times.

That concludes my presentation.

Q&A: Progress on the enhancement of base profit

Regarding the enhancement of base profit on page 10 of the presentation material, about half of the 60 billion yen profit contribution from new businesses is in sight, but an additional 110 billion yen will be expected from strengthening existing businesses, improving efficiency, and turnarounds. Please tell us about the progress you have made here, including specific examples. Although it may be difficult to demonstrate quantitatively, based on the certainty of this part, the equities market will measure the underlying profit and dividends of your company.

<Hori>

Regarding the strengthening of existing businesses, efficiency improvement, and turnarounds, it may be inaccurate to explain progress in quantitative terms on a quarterly basis, and we believe that explaining progress at the end of each fiscal year will provide a more accurate picture.

What we can say as of the end of the first half of the fiscal year, in the retail and food sectors for example, US company Ventura’s existing business is steadily getting stronger. The company has divested some of its businesses, taking into account their lack of proximity to the core business, and the likelihood of being able to generate sustainable earnings in the future. As a result, regarding the remaining business, there is now more confidence in their prospects for generating sustainable high earnings. I think this kind of business restructuring at our investees and group companies, etc., is a very easy-to-understand example.

In Mitsui & Co.’s own trading business, we are seeing progress in coffee trading, for example, where various on-site innovations have led to an increase in returns while reducing the amount of management resources used and lowering risks. I believe that this will be another steady factor in achieving the goal of a 110 billion yen increase in base profit, but I think it would be appropriate to quantitatively show this after a more precise look at the full-year financial results.

In healthcare, we sold the educational business, which was more distant from the core business of IHH, and we have further reorganized the earnings base as a whole. We expect an increase in dividend income from IHH as a result and for this to be part of the 110 billion yen increase in base profit contribution.

In the mobility business, we are also implementing a number of measures to strengthen existing businesses. In the Medium-term Management Plan (MTMP), we presented a cluster strategy for the mobility business, we have made progress in businesses adjacent to our core business, and we would like to continue moving forward steadily. Looking back on the past six months, I think it's fair to say that we've made some progress, but there are still steps we should take that have been agreed upon within the company. I would like to steadily implement these measures and explain quantitative progress in the full-year financial results.

Q&A: Shareholder returns policy

You explained that the decision to increase the dividend this time was made based on the company’s capability to generate strong cash flow, and the decision to repurchase shares was made based on the progress of asset recycling. Was this determined based on past results, or did the decision take into consideration, for example, an expected increase in base profit from new investments? So even if the operating environment is difficult next fiscal year, is it safe to assume that we can expect an increase in dividends if we can confirm that the company’s base profit has increased?

I understood that the decision to make a new share repurchase took into consideration of the sale of MRCE in Q2, so if the sale of Paiton is expected to go as planned in the second half, will you consider additional buybacks? Please tell me about the additional shareholder returns this time, and also regarding future returns.

<Hori>

Our shareholder returns policy remains unchanged at this time. The basic goal is to return around 37% of Core Operating Cash Flow (COCF) over the three-year period of the MTMP. We are considering a combination of flexibly implementing share repurchases and hopefully increasing dividends gradually. The decision to increase the dividend this time also takes into account the current MTMP progress toward its goal of increasing cash flow. For example, we have estimated that the contribution of new businesses to earnings will be 60 billion yen, but we are currently considering how the earnings base will be built up from new businesses that will have an immediate effect during the current MTMP, and whether there will be a sufficient base to increase dividends. Please understand that we discuss this internally before making an announcement regarding increasing the dividend.

With regard to share repurchases, while there are a high number of both investment and asset sale opportunities, we will also consider the strength of our balance sheet so that we are prepared for financial stress under the business environment that is extremely difficult to predict. Rather than linking an asset sale opportunity directly to share repurchases, we would like to make decisions based on judgment of things in a comprehensive manner, meaning if there is an asset sale, considering if it is appropriate to use that capital to flexibly execute a share repurchase after looking at it from various angles.

Q&A: Current level of underlying profit

If we take only Q2 into account, there are some loss-making segments and the impact of exchange rates. The full-year forecast shows one-time profit of approximately 170 billion yen, making it difficult to understand what the underlying profit is. You are forecasting profit of approximately 480 billion yen in the second half, but please tell us about your current level of underlying profit.

<Hori>

Our company generates profits through the three pillars of trading and logistics business with its various functions, business investment, and portfolio management. In addition, there is also profit we generate from portfolio reconfiguration, and in certain business models we generate profit at the time of exit rather than through earnings generated from keeping a business in our portfolio. We will look at these things in a comprehensive way to determine what is counted as base profit. This is a highly complex issue, so I believe we need to engage in a detailed dialogue with you all to provide clarity.

In terms of underlying profit, in Energy, opportunities for realized profits associated with LNG trading delivery are concentrated in the second half of this fiscal year. Looking at the timing of dividends and realization of trading profits from the LNG projects, it is expected that we will exceed the full-year forecast, so I think it would be better to look at things from a full-year perspective here. In addition, for mobility, we assume that the global economy, for example the US economy, will ease in the second half of this fiscal year, so we believe there is a possibility for upside if the economy holds up to a certain extent. In addition, if we take into account areas that are directly affected by the Chinese economy, for example, if you subtract one-time factors from the second-half forecast of 480 billion yen, and in areas where there is a gap between the first and second halves, such as in Energy, if you average it out on a full-year basis, that should get you somewhere close to the underlying profit. However, I think it would be best to make a comprehensive judgment based on the company’s multiple types of earnings in an overall approach, as I mentioned at the beginning.

Q&A: Operating segments that are showing signs of weakness

There are some segments such as Chemicals and Iron & Steel Products that are showing signs of weakness, but please let us know if there are any segments where there is a sense of slowdown or areas we should be cautious about.

<Hori>

Regarding Chemicals and Iron & Steel Products, there is no doubt that trading business around China, especially for Chemicals, was down in the second quarter, but there are some signs of bottoming out, so we expect it to recover in the second half of the fiscal year. Exports of steel products from Chinese mills to other countries are also increasing. There is a view that China’s economic situation will bottom out, considering the current trend of China’s economy and the Chinese government’s economic stimulus measures. We would like to keep an eye on this and work on it carefully. The downward revision to the full-year forecast for Iron & Steel Products is primarily due to the impairment loss related to Gestamp. In addition, Chemicals includes several exits from loss-making projects, some of those in the first half. If we proceed with this thoroughly, the flow of our earnings base will increase.

Chemicals and Iron & Steel Products, especially products that are close to the materials side of the business within the Chemicals segment, are leading indicators of the global economy, so we are watching them carefully. We would like to share our outlook with you at the timing of the Q3 and Q4 financial results.

Q&A: Progress of Asset recycling and forecast

Regarding asset recycling this year, even though you have set out targets in the MTMP, it appears that you have made significant progress in just the first half of this fiscal year alone, but is it correct to understand that this pace will not continue?

<Hori>

It certainly looks like there is more asset recycling this year than usual. However, as the company is steadily reconfiguring its portfolio and making the company’s business foundation better suited to the business environment and future prospects, we expect portfolio reconfiguration to increase, more so than in the past.

However, we need to continue applying investment discipline, and there are some cases where it is better to hold on to an asset and extend the period in which we can apply our functions, so I think it is necessary to make decisions on a case-by-case basis.

Q&A: Direction of shareholder returns

Based on your announcement of shareholder returns, the ratio of total returns to COCF will be 39% for FY March 2024. Although factors such as asset sales were explained, the earnings power and cash flow are slightly higher than expected in the MTMP, and I believe that available cash flow that can be used has increased. Given this increase, please tell us your thoughts on whether to prioritize increasing investment allocation or shareholder returns. I think you will need to somewhat increase shareholder returns in order to maintain ROE at a reasonably high level. Please let me know your thoughts on this point.

<Hori>

Regarding new investments, we continue to have good quality investment opportunities in our pipeline, and there are many candidate projects.

The multiple new investment projects listed on page 10 of the presentation material have been in the works since around the time of the spread of the COVID-19. When implementing an investment project, we proceed while confirming with the partner what kind of value-up plan we can expect after the investment, and we would not proceed with the investment until that plan is completed, As a result, we believe that such projects will result in a certain amount of return. We would like to invest in such projects, and we have a variety of projects, large, medium and small, in the pipeline. On the other hand, investment discipline is certainly in effect. In reality, our requirements regarding required returns or risk-return profiles are becoming stricter, so it has become the norm for business units to understand that funds will not be allocated to them for investing unless the project quality is improved, and so they are taking action. Therefore, if an excellent project that exceeds that expectation and can contribute to our future comes along, we would like to step in and utilize capital from the Management Allocation.

On the other hand, regarding COCF, as reflected in this shareholder returns announcement, we believe that the base of it is getting stronger. We are considering the overall shareholder return by multiplying the percentage to COCF over the three-year period of the MTMP, and we would like to proceed while maintaining a balance.

However, we are conscious of ROE. If an investment project does not go ahead due to our strict discipline regarding investment projects, there is a possibility that, for example, the company could directly shift to shareholder returns that increases capital efficiency. If an investment project exceeds our current hurdle rate with investment discipline, then such investment should steadily increase ROE, even if they require some time.

It's not that I’m consciously leaning towards one side or the other, but the fundamental thing is to raise ROE, and I would like to do this by applying discipline from both sides.

Q&A: Current status of LNG projects

What is the current status of the three LNG projects (Sakhalin II, Arctic LNG 2, and Mozambique)?

<Hori>

For both Sakhalin II and Arctic LNG 2, it is absolutely necessary to keep a close eye on the geopolitical situation and also to comply with the sanctions of various countries. In this context, we will work to ensure a stable energy supply. Through consultations with the relevant people involved, including various practical responses, and through ongoing discussions with relevant countries and partners, we have managed to continue a stable supply at present, including for Japan’s LNG imports.

Regarding Mozambique, I recently visited the area. The security situation has improved dramatically, and citizens relatively close to Area 1 who were forced to move are finally returning. We recognize that administrative and other services to citizens need to be restored, and that it is important to have food and other basic living infrastructure in place, and they are making steady progress.

We have been discussing with the relevant parties, including TotalEnergies, the operator, and we are now near a point where we can resume construction at the earliest possible date, but I would like to be accurate when specifying the timing, so I will refrain from speaking on that today. However, the conditions are coming together for us to resume construction in the not-too-distant future, and we will work to finalize them. Once we have made such a decision, we will let you know immediately.

Q&A: Breakdown of the enhancement of base profit

I understand that increase in base profit through strengthening existing businesses, improving efficiency, and turnarounds (a 110 billion yen increase) includes the results of digital transformation (DX) and green transformation (GX) initiatives. I think that DX will have effects across multiple segments, and GX will be related to portfolio replacement, including new projects. In the first six months since the start of the MTMP, please explain whether the planned initiatives have gotten off to a good start and how you see the contribution of these initiatives.

<Hori>

We are making company-wide efforts to improve our competitiveness by utilizing various tools related to DX. We think that it is necessary to manage a larger portfolio with the same or better quality without changing the current number of people promoting projects in Mitsui & Co.’s operations, and we are aiming to improve the company’s operational leverage through the use of DX. We do not explicitly include the results of these in the profit contribution of new business. On the other hand, we are also developing efforts to clarify within the company the efficiency of the number of people promoting projects through the use of DX. I hope to be able to talk about the effects of these efforts in due course.

Since many energy transition projects will take some time to contribute to profit and many will contribute after the current MTMP, we believe it is necessary to shift the time axis a little. On the other hand, we are willing to professionally manage the scarcity of materials that are essential for energy transitions and for which a market already exists. When those investments are realized, they will have an immediate effect because the market already exists. In this way, we would like to promote a combination of projects that take some time to contribute to profit, such as renewable energy, and material-related projects that will have a relatively immediate effect on profit.

Q&A: Measures to address economic trends

Although the operating environment is very strong, I believe the market is also watching with caution for a slowdown. The second half figures for “valuation gain/loss and special factors” were revised lower to 1 billion yen from 55 billion. I wonder if you made this revision while you wait and see to what extent there will be a slowdown in the economy. Also, what are your thoughts on defensive measures such as actually accumulating cost reductions?

<Hori>

As you noted, we have revised our figures for “valuation gain/loss and special factors” for the second half of the fiscal year. Although we cannot disclose details, this change is not so much in response to our reading of the operating environment, but rather recording a certain amount of valuation losses as part of the process of dealing with loss-making businesses. However, by taking these measures we expect flows to steadily improve and management resources can be allocated elsewhere. We are making progress on several such projects and have factored them into the figures for “valuation gain/loss and special factors”. It is a matter of wanting to deal with and improve upon a problem that we originally had.

On the other hand, we have been discussing internally about how we can respond to the economic slowdown by raising our antennae and alert level in all of our businesses. In particular, we are discussing pricing measures to deal with cost inflation and how to manage cost increases in the face of rising interest rates. For example, in the mobility business in North America, it is very important to devise measures to deal with rising interest rates, which will ultimately be passed on to products and services. We are making these kinds of efforts company-wide. Although we are cautious of economic fluctuations to a certain extent, in the end, the best defense is to improve our cost competitiveness and operating leverage, as I explained earlier, and the entire company is working together on this matter.

Q&A: Background of Increase of SG&A expenses

In relation to the pricing strategy against cost inflation, I think the level of control we have over cost management will also become more important in the future as the operating environment become increasingly uncertain. Looking at the current financial results from this perspective, Selling, general and administrative (SG&A) expenses increased about 20% year-on-year, and given that Q1 had an 18% year-on-year increase, it appears to be accelerated heading into Q2.

I understand that this is due to inflation and rising prices, including foreign exchange, but is this a figure that can be managed within the scope of your company’s assumptions, or do you think you will have to take some measures in the future? Please explain about costs.

<Hori>

The increase in SG&A expenses is, of course, due to inflationary factors, but also due to foreign exchange factors for overseas businesses, which will make SG&A expenses similarly large on a yen basis. However, this will change the same way for commensurate earnings.

We also have several examples of consolidation. For example, when we have an investment that goes from being an equity accounted investee to a consolidated company, in addition to revenue and gross profit, SG&A expenses will also increase. As I mentioned earlier, we will proceed with the projects, add value, and we will make sure to implement cost control and ultimately improve our operating leverage, including our headquarters’ employees, in each of our businesses.

Q&A: Progress on business cluster formation explained in MTMP

Looking at page 8 of the presentation material, growth investment has increased considerably since Q1, and I think it has progressed about 50% excluding Management Allocation toward the three-year MTMP target. I believe that your company has developed a business cluster strategy that combines each business and adjacent businesses in the MTMP. Please explain whether the progress in growth investment is due to an increase in the size of the business cluster or a timing issue in the execution of investments and loans.

<Hori>

There are not many deals in capital allocation that are particularly large in scale. However, there are always deals that are large and not yet executed, or deals that we decided not to proceed with for now. We will examine these projects carefully, including alternatives, and if there are any projects that we are confident to move forward with, we would like to announce them to you. In this way, we have continued to carefully select projects. We are committed to continuing to develop projects that will build our future earnings base, and we are disciplined in our examination of every project. As we do business in a number of different industries, we can examine if an opportunity is good from multiple angles. We are committed to managing potential growth investments through this kind of process.

Q&A: Impact of interest rate rise and its countermeasures

In the year-on-year factor comparison of the first half profit on page 15 of the presentation material, interest income and expenses are listed as the largest factor for the decline in base profit. Please tell us to what extent your borrowing interest rates are fixed or variable, and the sensitivity and the impact of interest rate rises on the company’s performance. In addition, please tell us how you will further increase profitability and improve net performance in response to rising interest rates.

<Hori>

How the higher interest costs are passed to our business differs from industry to industry. For example, in the mobility business, which has maintained good performance recently, I believe that the product mix will be the deciding factor. In automotives, I think it is important to offer a variety of items such as leasing, rental, fleet management, and credit actions, and to always have agile decision-making and such tools to decide where to place emphasis, or when it is better to have physical assets, and so on.

In addition, when the interest cost of an investment rises, although it is possible to carry out M&A using debt, I think it is necessary to conduct a return analysis that reflects those conditions, and whether the long-term stability that matches the debt is actually secured in the business. Therefore, the CFO Unit works together with the business units to look at each case individually.

<Shigeta>

As a premise, our funding is basically on long-term basis with variable interest rates. If we were to make a rough estimate based on borrowings with variable interest rates, for yen denominated borrowings, a 0.1% increase in rates would have an impact of approximately 2 billion yen before tax, and for US dollar denominated borrowings (based on the assumption that generally all foreign currency borrowings are in US dollars) a 0.1% increase in rates would have an impact of approximately 2.5 billion yen before tax, as a very rough estimate. However, as explained by the CEO, there will be an impact on interest rate hikes and foreign exchange rates, and there will be a portion that is passed on to prices or linked to improved earnings. Therefore, please understand that there are some positive factors scattered and hidden in other items in relation to interest rates while interest is only shown as a negative factor in base profit in page 15 of the presentation material. Please also note that the sensitivity I just mentioned is only on the interest expenses side.

Q&A: Scheduled maintenance of Sakhalin II

Sakhalin II had its first scheduled maintenance in July, after Shell exited from the project. Please tell us if there was any impact.

<Hori>

Since this is an operational matter, I cannot comment in too much detail, but I think it is safe to say that there have been no particular problems. Since the project has been in operation for a long time, a fair amount of expertise has been accumulated at the project site level, thanks in part to the past efforts of various partners.

Q&A: Strengthening the downward resilience of earning base

I see that you are strengthening the downward resilience of your earnings base through various management efforts, and I would like to hear your views on this point.

<Hori>

In terms of downside resilience, the mindset of managers is extremely important. Especially with so many unexpected events happening around the world, it is important to be agile and have alternative plans prepared at all times. There is no such thing as “enough”, and ongoing responses to issues are necessary, and we encourage them to think about it constantly.

Autumn is usually the time when we review the entire company’s portfolio. We formalize our business plan in the spring and after 6 months we review the entire business portfolio one by one. Each business unit is reviewing with the corporate divisions what steps can be taken to address downside resilience and what concerns exist in the scenario analysis. We have instructed each business unit to strengthen the process of such review, and we believe that the accumulation of such process will lead to downward resilience. In addition, we must always be aware of the need to raise the fundamental competitiveness of each business. At the same time, it is important that bad news be shared quickly and that steps be taken if there are any signs, and we will continue to work on this by always being focused.

Q&A: The possibility of additional share repurchases in this FY

The amount of share repurchases announced this time is a total of 50 billion yen and will be completed by the end of January. I would like to ask you to comment on the possibility of continuing the share repurchases after that, whether there may be any additional ones to be announced within the fiscal year.

<Hori>

I cannot say anything beyond the share repurchased announced this time, but we will continue to think flexibly within the overall framework I mentioned today. I would like to carefully communicate the progress and confirmation of the overall framework during our future dialogue.